Peter Brandt

@PeterLBrandt

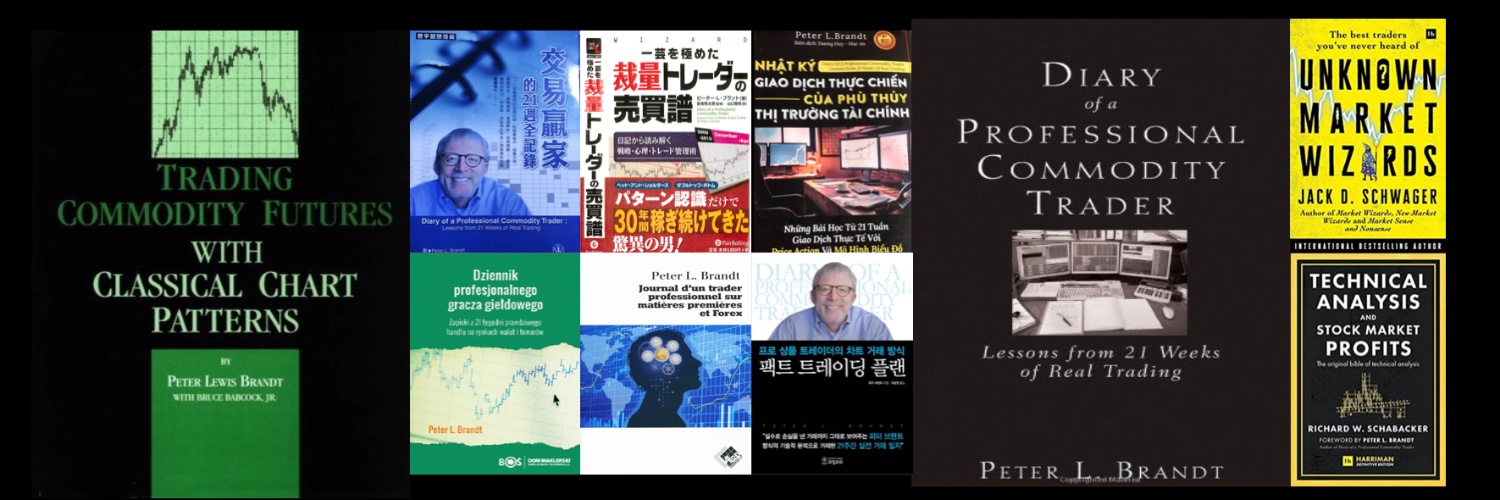

Futures mkt trader since 1975. Shokunin. Author. Market Wizard. ✝an. Membership http://peterlbrandt.com https://brandtp.substack.com Scam http://bit.ly/3umdvQd

The Factor is NOT a trade signaling service. Via Factor Updates and special reports I share the agonies, victories, mistakes & lessons of 50 rewarding years as a futures market trader. For The Factor visit peterlbrandt.com / for Bitcoin Live visit bitcoin.live/?aid=106

#Silver For the record I am long Silver. I am not a silver hater. The last big call I made on silver was to alert the world that price was topping out at $50 an ounce back in 2011. Wow, in the last 14 years silver’s been quite a performer. Silver needs to go to $100 an ounce just…

This is my long term Silver chart. While not technically a Cup and Handle, the chart nevertheless could support an advance to $95 per ounce if overhead resistance is hurdled $SI_F True for paper Silver as well as physical Silver

Consistently successful trading is a deep deep dive into the soul It is there a trader meets his or her real self, stripped of all pretense It is this perspective that allows real traders to distinguish the grinders from the posers Most of X is Poserville

Most traders start by obsessing over a single trade or setup—and that’s exactly where you should begin. You have to master that first. But if you want to generate real, consistent returns with lower portfolio volatility, the edge isn’t in one perfect trade—it’s in managing many…

Most traders start by obsessing over a single trade or setup—and that’s exactly where you should begin. You have to master that first. But if you want to generate real, consistent returns with lower portfolio volatility, the edge isn’t in one perfect trade—it’s in managing many…

Hey Grok, what is AISC (production cost) to produce an ounce of Silver?

About time to end this tax payer funded leftist propaganda machine

MPR’s parent company announces layoffs after Congress cuts public media funding startribune.com/mpr-layoffs-am…

This expectation management prevents loss aversion from creating destructive patterns. When you expect losses, they become neutral business events rather than identity threats. This psychological preparation prevents the cascade where unexpected losses trigger revenge trading,…

EXPECTATIONS!!!!! Expectations should be realistic Most traders hope/expect their next trade will be a huge winner My default expectation is that the next trade will be a loss This expectation prepares me to protect my trading capital (real money)

As a swing trader who may hold trades for weeks (sometimes months) My trades work for me so that I do not have to work for my trades Give me a thumbs up if you can think deep enough to understand the difference

Many of you trade 60-minute, 15-minute, 5-minute, even 1-minute chart bars I think that is crazy As for me - I trade weekly chart bars For example, the green dots on this Gold chart indicate points where I had weekly/daily chart trade set ups to be long New🟢dot soon? I think so

White families like this built the US without any handouts, unemployment insurance, free health or education ------ with only a minuscule of the income given to immigrants today, who are instructed by the elites to call these families "supremacists" who "stole" from them.

ApexTraderFunding joins forces with some very like mined characters files.brokercheck.finra.org/individual/ind… files.brokercheck.finra.org/individual/ind… Why is it that cockroaches always manage to find each other

It’s been an incredible day on Wall st and Times Square with Wall Street Global Trading Academy! #newtothesquare #apextraderfunding #futures #futurestrading #daytrading #wallst

It’s been an incredible day on Wall st and Times Square with Wall Street Global Trading Academy! #newtothesquare #apextraderfunding #futures #futurestrading #daytrading #wallst

I kinda feel like there is more packed into this single post, than most of FinTwit combined. Definitely gives you a lot to think about...

What does a real futures market trading account look like? I can only explain my own Real markets with my own real money on real exchanges Seven figure real money account balance I collect T-Bill interest on 60% of acct balance Trade about 40 different global futures contracts…

Typo "now" long, not "not" long

The Factor company trading account is not long Dec Gold and short an equal $ value of Sep S&P futures We trade real futures with real money in a real account with a real broker on the real exchanges None of this pretend futures crap for us

What does a real futures market trading account look like? I can only explain my own Real markets with my own real money on real exchanges Seven figure real money account balance I collect T-Bill interest on 60% of acct balance Trade about 40 different global futures contracts…

Shawn Hackett is my GO-TO GUY for weather affecting grains and softs

In todays video interview with Casey Seymour we talk grain markets heading into year end, increased recent volcanic eruption activity, the cooling Atlantic ocean trends and what lies ahead for weather the decade from 2028-2038 where almost no sunspots, cooling oceans and large…