Pierre Rochard

@BitcoinPierre

Follow for Bitcoin & capital markets insights. CEO of The Bitcoin Bond Company, Steward of @CatholicBitcoin, host of the @BitcoinForCorps Show.

This afternoon I testified at the Texas Senate Committee on Business and Commerce hearing in favor of SB 21, to establish a Texas Strategic Bitcoin Reserve. Thank you @DrSchwertner for introducing the bill, @LtGovTX for making it a legislative priority, and @DonnaCampbellTX for…

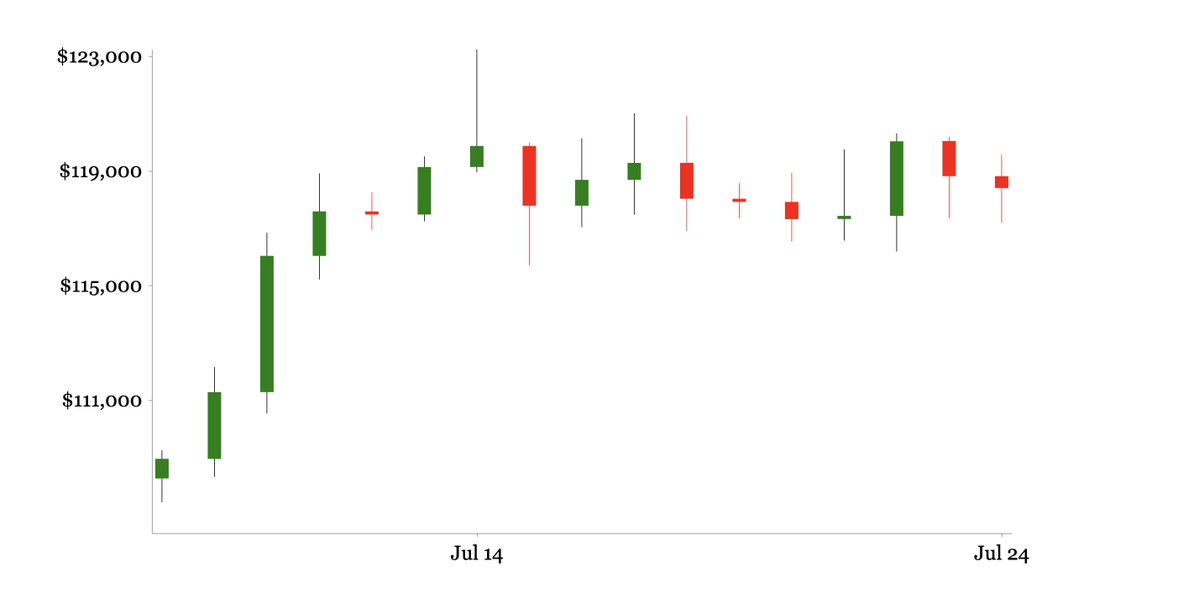

10 days since the $123,231 ATH on 7/14. BTC needs +$4,834 (+4.1%) for a new ATH.

I'll be speaking at the Bitcoin Financial Services Summit in Denver, October 16-18 hosted by @spacedenver Register to attend here: denver.space/bitcoin_financ…

Back in 2014-18, Patrick Byrne's publicly traded Overstock(dot)com chased “blockchain tokenization” with tZERO instead of laser-focusing on bitcoin treasury accumulation. They could have had a massive head-start on MSTR. Cautionary tale.

I'm co-hosting a Spaces this upcoming Tuesday 5 PM EST about "Post Quantum Implications for Bitcoin" with @MrHodl @benthecarman @tdryja @bitschmidty and experts from Blockstream, Chaincode, Spiral. We will put an end to the FUD. Audience q's allowed. x.com/i/spaces/1OwGW…

Frame it 🖼️

HAHAHHAHAHA HOLY SHLIT @TheDemocrats just deleted the chart they posted after staffers realized that the data implicates them for inflation

Why is the four-year cycle dead? 1) The forces that have created prior four-year cycles are weaker: i) The halving is half as important every four years; ii) The interest rate cycle is positive for crypto, not negative (as it was in 2018 and 2022); iii) Blow-up risk is…

🚨DID I HEAR SUPER CYCLE??? The four-year cycle is dead and adoption killed it. @Matt_Hougan says we're going higher in 2026. Early profit takers will be left behind!!! Full break down with @JSeyff and @Matt_Hougan in comments👇

Biggest IPO of 2025 and biggest pref IPO of the decade. $STRC $2.521 Billion

Strategy announces pricing of its Stretch Perpetual Preferred Stock ($STRC) Offering and upsizes the deal from $500 Million to $2.521 Billion. $MSTR strategy.com/press/strategy…

Largest US IPO in 2025? $2.521 billion $STRC 🚀

Strategy announces pricing of its Stretch Perpetual Preferred Stock ($STRC) Offering and upsizes the deal from $500 Million to $2.521 Billion. $MSTR strategy.com/press/strategy…

It's crazy that $MSTR can raise $2.5 billion via $STRC in half a week and most traditional finance professionals still have no idea what is going on. We are so early.

The number of public companies that hold 1,000+ BTC continues to grow, potentially signaling heightened institutional interest in bitcoin. Analyst Zack Wainwright on our team has been tracking this closely, particularly the companies holding 1,000 BTC or more. We have gone from…

Bitcoin’s monetary policy is beyond reproach, it always achieves its mandate.

We are so early.

Imagine thinking you missed out on Bitcoin and it’s only 2025

The Federal Reserve needs to bail itself out by adding BTC to its balance sheet. Fix the money, fix the world!

The federal reserve can't stay in the black. With Bitcoin though:

The federal reserve can't stay in the black. With Bitcoin though:

The kid analysts at @MSTRTrueNorth continually front run the institutions. Short credentialism, long meritocracy, all day everyday.

“You talk to institutions about #Bitcoin treasury strategies-they throw up their hands: ‘It’s leverage. It’ll blow up.’ Then I ask, ‘Okay, explain to me how?"- @ColeMacro at @BTCPrague with @keidunm, @BradleyDukeBTC, @1basemoney & Sam Roberts. 🎥 👇

It’s earnings season, and some pretty big crumbs are being dropped . The @CMEGroup’s crypto complex is posting absolutely massive numbers: Average daily volume reached 260k contracts in Q2 2025 (≈ US $12 billion notional), up 73% year-on-year.

I reiterate. I believe that in the short-to-medium term, $STRC could prove Strategy's most popular preferred by a wide margin. But if that turns out to be the case, why wouldn't Strategy have launched STRC first? Why did Strategy launch the preferred stocks that it did, in the…

JUST IN: @Strategy upsizes its $STRC preferred stock IPO 4x—from $500M to $2B—to accelerate #Bitcoin accumulation.

The impossible trinity states that only two of the following can coexist: free capital flows, exchange-rate stability, & interest rate control—this structural constraint defines the design space for any monetary-like asset or capital instrument in global markets. $MSTR

$MSTR Upsizes $STRC IPO 4x to $2B From $500M; Prices at $90, 9% Initial Dividend, 10% Effective Yield - Bloomberg