Kingdom Capital

@kingdomcapadv

Opinions on stocks, which are not investment advice.

National Presto $NPK Q2 out with the usual fanfare gopresto.com/uploads/conten…

Main $UNFI focal points: I think they can generate steady 2.5% EBITDA margin I think this is a steady business with good inflation/recession protection I don't think you can recreate this business for less than $5B I don't think Amazon is going anywhere Cyber risk overblown

Podcast #326 is up! @kingdomcapadv returns to discuss fintwit's favorite value turnaround, $UNFI yetanothervalueblog.com/p/kingdom-capi…

Fascinating to watch the divergent ways companies are taking their medicine on tariffs in guidance, and the ones that are not

Podcast #326 is up! @kingdomcapadv returns to discuss fintwit's favorite value turnaround, $UNFI yetanothervalueblog.com/p/kingdom-capi…

Wow, an office REIT with a 4.4 WALT and 5.4m square feet of space is being taken out at a 10 cap? That's...interesting

🏢💼 City Office REIT $CIO to Be Acquired in $1.1B Take-Private Deal 💰📉 Big news from the office #REIT world as City Office REIT has entered into a definitive agreement to be acquired by MCME Carell Holdings in an all-cash transaction valued at approximately $1.1 billion. 🔑…

What’s the last time a stock was heavily shorted, squeezed, and became some kind of a durable operating business that “the shorts” were wrong about?

What’s the matter babe you’ve hardly touched your farm-to-Tesla

One of the most impressive parts of Tesla’s Diner is the ingredients that they have sourced. This isn’t like any other fast food place. Tesla has sourced sustainable, organic ingredients that are actually good for you. Below is a list of where Tesla gets their ingredients…

lol

Current market cap of $QVCGA is ~$25m Current trading value of $QVCGP is ~$80m There's no other claims on TopCo assets, which at 3/31 was $241m cash & equity in LINTA and Cornerstone. Seems wrong. seekingalpha.com/article/479432…

seekingalpha.com/article/480302…

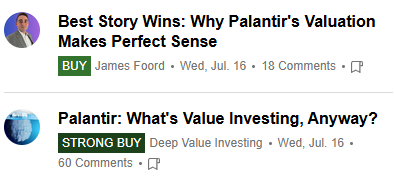

Submitted a "Hold" article about $IDR on Seeking Alpha, and disclosed no position in the stock. Just an overview of a company that has ~40x'd since John Swallow took over. Got editorial pushback for possibly being too "promotional" and not cautious enough. Meanwhile:

Clearly not everyone is on board with my $UNFI thesis, given, uh, "bearish sentiment" is highest it has been since early 2021 (fintel.io/ss/us/unfi). Funny time for that. Looking forward to discussing with Andrew later

Excited to have @kingdomcapadv on the podcast tmr. We'll be talking about fintwit's favorite grocery distributor turnaround / cyberattack victim $UNFI. Any questions for David?

A friendly reminder why companies like this should have an open buyback and an open ATM at all times

$KSS +90% The reason for the stock’s surge is unclear, but 49% of its float is sold short. The stock is also gaining traction on Reddit and social media.

The $CBL application on VIC has been getting bodied, but that's a nice sale price for a mall: businesswire.com/news/home/2025…

Getting aggressively long dotcom stocks

You suddenly wake up from a Saturday afternoon nap in 1998 to find it was all a dream--what you doing first?

Excited to have @kingdomcapadv on the podcast tmr. We'll be talking about fintwit's favorite grocery distributor turnaround / cyberattack victim $UNFI. Any questions for David?

Gotta hand it to @marketplunger1 He's been pounding the table on $IDR for months. Well done.

Submitted a "Hold" article about $IDR on Seeking Alpha, and disclosed no position in the stock. Just an overview of a company that has ~40x'd since John Swallow took over. Got editorial pushback for possibly being too "promotional" and not cautious enough. Meanwhile:

This is unambiguously illegal

This is unambiguously illegal

“Why has the cost of travel gone up so much?”

people have no idea what life was like before they were born

The most entertaining outcome would be another Malone entity doing a tender for a bunch of the debt at QVC

Ask yourself — If a RADIO company can get a debt deal done to extend $4.8bn of maturities by three years; haircut debt by ~10%; and keep cash interest unchanged then why can’t a company that sells products on TV w/ >2x sales, more FCF, and more EBITDA extend its RCF? $QVCGA $IHRT