The Partners Fund

@ThePartnersFund

Income Fund. Real estate. Royalties. Private Credit. Cash flow above all else. Pithy Twitter takes. Top notch Substack letter. Nothing is financial advice.

Why is booking a 100 bagger so tough? Because our ability to think that far into the future is insanely hard. AND it’s new to us. It was only in the last 500-600 hundred years have we been able to think far in the future. (20+ years) A thread... 1/

Gotta hand it to @marketplunger1 He's been pounding the table on $IDR for months. Well done.

Banana zone not looking great for all you crypto shitcoin maxis. 🟢Bitcoin up 74% over the past 12 months. (The chart looks INCREDIBLE) 🔻Solana DOWN 7% over the past 12 months. (The technicals look TERRIBLE) Just buy $BTC? Definitely not $SOL

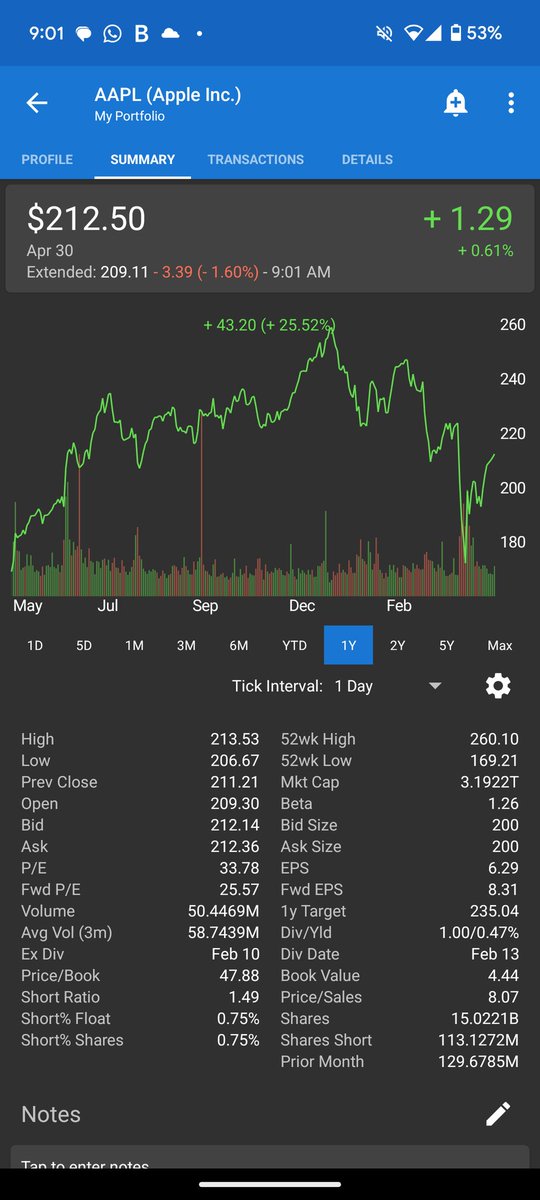

Name a worse looking chart from a mega tech cap than $AAPL

Remember last quarter when everyone used Burry as the new market timer again? Haha that was quick x.com/ThePartnersFun…

BREAKING 🚨: Michael Burry Just a reminder that Burry dumped his entire stock portfolio last quarter. Burry just got buried!

Apple's chart continues to look worse. Keeps getting rejected by the 50 DMA. UGLY! $AAPL

Would you pay $300+ billion for a company which won't be profitable until 2029 and expects to lose more than $40 billion? "OpenAI told investors last fall that it won’t generate a profit until 2029, and it expects to lose $44 billion before doing so, a person familiar with the…

$SOL rejected off the 200DMA. Not what you're looking for if you hold

Solana with a major breakout. That could run quickly. $SOL

Solana with a major breakout. That could run quickly. $SOL

Bitcoin up 20% since. Plus the famous golden cross happening now. Now the momentum traders will likely really come in. $BTC

Bitcoin broke the downtrend AND the 200DMA. That is bullish. Now that is actually bullish. (No, it has nothing to do with Saylor)

China's been offloading US Treasuries for years. Are they still the weapon everyone has been claiming them to be? What say you @biancoresearch & @DariusDale42

Any update here from Jonas @ecommerceshares ? Ha! $CVNA now at $287 ($33bn market cap) Up 150% over past 12 months

Adam Jonas at Morgan Stanley on $CVNA, with a “scam artist of the year” timeline: Feb-21: It’s the Amazon of Auto! Upgrade to $420! 🥳 Mar-22: Still Best-in-class, Carvana is like Tesla! Worth $360! 🥴 Nov-22: Now, IF it survives, base case DCF value is $1! Bear case $0.1! ☠️

I realized the ONLY way to make financial Twitter palatable is to mute the so-called perma experts (on both sides) who say with certainty they know why the markets went up and down each day. Try it... You'll thank me later @C_Reilly5 @NickRokke @Maverick_Equity

It's incredible to think the US/China tariff/trade escalation in the last month yet $AAPL is still up 25% over the past 12 months. The market either 1) has discounted the risk / doesn't think it's big enough 2) is completely oblivious and wrong

Bitcoin broke the downtrend AND the 200DMA. That is bullish. Now that is actually bullish. (No, it has nothing to do with Saylor)

Another monster $0.56 div distribution from Mesabi Trust $MSB.

FinTwit is telling you retail is tapped out? Well then, what about this stat: "Investors poured more than $60bn into money-market funds (MMF) in the first few days of April. MMFs now sit at $7.4 trillion as of Thursday, according to Crane Data going back to 1972" cc…

Hilarious nasdaq+9.5% and Bitcoin only up 6%. Can't even outperform on one of the best days in history.