Nugget Capital Partners (NCP)

@NuggetCapital

Energy nerd. Markets enthusiast. Research analyst specializing in resources w/ focus on energy. Long-short specialist. Principal at Nugget Capital (NCP) #OOTT

#OIL STOCK BUYING CHECKLIST: ✔️ Nuttall bearish ✔️ Amrita calling for $40 ✔️ Perma bulls selling oil to buy gas ✔️ TradeOilStocks not buying ✔️ Sankey bearish ✔️ Kao bearish ✔️ No Baskin podcast about CNRL past month ✔️ Burnsco not liking Baytex for torque ✔️ No #COM Spaces

As predicted by NCP, well in advance.

🚨 TRUMP ADMINISTRATION GREENLIGHTS CHEVRON TO RESUME PUMPING OIL IN VENEZUELA, SOURCES SAY -- WSJ

If there is a win for energy here, I'd bank on US LNG. Europe wants more LNG. Second guess refined products. I don't really see this as bullish oil.

A bit surprised we haven’t seen more strength in futures, particularly gas, given the EU-US trade deal. $250B/yr is a lot of incremental energy purchases. Is it even achievable? gonna take price, not trade deals, for more US drilling spend and production for export #EFT #OOTT

OUT NOW: FAIRFAX, STRATHCONA, E-L FINANCIAL & MORE! @BrownMarubozu came BACK on the show to share 2+ hours of insights! THANK YOU for chatting with me! HIGHLY recommend this episode. I hope you enjoy! Links in the replies ⬇️ $FFH $FRFHF $SCR.TO $ELF.TO $FNV $OLA.TO

Seeing @MPelletierCIO and oil bulls share $LBRT comments but I don't see any of them note Nugget Capital Partners additional comments. The CEO clealry said he is only adjusting horsepower to support simulfracs (an efficiency gain for E&P). Be careful w/ blind frac + rig "counts"

Liberty clearly said less fleets but same amount of horsepower as E&P shift towards simulfrac's. Fleet sizes are growing [in HPP] despite a drop in frac fleets. Activity levels sure do seem low but horsepower is not being shelved from the market. 😬

Did you add $RCI.B with the team at Nugget Capital Partners in the past couple months? Still long $BCE.TO but sold Rogers. I think Bell will catch bid between now and beginning 2026. Rogers prob keeps going up but I preferred some of my REITs with 'surer bet' catalysts for now.😊

The music

This is running a little too hot The previous high was late 2021 You know what happened in 2022

🇺🇸 US margin debt exceeded $1 trillion for the first time in history in June.

Glad you posted this. There is a lot of misunderstanding of rig counts and frac fleets. Also the impact of co development and cube development on inventory and long term productivity. Good explanation of the latter on Ovintiv call this morning.

Liberty clearly said less fleets but same amount of horsepower as E&P shift towards simulfrac's. Fleet sizes are growing [in HPP] despite a drop in frac fleets. Activity levels sure do seem low but horsepower is not being shelved from the market. 😬

OIL MARKET: Stack up, baby, stack up!!! Liberty Energy, the oil services company founded by US Energy Secretary Chris Wright, says it will reduce its fleet count due to drilling slowdown. | #OOTT

Out of $CVE.to. Can’t trust they will do the right thing - repurchase stock aggressively and cut costs.

Before Twitter I used to use Stockhouse. Went thru my old PM's this morning trying to find a post of something else and remembered this. I wonder how this guy made out? $WEED.TO down 99% as predicted by NCP in 2018. lol. It wasn't a straight ride down but it didn't take long.

Stop listening to the clown.

He dropped Baytex for space, power and gold. Brilliant.

Wow. You don't see these returns from top picks on @BNNBloomberg often. Nice work John!

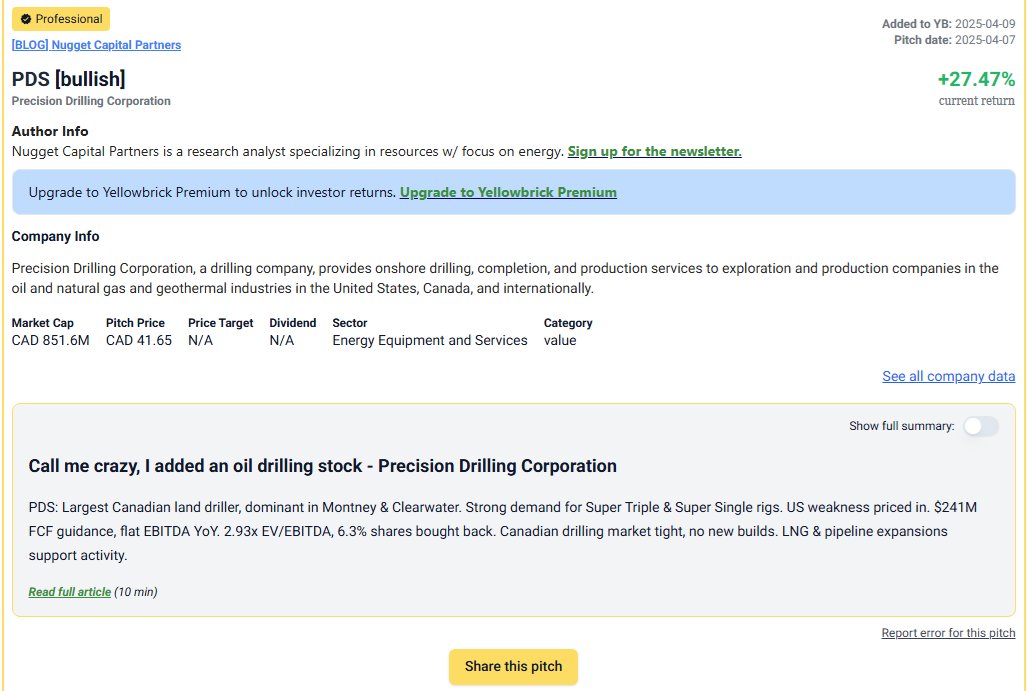

This @joinyellowbrick site is quite interesting. You can search an author's name to find their track record or at least the part of it that was picked up by their bots. You can see many NCP picks in the past & how they fared. Funny I can't find much for mouthy adversaries. lol?

What a compliment. Thank you so much @CoreyMi86736049. Truly flattered.

Nugget capital partners is the “Roudy rody piper” of x - the bad dude who wins a lot of fights, just not all of them 🤙

The stock is up literally 2% YTD. I agree that's good for many dividend dog investors in Canada but like Shaniah Twain once said... "that don't impress me much." (a BoL joke not mine. ) If $WCP.TO outperforms energy index that's a diff story. So far not happening. Sorry.

In what world is the dividend not sustainable at current oil prices?? They are literally generating profits well in excess of the dividend

Yeah, FWIW, the Nugget camp is no longer long $CVE. Wish those who are the best of luck though - you are going to need it. An on-the-ground expert has suggested this repair is 'billions' worth. Oh my.

Good write up by Dan Gray at @MeridianSource below in quote tweet Here is a video circulating local Lloydminster social media of the $CVE Cenovus Rush Lake thermal oil site. It was posted a couple days ago

Ask yourself why $HWX.TO can run debt free, always do organic new deposit finds and these names like Veren and Whitecap always have never ending levels of multi billion dollar debt with constant acquisitions, share issuances, and recycled of old 'non core' assets. Help me out.

Parody? WCP is running at 0.9x D/CF in 2026. In what world is this an issue?