James Ho

@jamesjho_

Co-founder @Modular_Capital

Lots of fun w this episode and sharing our investment frameworks, research process and fundamental / data driven approach to crypto Thanks to @tokenterminal @Oskari_0x for hosting us!

🎙️A new episode of the Fundamentals podcast is out! This time, we had the pleasure of hosting @jamesjho_ and @vincentjow_ from @Modular_Capital, a fundamental & thesis-driven crypto investment firm. Tune in below!

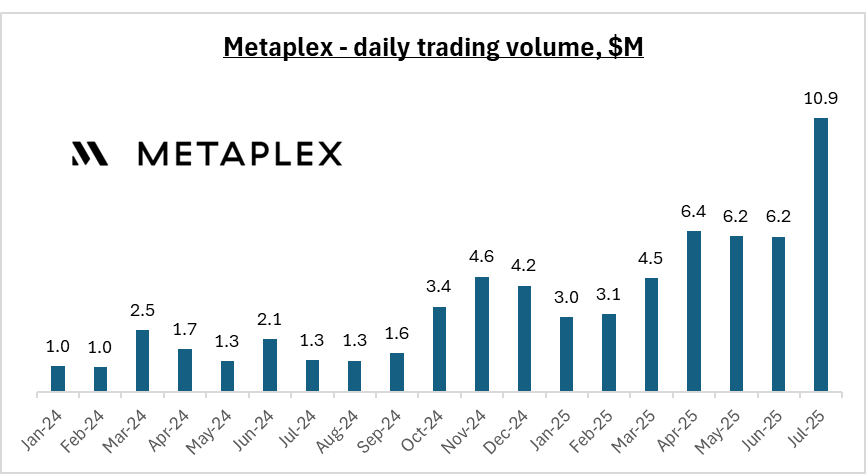

A follow up to our initial Metaplex thesis from ~2 years ago The roads have been choppy and the journey been long With this week's Coinbase listing, reaching $30M annual protocol fees, ~10% annual buyback yield, rise of entrants like Bonk to challenge Pumpfun, and new products…

x.com/i/article/1947…

It’s been an insane 12 hours - Binance Alpha trading competition ended w/ ~$1mm $MPLX airdrop - First Genesis launch sold out in 4 mins (LFG @DeFiTuna) - Coinbase $MPLX listing soon All of this on zero sleep as the father of a newborn, the best gift of them all Accelerate

Tokens created through Metaplex have accelerated driven by the launchpad wars Each new token drives protocol fees, which are on track to hit $2.1M this month ($25.5M annualized) 50% goes to $MPLX buybacks for the DAO the following month (July fees will fuel August buybacks)

Still early, but all signs point to the launchpad wars resulting in more tokens created, not less What do launchpads such as Pump, Bonk, Raydium, Jup, and Believe all have in common? They all use @metaplex to create tokens 🦾

.@Mable_Jiang was instrumental when we were launching @Modular_Capital and has been an incredible sounding board, thought partner, and first principles thinker from over the years Really excited to see her embark on this new journey w @trendsdotfun and pushing the frontiers of…

I’m excited to announce that I have started Trends @trendsdotfun, a value-anchored social protocol that pushes the frontier of information finance. It’s also a bittersweet farewell moment: my full-time gig with @fslweb3 has come to an end, but I will continue to support the…

It's a good day for innovation in America. A federal framework for stablecoins gets us one step closer to making crypto the backbone of the global financial system. By enabling faster payments and streamlining settlement, the U.S. now has the opportunity to lead. 🇺🇸

The GENIUS Act is a critically important milestone in the transformation of the global payment system and ensures the U.S.'s position in digital asset and payments innovation. Thank you @SenatorHagerty, @SenLummis, @RepFrenchHill and members on both sides of the aisle for driving…

Today we have 3 crypto bills (GENIUS for stablecoin, CLARITY for market structure, and anti-CBDC) passing the house w/ bipartisan support - marking a watershed moment for the crypto industry to thrive in the US of A 2025 has been a big year for the industry. BTC grew to a ~$2.5T…

All three crypto bills passing the house with significant Democrats support isn't on my bingo card. Most people expect the CLARITY Act to have lower chance of passing vs GENIUS and yet they are all passed at the same week. Truly a historical moment for crypto.

🚨BREAKING (I rarely use that term anymore, but this time I think it’s warranted 😁): All *three* crypto bills just passed the House and the GENIUS Act is now headed to @realDonaldTrump’s desk to become the first major piece of crypto legislation signed into law. Despite the…

The House just made history by passing major legislation on stablecoins (GENIUS Act) and market structure (CLARITY Act) in an overwhelmingly bipartisan way. This is a huge moment for crypto and for all Americans. We’re very close to having comprehensive, proactive rules in place…

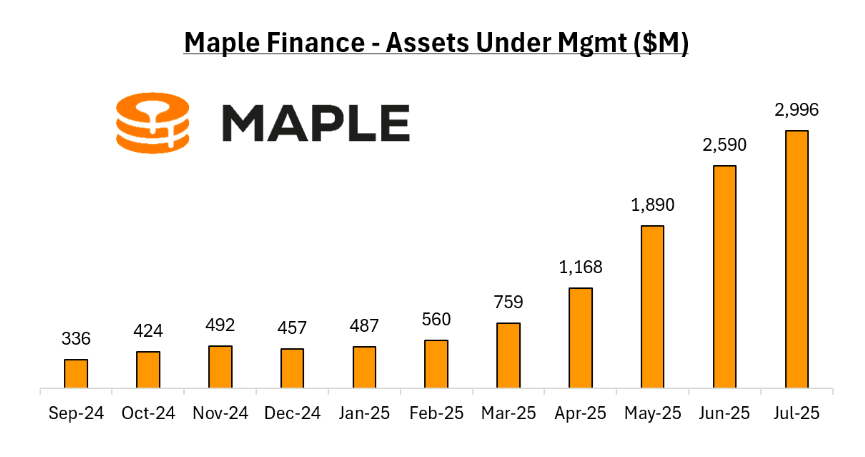

Maple reaches $3B AUM. That's 300% growth in 3 months. Becoming the largest asset manager onchain wasn’t enough. Just getting started.🥞

Maple is crossing $3 B TVL, a remarkable milestone over the last yr - 3X TVL growth in the past quarter - 10X+ TVL growth in last 12 months - syrupUSDC approaching ~$1B issuance - $1.1B+ loan book - $20M run rate protocol fees product market fit has never been stronger

As every part of the solana consumer stack fragments, $MPLX role in the ecosystem and pure play exposure to asset issuance continues to strengthen - Trading front end (Axiom, Photon, Trojan, Phantom) - Launchpads (Pump, Bonk, Believe, Jup Studio) - DEX pools (Raydium, Orca,…

A growing portion of launchpad volume is being routed from trading platforms, accounting for up to 59% of all launchpad volume. Approximately 10% of all Solana volume originates from trading apps, including Axiom, Photon, Trojan, and Phantom, among others. These apps focus on…

Metaplex daily trading volumes up 10X+ in last 18 months as the team continues to deepen liquidity for the token - Binance Alpha program - $5M+ liquidity pool from Metaplex Earn campaign - DAO liquidity pool (~$8M) from MTP-004 which passed last month Let the flywheel beginn

Great interview w/ @DegenMack walking through @metaplex growth plans and roadmap - $20M+ annualized run rate fees - Buyback ~10% of total supply a year - Infra standards behind all major launchpads - Genesis primitive for on-chain token launches Internet capital markets

Metaplex is powering over 1M new tokens a month, generating ~$2M+ in monthly protocol fees. In this new interview, @DegenMack sits down with @MapleLeafCap to talk about what's new for Metaplex including Genesis. Watch the full interview 👇

The new Silicon Valley is on Solana No middleman necessary. Just an internet connection and a dream This is exactly why we built Genesis to power the next generation of Onchain Token Offerings

The future of capital formation is happening on Solana. $600M raised in 12 minutes. Zero bankers. All while Wall Street was closed. Let’s break down what just happened with Pump’s raise.

Amidst these launchpads wars, $MPLX earns $20M+ in annualized fees, repurchase $1M+ monthly (which retires ~10% of total supply per year) and trades ~6x FDV to protocol fees Recently added to binance alpha list and continues to deepen on-chain liquidity Internet capital markets

1/ Metaplex June Round-up TLDR: • 1M+ fungible tokens created amidst Solana launchpad wars • $1.7M in protocol fees, $1.1M used to buy back 1% of $MPLX supply for the Metaplex DAO • $MPLX listed on @binance Alpha and @bitgetglobal Onchain • New Metaplex CLI launched in beta

.@RelayerCapital's thesis is that we are only in the very earliest stages of a renaissance in CeFi lending catalyzed by new product types, in particular more secure overcollateralized loans sourced from onchain DeFi lenders/capital. @maplefinance has led the way in this new…

Pendle has become one of the most impt defi legos - powering the growth of the largest yield bearing stables including @ethena_labs (USDe), @sparkdotfi (USDS), @maplefinance (syrupUSDC), and many others $2.5B of PT assets sit as collateral across money markets - in Aave, Euler,…

Pendle just crossed $5B in TVL — powered in large part by our growing PT economy. Today, ~$2.5B worth of Pendle PT is being used as collateral across money markets, making up ~5% of ALL collateral - a 52% increase since 4 months ago

Pendle crossed a huge milestone last week: $1.42 billion in weekly trading volume, the highest ever since our inception. The majority of this was driven by the May 29th maturity event, where $1.6b in TVL reached maturity. In fact, this maturity event had the best liquidity…