Augur Infinity

@AugurInfinity

Global macroeconomic and financial markets in charts, created using Infinity, an AI-powered analytics and visualization platform.

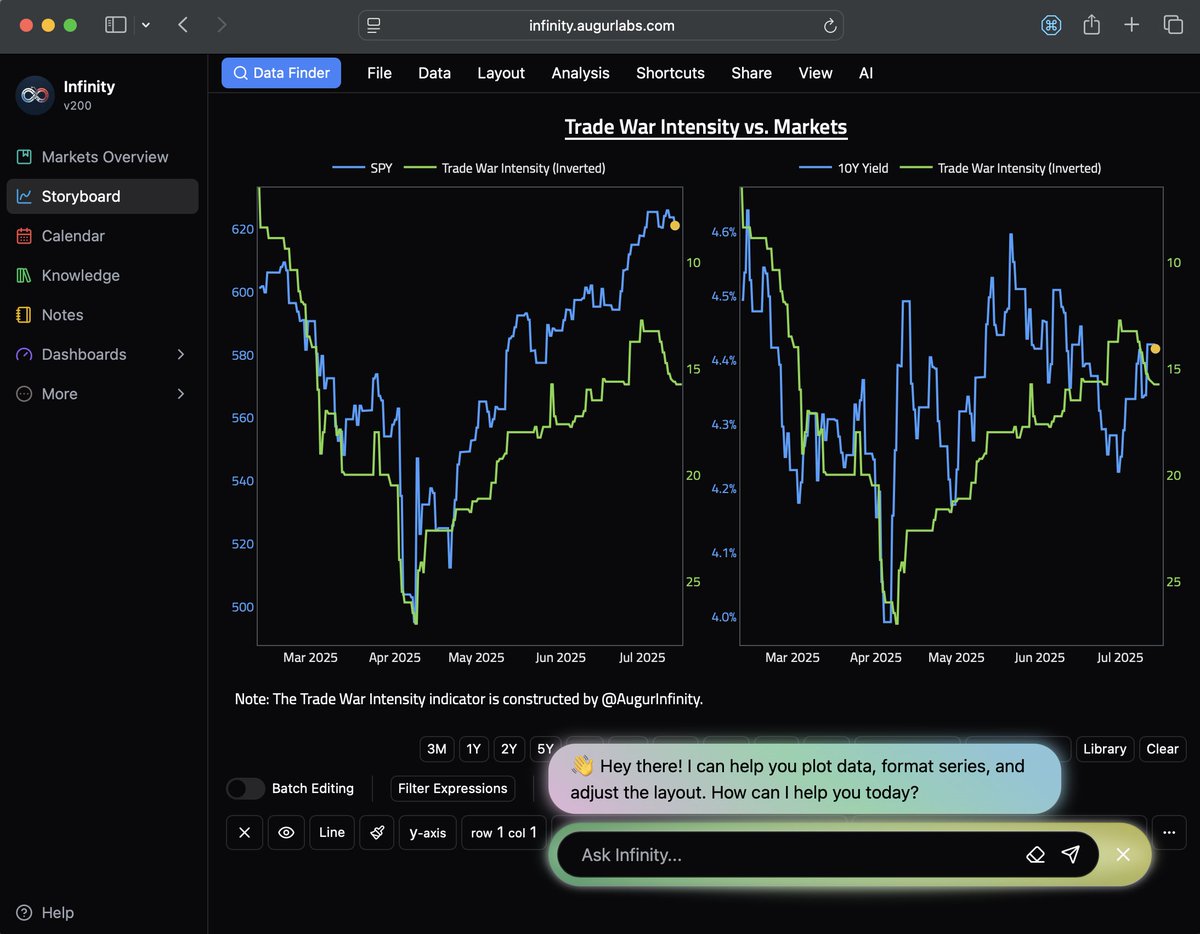

🚀 We’re proud to announce that our data visualization platform, Infinity, is out of beta! Infinity has been years in the making, and we’re thrilled to open it to the world. Infinity delivers institutional-grade macro and market data in a beautifully intuitive…

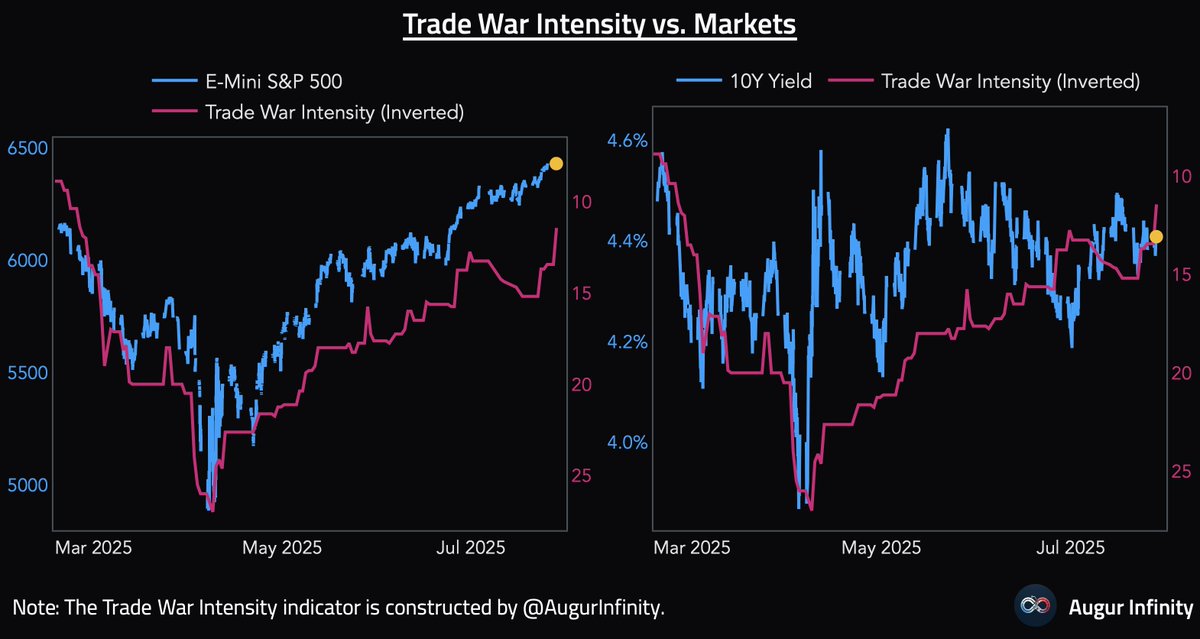

The EU trade deal brings some reprieve, but concerns over a global 15–20% tariff keeps the rally in equities muted.

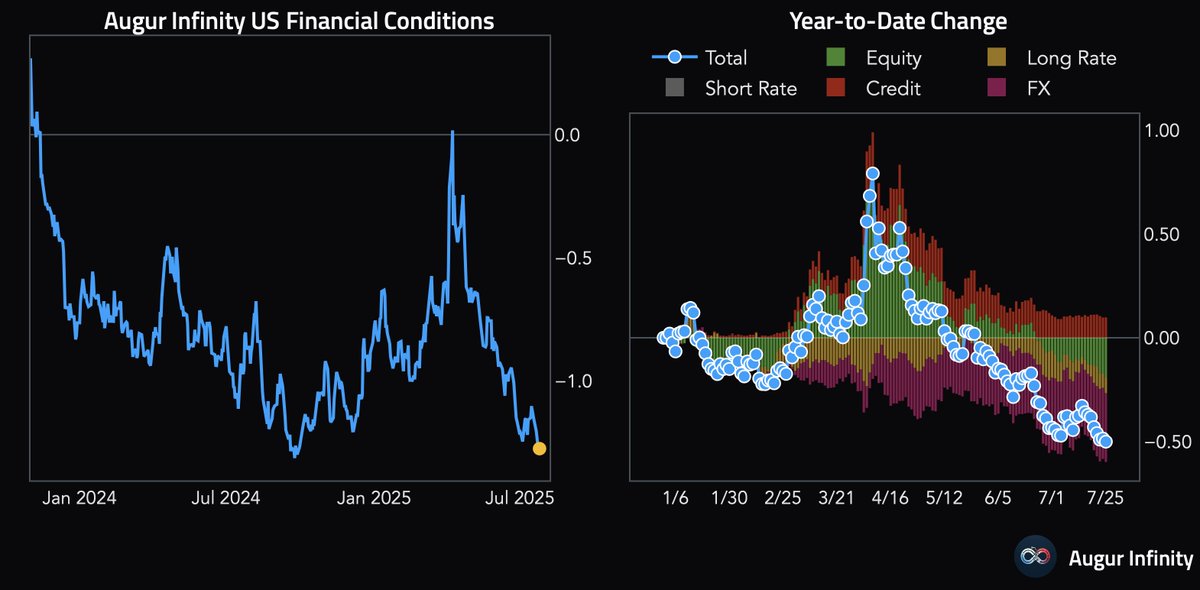

🇺🇸 US financial conditions has eased significantly this year, driven by the rally in equities, the weakening dollar, and a small decline in long bond yield.

🇺🇸 US Dallas Fed Manufacturing Index rose to 0.9 in July, a significant improvement from June's -12.7 and ending five consecutive months of negative readings.

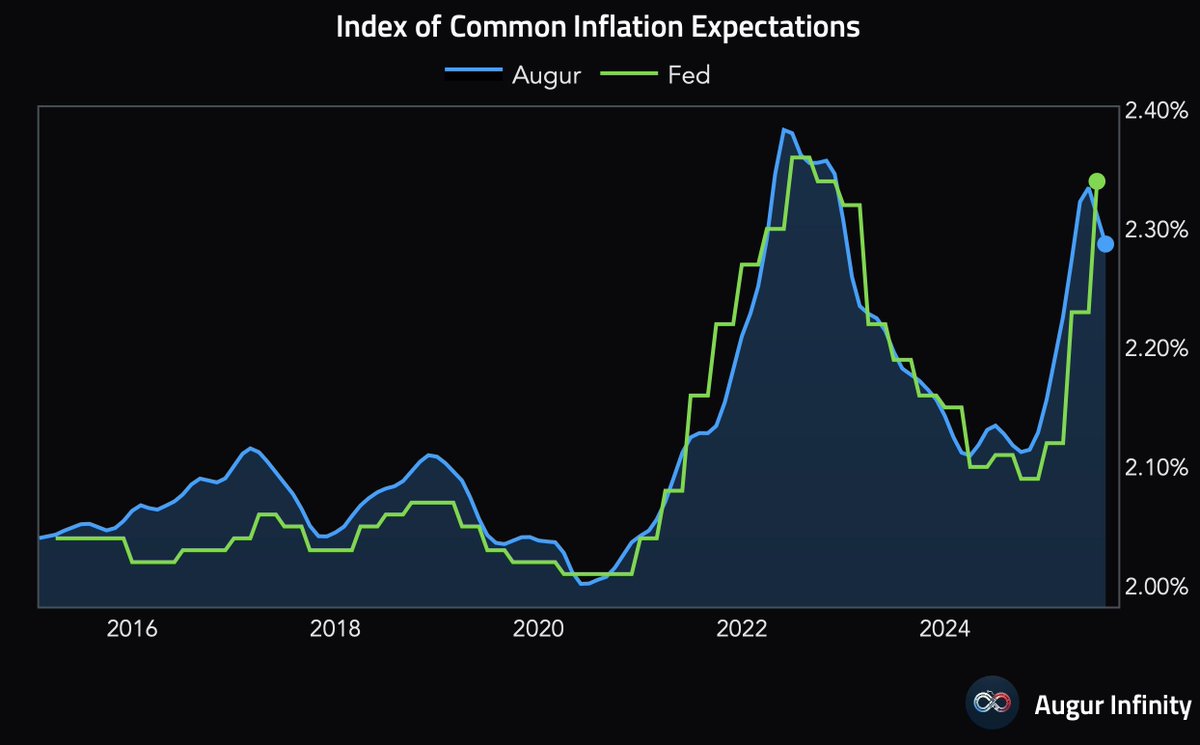

🇺🇸 The Fed's Index of Common Inflation Expectations rose sharply from 2.23% to 2.34% in Q2. However, our monthly tracking suggests the indicator has already turned down over the past two months. infinity.augurlabs.com/openstoryboard…

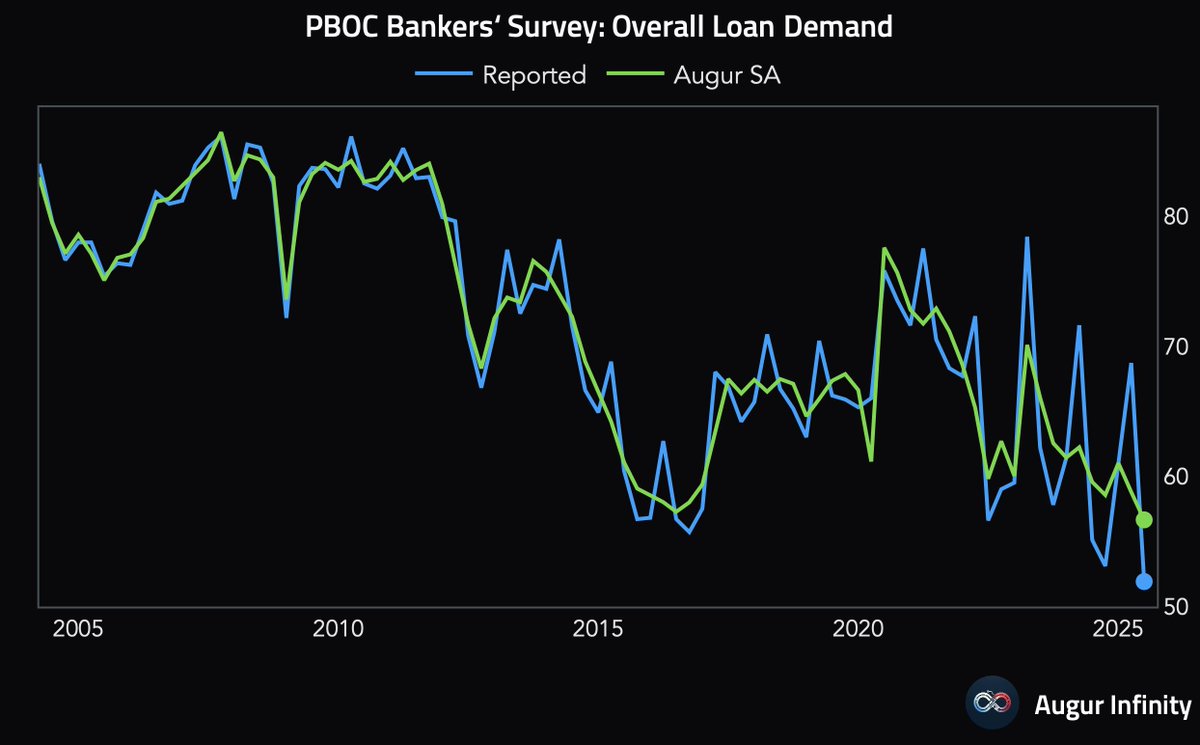

🇨🇳 According to PBOC's survey, loan demand in China has crashed to the lowest level on record. infinity.augurlabs.com/openstoryboard…

Greece vs France: Yields #chartoftheday (via @AugurInfinity) "Greece 10-year yield is roughly the same as France 10-year. 5-year Greek yield is now solidly below French 5Y".

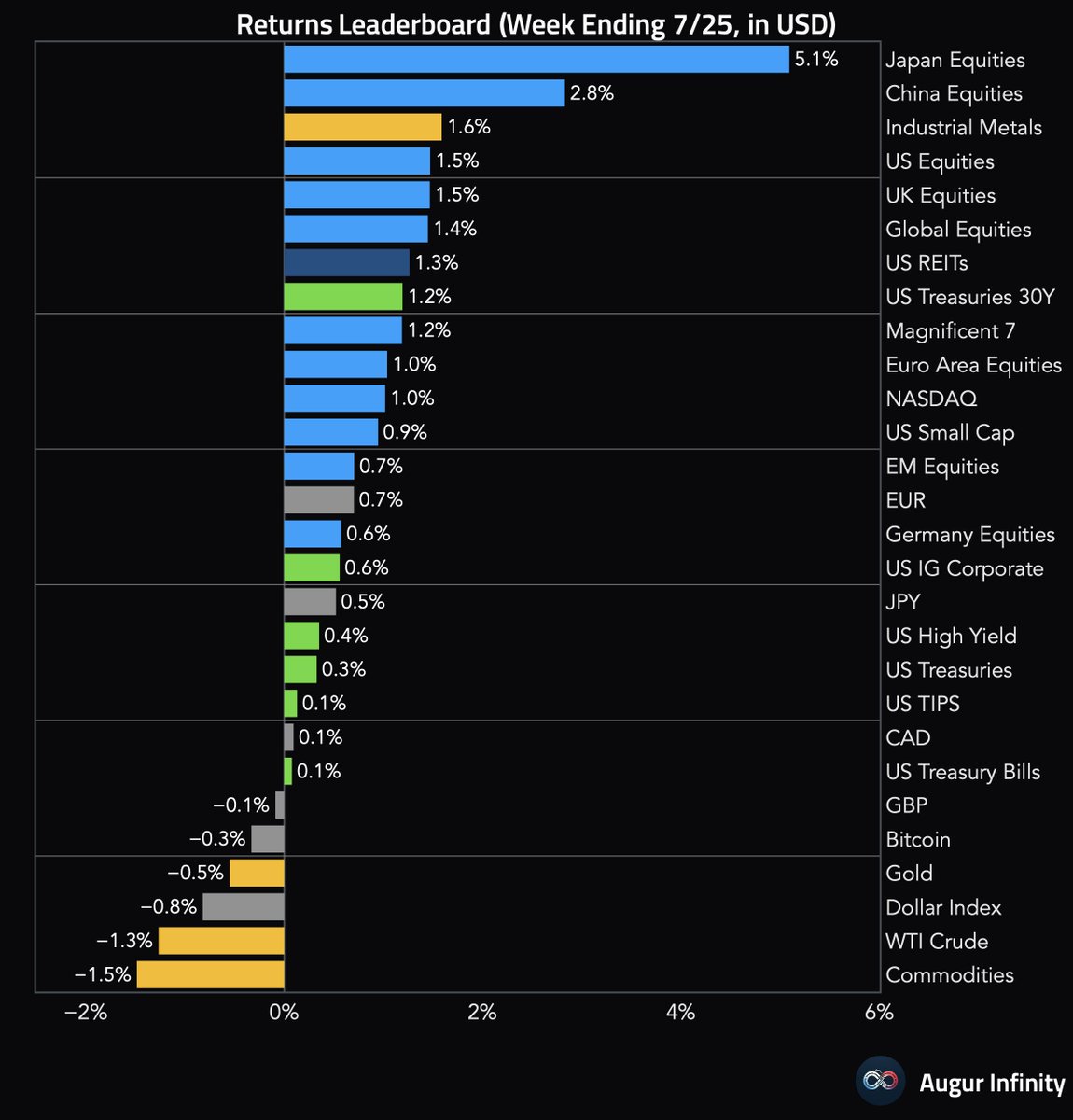

Here's how global assets performed in the week ending July 25, 2025. #investing

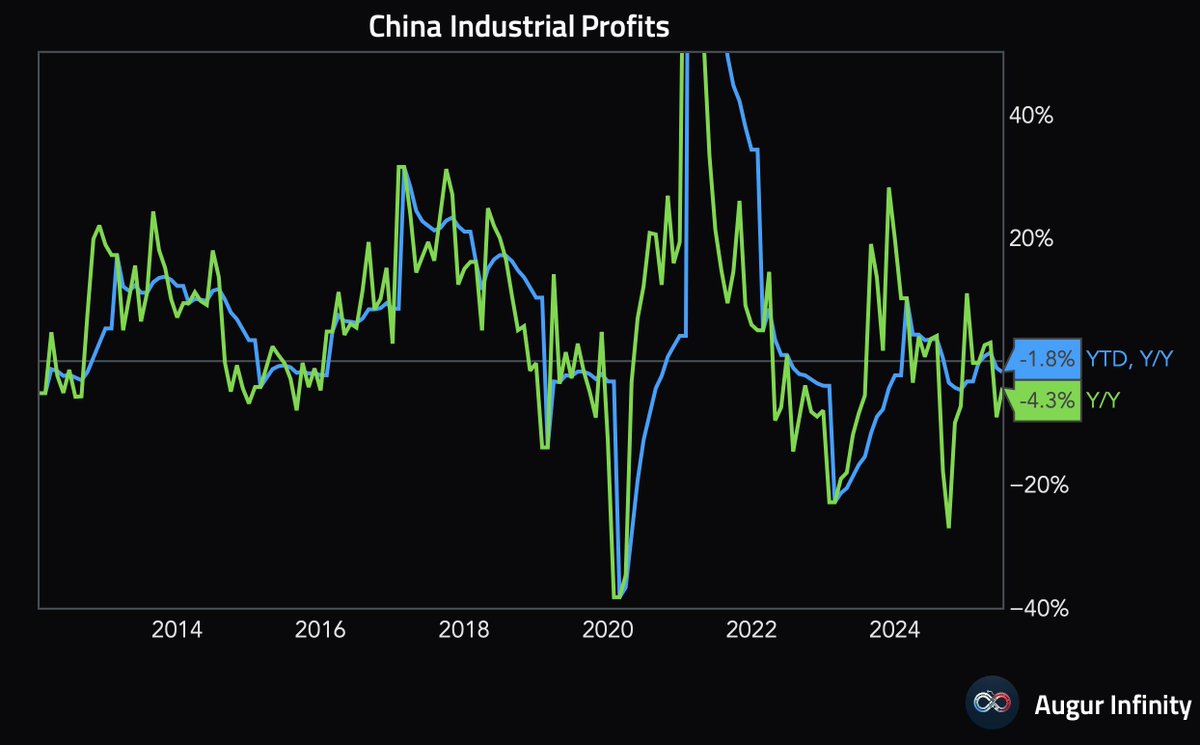

🇨🇳 China Industrial Profits for the first six months fell 1.8% compared with the same period last year. On a year-over-year basis (i.e., June vs. June), industrial profits declined by 4.3%.

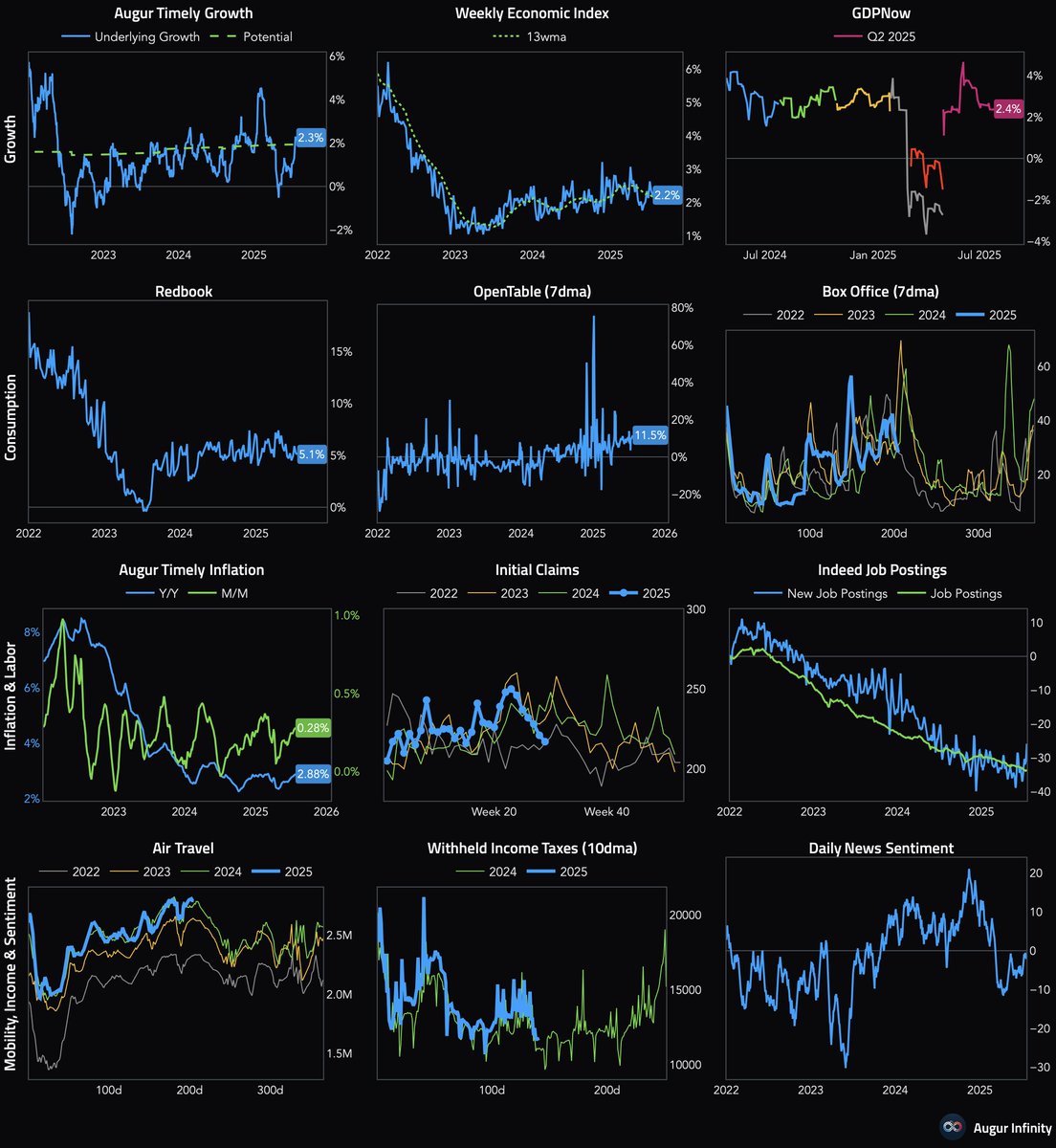

US high-frequency dashboard, composed of daily and weekly economic indicators (updated as of July 25, 2025). #economy

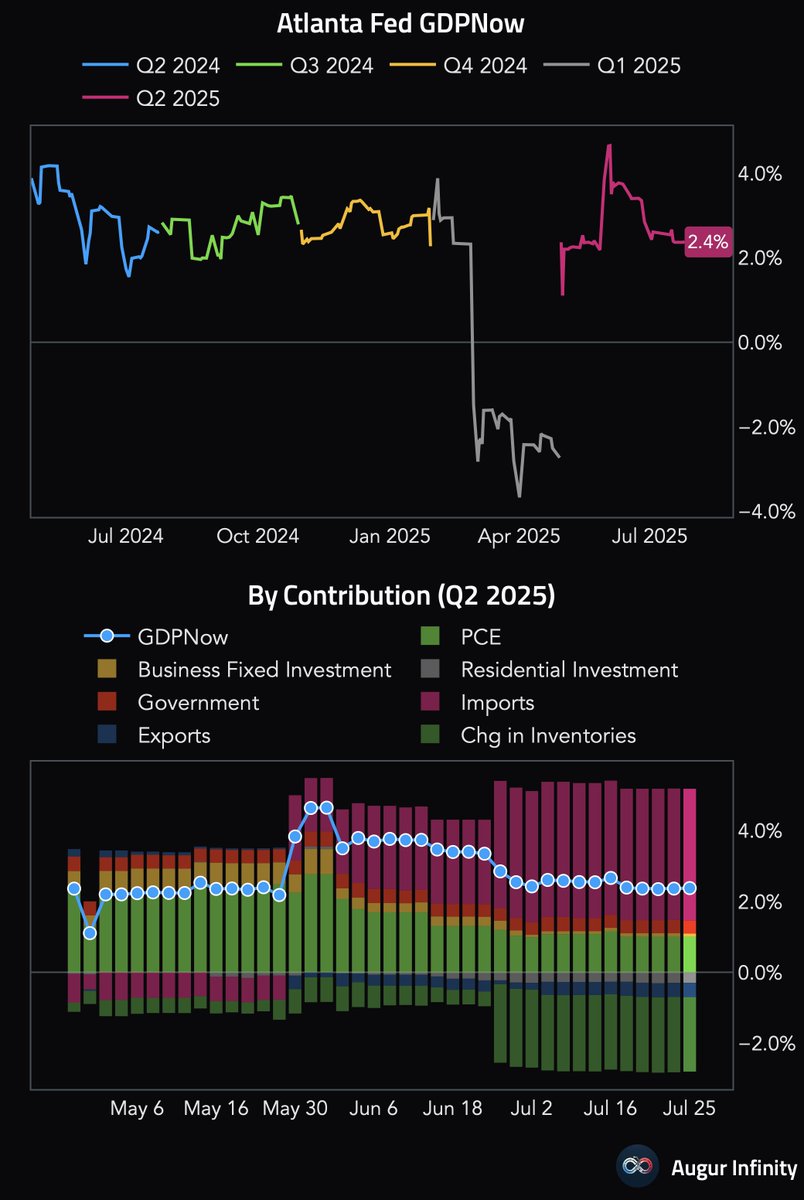

🇺🇸 The Atlanta Fed's GDPNow model is now tracking Q2 GDP at 2.4%, unchanged from July 18 after rounding.

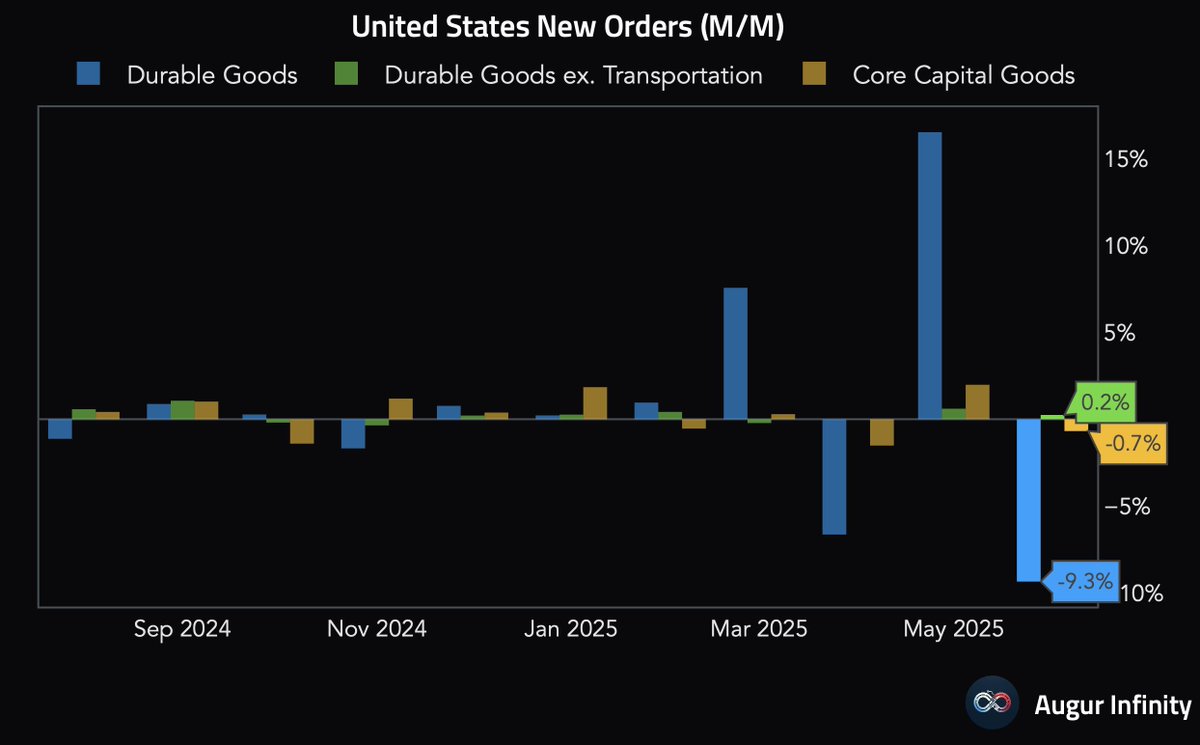

Durable goods orders fell 9.3% M/M, better than expected, driven by a $31B drop in volatile aircraft orders. Ex-transportation orders rose 0.2%. Core capital goods orders (a proxy for biz. investment) unexpectedly fell 0.7%, although a significant upward revision to May's data…

Market-implied long-term real earnings growth in the US remains significantly higher than in the rest of the developed world.

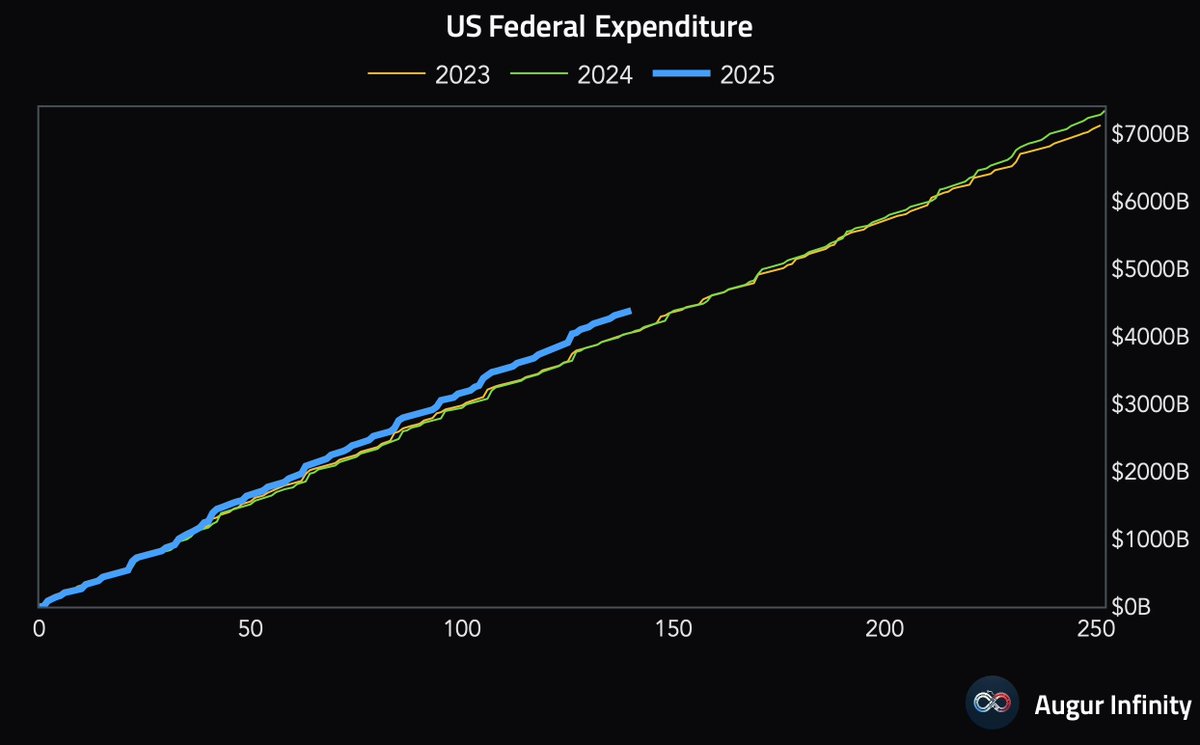

🇺🇸 US federal spending this year is running above prior year levels.

🇩🇪 Germany’s GfK Consumer Confidence unexpectedly fell to -21.5, missing the -19.2 consensus and declining from -20.3. This is the lowest reading for the index since April 2025, signaling persistent caution among households.

🇪🇺 The ECB held its deposit facility rate at 2%, a unanimous decision that was in line with consensus. President Lagarde stated that policy is "in a good place" and that the council is positioned to "wait and see," though she acknowledged that growth was a "little bit better"…

🇯🇵 Tokyo Core CPI (ex-fresh food) missed expectations at 2.9% Y/Y (3.0% EST). However, the New Core CPI (ex-food & energy) was in-line at 3.1% Y/Y, as processed food inflation offset weaker durable goods. Underlying inflation is stronger; excluding one-off factors, New Core CPI…

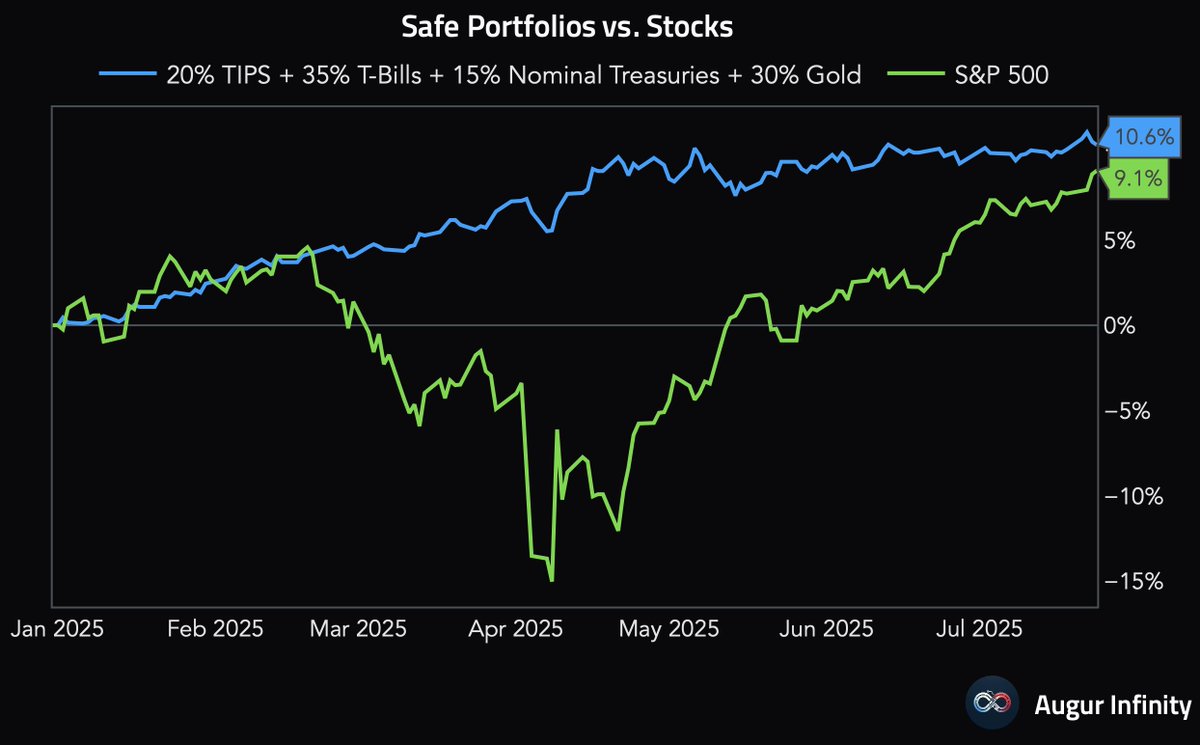

A simple portfolio of "safe" assets is still outperforming the S&P 500 this year.

🇺🇸 US margin debt exceeded $1 trillion for the first time in history in June.

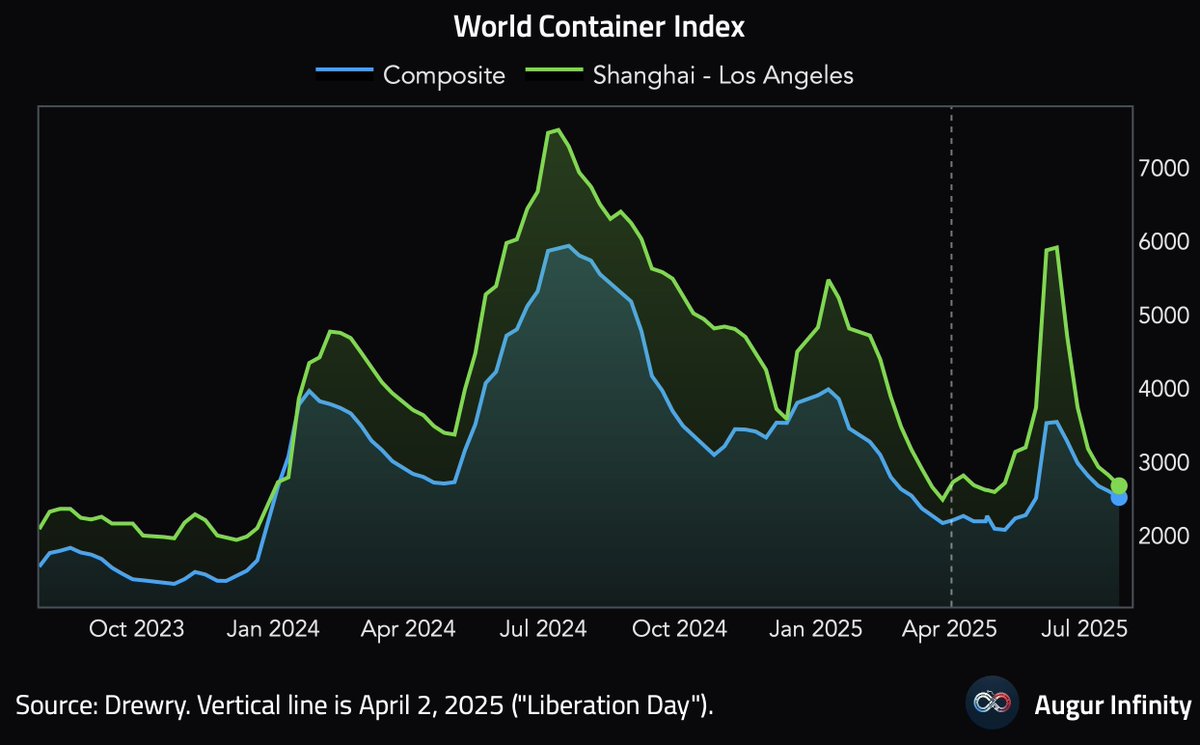

The World Container Index, which measures spot freight rates, declined for the 6th consecutive week.

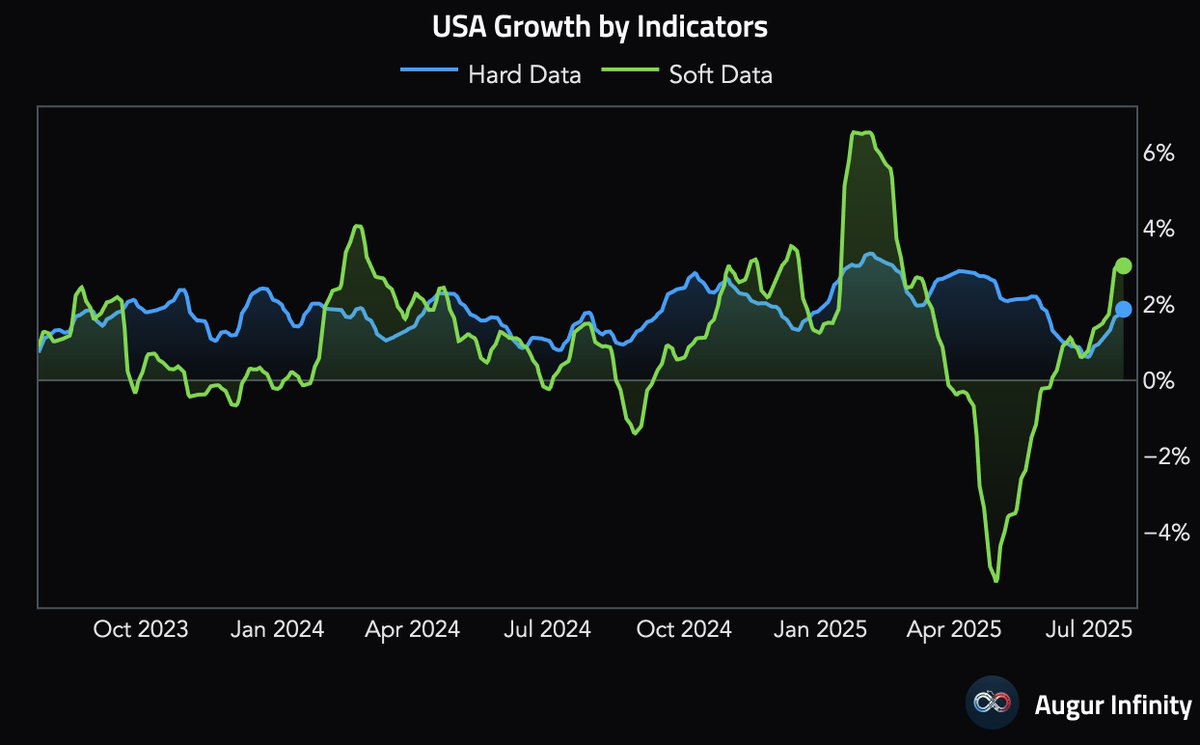

🇺🇸 Based on our estimates, US growth rates implied by both hard and soft data have improved recently.