Kmets

@kmets_

@aladdindao Maximalist | Kmets.eth

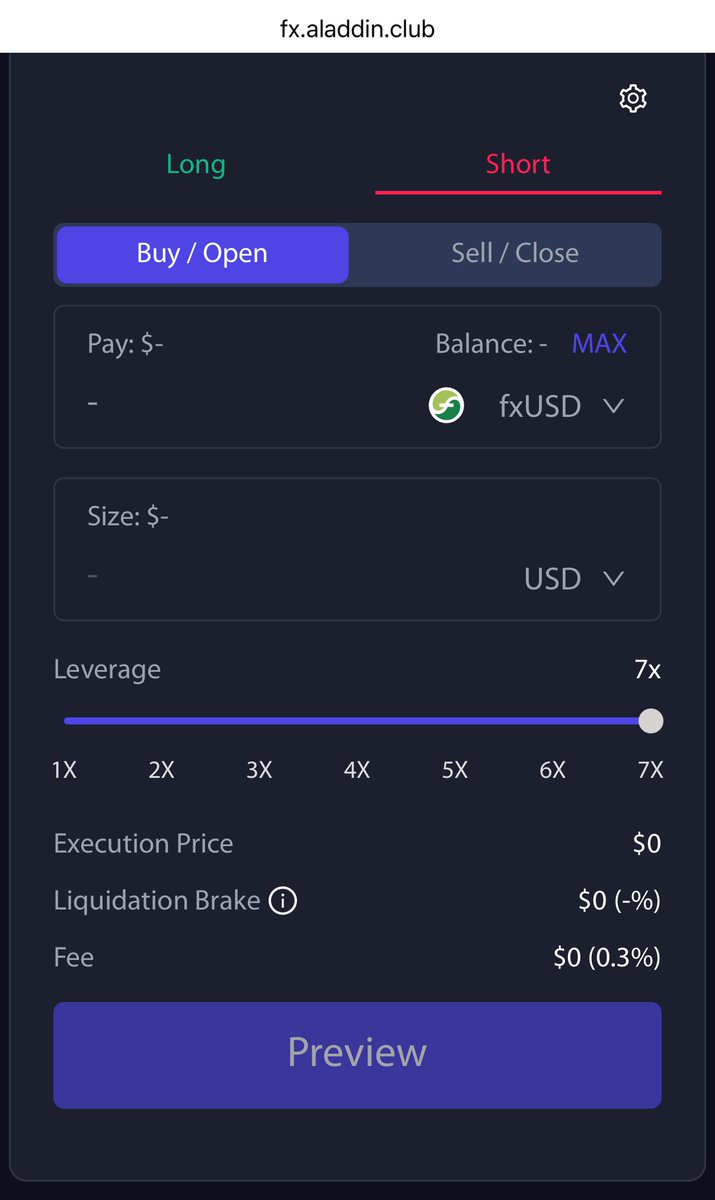

Today’s a good day to GO SHORT on @protocol_fx!

Shorting in DeFi is about to change. sPOSITIONs are going live today on f(x) Protocol bringing native, fixed-leverage shorts with 0% funding cost and minimal liquidation risk. No margin calls. No creeping fees. No centralized dependencies. Shorting in DeFi has always been…

Live now with @liangxihuigui, @taowang1, @knowyourself518, @MrQin_BTC 🔥 x.com/i/spaces/1OyKA…

The difference is now at 7.60% 19.70% pure organic APY 👇 fx.aladdin.club/v2/fxsave/

5.84% That's the difference between $fxSAVE's yield and the next best stablecoin yield. Are you really OK leaving almost 6% APY on the table?

I just noticed @protocol_fx launched shorts, meaning you can open long and short positions with no interest or funding. This has increased the volume / fees which have pushed the APY of the stability pool up to nearly 20%.

$crvUSD you have some company in the category for "stable-est stablecoin": $fxUSD @CurveFinance 🤝 @protocol_fx

Maybe everyone is already used to it, but out of all stablecoins backed by volatile collaterals, crvUSD seems to be probably the most stable

The inefficiency of DeFi markets is breathtaking. The repricing will be violent. $CVX $CLEV @ConvexFinance @0xC_Lever

Seems Big Mike is bullish @protocol_fx. I always knew he was a pretty wise fella!

👀 This is an interesting play from business perspective. Awesome but undervalued product creates a version on bnb chain. It might help to uncover its real potential on mainnet, not just bnb chain!

Everybody just now getting excited about $CRV and $CVX Real OG’s know @0xconcentrator has the $aCRV & $abcCVX Few. @aladdindao 🤝 @ConvexFinance

More incentives for $veFXN 🔥 $55K in incentives have been given to veFXN holders against there gauge votes by @aave GHO/fxUSD @ConvexFinance FXN/cvxFXN fCVX SP @SmarDex fxUSD/USDN @StakeDAOHQ FXN/sdFXN f(x) Protocol ETH/FXN feETH SP fxUSD SP

SOON 👀

Some DeFi protocols patent their designs. Others wrap basic leverage in flashy UIs and charge you for it. We went the other way. The sPOSITION code is out and open source! Because decentralization and trustless leverage should be public goods. 👇 github.com/AladdinDAO/fx-…

Optimizer is live for @protocol_fx on Votemarket, maximizing $veFXN voting returns with automated features: - Allocates votes to top-earning gauges - Sets gauges and weight limits - Targets or avoids specific reward tokens Optimize your voting strategy with one click.

🚨 How does @0xC_Lever actually earn $CVX for users? Here’s the deep dive 🧵👇 ——————————————————————— 1⃣ Users deposit $CVX into CLever. → That $CVX gets vote-locked as vlCVX on @ConvexFinance. 2⃣ vlCVX is used to vote on Curve gauge pools. → Protocols pay bribes (via…

FYI $asdCRV

The @0xconcentrator $asdCRV pool on Spectra is affected by the pool migration. Spectra created a new pool with a January 18, 2026, maturity using the updated "Curve SNG" architecture for an improved user experience. Before migrating to the new pool, review all information on…