CRFB.org

@BudgetHawks

The Committee for a Responsible Federal Budget is a nonpartisan group of budget experts concerned about this nation's fiscal future. http://crfb.org/subscribe

"In a massive fiscal capitulation, Congress has passed the single most expensive, dishonest, and reckless budget reconciliation bill ever – and, it comes amidst an already alarming fiscal situation," CRFB President @MayaMacGuineas writes in reaction to the House's passage of the…

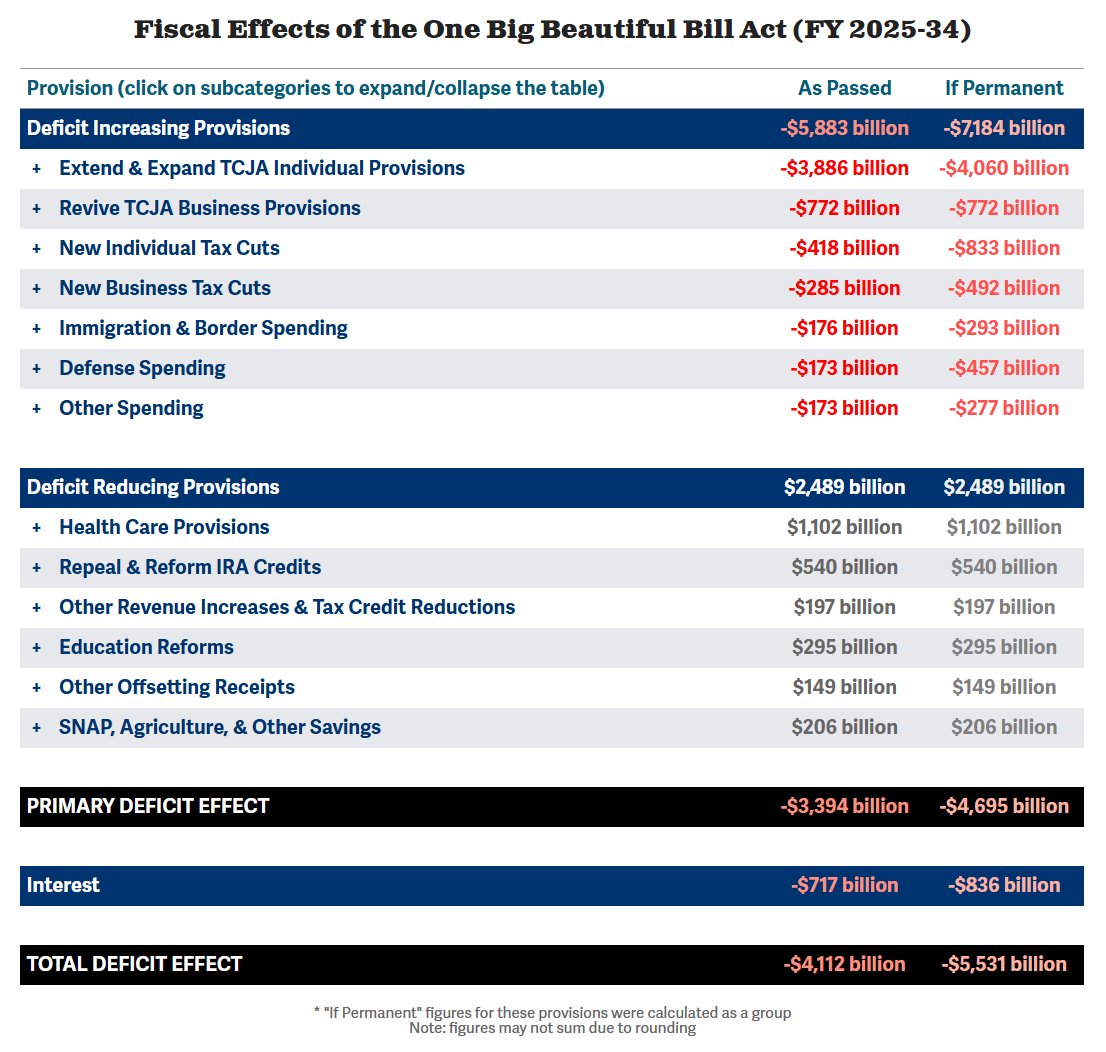

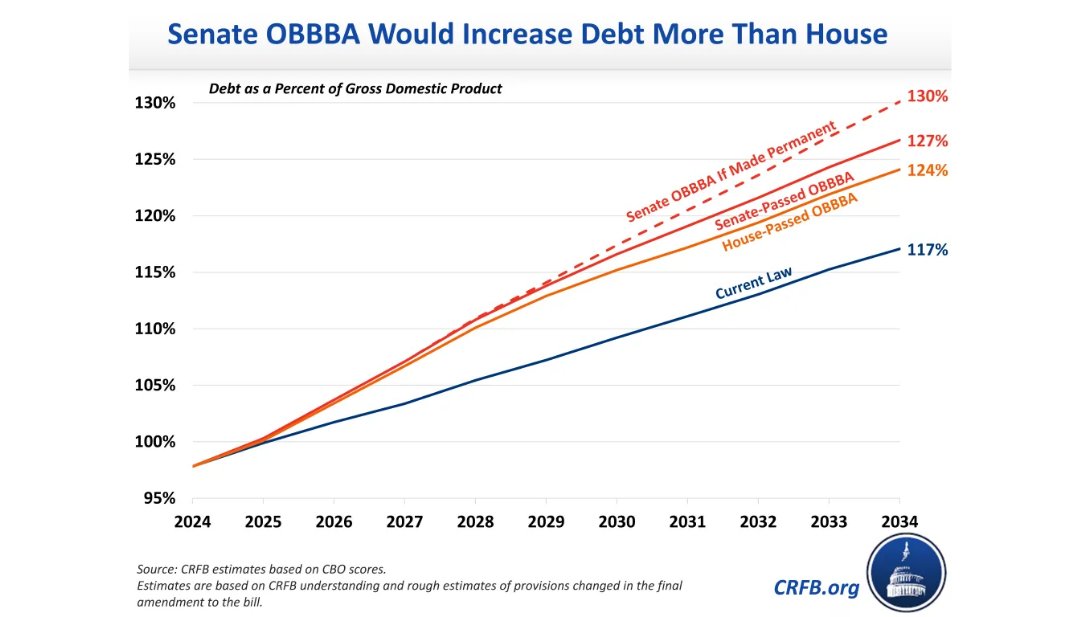

🚨 The One Big Beautiful Bill Act (OBBBA) will increase borrowing by $4.1 trillion through 2034, according to @USCBO: This includes: ➡️$5.9 trillion of tax cuts & spending increases ➡️$2.5 trillion of offsets ➡️Over $700 billion of interest costs If made permanent, we estimate…

🚨 Today, @USCBO released its final conventional score of the recently-enacted reconciliation bill known as the One Big Beautiful Bill Act (OBBBA). CBO estimates that the legislation will add $3.4 trillion to the primary deficit through 2034. With interest, we estimate it would…

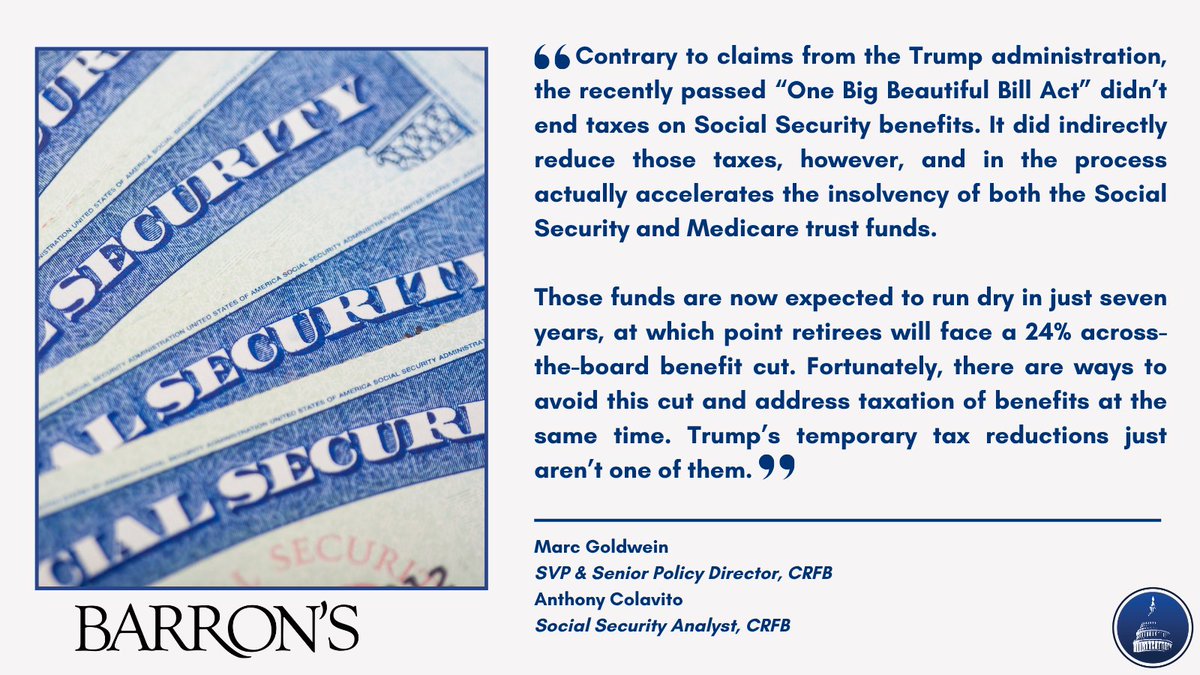

📰NEW in @barronsonline: CRFB's @MarcGoldwein and @AColavi explain that OBBBA didn't end taxes on Social Security benefits – but it did indirectly accelerate insolvency of its trust fund, leading to sooner cuts. "Fortunately, there are ways to avoid this cut and address taxation…

🚨NEW: A bill has been introduced that would significantly worsen the fiscal effects of the already debt-increasing reconciliation law (the “One Big Beautiful Bill Act”) – only 11 days after the legislation was signed into law. The bill, introduced by Senator Josh Hawley (R-MO),…

🩺.@CMSGov took a good first step toward site-neutral payment rates. The OPPS/ASC proposed rule would pay the same amount for physician-administered drugs at clinics and hospital outpatient departments. ➡️More site-neutral payments can help ensure the #Medicare program and…

Today, CMS issued the Calendar Year 2026 Hospital Outpatient Prospective Payment System and Ambulatory Surgical Center Payment System proposed rule introducing reforms to modernize payments, expand access to care, and enhance hospital accountability. cms.gov/newsroom/press…

Today, we brought together leaders from 16 bipartisan organizations. This is the beginning of an effort to build the bipartisan community in D.C. and throughout America — to get things done and make our nation stronger! Thank you for joining us, @NoLabelsOrg @WithHonorAction…

We’re on course for 2 3/4% CPI inflation for 2025. Via @katekgen at @BudgetHawks

🚨.@USCBO released its Monthly Budget Review for June 2025, estimating that federal spending, as measured by outlays, is $144 billion higher in the first half of calendar year 2025 than 2024. The following is a statement from CRFB President @MayaMacGuineas:…

We shouldn’t be passing any legislation that makes the debt worse,” says @mayamacguineas. “We should be passing legislation that reduces the debt, doesn’t add a penny, let alone $5.5trn.” The new tax bill, on “Checks and Balance economist.com/podcasts/2025/…

📰NEW in @dallasnews: What's more astonishing than recent warnings that #SocialSecurity will be insolvent in just 8 years? "That our political leaders have known for decades that the program faces insolvency and have failed to act," writes CRFB President @MayaMacGuineas.…

🚨"A DARK DAY FOR OUR FISCAL FUTURE": The House passed the Senate reconciliation bill, sending it to the President’s desk. This will be the most expensive reconciliation bill in history, adding $4.1 trillion to the national debt through 2034, $5.5 trillion if extended…

That's one GOP no vote for each $1 trillion added to the debt.

🚨 There are now FOUR Republicans voting NO on the rule. That's one more than they can afford. Unless at least one flips, this rule cannot move forward (presuming all Democrats show up).

Will the real Fiscal Heroes please stand up? Today’s a day for backbone – not backing down.

Speaker Johnson committed either $2 trillion of spending cuts or a reduction in the $4.5 trillion of tax cuts. The Senate bill only has $1.4 trillion of spending cuts, despite $4.5t of tax cuts. It violates the House limit by $600 BILLION!

The debt concerns are certainly warranted. Adding more to the debt than the CHIPS Act, the Bipartisan Infrastructure Law, the American Rescue Plan Act, and the CARES Act combined is a far cry from fiscal responsibility. ⤵️

GOP MO Rep Burlison on being a no on the rule for OBBB: For me it’s about the debt, the deficit. What the Senate sent back has a lot of errors in it, but more importantly it really blows up the deficit, and so I want to reign that in. I think that they moved too quickly. We want…

The Senate bill has only $1.4 trillion of spending cuts, despite $4.5 trillion of tax cuts. It breaches the House limit by $600 BILLION. This is not a close call... cc/ @chiproytx @RepRalphNorman @RepAndyBiggsAZ @RepEricBurlison @RepThomasMassie @RepSmucker

One of the complaints i've heard consistently today is something we've been pointing out in @PunchbowlNews the last few days The House's budget resolution clearly called for $2T in spending cuts for $4.5T in tax cuts. @RepSmucker and others made abundantly clear that this was…

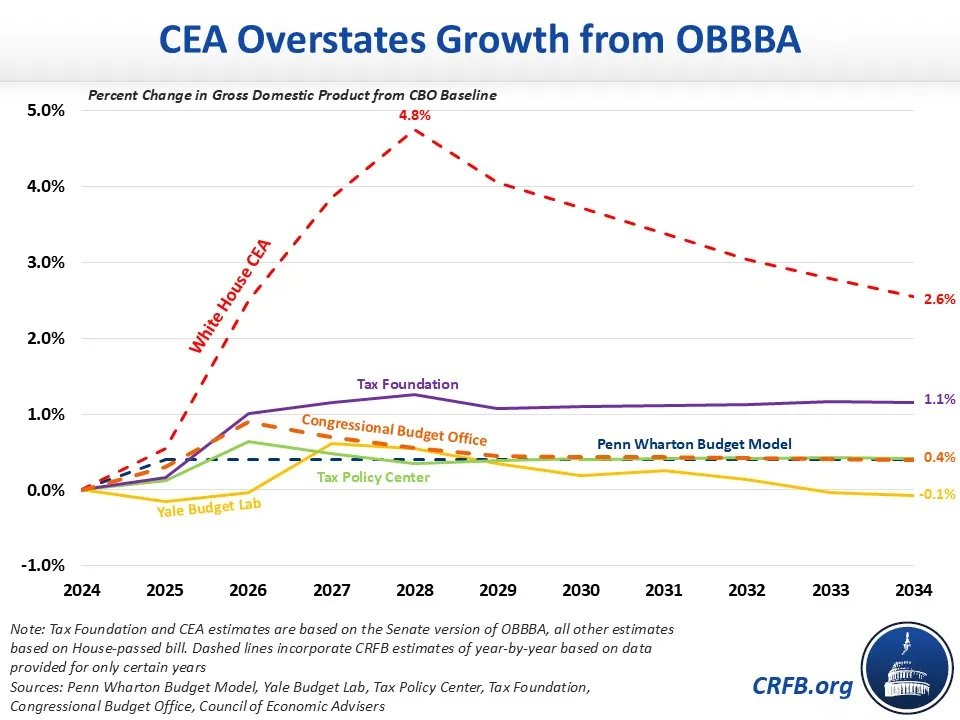

If the President is referring to the growth in our national debt, then this bill grows it even more. But if referring to the economic growth from extending tax cuts – it's quite the overstatement.

We have some concerns as well... ⤵️

MEANWHILE: House Freedom Caucus leaders are circulating this doc torching the Senate-passed "big beautiful bill." They say it increases deficits and contains insufficient clean energy cuts, inadequate Medicaid rules, "excessive port for Alaska and Hawaii," among other grievances.

📈NEW: The Senate reconciliation bill would massively expand the Radiation Exposure Compensation Act (RECA). CBO estimates it would cost about $8 billion – already more than 50 times as large as the current program in its peak year. But the Senate’s arbitrary expiration of two…