Ian Shepherdson

@IanShepherdson

Editor-in-Chief, Pantheon Macroeconomics. A 'danger to the world', apparently. Trial: http://www.pantheonmacro.com Speaking: [email protected]

34 years is enough for me. I could not have found a safer pair of hands than Sam's, plus he and Olly are way better at Excel than me.

Thrilled to formally become Chief US Economist at Pantheon Macro today. @IanShepherdson has been an incredible mentor since I switched focus from the UK in Feb. I look forward to maintaining Pantheon’s reputation for incisive research on the US economy, supported by Oliver Allen.

Some media reporting that the Philippines will "pay a 19% tariff". No, they won't. American purchasers of goods from the Philippines will pay the 19% tariffs. The burden falls on the buyers, not the sellers. Thank you for your attention blah blah blah

Just to be clear, that's a regressive 1% of GDP tax on Americans. *You* are paying it, not the overseas firms selling the stuff you want to buy. For someone who is not widely considered an actual ignoramus, Bessent does a great impression of one on TV.

We've brought in nearly $100B in tariff revenue so far and are on track for $300B this year. That's almost 1% of GDP. June delivered a budget surplus with higher revenue and lower spending. This is how we clean up the fiscal mess we inherited.

No, they won't be paying the tariffs. You will.

Leavitt: They have agreed to lower their tariff and nontariff barriers so we can sell our products and they will continue to pay tarriffs to sell products to us. Only President Trump could do that.

Whatever Treasury is paying him, it ain't worth the permanent reputational stain for stuff like this.

Today’s inflation report proves that tariffs are not inflationary. However, tariffs are a huge revenue source! They accounted for nearly all of the record large $27 billion June budget surplus (biggest since June 2015 excluding any timing shifts). Remember that when the…

👇👇👇👇

With the second quarter GDP coming out at the end of the month, remember any analyst who doesn't average the first two quarters is utterly clueless substack.com/home/post/p-16…

Surprise, surprise, UK payrolls were revised up bang in-line with their typical pattern. The question is why would anyone believe the dodgy first estimates from this series showing tanking jobs? With a typical revision to June data, the trend now seems to be for easing job falls

It's a bit of a nightmare to be a UK macro guy rn, but Rob is the one to follow.

Which do you believe? Payrolls that just got massively revised, or the other two series which are also revision prone and in the case of the LFS not firing on all cylinders yet. Jobs falling or rising solidly?....What the MPC would give for accurate data.

Talk is cheap

And in response to the tariffs, look how Home Depot responded. "Home Depot says it doesn’t expect to boost prices because of tariffs" Legendary.

And in response to the tariffs, look how Home Depot responded. "Home Depot says it doesn’t expect to boost prices because of tariffs" Legendary.

This is true in the sense that inflation is a *sustained* increase in the price level. But good luck persuading people there's a difference between a big increase in the price of almost all goods and inflation. Plus, if wages accelerate, the tariff hit can morph into inflation

“Tariff inflation” is an oxymoron. Raising a price via an explicit policy choice is not inflation, and resulting relative price changes in the economy are not a cognizable subject of monetary policy. A Fed holding rates higher in response is politicizing its role.

Embarrassing

Today’s inflation report proves that tariffs are not inflationary. However, tariffs are a huge revenue source! They accounted for nearly all of the record large $27 billion June budget surplus (biggest since June 2015 excluding any timing shifts). Remember that when the…

2/2 And of course, these #s reflect Trump's first round of tariffs, not the higher ones he's threatening or the copper levy. The Yale Budget Lab says the average effective tariff rate is about 15% and the new duties, if enacted, would lift it to 18%. See below:…

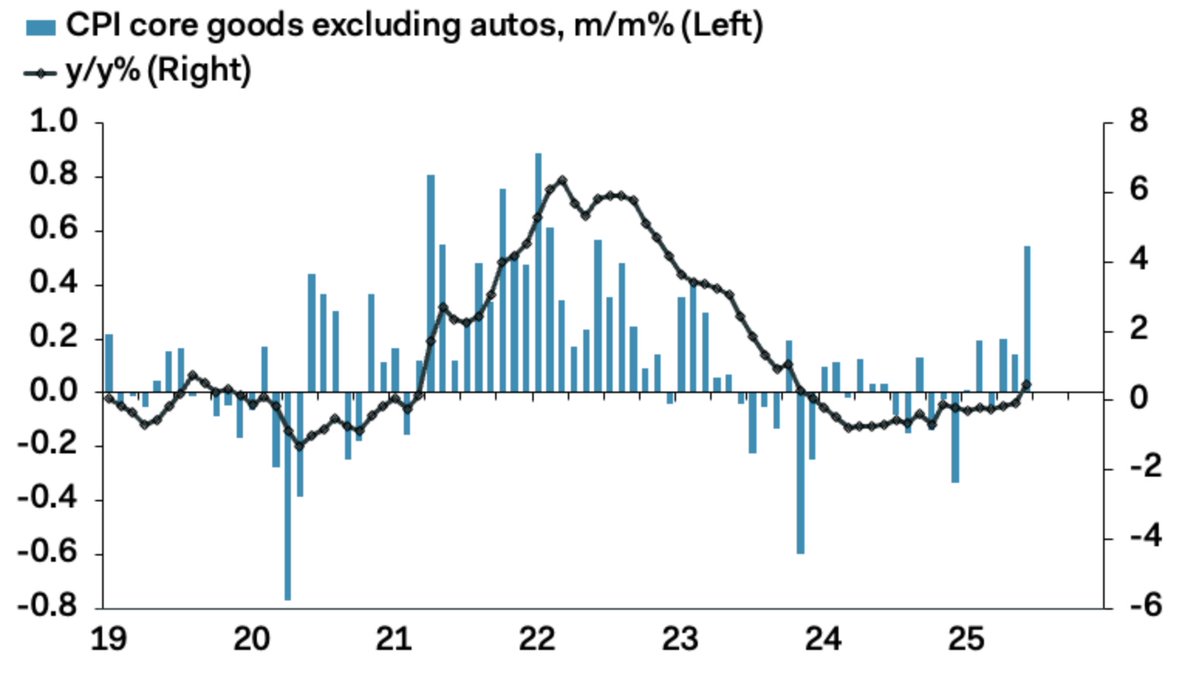

The message from today's CPI # is that Trump's tariffs are starting to show up in prices. It's not dramatic yet, but it confirms the analysis of economists like Deloitte's Michael Wolf and Pantheon's @IanShepherdson, who told me it would be a gradual process. 1/2

If you're booking with @British_Airways check your credit card payment receipt matches the amount on the e-ticket receipt. They've just charged my card more than $1000 more than the eticket receipt and are being fantastically useless about sorting it.

Treasury yields dip because core CPI marginally undershoots consensus. But look under the hood, and you'll see tariffs, in a big way. And far more to come.

It's inconceivable to him because he is not very smart and quite bad at thinking through complex problems

Peter Navarro: "With all these new advanced manufacturing techniques and the way things are moving with AI and things like that, it's inconceivable to me that Tim Cook could not produce his iPhones elsewhere around the world and in this country."

The dip in the unemployment rate was nowhere near statistically significant, so you can save time by not reading this non-"analysis". YW.

#FlashReport: Previous signs of labor market deterioration in May’s jobs report did not persist in June. Read the analysis of last month’s downtick in unemployment to 4.1% in our latest report ow.ly/fR0b50WkFIA