Curve Finance

@CurveFinance

Creating deep on-chain liquidity using advanced bonding curves, http://t.me/curvefi

WHLP is now live on Curve! Trade WHLP or provide liquidity in the new WHLP/USDT0/USDHL Stableswap pool to earn yield. Built on Curve's proven infrastructure for efficient stablecoin swaps with IL protection. Get Started: curve.finance/dex/hyperliqui…

Liquidity crisis which did not happen (thanks to @CurveFinance pools)

🩸wstETH Liquidity Crisis 1. Major ETH providers withdrew liquidity from AAVE 2. Farmers with wstETH/ETH looping positions are at loss and forced to sell at market, taking leveraged losses and driving down wstETH value 3. Arbitrageurs buy discounted wstETH and unwrap through…

Now tracking @CurveFinance Llamalend on our Fees & Revenue Dashboard

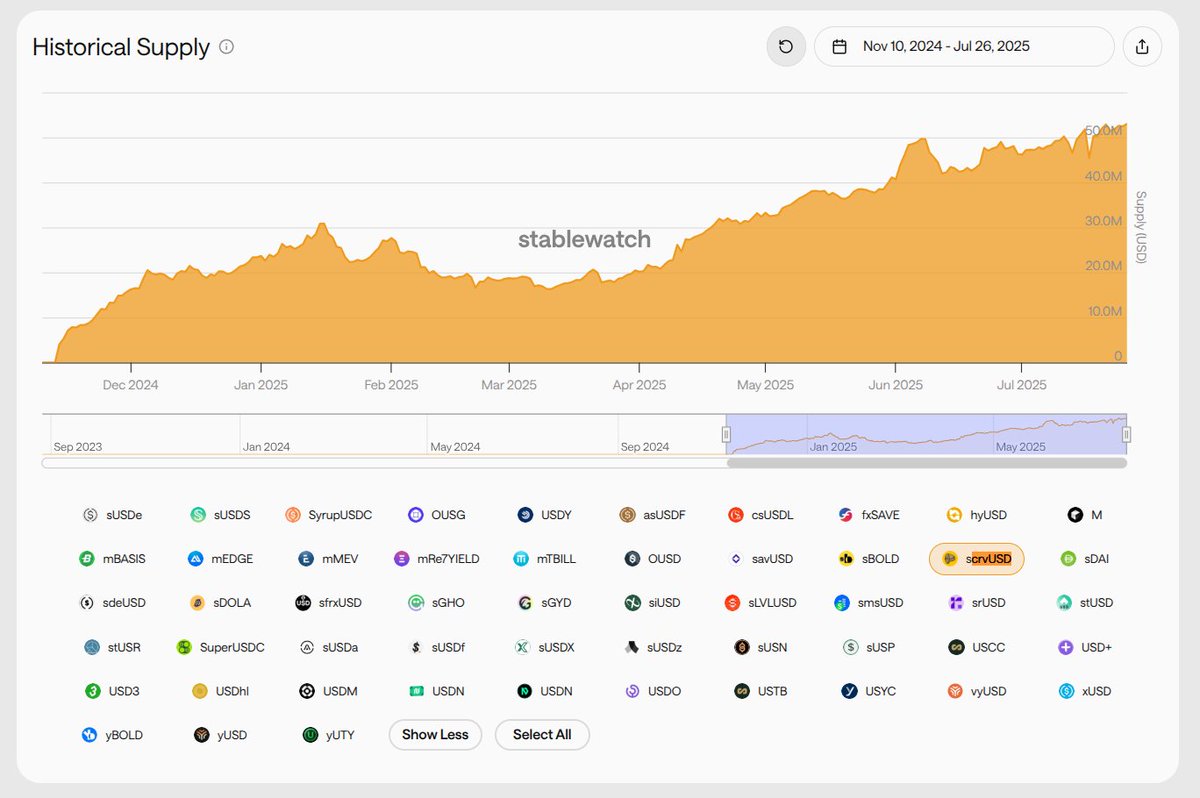

Maybe everyone is already used to it, but out of all stablecoins backed by volatile collaterals, crvUSD seems to be probably the most stable

Always awesome to see projects celebrating vote passing!

Important Update: We've recently secured Curve Gauge Vote for USDai/USDC and sUSDai/USDC pools on @arbitrum! $CRV rewards will start 2 weeks after weekly gauge weight via @CurveFinance are secured. $USDC + AI = $USDai

Some great yields on @CurveFinance rn >30% on numerous $USD pools and even even 30% on a $BTC pool! news.curve.finance/curve-best-yie…

8/8 If Ethereum is to be the core of the global economy, the DeFi sectors as a whole must stop confining themselves by short-term goals and instead start thinking how they affect the Human Civilization as a whole.

Boosts outside mainnet. Finally!

Staking V2 now live on @CurveFinance: Fraxtal, @base, and @SonicLabs Experience Stake DAO's upgraded infrastructure: + Instant boosted reward distribution + No reward dilution + Redesigned UI/UX (details coming 👀) Try it before the mainnet release:

Some people did not quite understand, so this needs explanation. Concentrated liquidity in ranges (like Uniswap3 and others doing that) tend to have liquidity from price A to price B. And this range of prices for stable pairs is VERY tight. Asset sometimes like to go out of…

Liquidity crisis which did not happen (thanks to @CurveFinance pools)

Some details about how our fully decentralized on-chain price oracles work news.curve.finance/curves-oracle-…

Excellent technical information and little-known historical context (Lobster DAO, a popular crypto community, originated due to launch of Curve)

x.com/i/article/1932…

👀

Use @CurveFinance NOW as a mini-app on Telegram — thanks to @TacBuild. This is next-level UX.

👀

Top @CurveFinance stable pool by organic yield. No dilution, no incentives (only points), just high-yield basis trading.

Maybe you know that we are building smart contracts on @vyperlang, not solidity. But almost everyone writes in solidity, why aren't we going with the herd? Are we crazy to go against the common wisdom? Let's find out why Vyper is our choice! news.curve.finance/state-of-vyper…

Yield time again? news.curve.finance/curve-best-yie…

Wait what

Yields on @StakeDAOHQ are getting crazy and pretty scalable as we are entering this phase of the market where liquidity mining pays MUCH more than lending (and I don't speak about boring points). Quick dive into the main opportunities for, $ETH, $BTC and Stables (1/8)

⚡ @newmichwill, Founder of @CurveFinance revealed a new way to eliminate impermanent loss using compounding leverage and interest-funded rebalances. It boosts capital efficiency and unlocks new markets like FX and gold. Full talk on AMMs and volatility: youtube.com/watch?v=DdLzII…