Samir

@heysamir_

Over-engineered fintech, stratfin, tech, politics and AI tweets and takes. Opinions my own.

In the age of AI search that no longer requires you to visit sites, these sites no longer get valuable traffic which means their monetization (via ads) goes to zero over time. If that continues, people will have less incentive to create free content that is subsidized by ads and…

One of the unsung heroes in this journey is their VP of Finance, Vignesh Nathan, who became the wartime HoF they needed to navigate the cloudy waters of regulation, major changes to GTM and Sales motions, updates to pricing & packaging and changes to headcount. He made the unit…

After years and years of "BaaS is dead," embedded finance provider @unit_co_'s latest metrics are eye-popping: 📈 Margin up to 37%, tracking to 50% by end of year ✈️ 4+ years of runway, tracking to profitability ⬛️ Larger and more deeply-embedded customers (a few of whom…

boom. today we're onboarding our first few @Square sellers for the new native bitcoin acceptance experience this is the way!

I wish all my portfolio company investor updates were like this latest one.

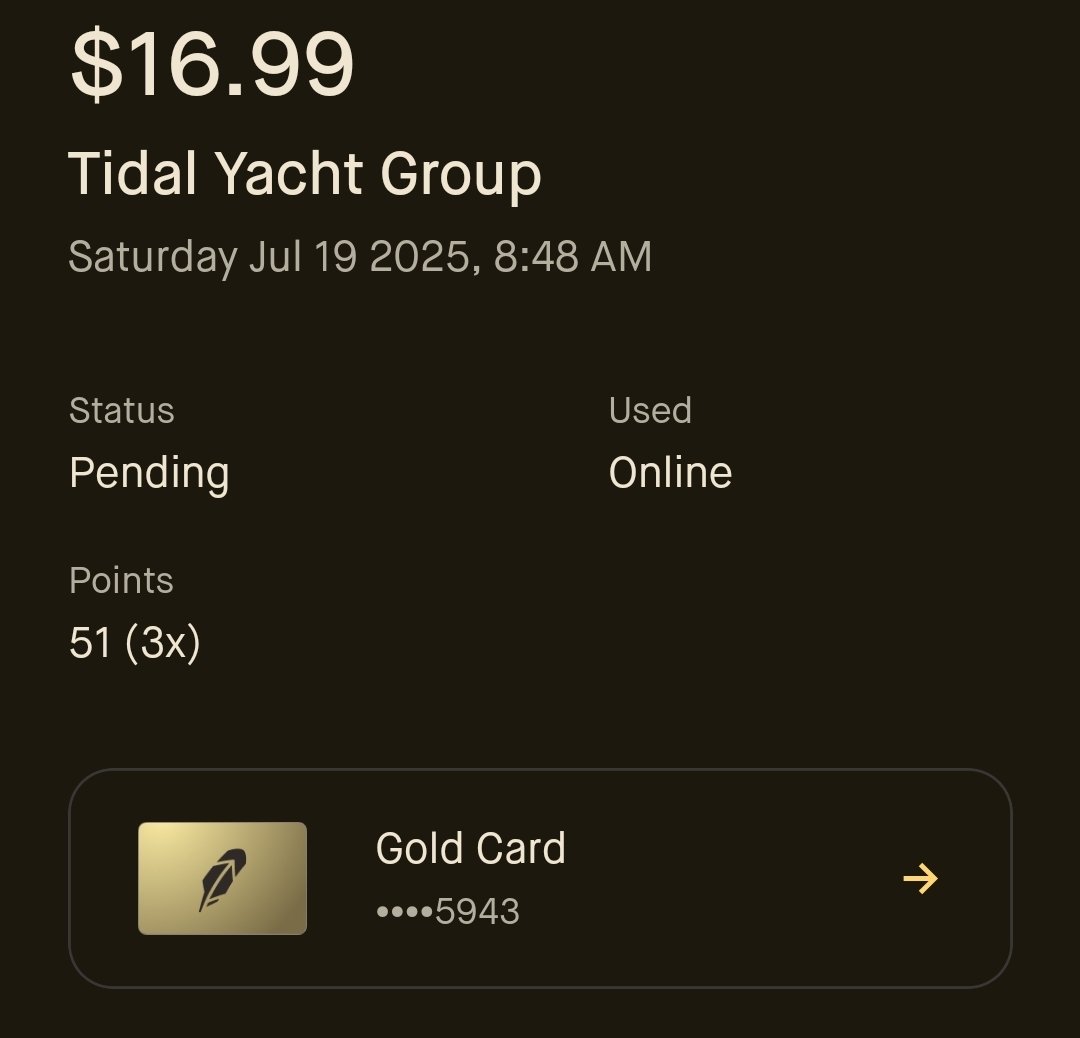

lol why does my @BlockIR @TIDAL subscription come through as "Tidal Yacht Group"? @nachunja this feels like something you already investigated on one of your deep dives.

We just lived through most consequential 24 hours in financial services law for the past two decades. And it will bring the biggest transformation of financial technology since the 1970s. Here's what happened and why it matters 👇

Something I never understood was why people gave others so much grief for BNPLing every type of transaction, even small dollar ones. Why not? You pay 0% APR and $0 late fees and just get to keep your liquidity to spend or monetize elsewhere. Smart money move would be to take…

not sure how you see a chart like this then just continue living your life

Today, AI giant @Anthropic announced the launch of Claude for Financial Services. Finance is a natural fit for AI given the reams of structured data the industry processes, and the big platforms are focusing more and more on fintech products. Anthropic has already signed…

Circle’s $CRCL IPO will go down in the history books. Priced at $31 a share at the IPO, the stock briefly touched $300 before settling just under $200. And yet, all I hear are bear cases with most of them centered around interest rates falling and Circle paying half of its…

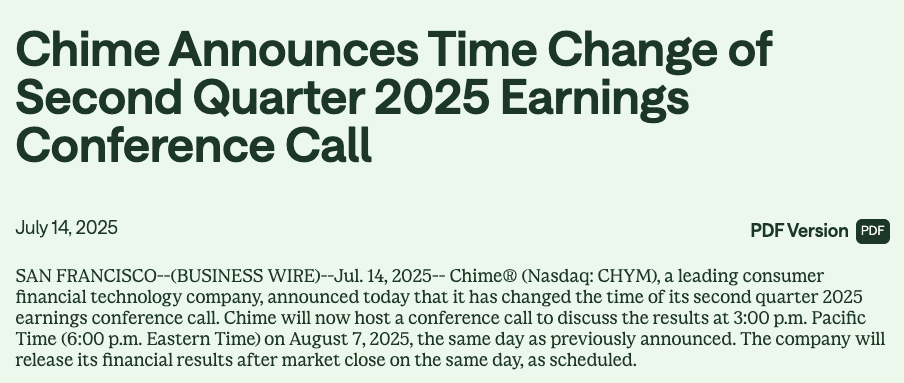

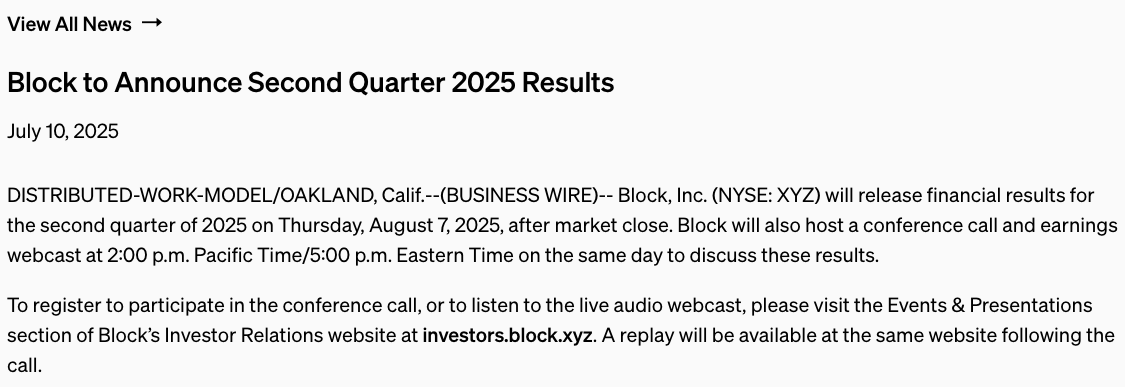

Clash of the titans - this is fintech's super bowl. Pretty interesting that Chime was originally going to report at exactly the same time as Block but moved it to 1hr after 🤔 I hope both of these companies crush it.

If I was @vladtenev, I'd buy Wealthfront with all stock. HOOD is +150% YTD and Wealthfront is sitting on $80B in total assets. Wealthfront's latest private valuation was ~$2B. Seems no brainer to me to acquire Wealthfront and cross-sell Gold sub, better trading UX, IRA, card.

Powerful overview of the SMB accounting space and the opportunity to disrupt the space by embedding into the tools SMBs already use as mission critical pieces of their operating stack. Congratulations to @layer_financial on the raise and @btv_vc for the investment. Oh and @theo…

Our portco @layer_financial just raised a $6.6M seed round led by our friends at Emergence. Over the years, we’ve spent a bunch of time thinking about how to disrupt Quickbooks (if such a thing was possible), so I thought I'd share our thinking here. QuickBooks owns…

My ORDER today (thanks to my boss, POTUS) will allow for Americans to use their RENT to qualify for a mortgage. Credit history will no longer just include credit cards and loans. This is HUGE.

What do I gotta do to get a reverse 7/6 ARM where it adjusts every 6 months for the first 7 years and then stays fixed thereafter? I want to lock in some of that sweet interest rate reduction benefit when JP gets replaced next year.

The word you're looking for is not pegasus but decacorn @AlexH_Johnson. Bilt will be a decacorn which is ludicrous. I have many thoughts on this Bilt raise that I'll share in my post tomorrow, but I want to get a few things straight: 1/ Wells Fargo did not strike a bad deal.…

The original idea behind Bilt was to help people stop renting and starting owning a home. As the company's CEO said in 2019: “We [Millennials] rent for, on average, seven years. You’re lighting that money on fire every month.” However, in an ironic twist, the company evolved…