Bob Elliott

@BobEUnlimited

CIO at @UnlimitedFnds | PM of $HFGM & $HFND | Fmr IC @Bridgewater | Described as one of the few "sane" voices on #fintwit | Comments are not investment advice

6/20/2025 | After a month of waiting, the turn in the data suggests it's time to start legging into the season of disappointment trade. Starting with 50% risk on a trade long bonds + gold and short stocks. x.com/BobEUnlimited/…

The combination of high expectations, softening growth, and a Fed on hold is a classic setup that favors bonds and gold relative to stocks. While it may take a little while for markets to acknowledge the reality it looks like 2H25 is shaping up to be a season of disappointment.

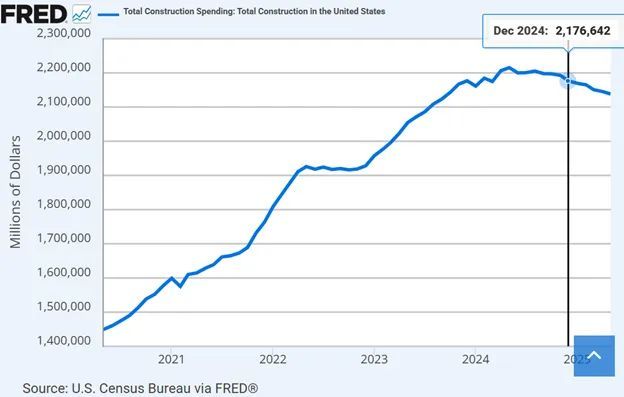

Construction spending powered the economy forward post-covid. Its now pretty clearly contracting.

I agree with @SecScottBessent that the Fed needs a radical overhaul. My take on what needs to be done below. x.com/BobEUnlimited/…

The Fed system needs DOGE more than anywhere else in government. It is the most powerful global economic policy maker, and it is desperately in need of simplification and modernization to restore credibility. A thread on what's to be done.

The Hard Data Read The slew of hard data released over the last couple weeks confirms a broad based slowing of the US economy. With most of the drag from tariff and immigration policies ahead, 2H25 is looking soft.

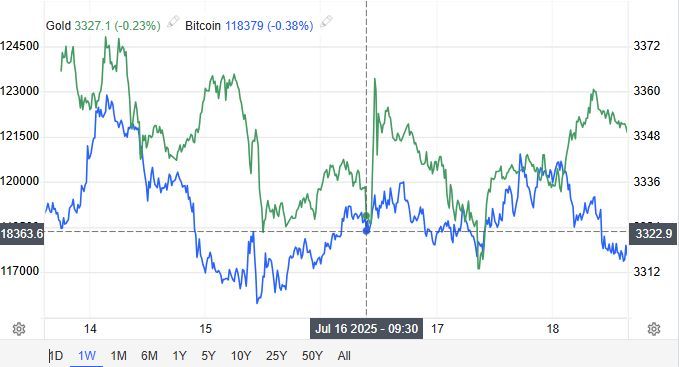

Another good stress test this week on whether BTC or Gold serve as a better contra-currency hedge to the risk of US running monetary policy that's too easy. When news broke about firing JP, gold surged and bitcoin did nothing.

What's the next policy catalyst to power stocks higher?

The last thing 401k investors need is high fee, illiquid private strategies offered by companies desperate to find the next schmuck to get rich on and hold their bags. My thoughts on @CNBCOvertime which @MorganLBrennan described as "spicy:" youtu.be/3S0sg615ptA?si…

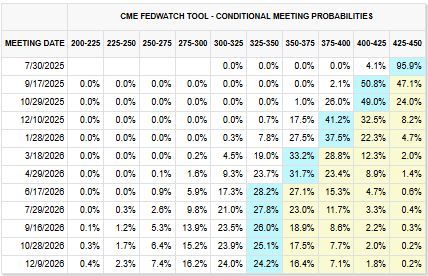

For all the noise around the Fed chair, short rate markets aren't pricing that the new chair will do much of anything (slated for May '26).

Great hanging out with @maggielake earlier this week on her (relatively) new show. The Q&A style format let to a wide ranging conversation across the major macro themes at play right now. youtube.com/live/4_bl5PBcX…