Counterpoint Dhaval Joshi

@DhavalVJoshi

Global macro strategist known for his counterpoint outside-the-box thinking. Currently Chief Strategist of BCA Research Counterpoint.

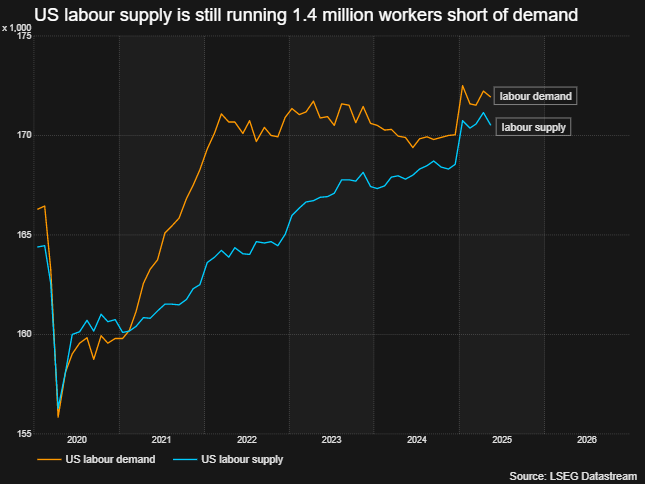

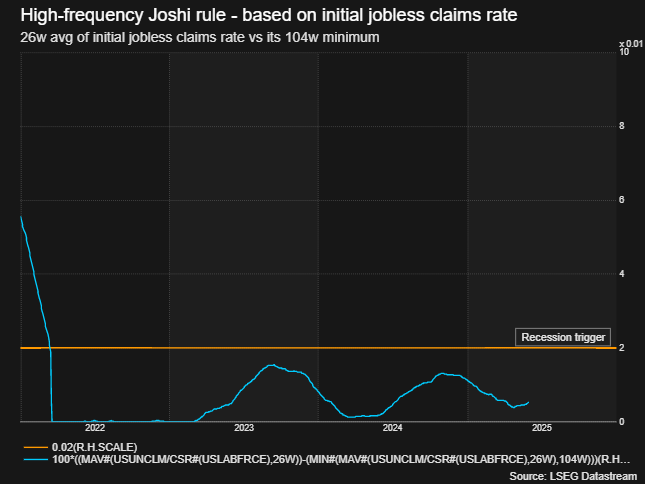

Trump's immigration policies are unwittingly? keeping the US labor market 'supply-constrained' and thereby still a LONG way from recession...

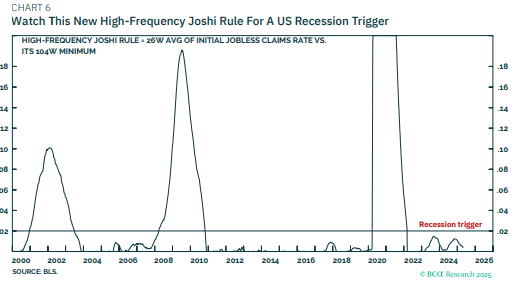

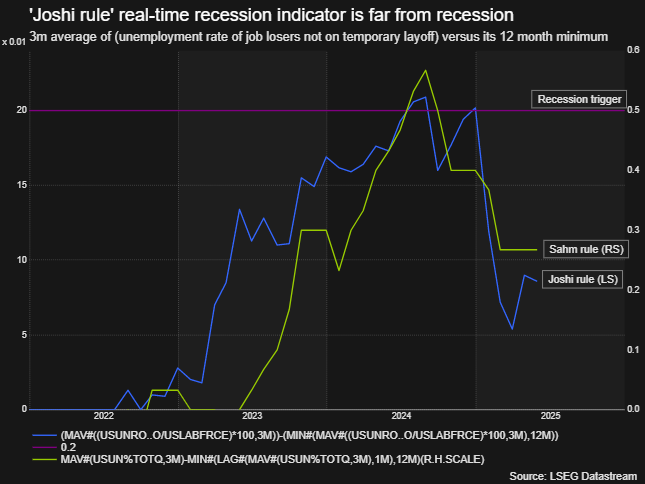

This brand new high-frequency ‘Joshi rule’ pinpoints the trigger point at which the US economy ‘phase-shifts’ to recession. And it tells us that, despite Trump’s chaos, the US economy is not near the recession trigger…

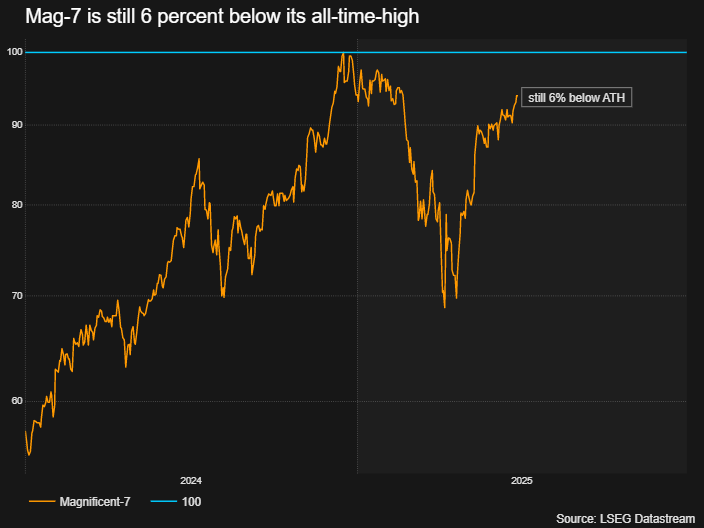

Note the huge divergence in 'Mag-7' stock performance (even excluding TSLA). Only NVDA and MSFT look 'magnificent' now. The rest less so, and AAPL is really struggling. Just shows how very narrow this rally is becoming...

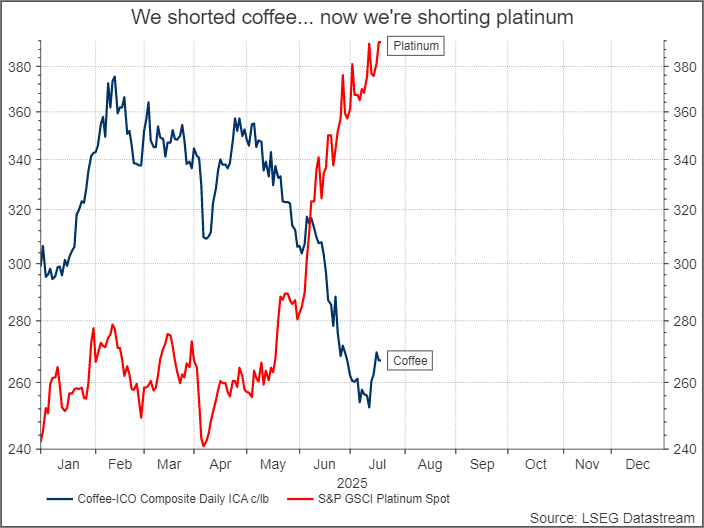

Our 'big short' in Coffee worked exactly as expected, returning us 30+ percent in just 3 months... and our next big short is Platinum...

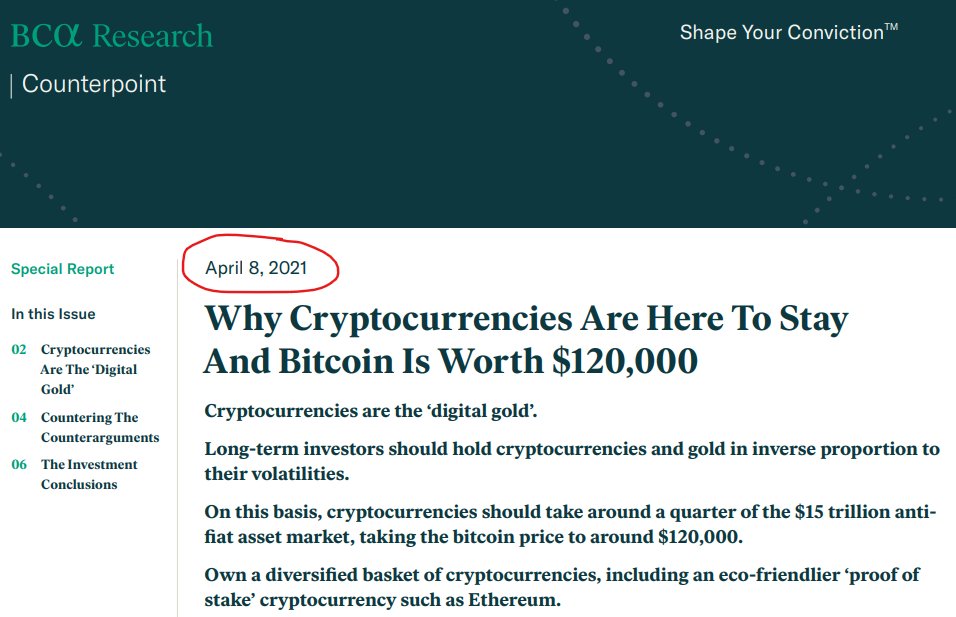

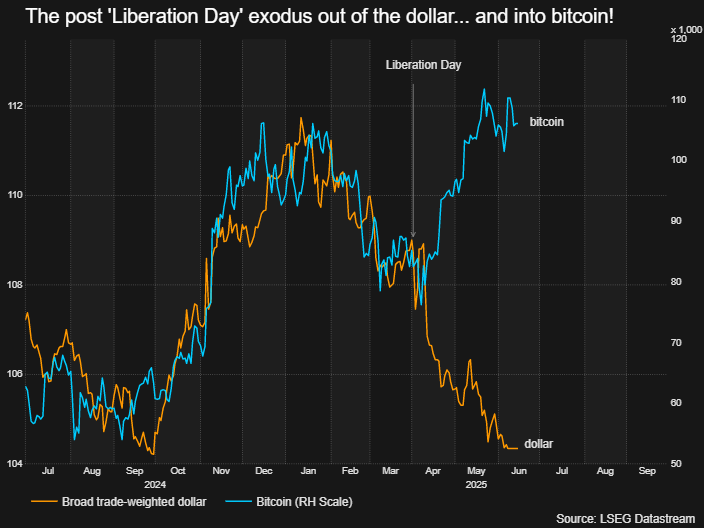

Four years ago, when I wrote that bitcoin would reach $120k, very few people believed me... but here we are at $120k!! For the record, my target is now $200k+ albeit with a tactical pullback to sub-$100k en route.

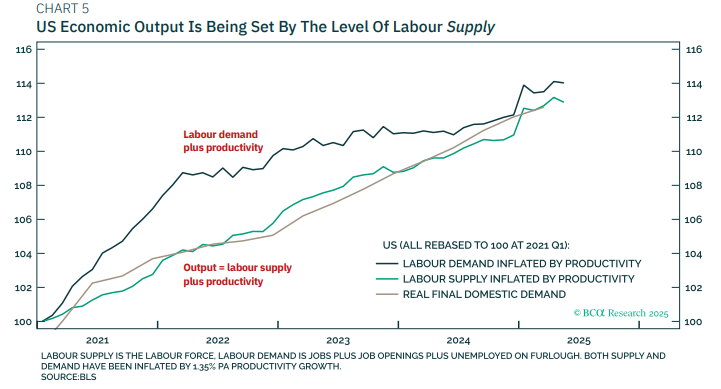

99% of economists are focusing on US demand, but 99% of economists are wrong!! In the labor supply-constrained US economy, output is being set by the evolution of labor SUPPLY, not demand. Time to listen to the 1% of economists who are correctly focusing on labor supply 😉

The just-released JOLTS confirms that the US still has a massive shortage of workers. Labor supply is still running 1.4 MILLION workers short of labor demand. The US doesn't have a demand problem, it has a supply problem...

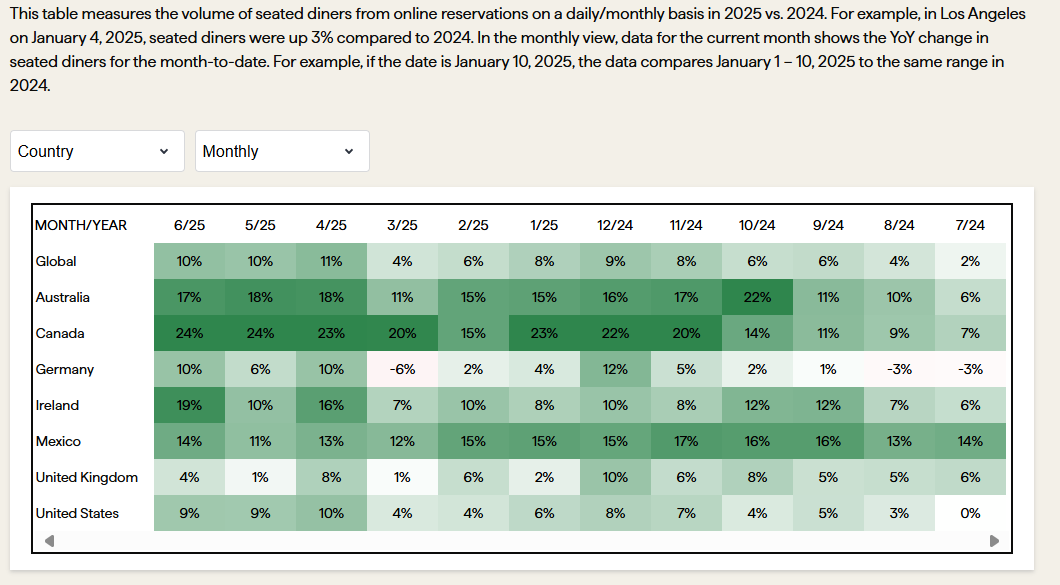

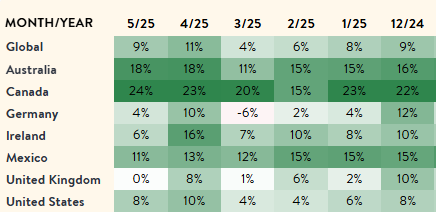

Online restaurant bookings for the month of June show that consumers around the world are holding up pretty well, except perhaps in the UK...

In terms of a new ATH, the one to watch closely is the Mag-7 index which is still 6% below. If it does reach a new ATH, then AI's structural uptrend is intact. Until then, this could just be a powerful counter-trend rally.

US immigration crackdown will leave deeper scars than tariffs on.ft.com/43U1Z01

Is the pound on the road back to $1.60? BCA Research analyst Dhaval Joshi makes the case that America's Brexit is set to cancel out the UK's Brexit. bloomberg.com/news/newslette…

The biggest winner of 'Liberation Day' is... drum roll... ...BITCOIN!!

«The stock market might be in a bursting bubble configuration» – Interview with Chief Strategist Dhaval Joshi fuw.ch/dhaval-joshi-t…

The Joshi rule (and the Sahm rule) recession indicators remain very well behaved when updated for the just-released (May) US jobs report... US recession NOT IMMINENT

Following the latest US initial jobless claims for the week ending May 30th, the high-frequency 'Joshi rule' signals that the US labor market is still a long way from recession...

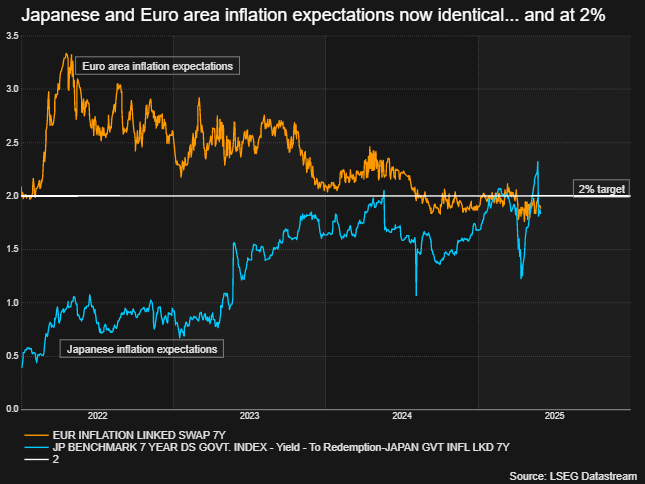

Japanese and Euro area inflation expectations are now IDENTICAL, and bang on the 2% target. And yet, the BoJ policy rate is at 0.5%, while the ECB is at 2.25%. Something's got to give. And if it's the BoJ, it ain't going to be pretty when all those yen carry trades unwind...

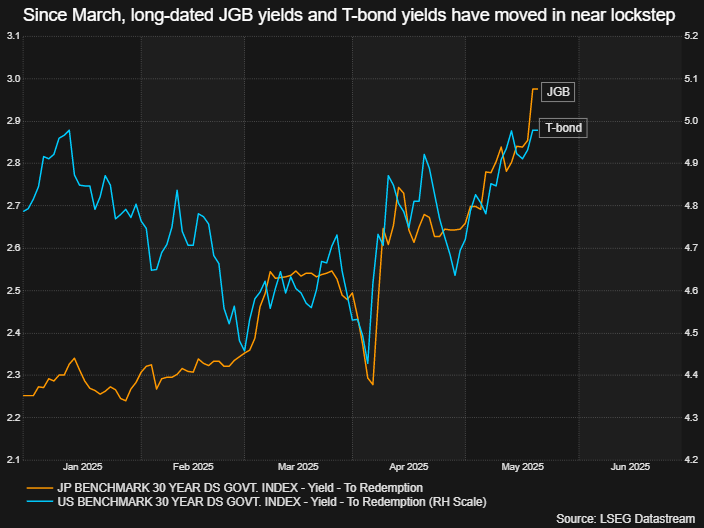

A lot of hype about the recent surge in the 30-year JGB yield. Yet since March, the JGB yield has moved in near-perfect lockstep with the US T-bond yield. So this is not about Japan specifically. This is a global phenomenon...

Despite the Trump chaos, restaurant bookings show that most major economies are holding up well. If consumers were tightening their belts - literally and metaphorically - this is where you'd see it first! No signs of a US recession here. (Opentable yoy change in bookings)

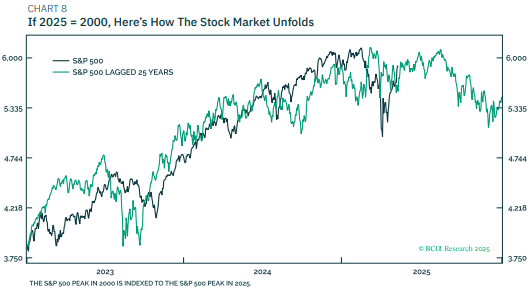

This year’s plunge in tech stocks followed by the recent strong counter-trend rally is eerily reminiscent of 2000. So what happens next if 2025 = 2000? The stock market rallies into the summer, but relapses in the second half of 2025 as the tech bubble resumes its deflation...