Samuel Tombs

@samueltombs

Chief US Economist at Pantheon Macroeconomics.

Thrilled to formally become Chief US Economist at Pantheon Macro today. @IanShepherdson has been an incredible mentor since I switched focus from the UK in Feb. I look forward to maintaining Pantheon’s reputation for incisive research on the US economy, supported by Oliver Allen.

Increasingly hard to claim that the uptick in claims we've seen lately just reflects residual seasonality, particularly with continuing claims jumping to 1,956K, the highest since Nov '21. The labor market is cooling, albeit gradually, and from a decent starting point

April's US import price data are an early blow to hopes that overseas businesses will lower their prices in response to the tariffs. Prices for nonfuel imports, which are measured before tariffs and shipping costs have been applied, rose 0.4% in April.

CPI and PPI data imply that the core PCE deflator rose by 0.28% in June. That's below our post-CPI estimate (0.35%) due to a relatively muted rise in portfolio management charges and a further fall in airline fares. But it's still consistent with a material boost from the tariffs

Looking forward to the update to this report following the June CPI data.

That settles it: the tariffs are inflationary (amazing it was ever a question). Big increases in June in prices for goods, like toys, sports equipment and appliances, that are mostly imported. Prices for exempt goods (drugs, cell phones) flat or falling Worse to come in July.

The drop in initial claims last week was driven by states with relatively large auto sectors. The timing of annual shutdowns for retooling varies every year, leading to swings in claims at this time of the year which are simply noise. Expect claims to rise again over coming weeks

"The tariff boost to consumer prices will be undeniable in June's data" @samueltombs buff.ly/gSCiGal #PantheonMacro

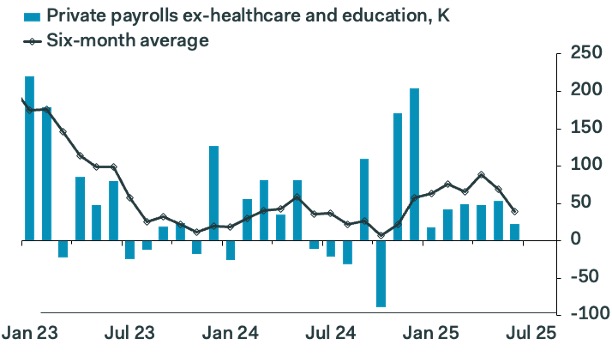

Baffling to see Treasury yields up on the basis of seasonal adjustment issues with education payrolls and noise in the poorly-estimated unemployment rate. The key news is the further slowdown in growth in private payrolls, excluding health and education. The tariffs are hurting:

ADP employment is pretty useless at the best of times, but the 33K fall in June looks especially implausible. The big drag for ADP lately is health and education. Really hard to see why employment here would be plunging when it's noncyclical and openings have held up well

The 0.4% drop in personal incomes looks scary, but this is just volatility in the social security component as the boost from lump-sum payments due to the Social Security Fairness Act faded. The bigger story is in spending. -0.3% on the month and very little forward momentum

Continuing jobless claims are now clearly picking up, consistent with the unemployment rate rising to 4.3% in June, from 4.2% in May. Leading indicators of hiring and firing point to a faster increase over coming months. The Fed pivot is not far off.

The US unemployment rate will hit the FOMC's end year forecast of 4.5% about six months early, if the Conference Board's indicator of job availability is right:

A slight hawkish pivot in the Fed's dots - but don't forget the median participant expected last June to ease by 25bp in 2024, much less than the 100bp ultimately delivered. We still look for 75bp easing this year, as the unemployment rate rises faster than the FOMC expects.

Ugly headline housing starts number today mostly due to the extreme volatility in MF starts, but real signs under the hood that new SF family construction is rolling over. SF permits down 10% since Feb. High inventory & cratering homebuilder confidence suggest a long way down yet

CPI and PPI data imply the core PCE deflator rose by just 0.12% in May, but that will be the last benign print for a while. Inventories are running low and some volatile services components (inc. portfolio management) will rebound. Brace for 0.3-to-0.4% prints in June and July.

Some isolated examples of tariff-driven rises in US consumer prices in May - prices for appliances and toys leapt - but in general we are still not seeing a substantial impulse. It's early days though - past experience suggests goods price rises will accelerate this summer.

The pattern of downward revisions to payrolls, as more data are collected, has re-emerged with a vengeance. The 104K downward revision to estimated payroll growth in March between the 1st & 3rd estimates is the largest for 4 years. May's print will be c.100K after revisions.

Anyone suggesting the massive fall in the trade deficit in April is a "win" or a sign that "tariffs are working" is a clueless bluffer. We had massive stockpiling of a few types of goods pre-tariffs, that's now unwound and taken us back to late 2024 levels. Simple as that.

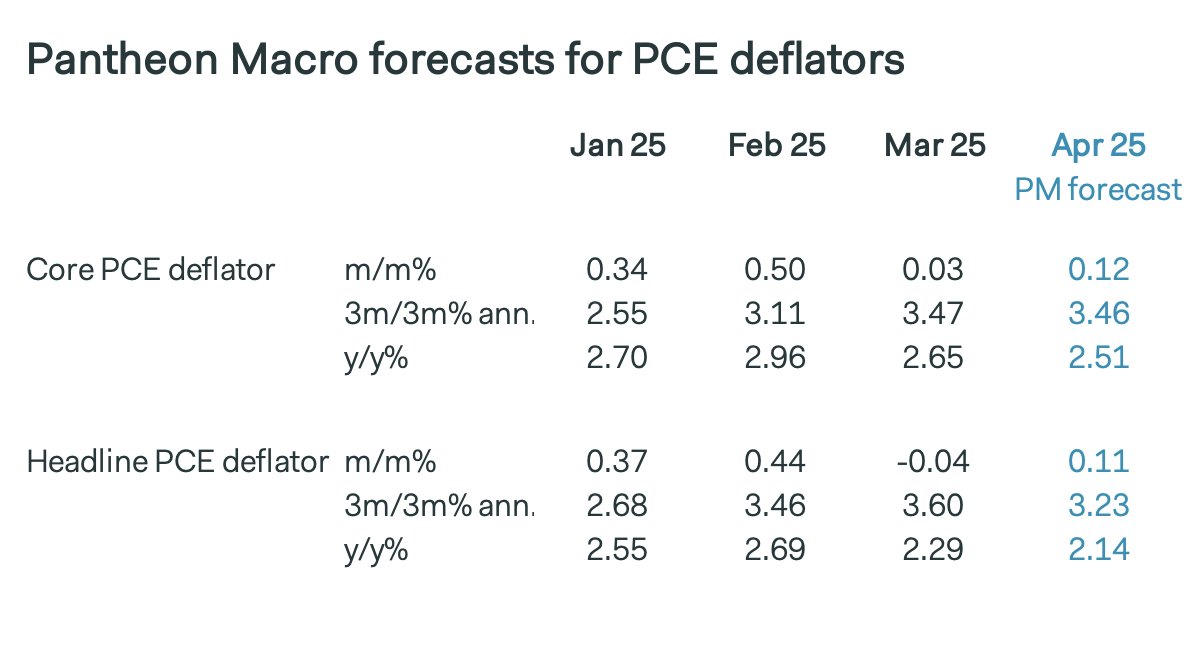

We're tracking a 0.12% increase in the April core PCE deflator after today's PPI data (little changed from our post-CPI estimate of 0.11%). As expected, portfolio management prices plunged and airfares were weak. Another good print from the Fed's perspective.

We're tracking a 0.11% increase in the core PCE deflator after the CPI data. The contribution from CPI components will be in line with the 12-month average, but we expect big falls in the PPIs for air travel and portfolio management fees. The FOMC can expect another good print.