Karl Schamotta

@Karl_Schamotta

Chief Market Strategist, Corpay by day. Nerd by night. Subscribe to my daily FX note: https://corpaycurrencyresearch.com/newsletters/

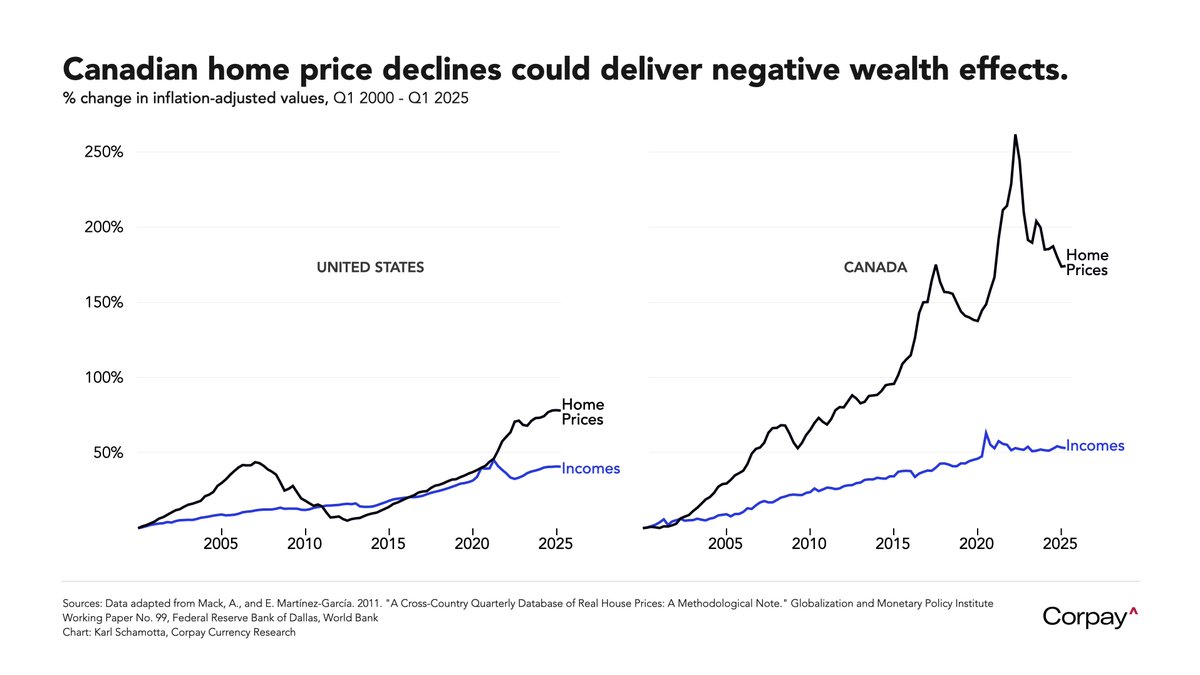

In real terms, Canadian real estate markets are (arguably) suffering their biggest downturn since the early nineties—something that could be negative for growth in the short term, but positive for productivity and social harmony in the long term:

"In the five months since President Trump first announced sweeping tariffs, Amazon quietly raised prices on low-cost products..., a Wall Street Journal analysis of nearly 2,500 items found." wsj.com/business/retai…

The yen and dollar are trading at levels last seen … checks notes … at noon today:

Commodore Perry might beg to differ.

TRUMP SAYS HE HAS JUST SIGNED THE LARGEST TRADE DEAL IN HISTORY WITH JAPAN.

That’s not an accurate headline. Let me fix it: The U.S. and Japan have agreed to tax their respective peoples 15% each on one another’s goods for no apparent reason.

US and Japan agree on trade deal to reduce tariffs to 15% s.nikkei.com/3H1fAKh

“Even Schrödinger's cat watches Jerome Powell's pressers before deciding if it's alive or dead”

Ten facts about Jerome Powell few know about.

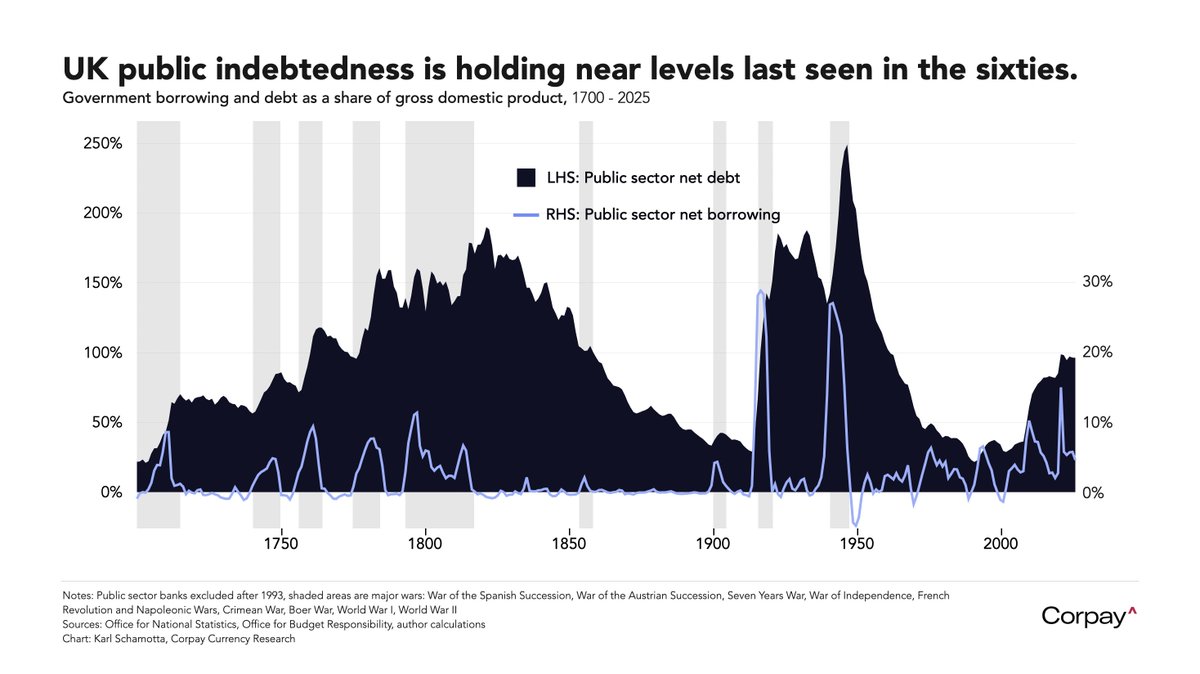

Government debt in the UK is near levels last seen in the sixties, but appears to be stabilising, unlike what's happening in the US:

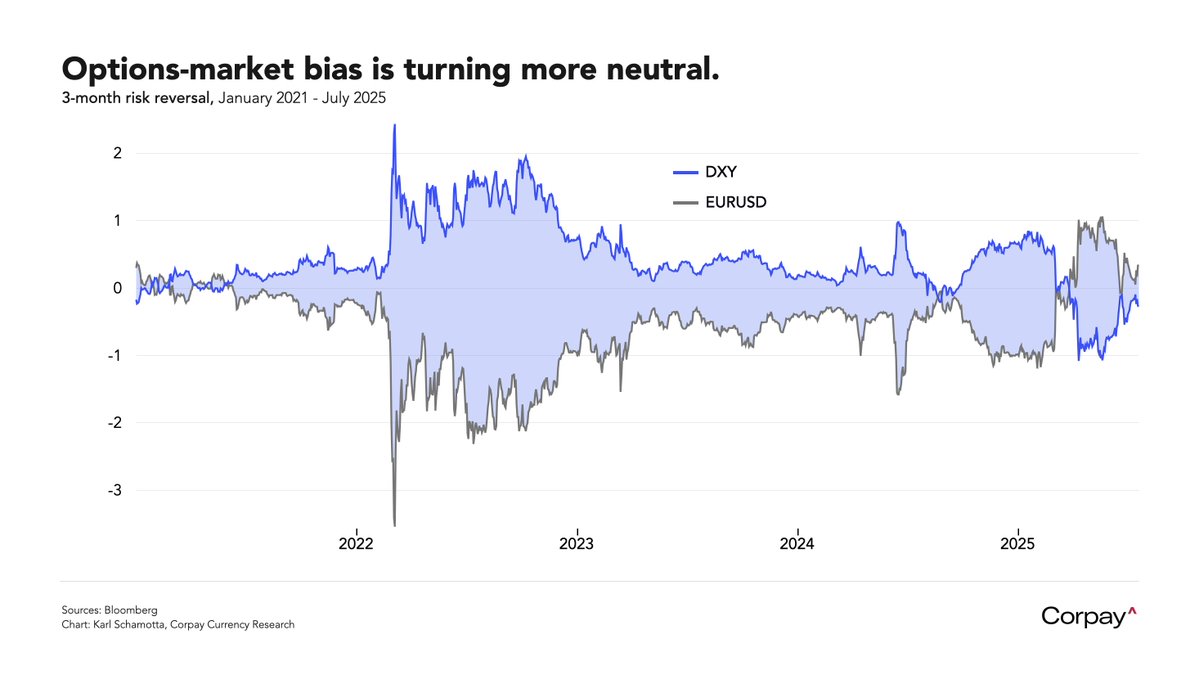

Options markets are turning more neutral on the dollar and euro, although—unusually from a historical perspective—the euro is still seen having slightly more upside:

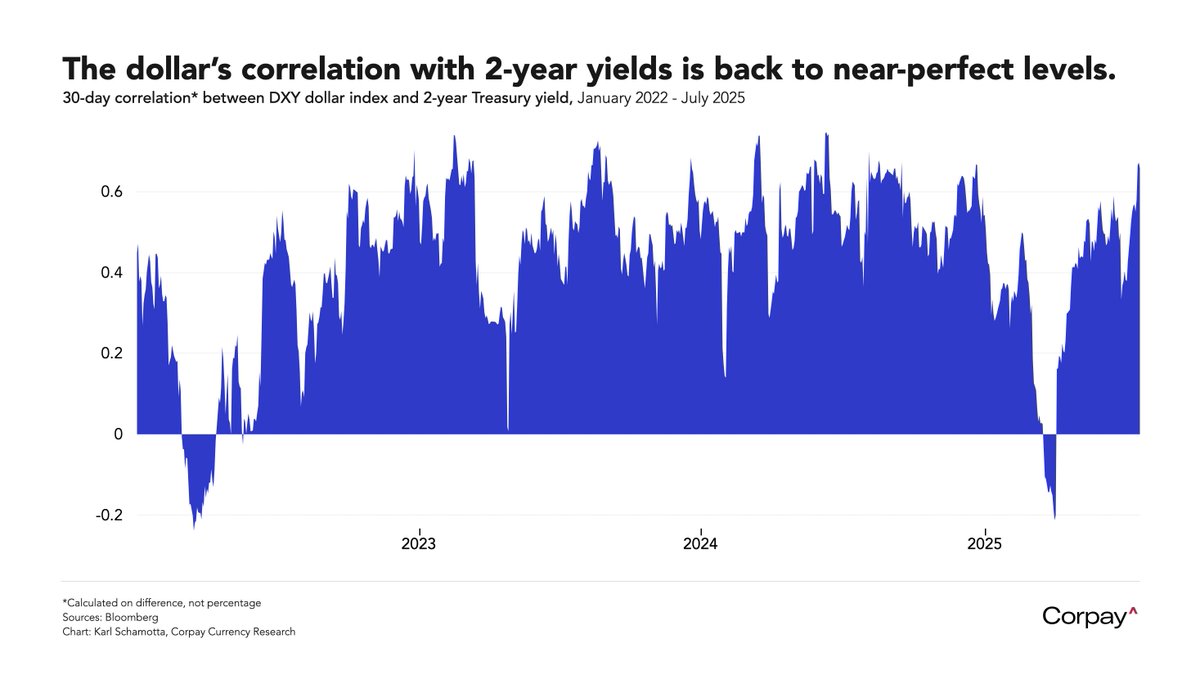

Yields—but oddly, not yield differentials—are back to driving the US dollar bus:

Believe this is specific to China

BESSENT SAYS AUGUST 12 TARIFF DEADLINE LIKELY TO BE EXTENDED

Have they tried distributing a dot plot?

As the White House continues to scrutinize the Fed's HQ renovations, the central bank publishes a virtual tour on its website and highlights changes made since the 2021 proposal federalreserve.gov/faqs/building-…

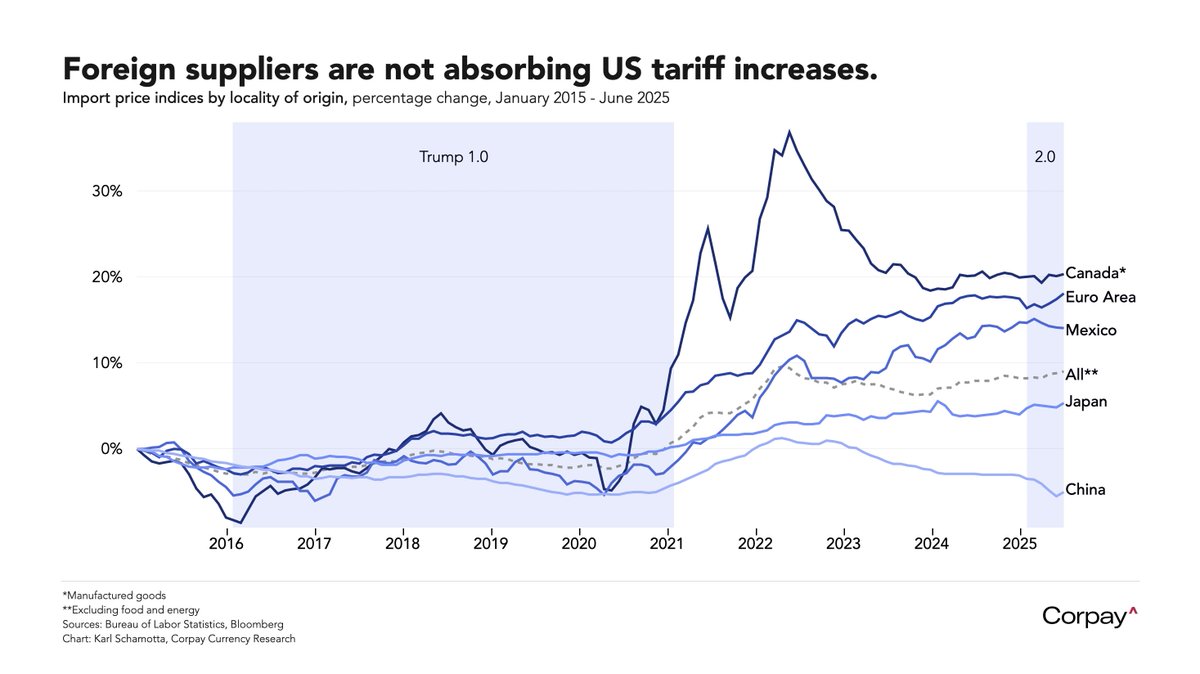

The evidence thus far does not suggest that foreign suppliers are absorbing US tariff increases:

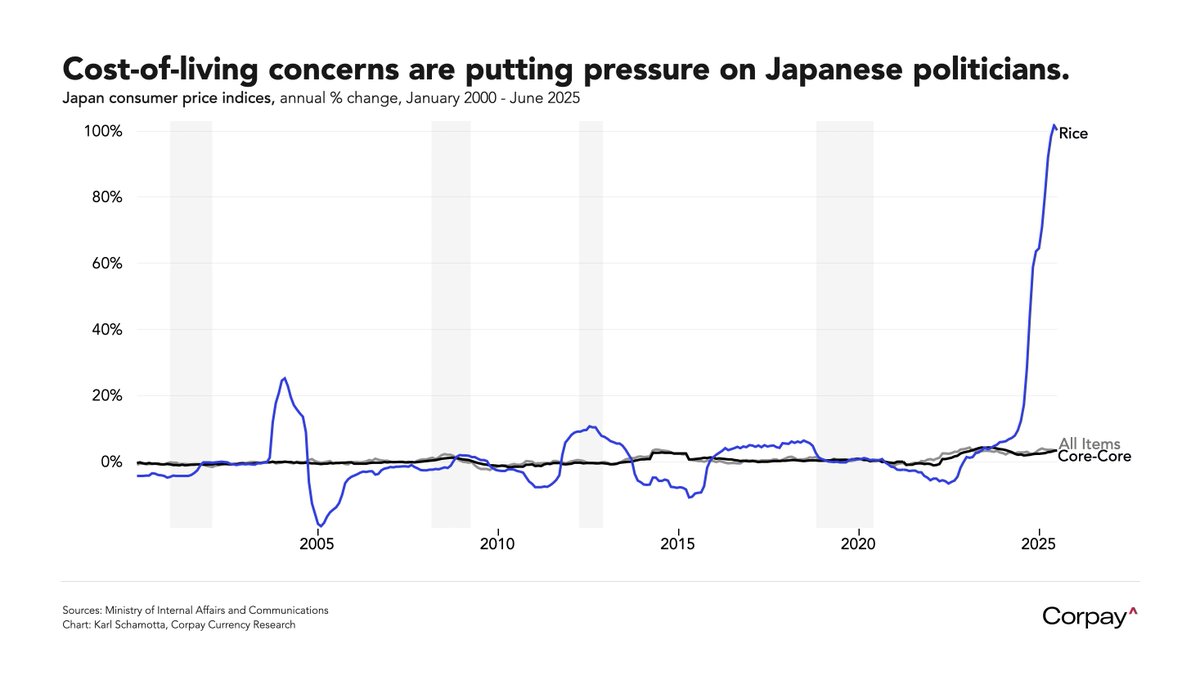

Japan doesn't have an inflation problem, it has an autarkic rice problem.

Is it sad and embarrassing that I was aware of the Goetzmann book, but not the song?

I don’t believe in supernatural stuff, but this song was playing as I turned my car on this morning and I think possibly the universe is telling me something.

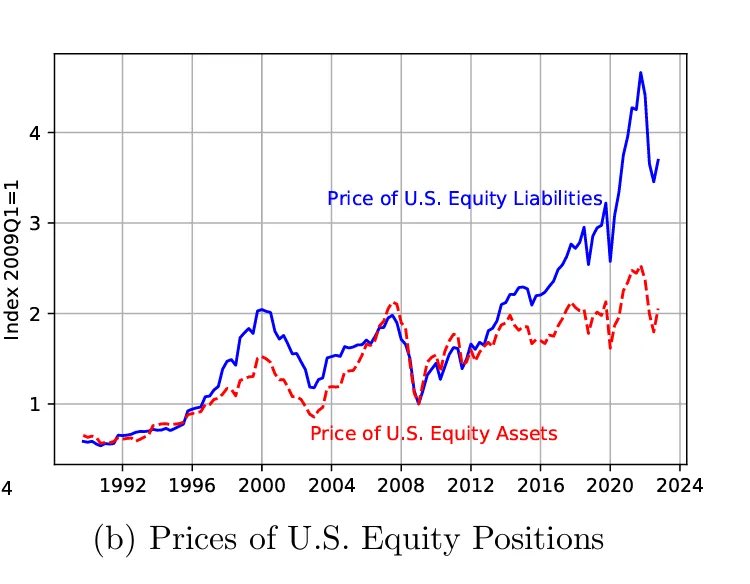

Fantastic work from @adam_tooze this morning, expressing* a view I’ve come around to: to some extent, recent US financial dominance comes from the political economy’s willingness to offer investors superior pillaging opportunities. *more subtly of course…

"DOGE, another area of investor concern in April, was nothing but a massive head fake (just as we predicted). And there is no appetite for fiscal austerity – the budget deficit is only getting bigger." @darioperkins @TS_Lombard

What happened after Sputnik? @ATabarrok provides a striking summary: NSF funding tripled in a year and increased by a factor of more than ten by the end of the decade. The National Defense Education Act overhauled universities and created new student loan programs for foreign…

The great Japanese inflation scare of '24-'25 which has been a favorite of the fintwit doomers is fading as expected. And with it hopes for rapid tightening from the BOJ or a reverse carry trade shock.

For all the noise around the Fed chair, short rate markets aren't pricing that the new chair will do much of anything (slated for May '26).

Risk reversals are still pointing to asymmetric upside in the euro, but punters willing to place a short-term bet on it are few and far between:

Dollar longs according to the CoT report from the CFTC aren't actually all that big at the moment. Maybe a 6/10. What's interesting is that Euro longs against the Dollar remain quite modest. Maybe a 5/10. All that EU chest-beating we have to listen to isn't impressing anyone...

Achilles didn’t stand a chance.

This dude shows a tortoise it can go way faster with a ride and it even learns how to turn like a pro.