Marc Goldwein

@MarcGoldwein

Proud dad. Nonpartisan budget wonk + econ prof. Tweeting on fiscal & economic policy & the world. Thoughts are 𝐦𝐲 𝐨𝐰𝐧!

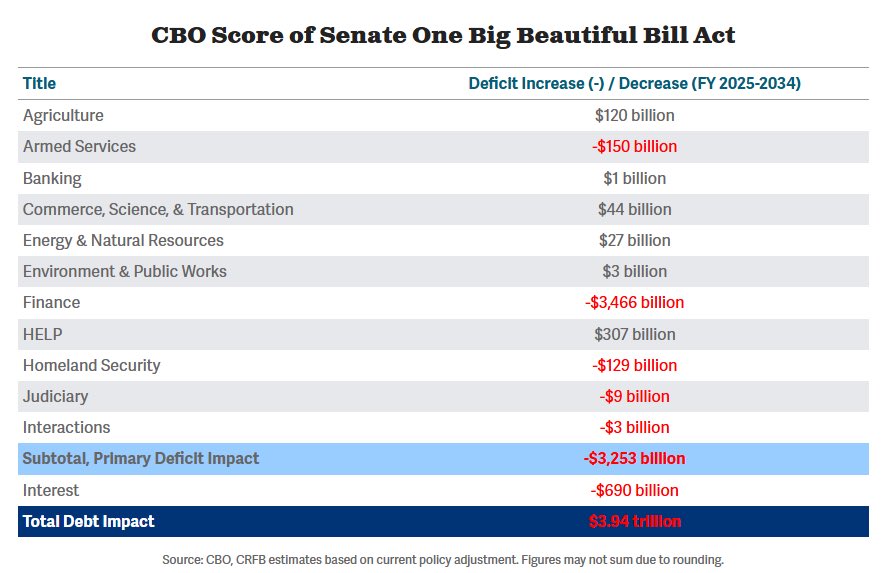

🚨 CBO is out 🚨- the Senate bill adds over $3.9 trillion to the debt as written. Way more if extended. crfb.org/blogs/cbo-scor…

endorse

Why did FRED go to having their second line default to a dot line, instead of a solid line? The only miss in a long line of Ws, I don't get it.

In response to Hamas leaders’ statements, people in Gaza have launched an initiative of raising white flags on their tents—a message that they’ve surrendered and want nothing but an end to the war.

Yesterday, at the invitation of my dear friend MK Naama Lazimi, I spoke as a Palestinian guest at a Knesset committee hearing on the potential for political and regional developments between Israel, the Saudis, and the Palestinians – focusing on how it could impact youth across…

A new study finds that when hospitals acquire physician practices, those doctors raise their prices by 15% within 2 years compared to independent peers. Healthcare M&A should be about integration and efficiencies. Too often, it's just about leveraging higher reimbursements rates.

Ben Bernanke and Janet Yellen: The Fed Must Be Independent nytimes.com/2025/07/21/opi…

Our mutual humanity is our source of hope for ending this human tragedy. Thanks @AlonLeeGreen תודה شكرا

Happening now in Tel Aviv: we march with the pictures of the children in Gaza who were starved to death by our government and our army. We cannot accept it. We call people to refuse the starvation, to refuse the killing, to refuse the annihilation.

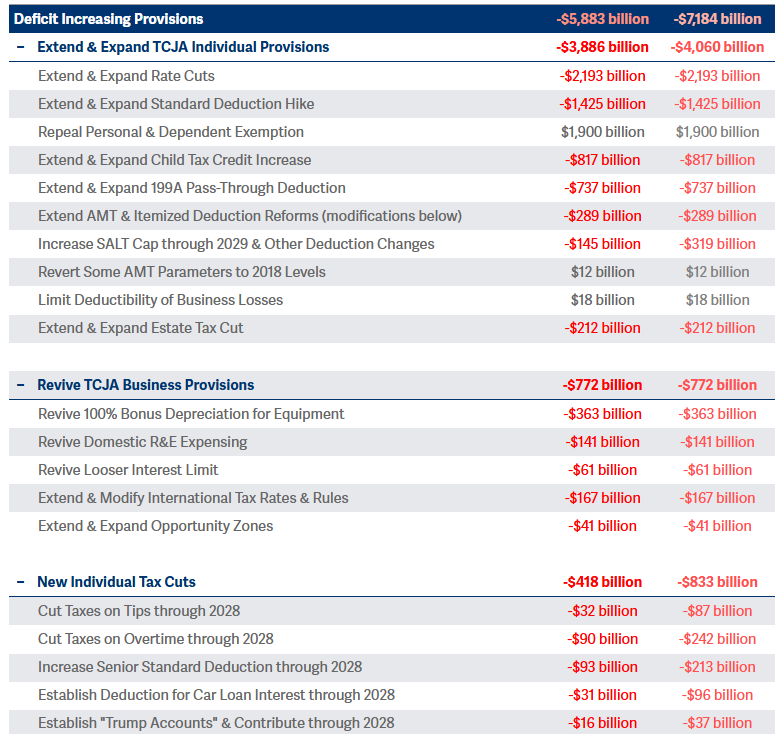

And when the the new tax cuts expire in 2028/2029, they’re gonna say “we need new tax cuts and can’t just extend the old ones” and they’ll try to do the same thing again.

The reconciliation bill cost way more than just a clean TCJA extension.

The reconciliation bill cost way more than just a clean TCJA extension.

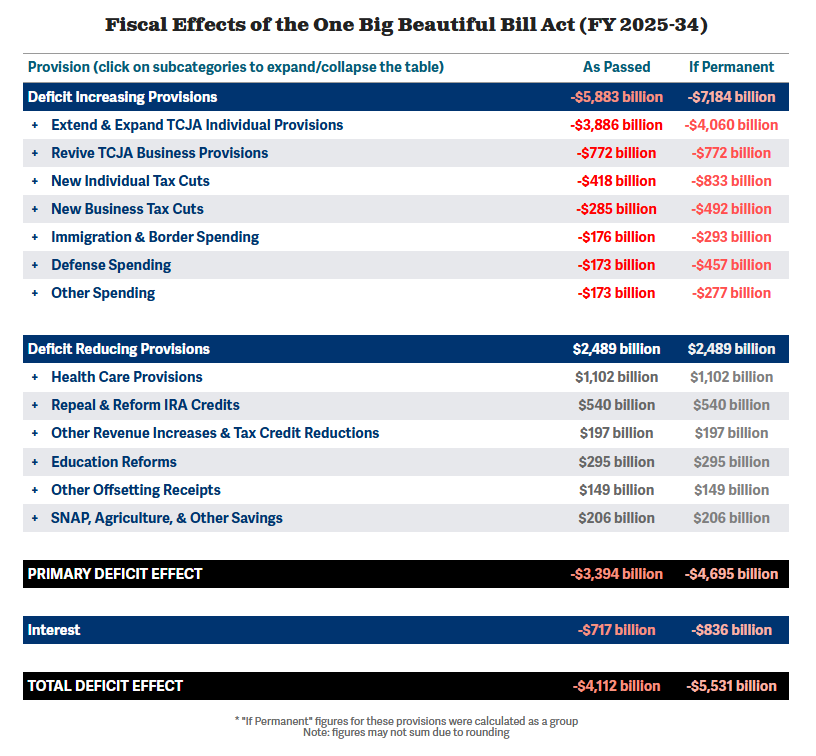

It would have cost 3.8 trillion to just extend all expiring tax provisions But instead Rs wrote something that cost 4.7 trillion (but turned some of it off early to pretend it only costs 3.4 trillion) And the 2nd decade impact is larger because some of the savers are one-time

The algorithm needs to make this viral.

See what's in the One Big Beautiful Bill Act with CRFB's new expandable summary table: crfb.org/blogs/whats-on…

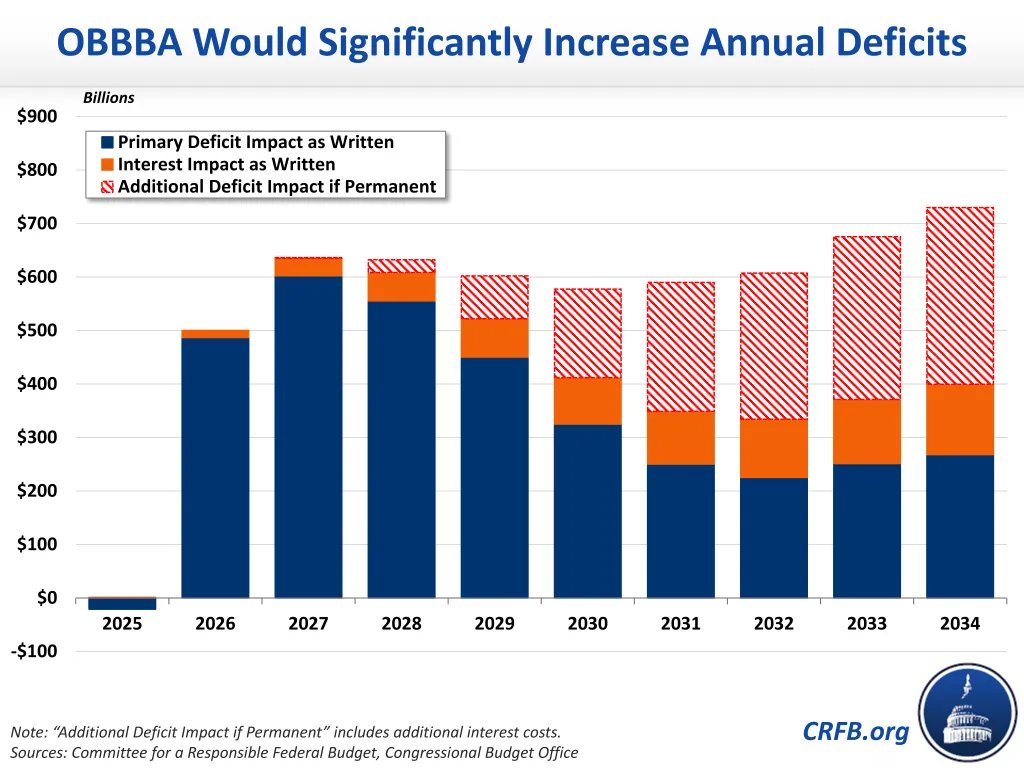

Your reminder that lawmakers just added $4 trillion to the 9-year deficit -- $5.5 trillion if OBBBA is permanent. We're talking $600 billion per year! crfb.org/blogs/whats-on…

See what's in the One Big Beautiful Bill Act with CRFB's new expandable summary table: crfb.org/blogs/whats-on…

Because the program is not in balance, these workers either need to pay more tax, or accrue fewer future benefits to fix it. These are not exactly identical, but you can't really avoid the "pain" unless you are willing to tax someone else to fill the gap.

"Young Workers Could Lose $110,000 in Lifetime Earnings to Keep Social Security Solvent" cato.org/blog/young-wor… via @CatoInstitute @RominaBoccia

By the way @bennyjohnson was getting paid half a million a month by the Russians. pbs.org/newshour/amp/p…

the fastest growing political youtube channel is benny johnson's account, he grew more last quarter than the next four highest accounts combined...

What if I told you that Trump has a point when it comes to the problems with taxation of benefits? What if I further told you that a smart way to fix them is to tax more benefits. And what if I also told you that we could fully end taxes on benefits AND improve solvency?

"Today’s youngest retirees will be just 69 years old when insolvency demands deep cuts in benefits. Time is running out to enact thoughtful reforms," wrote @MarcGoldwein & Anthony Colavito @BudgetHawks barrons.com/articles/socia…

So depressing that the cutting edge bipartisan idea on Social Security reform is “what if we cover the whole shortfall by going into massive debt for 75 yrs, but also take out $1.5 trillion *more* debt to put in the stock market, and hope that pays for some of it”

Actually, OBBBA does not end taxation of Social Security benefits. In @barronsonline, my colleague and I have a plan that could. And would improve solvency at the same time! barrons.com/articles/socia…

The One Big Beautiful Bill delivers on President Trump’s NO TAX ON SOCIAL SECURITY promise. Under the One Big Beautiful Bill, 51.4 million seniors — 88% of all seniors receiving Social Security income — will pay NO TAX on their Social Security, according to @CEA47.

$4.1 trillion.

🚨 Today, @USCBO released its final conventional score of the recently-enacted reconciliation bill known as the One Big Beautiful Bill Act (OBBBA). CBO estimates that the legislation will add $3.4 trillion to the primary deficit through 2034. With interest, we estimate it would…

Based on your bio as a nonpartisan budget expert and econ prof, plus tweets emphasizing fiscal responsibility, debt reduction, human rights, and evidence-based policy (e.g., vaccines, inflation analysis), you most resemble Alexander Hamilton. He pioneered U.S. fiscal systems,…

Based on your bio as a nonpartisan budget expert and econ prof, plus tweets emphasizing fiscal responsibility, debt reduction, human rights, and evidence-based policy (e.g., vaccines, inflation analysis), you most resemble Alexander Hamilton. He pioneered U.S. fiscal systems,…

Hello,@grok, which historical leader am I most similar to? Please take into consideration all of my tweets, my bio and all information in general