Robin Brooks

@robin_j_brooks

Senior Fellow @BrookingsInst, previously Chief Economist @IIF and Chief FX Strategist @GoldmanSachs. Opinions are my own. Email: [email protected].

last week the EU sanctioned 105 tankers to bring the total sanctioned to 440-plus. Today the UK added another 135 ships to its list, as well as the UAE-based subsidiary of Litasco, linked to Lukoil, one of the major oil exporters in Russia and Intershipping Services (the flag…

Huge opportunity this week for the CBRT to reset inflation expectations lower by surprising the market on the downside (smaller cut) with its policy rate decision this week. A smaller cut this week will allow larger rate cuts later on. No jam today, for jam tomorrow.

Piyasa yıl sonu enflasyon beklentileri geriliyor: TCMB Anketi medyan %29,5 Bloomberg Economics: %28 Yön olumlu, ancak beklentiler hâlâ TCMB’nin %19–%29 tahmin aralığının üst sınırına yakın. Hanehalkı ve firma beklentileri ise mevcut enflasyonun üstünde. blinks.bloomberg.com/news/stories/S…

I think @robinbrooks_j raises a good point here, but I think an equal if not bigger Deflationary contributor is from the downward demand shock on tariffed goods in the US, which accounts for 35% of global consumption.

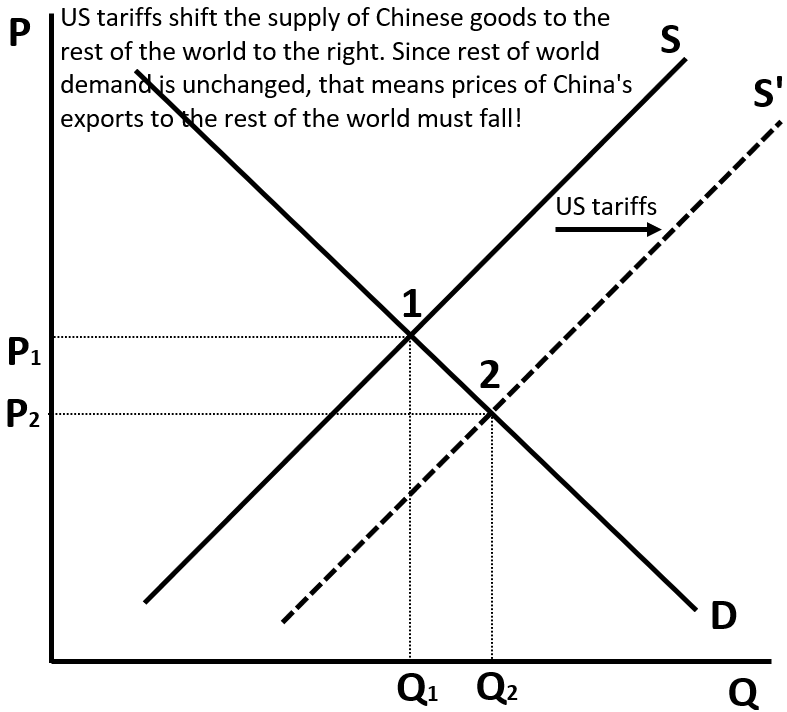

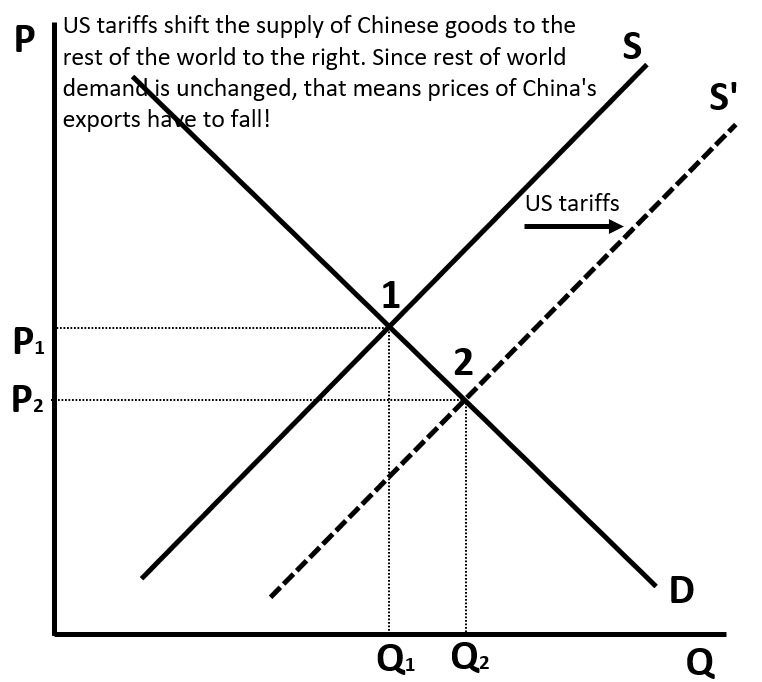

Macro 101 on China tariffs. If China doesn't transship goods to the US, it must export them to the rest of the world (ROW)). Supply of goods to ROW goes up. Since ROW demand is unchanged, prices must fall to generate demand. US tariffs are a deflationary shock for China and ROW.

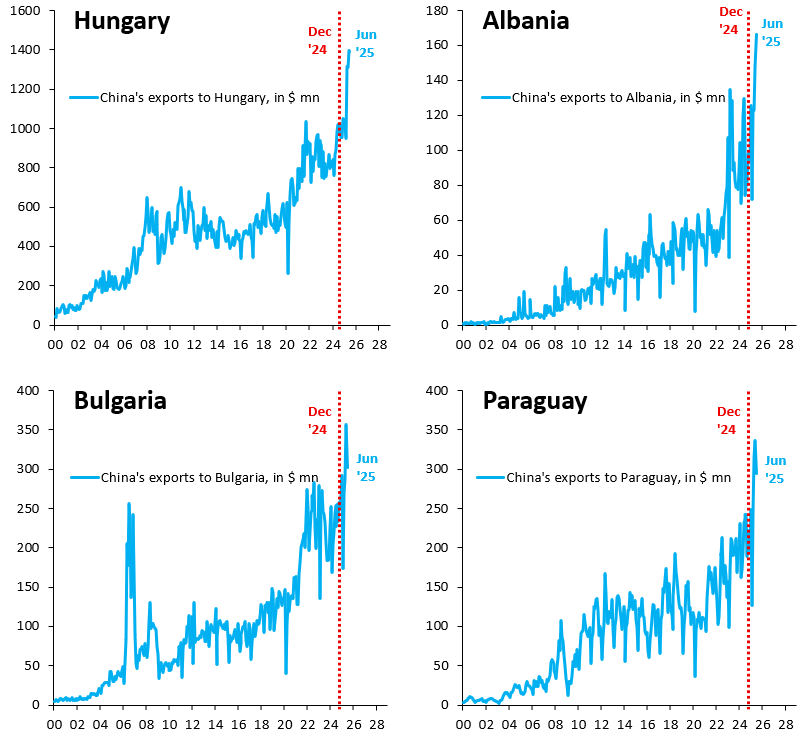

If China's exports show a sharp rise to one country, that could be for idiosyncratic reasons. But if China's exports rise to all kinds of places right after the imposition of big US tariffs, that's a sign China is scrambling to find new export markets. That's what's happening...

Devastating: Extreme right polling neck-to-neck with chancellor Merz’s CDU for 1st time (Merz has promised to halve support for the AfD); SPD numbers continue to decline. The coalition badly needs to get a grip on domestic policy issues (record debt, government dysfunctionality)

Sonntagsfrage zur Bundestagswahl • Forsa für RTL/n-tv: CDU/CSU 25 % | AfD 25 % | SPD 13 % | GRÜNE 12 % | DIE LINKE 12 % | BSW 4 % | FDP 3 % | Sonstige 6 % ➤ Übersicht: wahlrecht.de/umfragen/ ➤ Verlauf: wahlrecht.de/umfragen/forsa…

Si sumamos está dinámica global deflacionaria de los bienes chinos en el contexto de guerra comercial de 🇺🇸al contexto de apreciación cambiaria y de eliminación de barreras comerciales en Argentina,es de esperarse un fuerte aumento de importaciones desde China en el H2 del 2025

Macro 101 on China tariffs. If China doesn't transship goods to the US, it must export them to the rest of the world (ROW)). Supply of goods to ROW goes up. Since ROW demand is unchanged, prices must fall to generate demand. US tariffs are a deflationary shock for China and ROW.

I’ll be doing a live stream with @tashecon on Russia sanctions this Friday (Jul 25) at 8 am (ET). Tim coined the term “Fortress Russia” many years ago. We’ll see if he still thinks it’s still a fortress. Photo is from a summit in Uludag in Turkey in 2019. open.substack.com/live-stream/44…

China's growth model is based on exports. US tariffs now threaten that growth model. China's response is to either transship goods to the US via 3rd countries or export to new markets. Either way, that hits profits of China's exporters and is deflationary. robinjbrooks.substack.com/p/why-us-tarif…

I vigorously agree with @robin_j_brooks and we have been showing this at @TheEIU in great detail via our Archimedean Trade Index. DM me for more information.

Macro 101 on China tariffs. If China doesn't transship goods to the US, it must export them to the rest of the world (ROW)). Supply of goods to ROW goes up. Since ROW demand is unchanged, prices must fall to generate demand. US tariffs are a deflationary shock for China and ROW.

In other words as I've stated, China exporting deflation onto the world due to US tariffs and lacklustre internal consumer demand. Countries are going to competitively devalue their currencies overcome tariffs. A "race to the bottom" in foreign exchange rates as central banks...

Macro 101 on China tariffs. If China doesn't transship goods to the US, it must export them to the rest of the world (ROW)). Supply of goods to ROW goes up. Since ROW demand is unchanged, prices must fall to generate demand. US tariffs are a deflationary shock for China and ROW.

I'm doing a live stream discussion with @tashecon on Russia sanctions this Friday at 8 am (ET). No one knows Russia better than Tim. After all, he came up with the term "Fortress Russia," which he's since replaced with "Rubble Russia." Substack link below. open.substack.com/live-stream/44…

Macro 101 on China tariffs. If China doesn't transship goods to the US, it must export them to the rest of the world (ROW)). Supply of goods to ROW goes up. Since ROW demand is unchanged, prices must fall to generate demand. US tariffs are a deflationary shock for China and ROW.

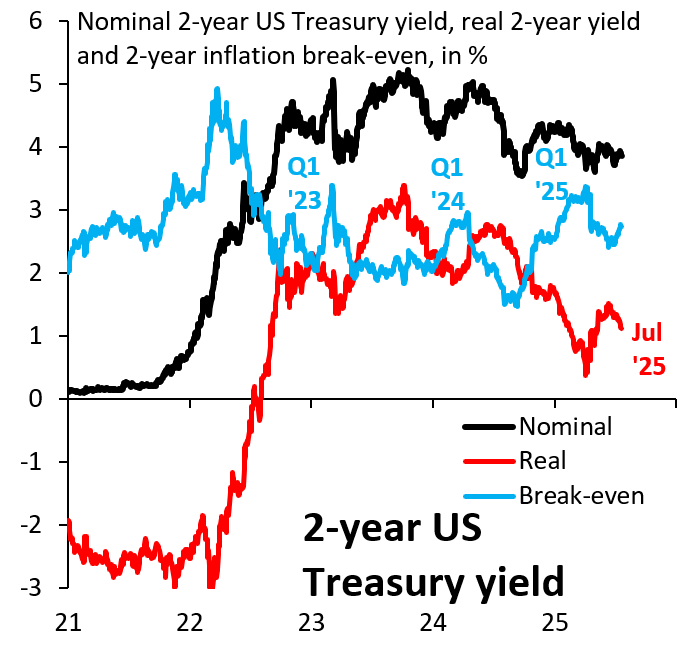

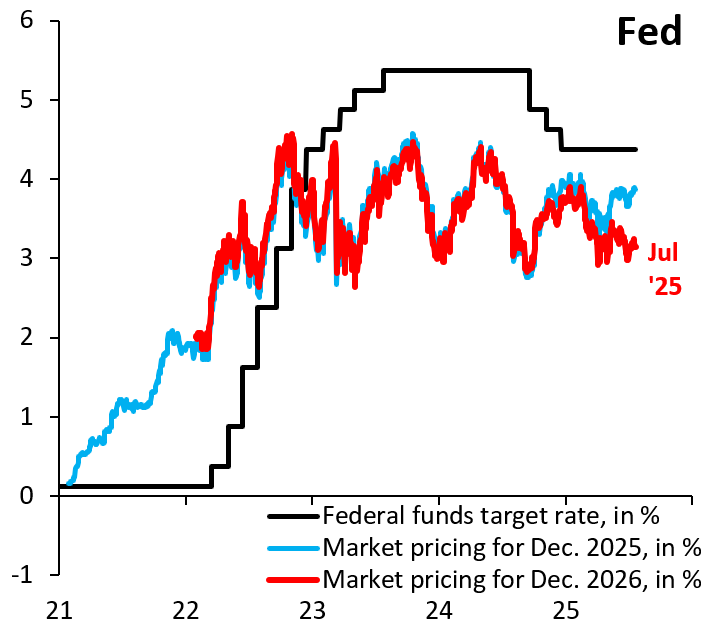

Markets have ignored the coming inflation impulse from tariffs. Inflation break-evens this year follow their usual path dictated by residual seasonality in the CPI, rising in Q1 and then falling back (blue). Lots of room for markets to reprice, which means upside for the Dollar.

Markets price 125 bps in cuts from the Fed through the end of next year. That's way more easing than markets price for any other G10 central bank. Kind of bonkers when you consider that tariffs are inflationary for the US and deflationary for everyone else. Dollar bullish...

"The threat to central banks from ‘fiscal populism’. When monetary policy is set to meet government budgetary needs, these institutions become piggy banks" Andy Haldane in FT today. Great oped. ft.com/content/237226…

True in many other places. Random migration policies are dumb.

The economic value of the H-1B program could be increased by 88% without changing the number of visas if we stopped giving them away at random.

Episode number 500 is happening this week on @Macro_Musings. Today's newsletter is on this milestone and includes a NGDP targeting mug giveaway contest. macroeconomicpolicynexus.substack.com/p/macro-musing…

Nice chart of China's monthly goods export to the US & to everyone else - overall Chinese exports holding up due to transshipment to US & discounting to other final destinations.

China is in a tough spot. It's exports to the US are down -24% q/q in Jun '25. Exporters have only 2 options: (i) transship to the US; (ii) export goods to other countries at a discount to generate demand. Either way, a big hit to profitability and a deflationary shock for China.

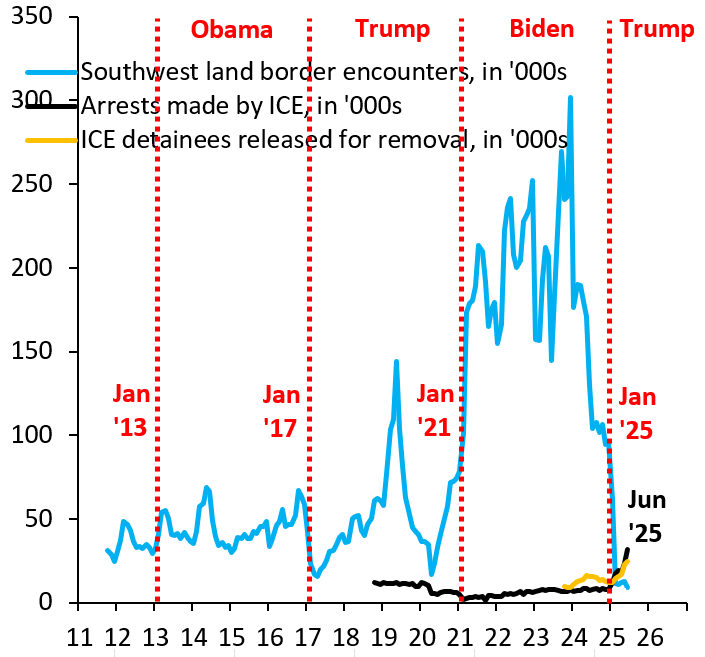

Images of ICE arrests and deportation are hard to watch. Today's Substack puts the numbers for these things into context against the previous huge migration inflow. We urgently need reform of asylum law to better balance needs of citizens vs non-citizens. robinjbrooks.substack.com/p/tougher-us-i…

💯💯💯

We all want fiscal responsibility. But that won't happen as long as central banks cap yields when they spike, as the Fed did in 2020. You can cap yields, but that inevitably incentivizes bad fiscal policy. Our fiscal mess is inextricably linked to the Fed. robinjbrooks.substack.com/p/fiscal-respo…