SRSrocco Report

@SRSroccoReport

How Energy & the Falling EROI (Energy Returned On Investment) will impact Precious metals, Mining & the Economy

IMPORTANT METALS & ENERGY UPDATE JULY 25TH 2025: Big Surge In Gold Shorts & Big Declines In U.S. Oil Production Beginning VIDEO REPORT: srsroccoreport.com/important-meta… Memberships: srsroccoreport.com/membership/

Silver Alert 1 and 1/2 years ago I made the comment about Silver possibly being on the verge of the mother of all short covering rallies (see below). I even pinned this post because I believed in my thesis and analysis. I even positioned my hedge fund to be overweight (approx…

We could be on the verge of the "mother of all short covering rallies" for #SILVER Managed Money is now over $1 Billion net short in notional value CAN YOU DIG IT!!!!!

Maybe Sen. Lummis should do a better job for Americans instead of just pumping Cryptos, is do a bit of research on them. papers.ssrn.com/sol3/papers.cf…

Comprehensive market structure legislation is the key to making America the crypto capital of the world.

THE LARGEST GOLD MINER vs. THE LARGEST BITCOIN MINER: The Numbers Show The Disaster Called Bitcoin Mining Video Report: srsroccoreport.com/the-largest-go… Why Subscribe: srsroccoreport.com/why-subscribe/

You mean like, Oracle, Microsoft, Amazon, Google & Apple?? Largest Tech firms in the world... "there is no mention at all of blockchain-tokenization in their earnings calls. Blockchain for the most part... is a Red Herring.

The biggest risk facing corporations today is having a board of directors that is anti-bitcoin.

Very Important to know the "Fine Print" when deciding on a Precious Metals storage program. Bob always puts the Client first.

Precious Metal storage programs contain elevated risks beyond the customer's ability to accurately assess or protect from. One of the greatest risks is the contract or agreement, itself. The investor or storage customer agrees to set of known conditions as well as unknown…

You bring up a valid point to discuss. Since 1995, Newmont's share price has more than doubled from $30 to $65. Also, the company paid $13 billion in Dividends. $MARA diluting shareholders with Hefty stock-based compensation. Using Shareholders to line pockets.

You realize that newmont is possibly the worst example possible right? They’ve literally made 0 gains in 30+ years yet you still tell people to invest. It’s kinda insane don’t you think?

WHOOPS... U.S. Oil Rig Count Down Another 7 Rigs This is BAD NEWS for the U.S. Shale Oil Industry & Domestic U.S. oil production. Get ready for Large Declines in U.S. oil production coming in the months ahead. srsroccoreport.com/why-subscribe/

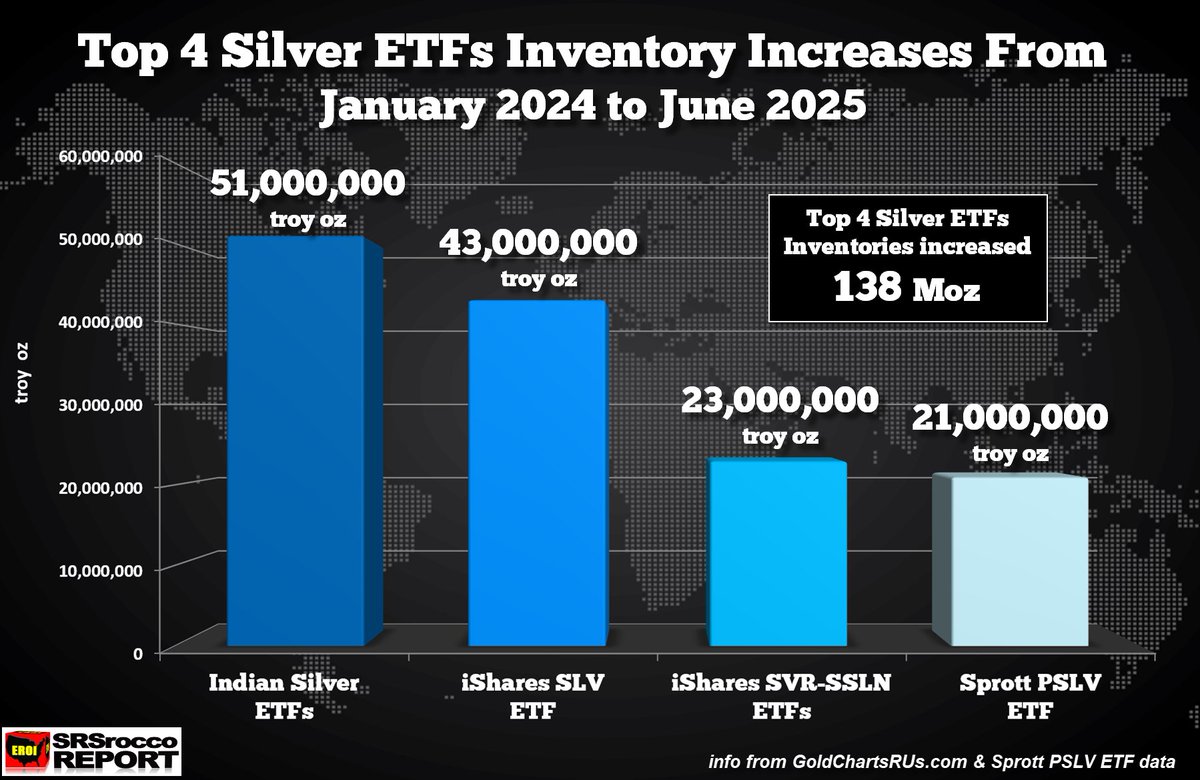

Looks Like Something BIG Is Happening In Global Silver ETF Inventories. Indian Silver ETFs Inventories increased the most in the world by 51 Moz since the beginning of 2024. srsroccoreport.com/why-subscribe/

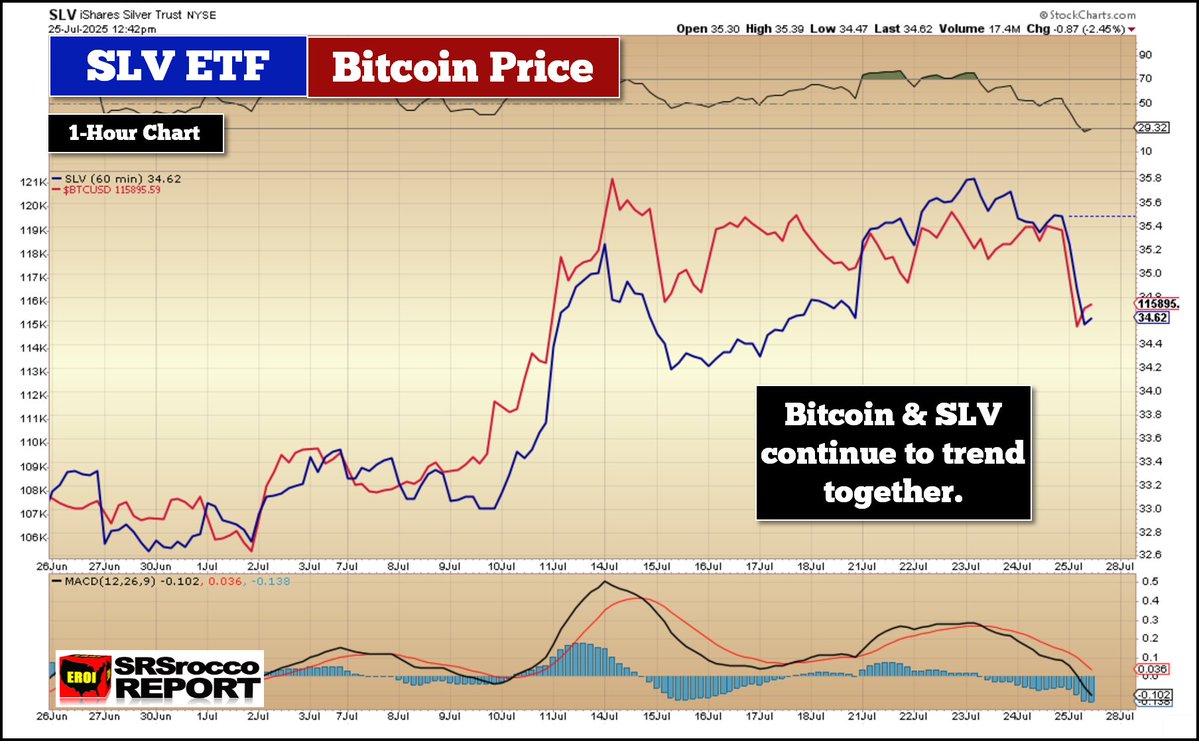

HOW INTERESTING... The SLV ETF (Silver) & Bitcoin continue to trade in a similar trend. Both selloffs in $Silver & $BTC today look nearly identical.

Why Silver Won’t Stop at $50 This Time aweber.com/t/SSOHW

The Mighty Silver Melt up Continues... Are we heading to $50 as Three Times is a Charm?

If we tally up all the COSTS, $MARA's breakeven for Bitcoin Mining in Q1 2025 was $168K per $BTC. No wonder they resorted to Diluting shareholder value and issuing debt.

So the management team that couldn’t mine Bitcoin as a profitable business proposition is now simply going to buy it…with your money. $MARA

MOST IMPORTANT REPORT: Why The Gold & Silver Prices Diverged The analysis in this video report I have never seen anywhere else. VIDEO REPORT: srsroccoreport.com/most-important… Membership: srsroccoreport.com/membership/

Shows how little you know about silver. The reason the gold price has performed better than silver is due to the higher cost of production, not because it is a by-product metal. KGHM Polska Miedz, largest by-product silver miner (40 Moz yr) barely breaking even.

shows how little you know about mining. much silver basically by product of mining more valuable metals such as gold. silver is a by product metal

One of the reasons Gold outperformed Silver, has to do with the Cost of production. 1980-2025, Gold Costs increased from $275 to $2,000 1980-2025, Silver Costs increased from $10 to $25.

If you bet Silver eventually follows Gold a la 1978-80 The current gap remains historically wide

WHY ARE BITCOIN & SILVER TRADING TOGETHER: The Bitcoin Price May Be Limited To Its Rising Production Cost If we compare the Bitcoin and SLV ETF (silver price), both surged higher on July 11th, peaked simultaneously. FREE VIDEO: srsroccoreport.com/public/why-are…

If that is the case, then why does $BTC trade right along with the SLV ETF (Silver price)?

Bitcoin has the ultimate unfair advantage in monetary competition because it is perfectly fair to all players.