Alex Johnson

@AlexH_Johnson

Writing and podcasting from the 🏔️ | @FintechTakes

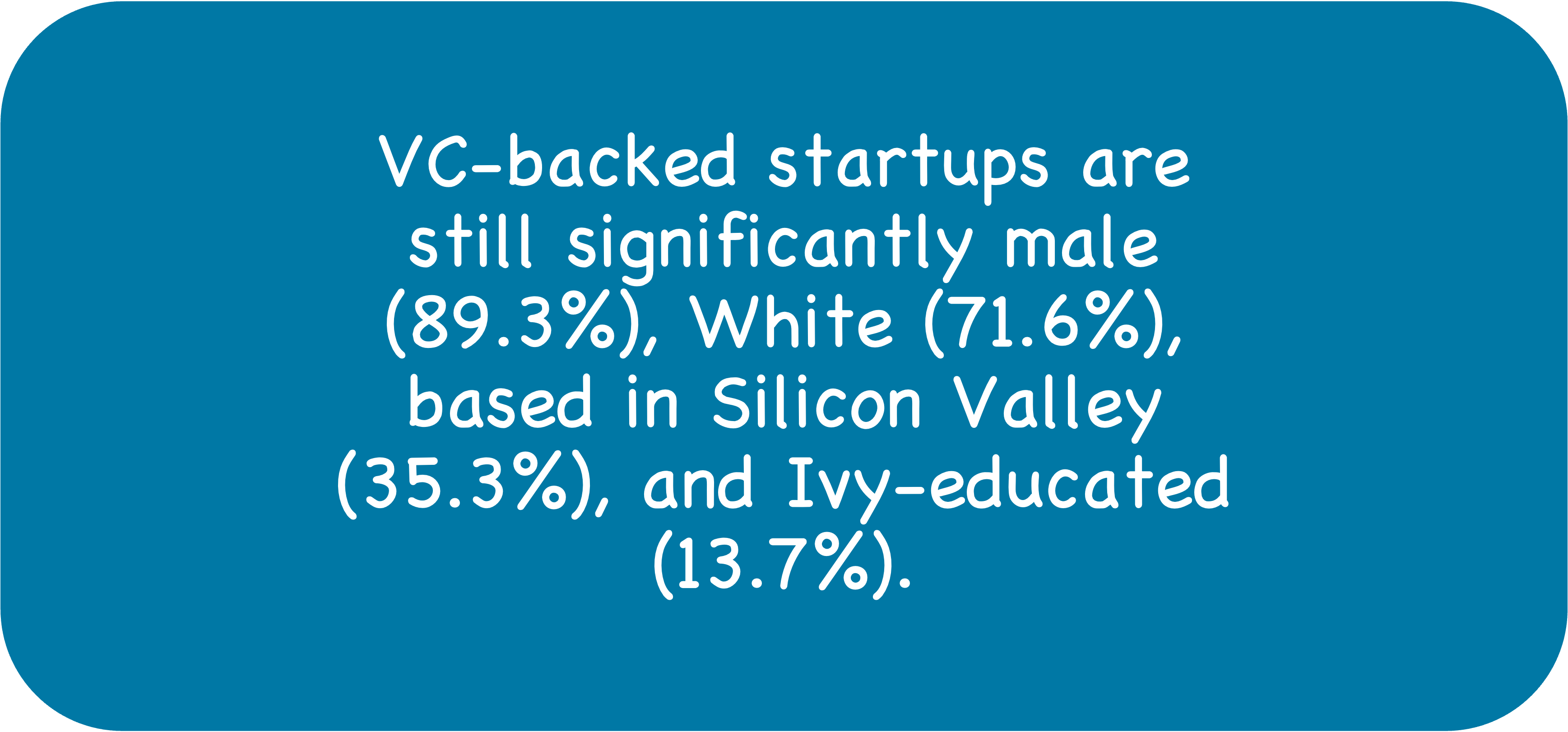

I asked a couple dozen female founders and founders of color in fintech about their experiences raising money from VCs and how that process can be improved. Here’s what they said: workweek.com/2022/10/15/how…

We desperately need more objective data on crypto ownership and usage. Most of the data out there is from surveys conducted by crypto companies or advocacy organizations and it is embarrassingly bad. These surveys suggest that the total number of Americans who own crypto is…

Pretty funny tweet given that offering yield on payment stablecoins is blatantly against the spirit of the GENIUS Act.

I'd have more respect for white collar criminals if they spent their ill-gotten gains on cooler stuff. For the most part, it's all fancy cars, vacation homes, and country club memberships. Boring.

If I wanted to get smarter on the benefits and drawbacks of digitizing bearer instruments on distributed ledgers, where would I start? Any good articles or papers on this topic?

Absolutely wild to criticize anyone else for spending too much time on social media.

Senator Warren sent me a letter today. My response: “Senator Warren, in her typical hypocritical manner, spends her own days on social media attacking President Trump and others, like Director Pulte, who are fixing the broken Biden-Powell housing market.”

Everyone’s excited about agentic commerce. What if we aimed higher? In this clip from Not Fintech Investment Advice from the @FintechTakes Takes podcast, I floated a (slightly ranty) idea: Before we build agents that help consumers spend more efficiently ... can we build agents…

Literally everyone disagreed with this prediction, but I still have eight years to go and I'm feeling good about it.

The FICO Score, as a mechanism for establishing a common understanding of a consumer’s credit worthiness, will be dead within the next ten years. The implications for credit monitoring, PFM, and loan securitization are immense. A big opportunity for new solutions.

Bankers everywhere buying these for meeting with their delinquent borrowers

WNBA players, whose salaries are subsidized by the NBA, wear t-shirts declaring “Pay Us What You Owe Us.”

Who would be the best person to talk to about how LLMs are changing customer acquisition in financial services? The focus is on B2C rather than B2B, so perhaps someone sharp at a big fintech company noted for its marketing prowess, like Credit Karma? LMK!

"It’s just math. Predictive math." Order the shirt here👇 store.workweek.com/products/finte…

New favorite quote about credit scores: “It’s just math. Predictive math.” Yes, it’s on a Fintech Takes t-shirt. Yes, you can have one. DM me to order!

Kalshi sucks. Prediction markets suck. The financialization of everything sucks.

🚨SOMEONE JUST PUT $19K ON THE CEO LEAVING IT'LL PAYOUT OVER $42K THE CEO RECENTLY DELETED HIS LINKEDIN

“Go use this very powerful tool carefully so that we can see all the ways it will break and be exploited by the bad guys.” Remarkably honest. And not at all how we think or talk about product development in financial services.

Today we launched a new product called ChatGPT Agent. Agent represents a new level of capability for AI systems and can accomplish some remarkable, complex tasks for you using its own computer. It combines the spirit of Deep Research and Operator, but is more powerful than that…

I have some questions! - Does Dakota issue DKUSD itself or is it done through a partner like Paxos? - Can customers opt to store funds in other stablecoins besides DKUSD? - Will Dakota comply with the GENIUS Act when it goes into effect? And if so, how will it be able to offer…

x.com/i/article/1945…