Javier Blas

@JavierBlas

Energy and commodities columnist at Bloomberg. Co-author of the 'The World for Sale' http://amzn.to/3t6dVJV Any views expressed are my own. [email protected]

This week, The World for Sale comes out in paperback It explains how oil and commodity markets work, how they influence geopolitics, and the extraordinary power of a few traders you've probably never heard of Please take a look smarturl.it/TheWorldForSal…

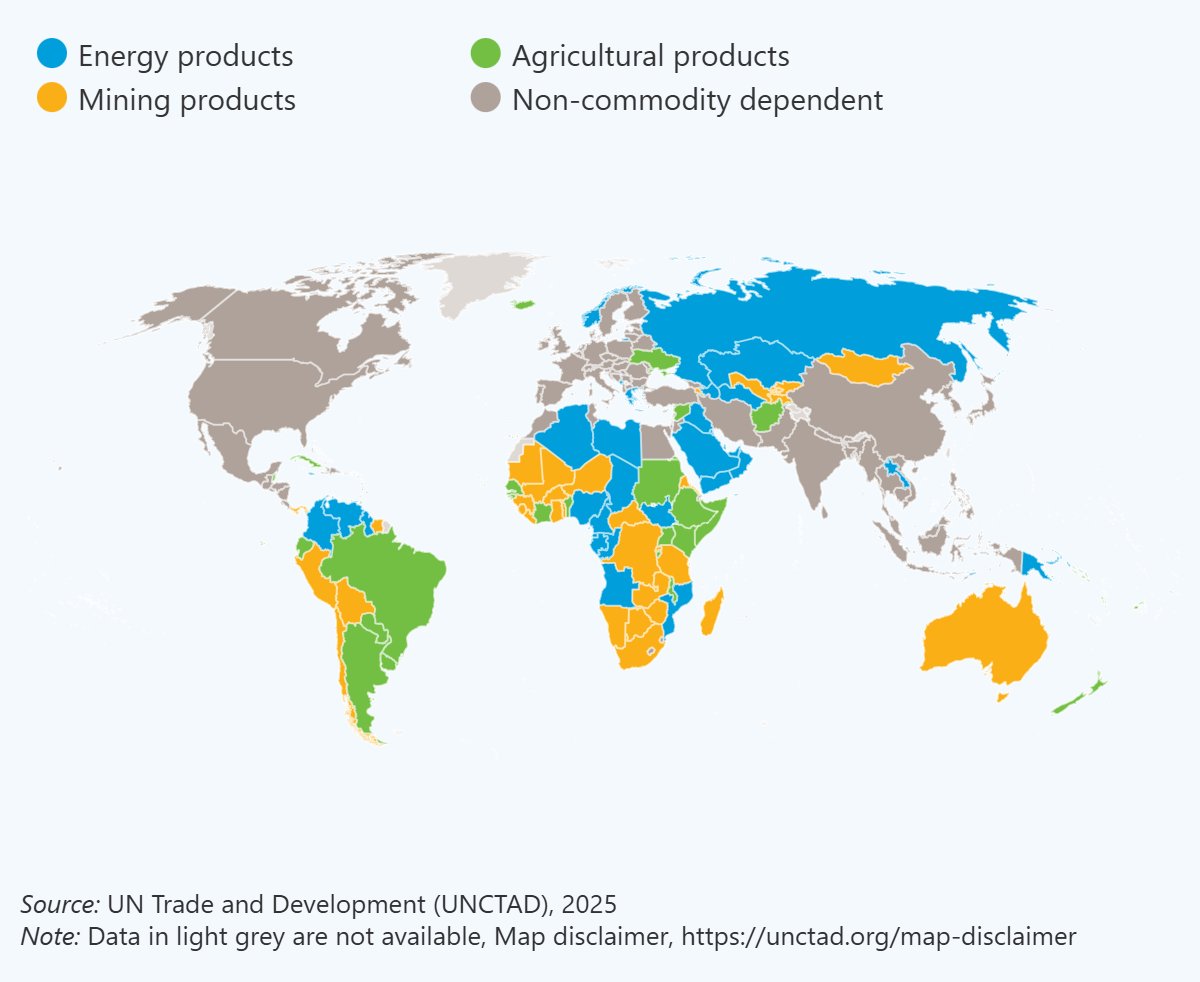

MAP OF THE DAY: An update on commodity dependence from annual @UNCTAD. (Measured as any country that makes >60% of its merchandise export earnings from commodities) Across developing countries, 2/3 of them (95 out of 143) remain commodity dependent. unctad.org/news/commodity…

ICYMI: When losing is another way of winning. #OOTT $CVX $XOM bloomberg.com/opinion/articl…

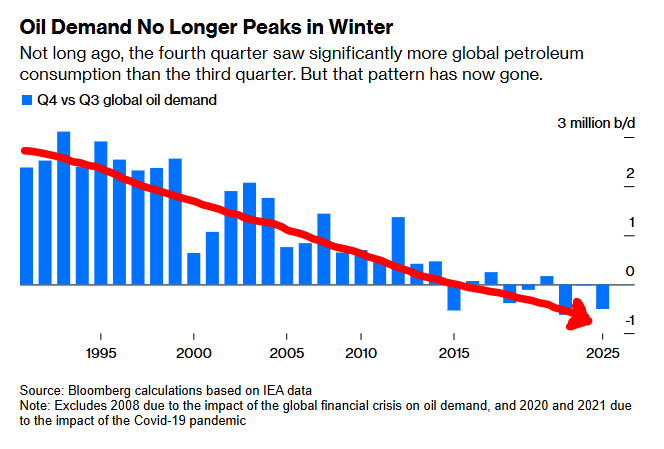

CHART OF THE DAY: The seasonality of the oil market has changed dramatically. Because the shift has happened incrementally over a long period, it often doesn’t get the attention it deserves. But the chart below makes it obvious. My @Opinion take here: bloomberg.com/opinion/articl…

COLUMN: The seasonality of the oil market has changed dramatically over the last two decades. While in the past (and until ~2015) annual peak demand was set in 4Q, now it's 3Q which sees the highest consumption. That matters a lot this year | #OOTT bloomberg.com/opinion/articl…

REACTION COLUMN: Exxon wins despite losing. Chevron has won its legal fight against Exxon over Hess/Guyana. But Exxon got what it wanted: delay the deal. Are Exxon legal tactics honourable? Maybe not, but ultimately, all's fair in love, war and oil M&A. bloomberg.com/opinion/articl…

BREAKING: Exxon loses Guyana arbitration against Chevron. In a statement, $XOM said: “We disagree with the ICC panel’s interpretation but respect the arbitration […] We welcome Chevron to the venture.” This is a huge victory for $CVX boss Mike Wirth (and John Hess)

Exxon vs Chevron arbitration on Guyana is imminent. The outcome will reshape Big Oil: at stake is Chevron's $60-billion acquisition of Hess, and access to one of the world's most important oil discoveries. Background in this @Opinion column from 2024 bloomberg.com/opinion/articl…

Hershey last week informed its retail customers of a roughly **double-digit** percentage increase, the company official said Tuesday.

Hershey is raising prices on its candy, a company official said, in response to continued high cocoa costs on.wsj.com/4kSkLKr

It's been several months since the US sanctioned Chinese refiners that buy Iranian crude. Every new sanctions announcement that selects other targets foregrounds this choice: the US is holding back from action that could meaningfully disrupts Iran's oil exports.

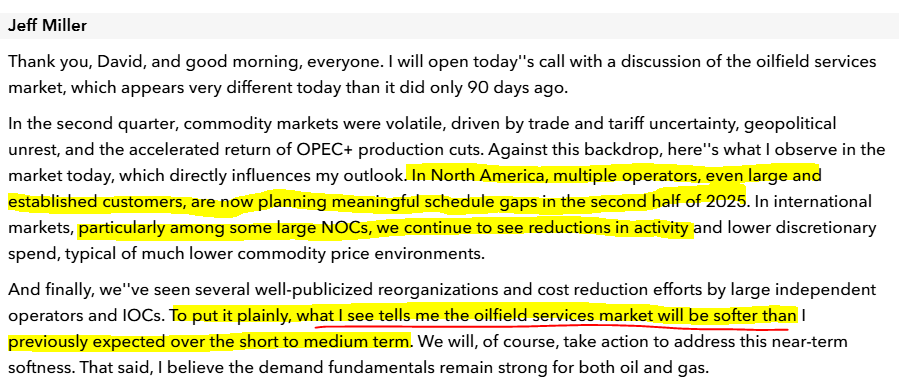

Oil services giants $SLB and $HAL both singling out a slowdown in activity in Saudi Arabia (linked in part to delays in the development of the the large Jafurah unconventional gas field) #OOTT #SaudiArabia

OIL MARKET: Halliburton, the world's largest oil fracking service company, says it sees "softer" market than it had expected 90 days ago. It notes lower drilling and completion in North America, plus a reduction in activity by national oil companies globally | #OOTT

Saudi oil giant Aramco has suffered quite a fall of grace. Its stock value fell on Tuesday to a fresh >5-year low. At 23.99 riyals per share, it's trading at its lowest level since March 2020, when Brent was at ~$25 a barrel. Since its IPO, it's down >17% -- worse than BP !!!

Good for the @WSJ to highlight not only China's efforts to reduce its domestic oil demand (via EVs and renewables), but also its often ignored efforts to **boost domestic oil production** (via massive drilling). #China #OOTT wsj.com/world/china/ch…

Activist investor Elliott calls on BP’s new chairman to address the company’s “cost base, capital allocation and poorly received turnaround plan.” “The company requires decisive and effective leadership to overcome its chronic operational under-performance.”

BP says Albert Manifold will become its next chairman from Oct 1, replacing Helge Lund. (The very aptly named for the oil industry) Manifold was formerly the CEO of construction materials group CRH | #OOTT $CRH bp.com/en/global/corp…

Hey… We all know US crude production gonna drop or stay flat at best — that ain’t the issue for next year’s balances. Don’t get it twisted.

Scott Sheffield isn’t pulling any punches against Exxon Mobil. (… and now, Exxon CEO has a rather unhappy shareholder, one who has demonstrated he’s willing to legal up in a fight… ) For background into the matter, here: x.com/JavierBlas/sta… #OOTT $XOM

Let's not forget that ExxonMobil threw Scott Sheffield under the bus. Exxon said at the time that the FTC's allegations about Sheffield were "entirely inconsistent with how we do business" (The $XOM statement raised a few eyebrows at the time in Houston and Dallas)

🇮🇳 Nayara Energy (Vadinar) is India’s 2nd-largest refinery. Rosneft owns 49%. Nayara + Reliance account for 45% of RU’s seaborne Urals exports. Now, Nayara is EU sanctioned. But Nayara’s primary export markets are Africa, SE Asia, and the Middle East → 80%+ of exports. ✍️🏻

📚📚 Delighted to see the French edition of ‘The World for Sale’ (‘Un monde à vendré’) reviewed in all the major 🇫🇷 weekly political magazines: 📖 @Le_NouvelObs ➡️ nouvelobs.com/economie/20250… 📖 @LePoint ➡️ lepoint.fr/societe/les-tr… 📖 @LEXPRESS ➡️ lexpress.fr/economie/javie…

OIL MARKET: EU backs new sanctions package against Russia (the 18th), including a lower oil price cap (likely to be set ~$15 below market prices). Plus more shadow fleet tankers. To be seen the impact: in the past, Moscow has been able to sidestep all sanctions within a few weeks

Nord Stream pipelines will be banned. A lower oil price cap. We are putting more pressure on Russia’s military industry, Chinese banks that enables sanctions evasion, and blocking tech exports used in drones. (2/3)