Felix Vezina-Poirier

@felixavp

Cross-Asset/Global macro strategist @bcaresearch

Steepeners still have room to run. Fed caution on inflation is keeping front-end yields elevated despite weakening labor data, while the long end is pressured by term premium and outflows.

Rising political pressure on the Fed risks de-anchoring long-term inflation expectations. A dovish, politically driven nominee could trigger a bear steepener. 5y5y CPI swaps are drifting away from fundamentals, increasingly reflecting risks to Fed credibility.

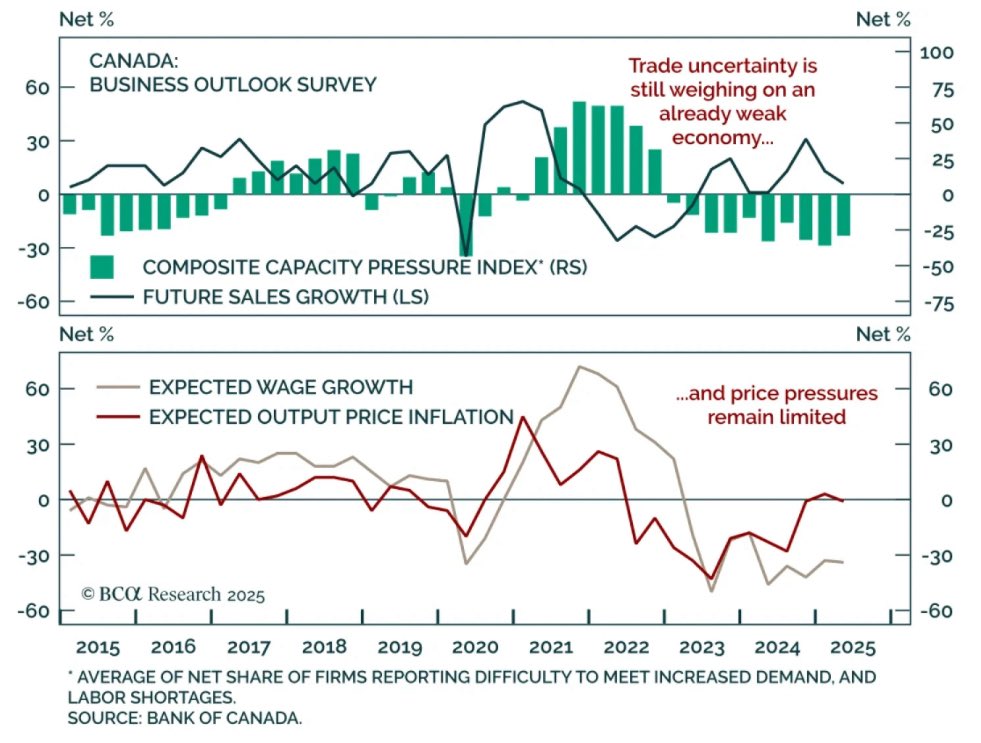

🇨🇦 BOS showed weak sentiment with subdued hiring/investment plans, and contained inflation pressures, reinforcing the case for deeper BoC cuts. With firm CAD and rising yields tightening FCIs, we stay overweight CGBs. A CAD 5s10s steepener is a clean way to position.

Firing Chairman Powell will just make his successor's job harder. They will be perceived to be taking orders from the WH and likely to get more pushback within the FOMC when laying down the case for easing.

NEW: Trump asked a group of lawmakers if he should fire Jerome Powell – and people in room voiced approval, sources told @CBSNews. Several said Trump indicated he will do it. Trump has been socializing the possibility of a for-cause firing, but White House has not yet formally…

🇨🇦 strong jobs print doesn’t derail BoC easing. Gains were part-time, wages cooled, and labor data is noisy. With tighter conditions and limited cuts priced, CGBs remain attractive. A CAD 5s10s steepener is a clean way to position.

Challenging small biz dynamics confirm growth risks. Firms that front ran tariffs now face excess inventories amid weak sales. The stagflationary tone in NFIB supports a defensive stance. With macro subdued and valuations stretched, we stay modestly underweight risk assets.

Stronger CAD and tighter financial conditions means more BoC cuts are needed. With yields rising alongside USTs, CGBs look attractive. A CAD 5s10s steepener offers a clean way to position for domestic easing while staying insulated from global fiscal pressures.

Trump’s renewed attacks on Powell raise the risk of an early Fed nomination. An early, dovish pick would create rates volatility by injecting conflicting signals into the policy outlook. Dual messaging would muddy the waters. The White House may want loyalty, but markets (and…

🧩 “The optimal market reaction to any Fed chair nomination may be none at all.” Our Daily Insights Chief Strategist @felixavp was quoted in @Reuters on what to watch as the Fed chair decision approaches. His view: 📉 A muted response, or a drop in long-term yields, would…

European assets face near-term headwinds: tighter financial conditions, deflation risks, and geopolitics. Strong data lifted EUR and yields YTD, but that strength now sows the seeds of weaker growth. Tactically fade EUR/USD. Longer-term, buy Europe on dips.

If you were to look at only returns during the US session this year, EUR/USD is flat YTD, roughly tracking relative rate differentials. But foreigners have cared little about fundamentals, they just want to GTFO of the dollar.

🧩 “The optimal market reaction to any Fed chair nomination may be none at all.” Our Daily Insights Chief Strategist @felixavp was quoted in @Reuters on what to watch as the Fed chair decision approaches. His view: 📉 A muted response, or a drop in long-term yields, would…

A falling dollar usually eases financial conditions, but not this time. Sticky yields and USD exodus/diversification mean no real impulse to growth, while data surprises turn negative. Risk assets have decoupled from fundamentals. We recommend selling into strength. @bcaresearch

📈 The S&P 500 has erased its 2025 losses—but is the rally built to last? Our Daily Insights Strategist @felixavp was quoted in @FT, urging caution: ⚠️ Relief from policy-inflicted stress may be lifting markets temporarily, but it doesn’t strengthen the real economy or reverse…

A very busy week for the econ calendar. Thursday will be key with the first hard data on consumer spending after collapsing confidence. But policy has driven markets, not econ data itself. Even a weak retail sales print could be overlooked by markets as US-China talks lift trade…

This week's focus will be FOMC on Wed. Short-term inflation expectations have not crested yet & hard data remains resilient even if soft data is in free fall. The Fed is comfortable staying on the sidelines for now. Risk assets are at a pivotal point with SPX back to Liberation…

Friday's US job report will be the first April data release indicating whether survey/soft data weakness is spreading to hard data. Next up will be retail sales/IP on May 15, and then durable goods on May 27. Markets have reacted more to hard data deterioration than new lows in…

The US is seeing higher inflationary pressures than the RoW, but data for April so far suggests the trade shock is different than the COVID shock. ...But watch supply chains, as slower delivery times would make trade-driven inflation much stickier. The "good news": Labor…