bob coleman

@profitsplusid

Idaho Armored Vaults stores all physical precious metals outside the financial system in insured, segregated, and armored vaults.

We could be on the verge of the "mother of all short covering rallies" for #SILVER Managed Money is now over $1 Billion net short in notional value CAN YOU DIG IT!!!!!

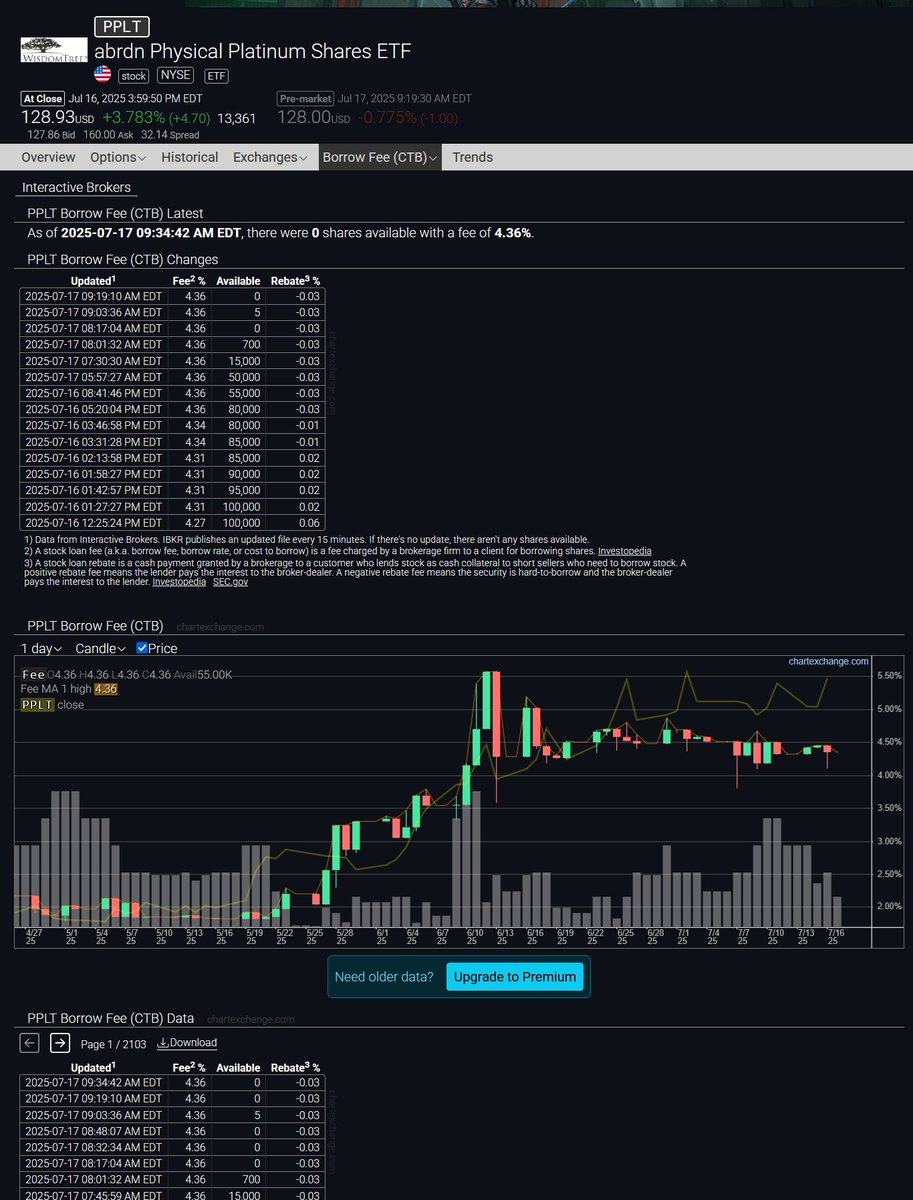

Platinum ETF Alert (PPLT) The Borrowing fee just hit a new 2 year high while the shares available to borrow continue to skate along the floor for abrdn Physical Platinum Shares ETF Currently only 700 shares to borrow.

Gold up another $30 after GVZ breaking out from its falling wedge pattern

Gold Volatility Alert - GVZ Gold Volatility Index (GVZ) just broke out of its falling wedge. In the past that has resulted in higher gold prices. See highlighted points.

abrdn Physical Platinum Shares (PPLT) ETF Alert One subject not discussed very often is the "Fails to Deliver" (FTD) PPLT had one of the most concentrated periods from May 2025 to late June 2025 of clearing firms failing to deliver shares. (top chart) Failure can occur when a…

#Silver seems tight on the commercial side and abundant on the retail side

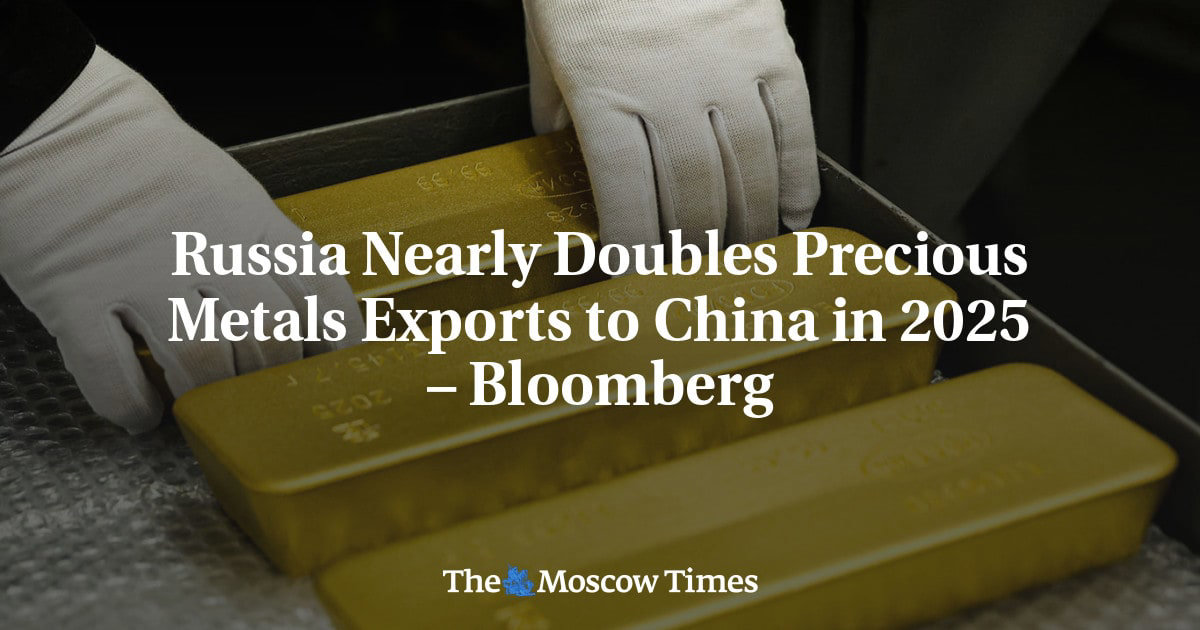

One would think that market makers would be delivering silver to SLV to create shares in order to meet the demand for those who want to borrow these shares. In fact, just the opposite is happening. SLV Shares outstanding have fallen by 10,900,000 shares since last Monday…

Follow Bob!

***SLV ETF ALERT*** Walking into the beginning of trading on Monday morning and no available shares to borrow in the SLV ETF again. Shorts....Whatcha gonna do? To quote the great Bob Marley … Whatcha gonna do? Whatcha gonna do when they come for you? Bad boys, bad boys…

One would think that market makers would be delivering silver to SLV to create shares in order to meet the demand for those who want to borrow these shares. In fact, just the opposite is happening. SLV Shares outstanding have fallen by 10,900,000 shares since last Monday…

They’ll make more shares!

Gold Volatility Alert - GVZ Gold Volatility Index (GVZ) just broke out of its falling wedge. In the past that has resulted in higher gold prices. See highlighted points.

UPDATE EFPs are rising again on an accelerated basis. Platinum just went up 100% with lease rates at 30% One other edit. My apologies to Inner Circle. They wrote the song mentioned below.

***SLV ETF ALERT*** Walking into the beginning of trading on Monday morning and no available shares to borrow in the SLV ETF again. Shorts....Whatcha gonna do? To quote the great Bob Marley … Whatcha gonna do? Whatcha gonna do when they come for you? Bad boys, bad boys…

Russia Nearly Doubles Precious Metals Exports to China in 2025 – Bloomberg msn.com/en-us/money/ma…

***SLV ETF ALERT*** Walking into the beginning of trading on Monday morning and no available shares to borrow in the SLV ETF again. Shorts....Whatcha gonna do? To quote the great Bob Marley … Whatcha gonna do? Whatcha gonna do when they come for you? Bad boys, bad boys…

Many risks involved with these securities. Authorized participants which are market makers and liquidity providers for the ETFs as well as other markets can be over run if spreads or other ratios which they use to manage risk and profit become distorted outside their liquidity…

I think what Bob is politely trying to say is that the performance is guaranteed by the same Banker that is shorting the paper price. That's called Counterparty risk, and you have to trust the banker. Caveat Emptor

One of the reasons Gold outperformed Silver, has to do with the Cost of production. 1980-2025, Gold Costs increased from $275 to $2,000 1980-2025, Silver Costs increased from $10 to $25.

If you bet Silver eventually follows Gold a la 1978-80 The current gap remains historically wide

Owning a closed end trust where the sponsor allows and is incentivized to have their investment trust trade at a chronic discount to NAV does not benefit existing investors. This is similar to the retail dealer industry constantly lowering their buy back price under spot. This…

I suggest, if you can only access securitised Silver, $PSLV as the prospectus is superior to $SLV e.g. the investor own units that have a claim to the silver. Being fully allocated, units take physical bullion off market. That said there were recent doubts about $PSLV!!

Not investment advice. However, buying SLV is simply buying price representation of silver with no guarantee of return of investment or legal ownership of the shares or the underlying metal. Trading is much different than owning as a store of value. Physical, held directly, can…

@profitsplusid please share thoughts on this. People are trying to protect there wealth. Thanks for what you do

Bob is a star Follow Bob

***Gold Volatility Alert *** GVZ (Gold Volatility Index) is nearing a breakout of a falling wedge. This has lead to upward gold prices in the past. See highlighted sections.

Thank you again @JG_Nuke for another great conversation

Silver is ripe for a short squeeze even as metal dealers are drowning in inventory. WTF is going on? #SilverSqueeze h/t @profitsplusid

#Silver's Great Divide: The Physical vs. The Paper Markets Diverge, with Bob Coleman @profitsplusid & Jack @JG_Nuke "Silver's Illusion of Liquidity tells us Silver Markets will rebalance through a Squeeze on Physical" - Daniel Ghali 📺 A MUST WATCH 📺 youtu.be/AII-H08LTgs?si…

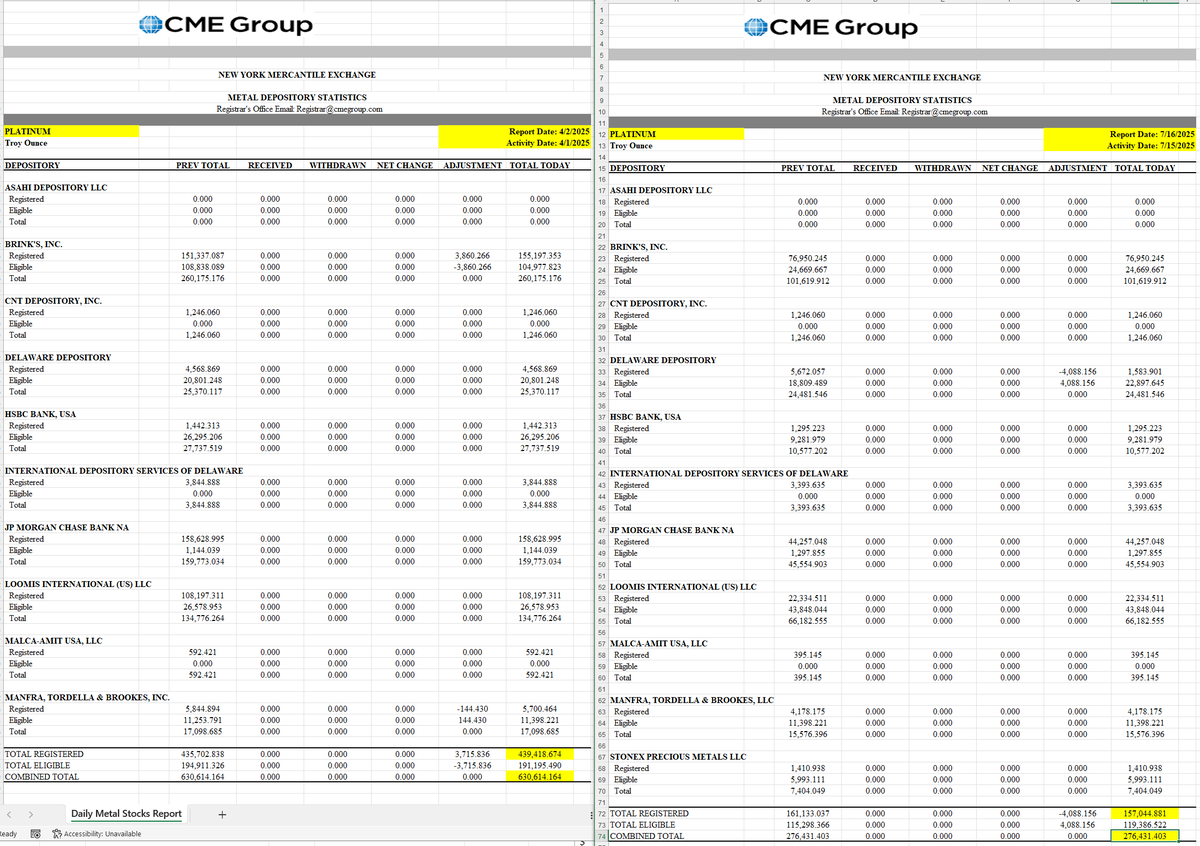

Physical Platinum in NYMEX vaults In just 3.5 months, the amount of physical platinum backing all the NYMEX futures contracts (registered category) has dropped or been delivered out of vaults by 64% since April 1 , 2025. Total inventories have dropped by 56% over the same time…

PPLT ETF Alert The abrdn Physical Platinum ETF has no shares available to borrow. What is going on with the white metals? Lease rates for Platinum went vertical the last few days. Financing costs are rising. Unlike Silver, Physical Platinum has been leaving the Comex.