Young Saylor

@YoungSaylor21

In Saylor we trust. Not affiliated with Saylor. NFA.

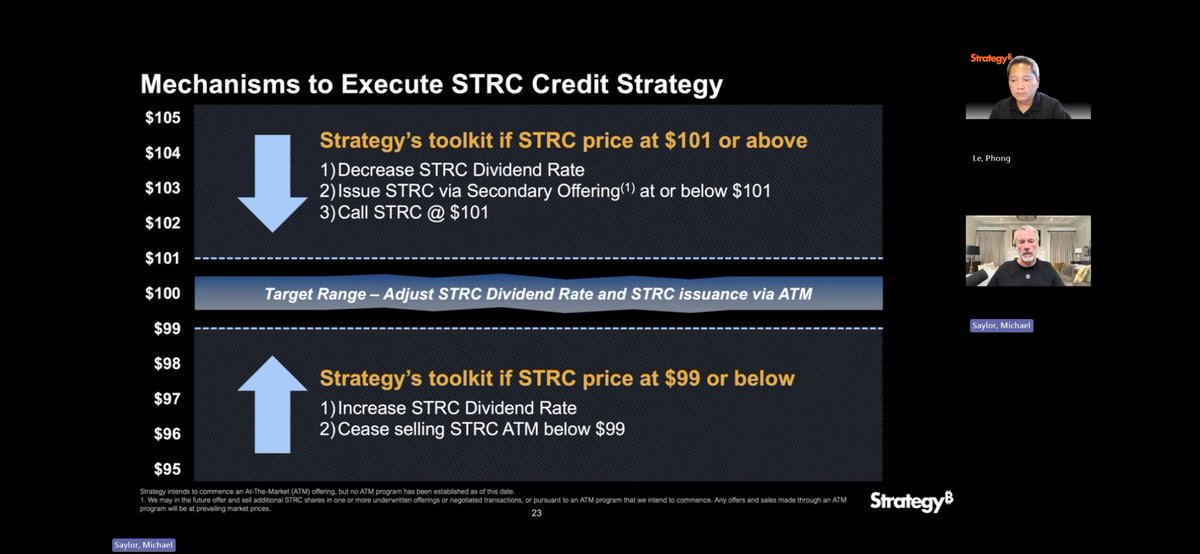

Morons: ATM doesn't affect price Saylor: If price is too low, I'm stopping the ATM

Does anyone actually understand the ATM strategy? @PunterJeff @hillery_dan

What are your thoughts? I was hoping a little more of $STRF $STRD $STRK.

It varies from 2-7% and if it didn't have an impact on mNAV, clearly he'd do 20-70% instead. ATM + deleveraging = mNAV compression If anyone has a better theory on why it has underperformed IBIT since $21B plan, let's hear it.

$MSTR “Saylor should let the mNAV run” Grossly over estimates @Strategy’s ability to impact the stock by turning on or off the ATM. The stock trades billions of dollars everyday, of which, about 98% is not the ATM. I choose to focus on the ~98%.

Let's say a company dumps their entire multi billion dollar ATM in a single day. mNAV would compress like no other, and ppl like Jesse will still be hand waving about "sentiment." Blaming sentiment is cope for a poor treasury strategy.

Do you not realize that sentiment is the primary driver of that current estimation, rather than fundamentals and track record?

You cannot run a 10 year strategy if your shareholders bail in between

Just remember when you whine about the ATM, that @saylor has clearly stated he is running a 10 year strategy.

The most important KPIs for a BTCTC: 1. Share price 2. mNAV expansion 3. Everything else

.@grok what % of the fixed income market can buy non rated (S&P/Moody's/Fitch) instruments?

I think Dan will be the only thoughtful member of @MSTRTrueNorth on this topic, while everyone else brushes it off. I also suspect most TN members have <20% net worth in $MSTR so are incentivized to support Saylor at any cost for clout rather than engage in debate.

If you want the market to place the appropriate multiple on Strategy’s preferred treasury operations, One must be willing to allow the price of the common security rise to meet the price of the marginal SHAREHOLDER who is willing to sell, not the issuing corporation determining…

.@Saylor goes on dozens of podcasts a year, and not a single one asks him the details of his strategy. We don't want to hear him talk about how he got into bitcoin for the 100th time. We want to hear him talk about the exact mechanics of his treasury strategy.

We should all ask @saylor to explain this slide in detail on the next EPS call, as it's still extremely vague and difficult to reconcile with weekly ATM updates: 1. If you're seeking to drive up mNAV, why are you selling common shares at lower and lower mNAVs? 2. What exact…

We should all ask @saylor to explain this slide in detail on the next EPS call, as it's still extremely vague and difficult to reconcile with weekly ATM updates: 1. If you're seeking to drive up mNAV, why are you selling common shares at lower and lower mNAVs? 2. What exact…

Strategy bought 6,220 ₿ for $739.8M at $118,940 per ₿ last week, primarily funded by $MSTR ATM sales ($736.4M), big drop in preferred ATM sales ($STRK $0.7M, $STRF $0.2M, $STRD $3M), Strategy now up to 607,770 ₿, has acquired 161,370 ₿ in 2025

How to tell if somebody has zero clue about BTCTCs: "Acquire cash flowing businesses" Could not get past 20 seconds

I sat down with @WClementeIII and @0xbenharvey to discuss bitcoin treasury companies, including premiums, capital sources, debt levels, and bitcoin-per-share growth. Enjoy! TIMESTAMPS: 0:00 - Intro 1:12 - ‘Bitcoin treasuries uncovered’ takeaways 8:06 - Strategy’s bitcoin per…

The next repricing will be violent. It will make Mar '24 and Oct/Nov '24 look like blips.

15x P/E multiple on BTC $ Gain = 4x mMAV this cycle 30x P/E multiple on BTC $ Gain = 8x mNAV next cycle

15x P/E multiple on BTC $ Gain = 4x mMAV this cycle 30x P/E multiple on BTC $ Gain = 8x mNAV next cycle

The reality is $STRC's market cap will outpace $MSTY's AUM in a year and 10x in four years

People are saying $STRC is a $MSTY killer. But it isn't. I would like it to be. It would be awesome to see MSTY's AUM flow into STRC and fuel BTC buys. But that's not what will actually happen. The reality is that there is very little overlap between the types of buyers.

It only took him a few hours!! $STRC LFG!!!!

Most successful convertibles AND preferreds this century aren't enough for Chanos 🤡 @saylor looking at this drawing up another billion dollar preferred offering

If the chart of your investors pulling money of out your fund looks like this, does that make you a snake oil salesman? 🤔 @grok and @gork what are your thoughts?

We have been told lots of things…

Most successful convertibles AND preferreds this century aren't enough for Chanos 🤡 @saylor looking at this drawing up another billion dollar preferred offering

We have been told lots of things…

Is Saylor A/B testing here with 0 common ATM in June and billions in July?

Strategy bought 6,220 ₿ for $739.8M at $118,940 per ₿ last week, primarily funded by $MSTR ATM sales ($736.4M), big drop in preferred ATM sales ($STRK $0.7M, $STRF $0.2M, $STRD $3M), Strategy now up to 607,770 ₿, has acquired 161,370 ₿ in 2025

If $MSTR hammers the common ATM based on volume, what prevents shorts from creating artificial volume to drive shares down? Is this what happened on Friday?