Sharples 🟪

@0xSharples

data @blockworksres

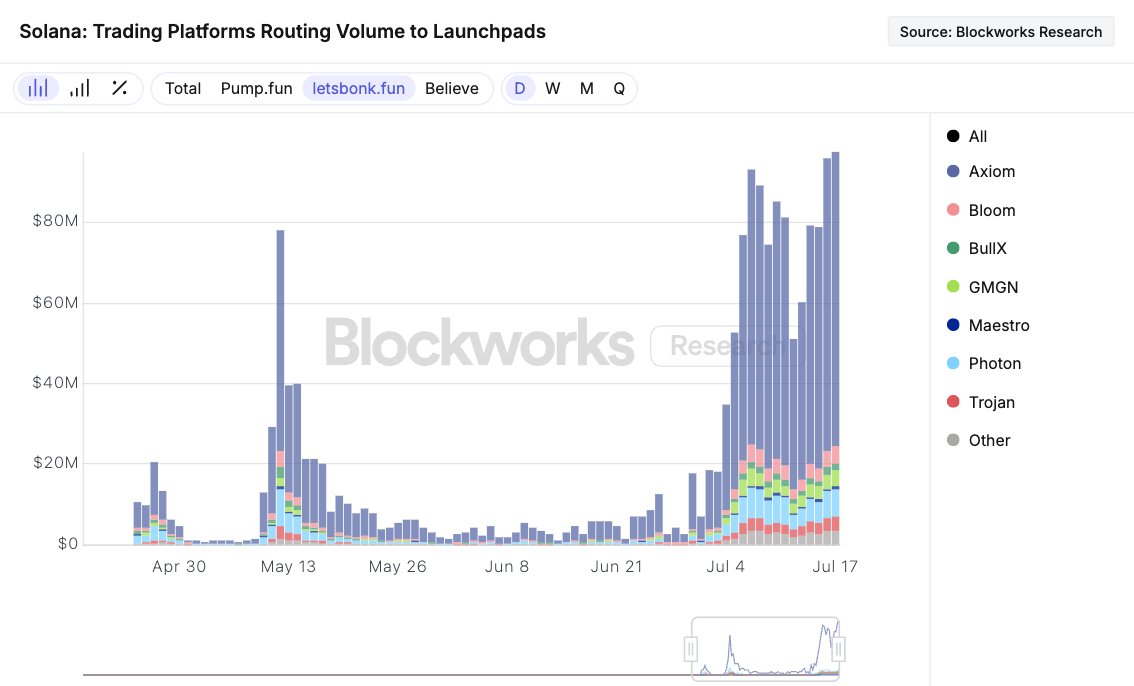

It's well known that Axiom is one of the top revenue-generating apps in crypto; however, very little has been discussed about where these retained earnings are allocated. Most of Axiom's holdings are onchain, instead of a CEX. Over $70 million is currently staked on Solana, $15…

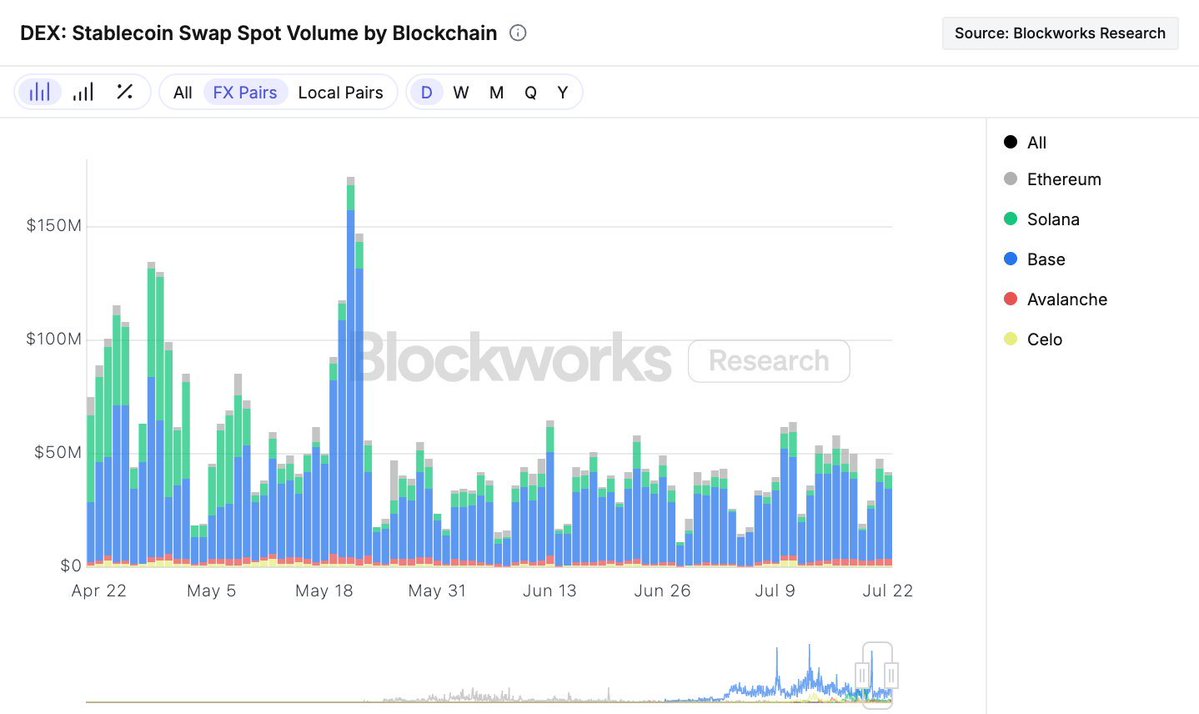

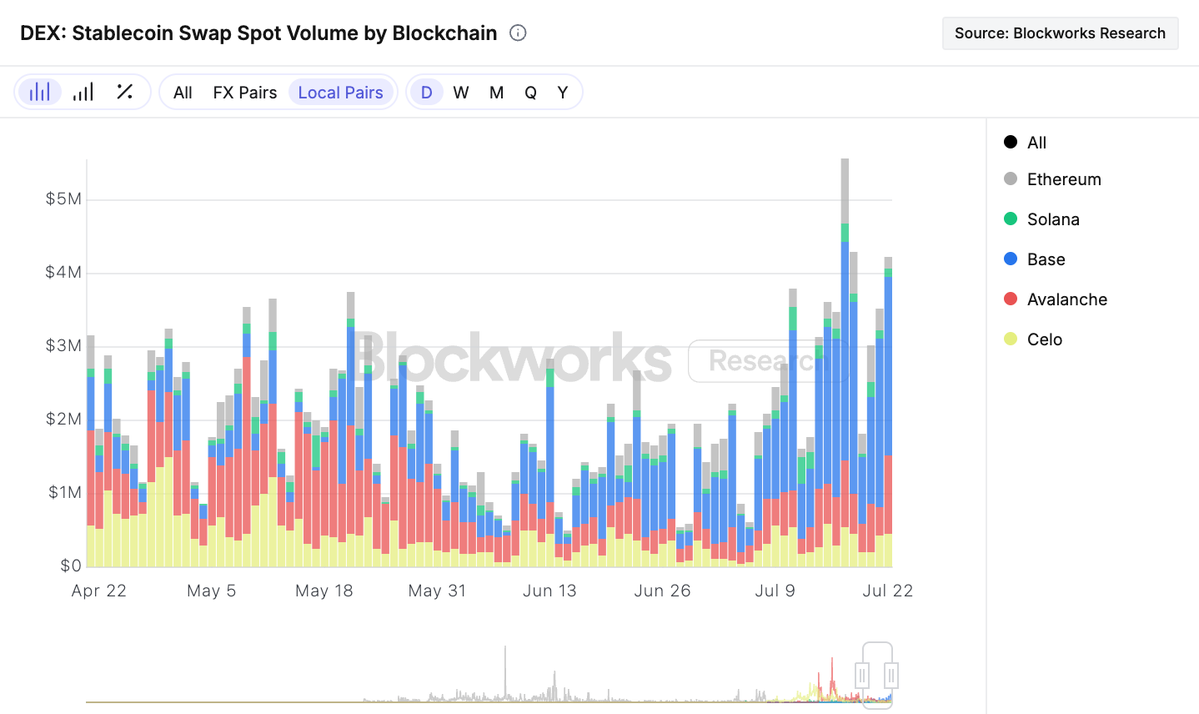

Base currently has about a 70% market share in foreign exchange volume across blockchains. The biggest FX pair is EUR/USD on @AerodromeFi. Even excluding EUR/USD, other FX pairs have also been rising, such as CAD/USD, GBP/USD, and CHF/USD.

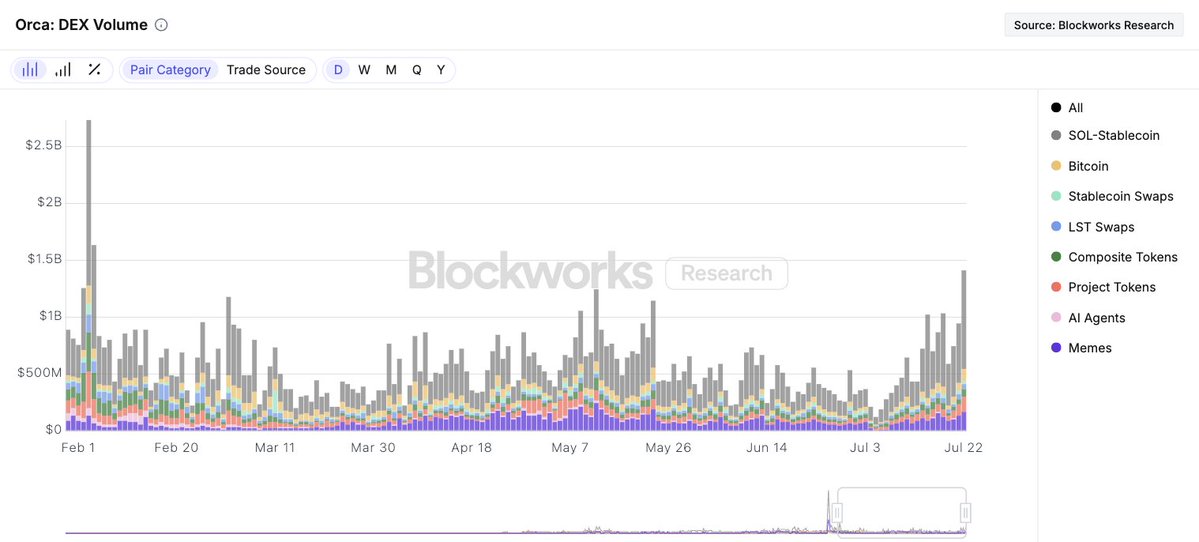

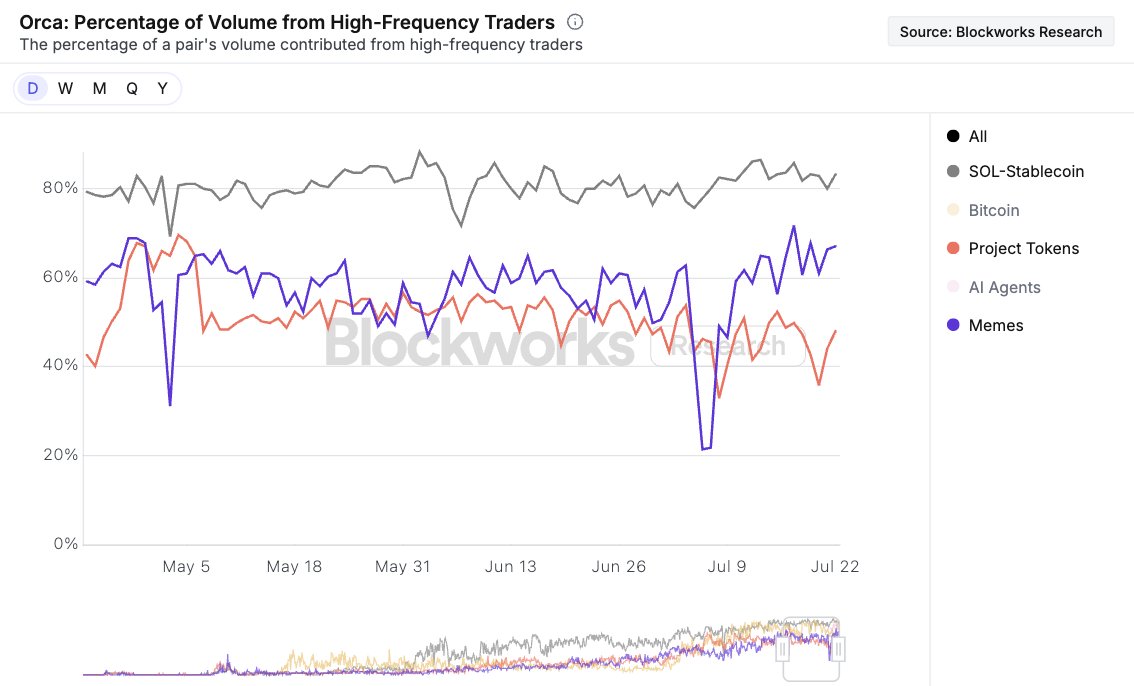

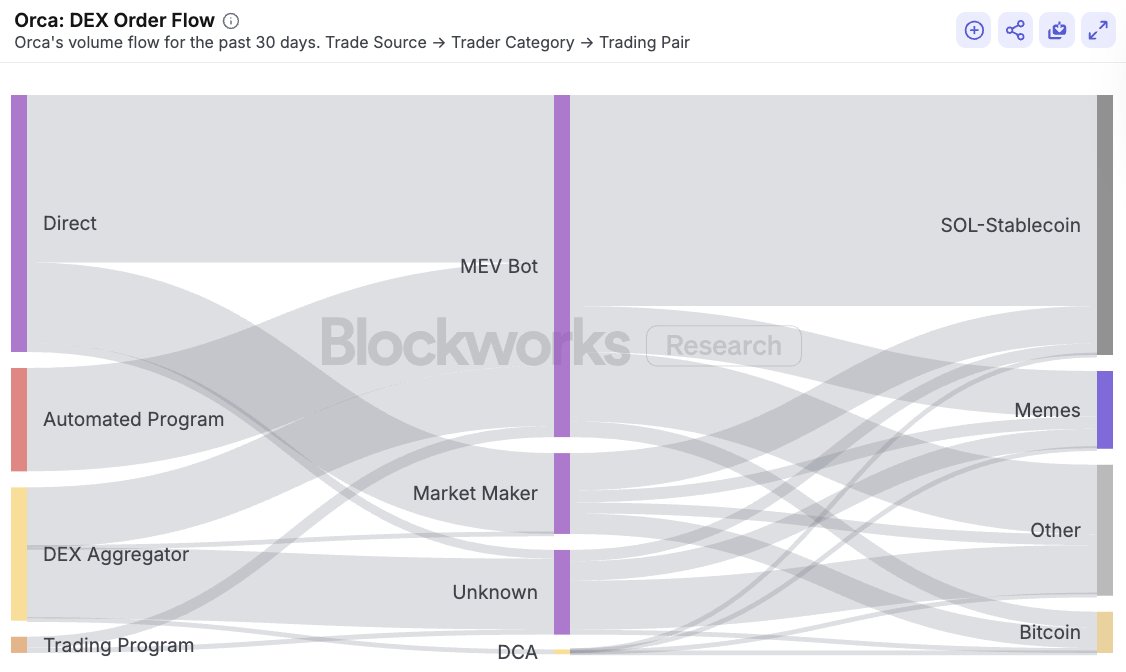

Orca has seen its daily volume reach just under $1.5 billion, a six-month high. SOL-USD is the most popular category, accounting for approximately 60% of this volume. About 80% of SOL-USD volume is driven by high-frequency traders (people who trade more than 10k times a day).

Solana DEX volumes reached a two-month high, with just under $6 billion in daily spot volume. SOL-USD was the most popular category with around $2.6 billion in volume. The top four DEXs: - @RaydiumProtocol $1.9b - @orca_so $1.4b - SolFi $750m - @MeteoraAG $620m

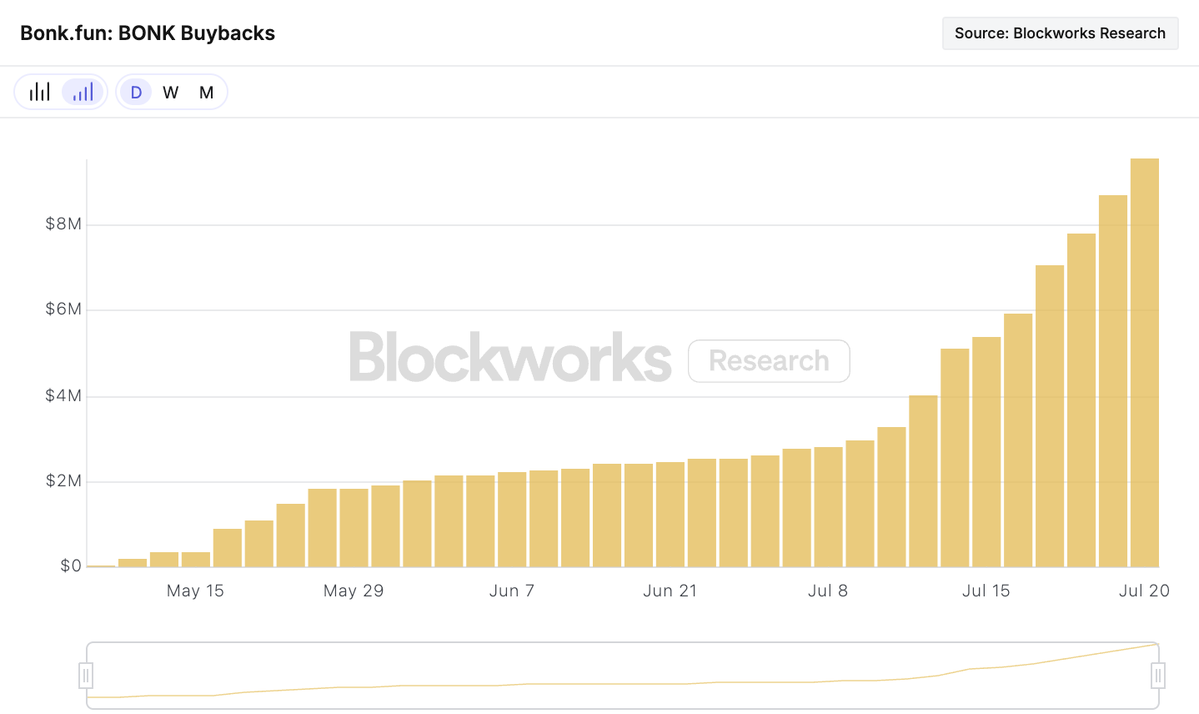

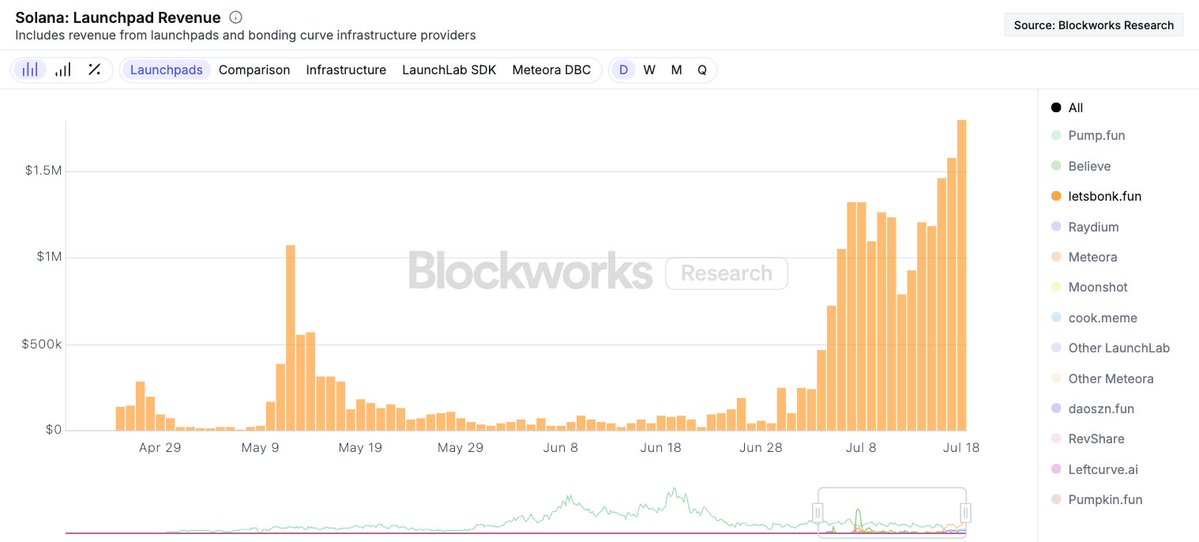

The success of @bonk_fun has enabled close to $10 million in buybacks already for BONK. Over 400 billion BONK tokens have been repurchased. Approximately $7 million of these buybacks occurred in the last two weeks. Annualized, this is over $180 million in buybacks. Probably a…

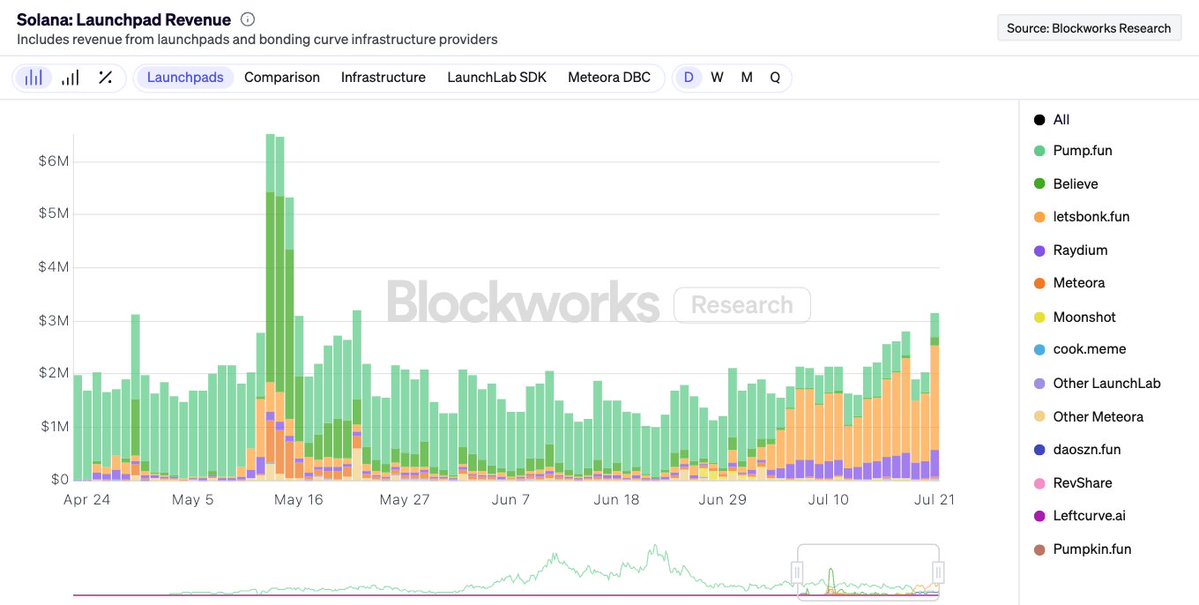

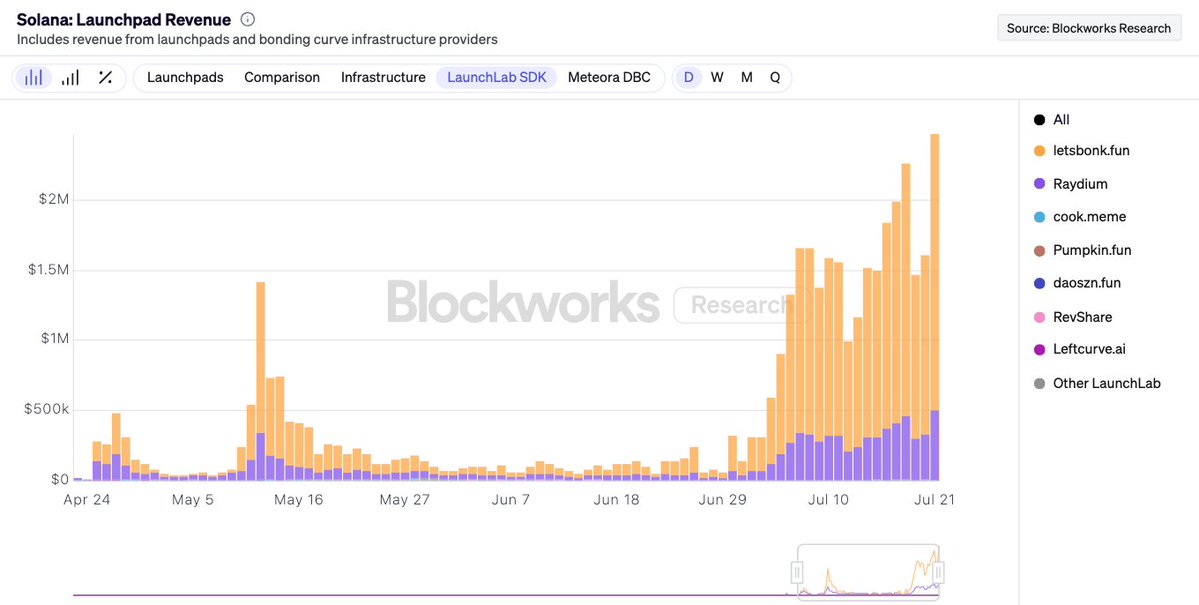

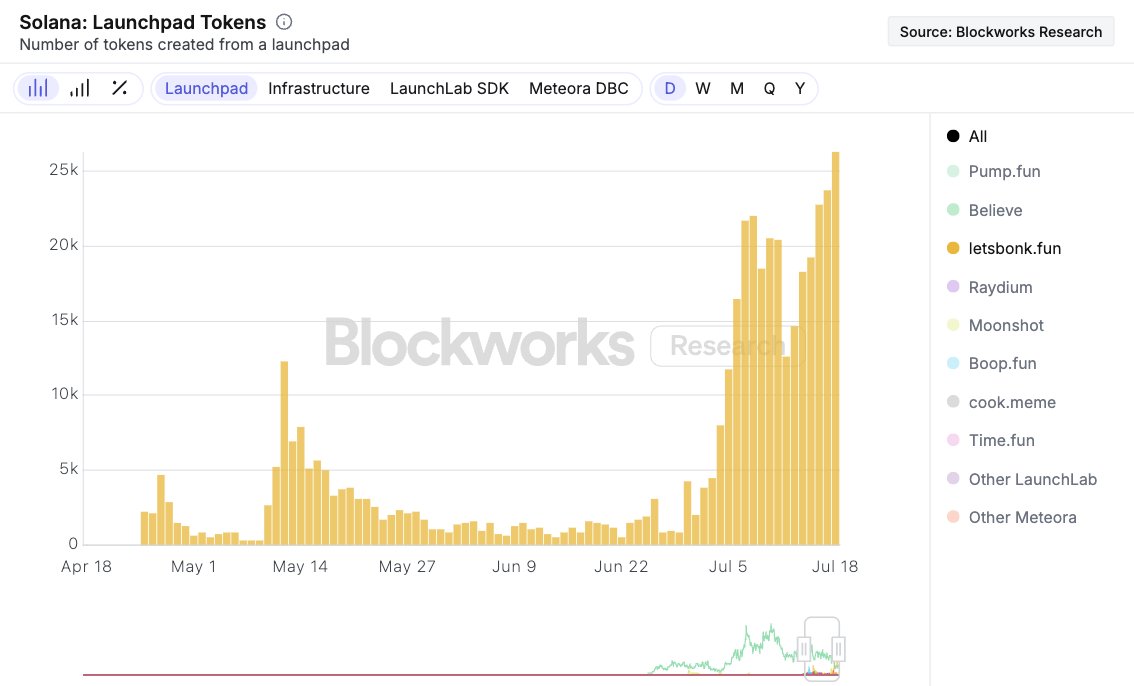

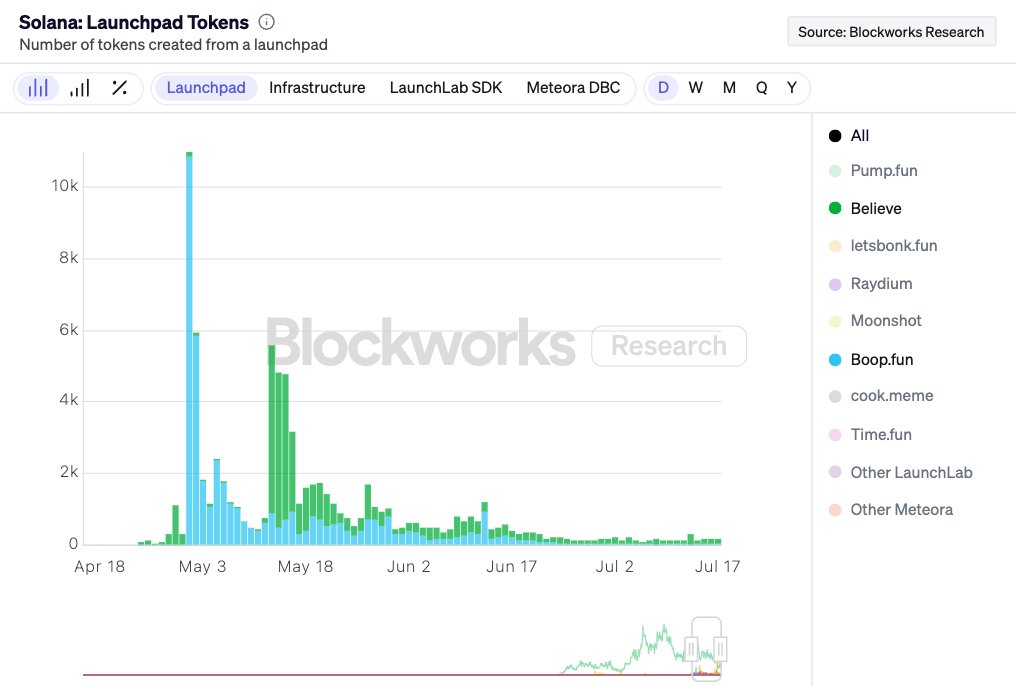

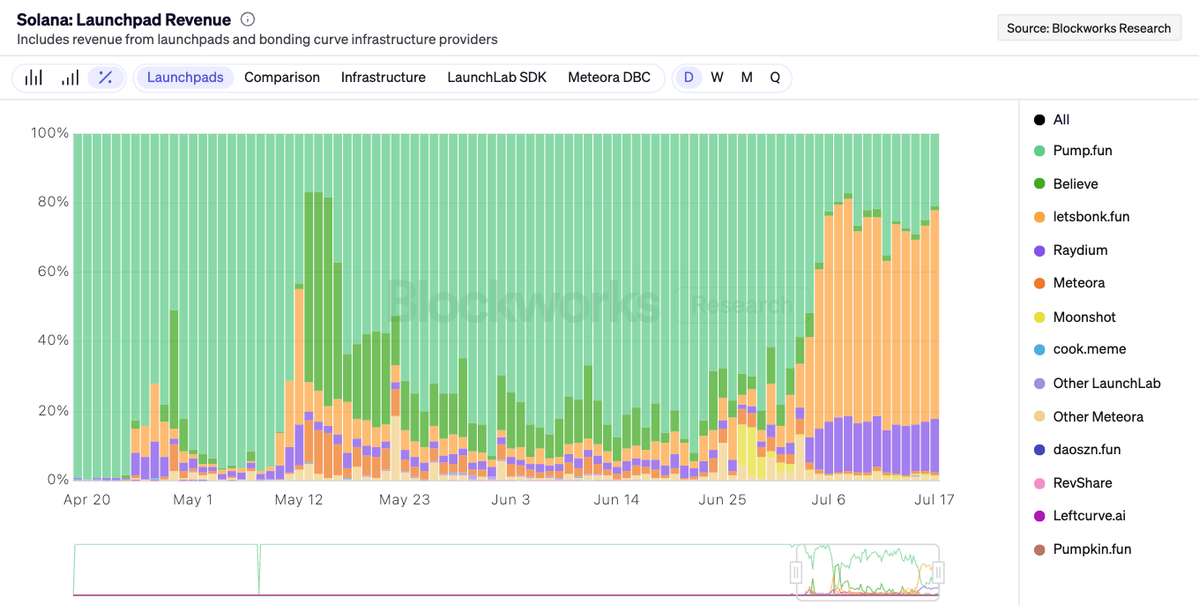

Daily launchpad revenues on Solana reached a two-month high, mainly being driven by @bonk_fun. Over 80% of this revenue comes from products using @RaydiumProtocol's LaunchLab SDK.

Ethereum ETF volume paints a similar picture. Ethereum ETF volumes more than doubled last week from the previous week. Did about 1/3 of Bitcoin ETF volume despite the Bitcoin ETFs being 8-9x larger.

40% of the overall ETH ETF assets under management have come in the past 8 trading sessions 🤯 eth/acc

Bonkfun hit all-time highs yesterday in a few categories: - Over 26k tokens launched - $1.8 million in @bonk_fun revenue - $100 million in trading platform volume

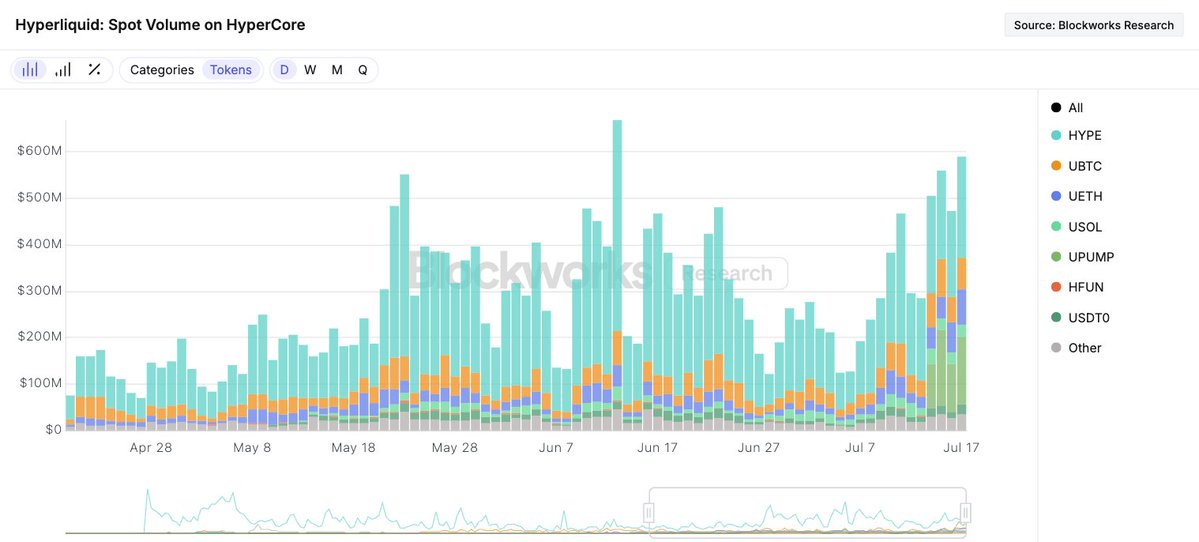

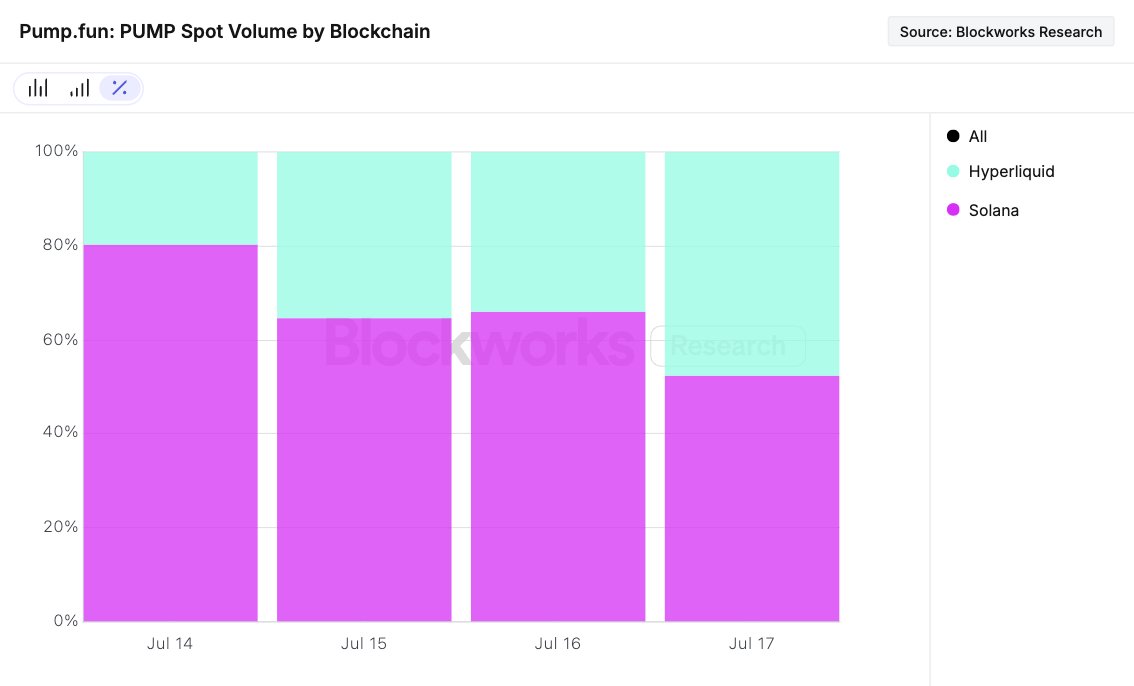

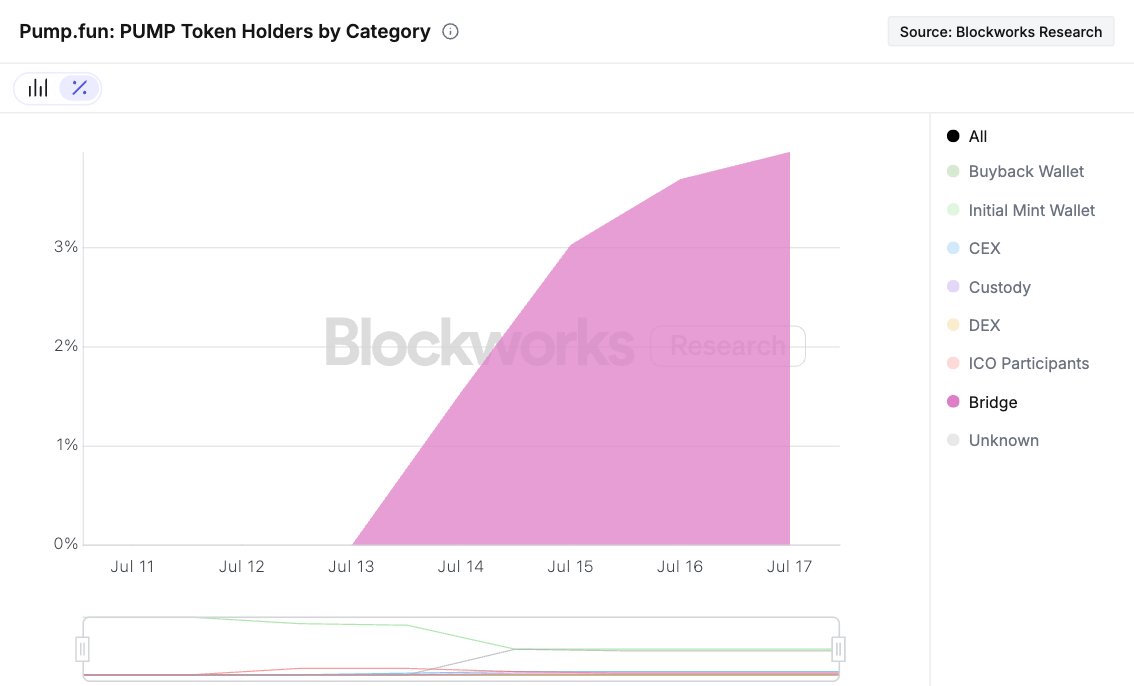

The launch of PUMP on Hyperliquid has been a tremendous success. Using @hyperunit, PUMP's spot market on Hyperliquid is currently the second-largest market. Its spot volumes on Hyperliquid are up to $150 million daily, accounting for 25% of HyperCore's total spot volume. HYPE,…

History has shown that creating a non-Pumpfun launchpad on Solana brings attention to it in the first few days, but fades over time. When Raydium announced it was gonna create a launchpad, I believed it was Pumpfun's most significant challenge to date due to Raydium's…

Recent Morpho deployments gaining traction - over $450M supplied and $160M borrowed across Polygon, Worldchain, Unichain, Katana, Plume and others. Still small compared to the near $3B combined supply on Ethereum and Base.