jack-anorak

@jack_anorak

clothes make the man

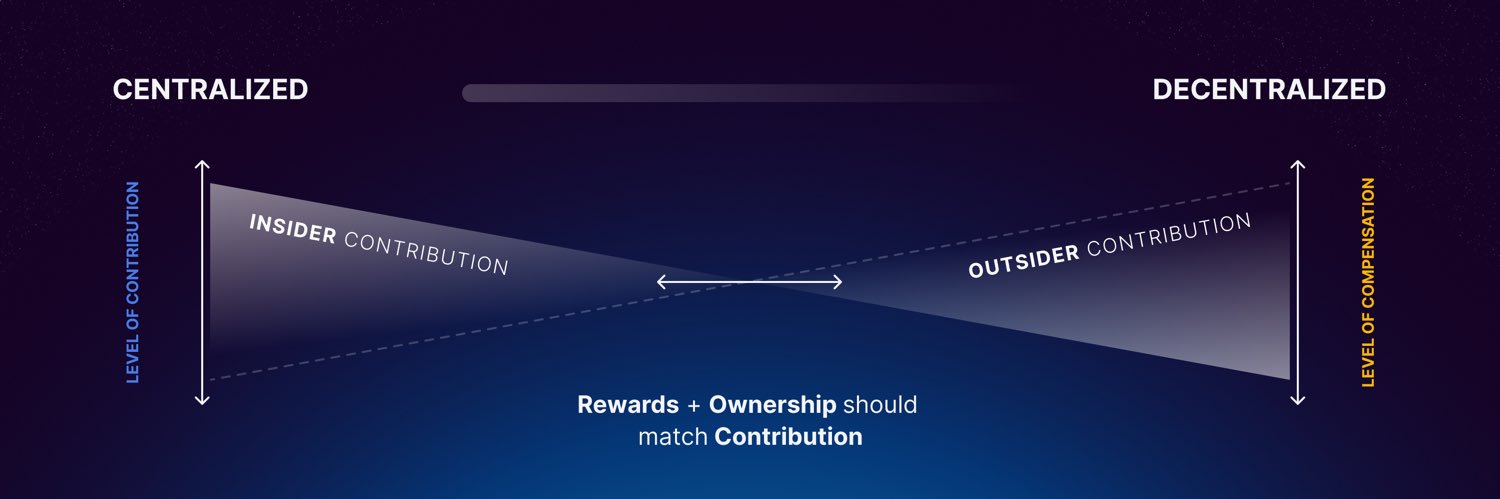

ya i talk abt work a lot but hear me out imo our case offers better models: • how you build and earn as a team (alongside users) • how you define a protocol's success (make, don't take) • how you define stakeholders (expansively) i'm proud of how we're pushing org logic

day 1 now imagine when we really get going

Base currently has about a 70% market share in foreign exchange volume across blockchains. The biggest FX pair is EUR/USD on @AerodromeFi. Even excluding EUR/USD, other FX pairs have also been rising, such as CAD/USD, GBP/USD, and CHF/USD.

Imagine being the willing buyer of lindy effect premiums in an industry this fresh and new. Can you even remember half the incumbents from last cycle or how quickly they faded to irrelevance? History repeats and some of you are buying Blockbuster and AOL w/ worse fundamentals.

damn

i didn't recommit to another tour of duty at coinbase to fuck around. i did it to build the future, powered by the infrastructure of the greatest crypto company in the world, with a strategy that embraces the best of on-chain, decentralization, and positive sum collaboration.

afaict @AerodromeFi might be the only org on the planet that does something better than just buybacks public good wallets buyback and use AERO to aid growth, but nobody has any claim to them so it's like a burn (everyone owns more of the pie) but it also puts capital to work

Unironically, I think most alt-L1s will become L2s @Celo showed the playbook: – Halved inflation from 2% to 1% – Reduced block times from 5s to 1s – Eliminated 300k+ lines of legacy code – Fully integrated into Ethereum’s ecosystem, the largest dev community in crypto – Carbon…

we’ll take @monad_xyz @berachain @Somnia_Network @solana @avax @cosmos @Polkadot @Cardano and every other altL1 and turn them into L2s ✊ Ethereum. Consume. All.

Last epoch, Aerodrome generated over $2.3M in revenue while $AERO emissions exceeded $AERO locks by only 1%—earning yield while functionally maintaining circulating supply.

these wallets are going to bitterly compete against one another. it's not a straightforward play for most a lot of native crypto companies attacking this space are going to get steamrolled if they don't have an angle one thing they all must do, tho: get the best trade execution

Gone are the days of wallets as boring desktop plugins. From here wallets will be destinations themselves and vying to become superapps like WeChat but for crypto.

Most don't realize but, @AerodromeFi is everything the $ETH community wishes Uniswap could have been: ☑️ 100% of protocol rev redirected back to voters ☑️ Zero team unlocks, no extraction to insiders ☑️ Regular protocol token buybacks ☑️ Aligned incentives across all…

onchain trading, capital formation, and payments are nearing the point where they’re just better products than offchain alternatives. once we cross that threshold things will change fast

Budget proposal for Optimism retro moved from 87m $OP ➡️ 20m $OP after @labsGFX pushback. GFX Labs always guarding that tokenholder chicken coop.

I won't be running for the @Optimism Grants Council this coming season. Will just be too busy with @VelodromeFi and @AerodromeFi. Huge things ahead, and I need to direct all my energy there. Feels a little sentimental. My work with Optimism – including my lobbying for the GC's…

now imagine startup CEOs that have already cashed out over 8 figures on massively inflated token valuations well before their products do anything or make any money

One thing that surprised me about running a startup is the monumentally low quality of most startup CEOs. Literally just caring about product inspires engineers. They have stories of totally checked out zombie startup CEOs and I think this is the default state of most startups.

I’m not even going to format or explain this more bc it feels like giving up too much of the endgame but @VelodromeFi built tech to deliver better cross chain swap execution than even bridge aggregators can. Right now. Live. Directly on the swap page.

anyway, let's talk about growing market segments

The #1 Bitcoin Pool Across All Chains As Bitcoin continues to break records, so too does Aerodrome—capturing the top BTC pool in all of DeFi the last 24 hours. Aerodrome is the home of $BTC onchain

yes, we are asking this it's a good question, some would say the best

dudes on CT will ask why a business doesn't share 100% of revenue with holders of its cryptocurrency token this industry man

Step 1: Launch front end fee, direct to Labs Step 2: Fracture liquidity with UniV4 Step 3: Say only our FE can fix this Step 4: Profit (for equity holders)

The tinfoil hat theory about Uniswap v4 btw is that the main purpose of hooks is to completely break UI integrations and greatly increase the complexity of building interfaces that service all Uniswap liquidity, thereby entrenching Uniswap’s sole cash cow, the frontend fee