Austin Barack

@AustinBarack

Founder and Managing Partner @relayercapital. Previously Partner @coinfund_io. Supporting founders w/ protocol design, gtm, and tokenomics. nfa/dyor

$MOBY token utility flywheel

New Premium Feature: 5m and 30m Trending 📈 Holders of 10,000 $MOBY or more now have access to 5 and 30 minute Trending timeframes. Pinpoint smart‑money moves the instant they start. This is just the first of many features unlocked by $MOBY ownership.

New product just released to efficiently land transactions on Solana, meaningfully expanding @sanctumso's addressable market. $2.7B of Solana staked in their products. Revenue switch turned on in Q1. Validator LST product purpose built for new wave of public treasury…

Introducing Gateway — The transaction control center that gives teams unrivaled control over Solana transaction execution.

And by the way. Everything is being recorded 📸

New Update: Ultra Swap 📈 Our trading infrastructure has been completely revamped and is now powered by @JupiterExchange Ultra. ⚡️ Lightning fast trades 📊 Best prices 💡 Intelligent dynamic slippage 💰 Lower fees than popular bots or terminals Turn on "Quick Buy" to trade…

(1/3) Sanctum has acquired @IronforgeCloud. At its peak, the Ironforge team handled up to one-third of all Solana transaction volume, making it one of the ecosystem’s most trusted transaction layers. The acquisition brings Ironforge’s battle-tested architecture and the team…

What we shipped live this week at @mobyagent: Monday: 5m and 30m trending Monday: Features gated by $MOBY ownership Tuesday: Aggregated Pools Thursday: New trading infra powered by Jupiter Friday: New token search & leaderboard optimizations Back at it again tomorrow

This week 49 ETH ($172k) of revenue was used to buy 135k $ETHFI

EXCLUSIVE: Solana liquid staking startup Sanctum acquired Ironforge in an all-cash deal blockworks.co/news/sanctum-a…

New from me 💣: @sanctumso has acquired @IronforgeCloud in an all-cash deal. More in the @Lightspeedpodhq newsletter.

49 ETH ($171k) of revenue will be used for $ETHFI buybacks this week. Buyback execution update coming soon.

This is an important foundational piece for where things are going for @mobyagent.

New Update: Ultra Swap 📈 Our trading infrastructure has been completely revamped and is now powered by @JupiterExchange Ultra. ⚡️ Lightning fast trades 📊 Best prices 💡 Intelligent dynamic slippage 💰 Lower fees than popular bots or terminals Turn on "Quick Buy" to trade…

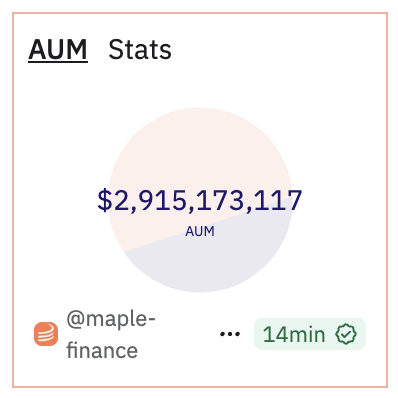

$1B to $3B in 3 months. That is a product users love. Accelerate.

Maple reaches $3B AUM. That's 300% growth in 3 months. Becoming the largest asset manager onchain wasn’t enough. Just getting started.🥞

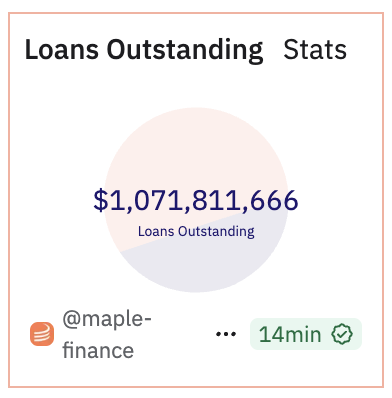

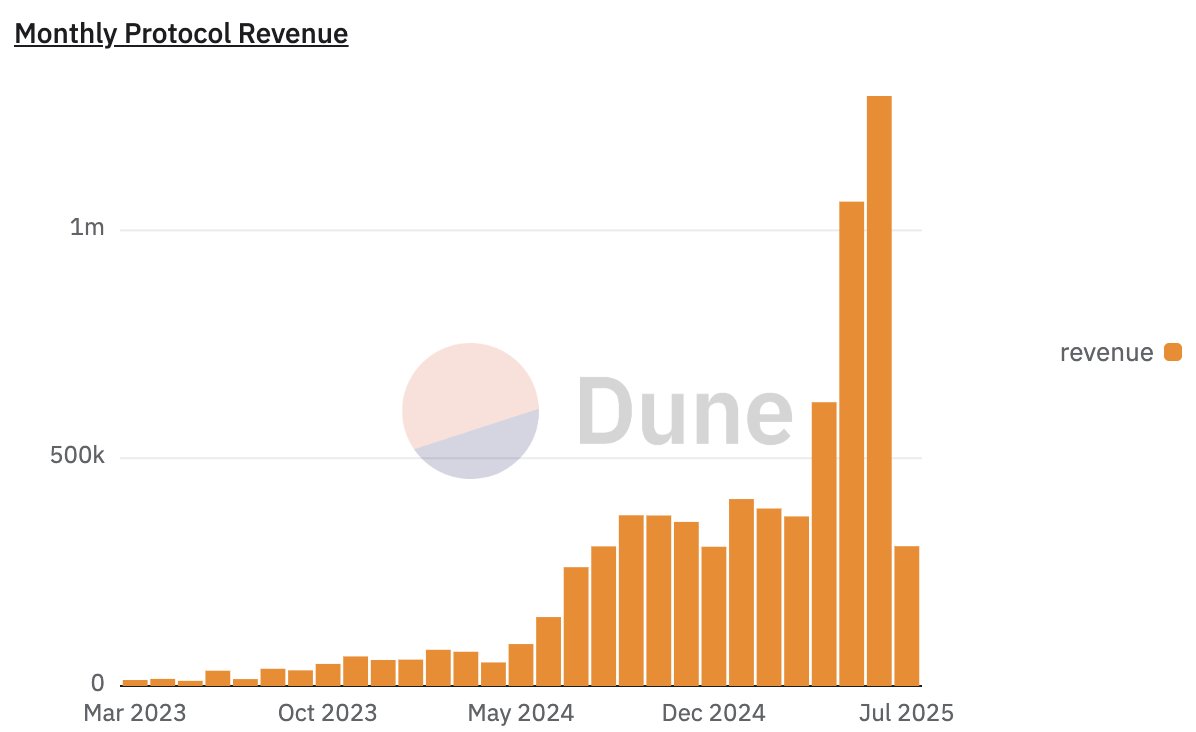

Maple is crossing $3 B TVL, a remarkable milestone over the last yr - 3X TVL growth in the past quarter - 10X+ TVL growth in last 12 months - syrupUSDC approaching ~$1B issuance - $1.1B+ loan book - $20M run rate protocol fees product market fit has never been stronger

Veda running away with the market. Incredibly impressive

It’s all-time-high season as Veda crosses $4 billion in TVL. Thank you to our partners and depositors for your continued trust. The billions may change but the mission doesn’t. Higher.

Alpha for @maplefinance: There's more dominos beginning to fall for $SYRUP that makes me think "you ain't seen nothing yet". Big Domino Last month a "Temp Check" appeared on @aave to onboard syrupUSDC. Why is the proposal so positive sum for both parties? Aave gets: - New…

Maple, the product market fit case study.

What product market fit looks like (@maplefinance case study): - Maple TVL approaching $3B (5x increase in the last 4 months) - Loans outstanding recently surpassed $1B, with supply utilization remaining high (indicative of high loan demand) - ARR approaching $20MM and revenue…

What product market fit looks like (@maplefinance case study): - Maple TVL approaching $3B (5x increase in the last 4 months) - Loans outstanding recently surpassed $1B, with supply utilization remaining high (indicative of high loan demand) - ARR approaching $20MM and revenue…