BCA Research

@bcaresearch

BCA Research is the essential source of macro insight for the world's investors. The leading independent provider of macro investment research. Founded 1949.

New speaker confirmed: @SteveMiran, Chair of the Council of Economic Advisers in the Trump Administration, will keynote our upcoming annual conference in October. To learn more or RSVP, click here: tinyurl.com/2jp7wt7m

Extremely busy week ahead: FOMC, payrolls, and the August 1 trade deadline. The US economy remains resilient, but signs of slowing consumption and labor momentum are emerging.

The anti-dollar trade is alive and kicking. One of the beneficiaries of these are hard assets outside the US, like land (especially agricultural), but also precious metals like gold, silver, platinum and palladium, that have historically been a store of value as the chart below…

🚀 Meme stocks are back Our US Equity Strategist Irene Tunkel was quoted in @thetimes on what’s driving the latest surge in speculative names Her take: 📈 Frothy sentiment, lingering liquidity, and record S&P 500 highs are fueling risk appetite 💸 Pandemic-era stimulus money is…

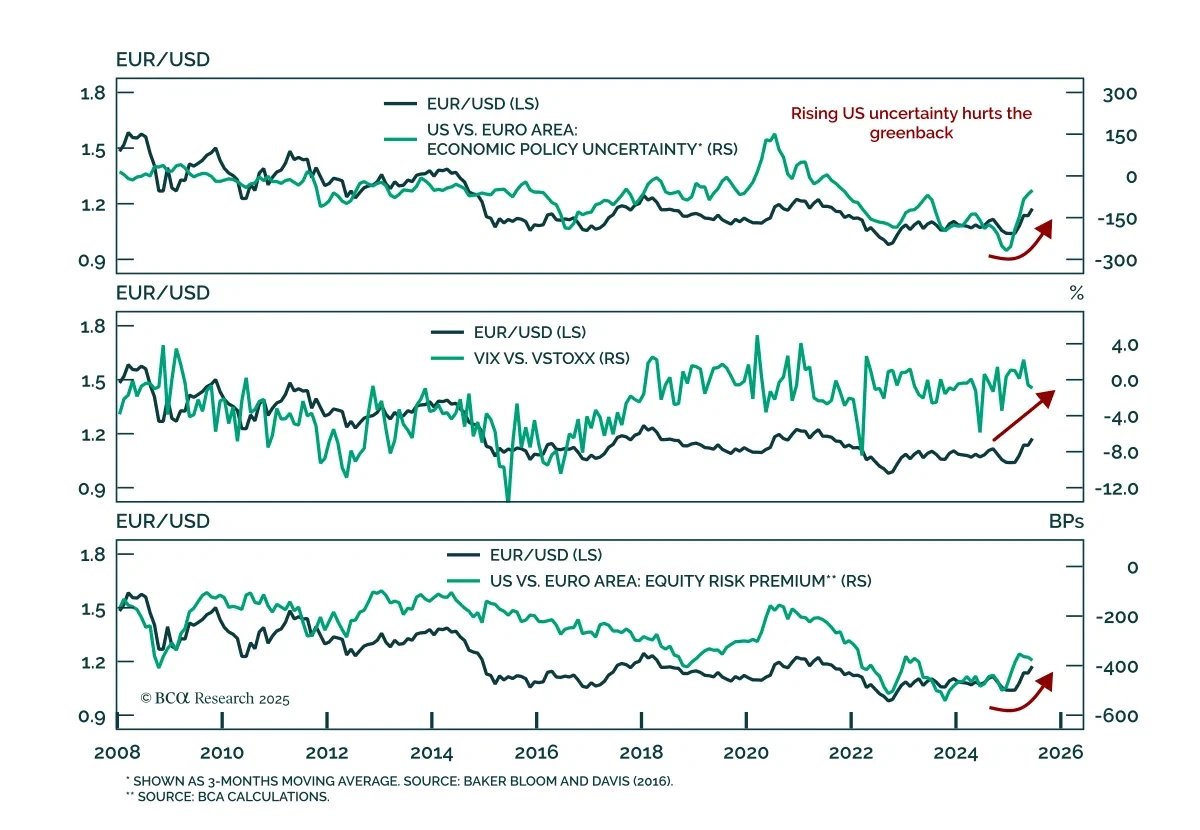

📈 BCA's #ChartOfTheWeek! Rising US macro uncertainty and external imbalances are reinforcing euro strength. @SavaryMathieu sees EUR/USD in a multi-year bull market as Trump’s policies fuel risk premia, BoP stress, and doubts about the USD’s global role. A short-term pullback…

📺 Why overweight European small caps? Our Chief European strategist Jeremie Peloso joined @ausbiztv to explain BCA’s call: 🏠 Small caps, especially in real estate, look undervalued and benefit from a domestic revenue tilt 📉 Falling eurozone rates favor real estate over banks…

AI represents an existential threat to humanity over the next 5-10 years, according to @bcaresearch's clients in the latest weekly poll on our website: bcaresearch.com/home

The fact that we are having this debate at the dawn of the AI age rather than thousands of years in the future suggests that there will not be many conscious observers in the future (see Section XII, page 29 for details). bcaresearch.com/sites/default/…

AI represents an existential threat to humanity over the next 5-10 years, according to @bcaresearch's clients in the latest weekly poll on our website: bcaresearch.com/home

The market is cheering President Trump’s trade deals. Many investors don’t understand how tariffs, any tariffs, can be a positive for the economy and stocks. They are not. But the market did not correct on April 3 due to 10% or 15% tariffs. It corrected because of a left tail…

Tech companies are becoming more capital intensive. But they have also become more labor light. Median EBIT per employee for the hyperscalers has surged

📈 Could the euro rally to $1.40? Our DM ex-US Chieft Strategist @SavaryMathieu was quoted in @WSJ on long-term EUR dynamics. His take: 💶 Eurozone’s strong external position contrasts with the US’s growing current account deficit ⚖️ Rising US policy risk and deteriorating…

@bcaresearch Everyone is talking about Toyota stock today (yes, I have CNBC updates on my phone too). Meanwhile, SoftBank has quietly doubled in just 3 months. You can be long #VentureCapital (which we are) through public markets too, not just private ones.

Lots of surprised folks out there that the Trump administration is concluding trade deals... as if they are watching Trump "cook" for the first time. Remember, there is ALWAYS a deal at the end of the Trumpnado. You may not like the deal. But that is a YOU problem.

BCA's Chief Geopolitical Strategist @mgertken gives his perspective on the US-Japan trade deal.

Rising political pressure on the Fed risks de-anchoring long-term inflation expectations. A dovish, politically driven nominee could trigger a bear steepener. 5y5y CPI swaps are drifting away from fundamentals, increasingly reflecting risks to Fed credibility.

BCA Chief Commodity & Energy Strategist @RoukayaIbrahim comments on whether she sees upside in copper prices from here.

Can the US fix its fiscal mess without heavily cutting social security and medical benefits, defense spending, or substantially raising taxes on the median voter? Next week's Bank Credit Analyst report will tackle this question. Preventing the US debt-to-GDP ratio from exploding…

Note the huge divergence in 'Mag-7' stock performance (even excluding TSLA). Only NVDA and MSFT look 'magnificent' now. The rest less so, and AAPL is really struggling. Just shows how very narrow this rally is becoming...

Thank you for the shoutout @rev_cap! Appreciate the format below.

This geopolitical draft board / “trade value” rating exercise from the Geopolitical Cousins was a fun and educational exercise @Geo_papic and @JacobShap consistently putting out great and enjoyable stuff lately Giorgia Meloni gets my vote for most talented leader globally

🇨🇦 BOS showed weak sentiment with subdued hiring/investment plans, and contained inflation pressures, reinforcing the case for deeper BoC cuts. With firm CAD and rising yields tightening FCIs, we stay overweight CGBs. A CAD 5s10s steepener is a clean way to position.