Brian Brookshire (Bitcoin Overflow)

@btc_overflow

Advocate for bitcoin adoption. Bitcoin Treasuries. $MSTR. $MTPLF. Entrepreneur. Investor. @VibeCapitalMgmt. @Stanford alum. NFA.

Look, the strategy is really simple. Keep DCA-ing into #Bitcoin. That's it. Seriously, you can stop reading here.

Today, in fact, might have been BTCTC capitulation day. We'll see what the coming days bring, but for now $MTPLF is orange again in the land of the rising sun on the dawn of a new day.

Feels like BTCTC capitulation week. $SWC led with a possible bottom last week. Perhaps the rest of the sector finds a bottom this week. Consolidate for a few weeks, start grinding back up.

Adam Back tried to buy so much $MTPLF today that his orders didn't all fill. If you capitulated Metaplanet shares today, say hello to their new owner.

buying more tomorrow morning too, didn't all fill today. and if it falls i'm gonna buy another tranche. mispriced level.

$NAKA has $700M in escrow that unlocks following the expected closing of its merger on Aug. 11. Probably nothing.

GM! KindlyMD and Nakamoto are pleased to announce that we have filed the definitive information statement with the SEC, following the conclusion of SEC review. We expect the transaction to close Aug. 11 at the earliest (1/3)

The @UTXOmgmt / @nakamoto premium on BTCTCs just went way up. The capital rotation in the sector has made people realize there is only room for one major player in each non-US market. Companies without industry names behind them will have a much harder time securing dominance.

The long-term capital and credit market arbitrages that make BTCTCs possible aren't going away anytime soon. Bitcoinization is a multi-decade project. The ability to simply stay the course with conviction will be a large factor in separating winners from also-rans.

Almost one year ago, I shared the post below. At the time, we held just 246 BTC and the stock had dropped 70% in six trading days, from ¥300 to ¥89. Today, we hold 66 times more Bitcoin. Internally, we are smarter, stronger, and more efficient than ever. We are still here,…

I'm far more bullish on $STRC than any of Strategy's other preferred stocks to date. Large scale institutional adoption of STRF/K/D is not really here yet. STRC, however, fills a more pressing need today that complements demand for $MSTR--a place to park short-term cash.

Excellent visual depiction of my point from earlier. Looks like $MTPLF is on its own 5-6 month cycles.

Yes!!

Hold up. 50 million H100s. 🤔 H💯DL.

"yeah so after this we're doing 50 million h100s, lock in"

The current $MTPLF environment is very much like 4 months ago. And the 4 months before that. And the 4 months before that. Almost like it's cyclic.

$MTPLF MSW program functioning as intended. No selling into weakness. mNAV compressing. Weak hands rotating to strong hands. We've been here before.

Voluntary Disclosure Notice: No stock acquisition rights were exercised from Tuesday to Friday last week; exercise status remains unchanged since the previous disclosure. contents.xj-storage.jp/xcontents/3350…

Beautiful new analytics dashboard for H100 $HOGPF $GS9. Powered by @StrategyTracker.

Our analytics page is now live! Thanks to @strategytracker for the amazing work. 🔗 treasury.h100.group

Feels like BTCTC capitulation week. $SWC led with a possible bottom last week. Perhaps the rest of the sector finds a bottom this week. Consolidate for a few weeks, start grinding back up.

H100 $HOGPF's new $GS9 listing on the Frankfurt Stock Exchange will resolve access issues for many. Notably, the listing makes it available to IBKR users worldwide.

H100 Group AB has been approved for trading on the Frankfurt Stock Exchange (Open Market). Trading commenced today, 22 July 2025, under the ticker symbol $GS9. This marks an important milestone as we continue expanding our global presence.

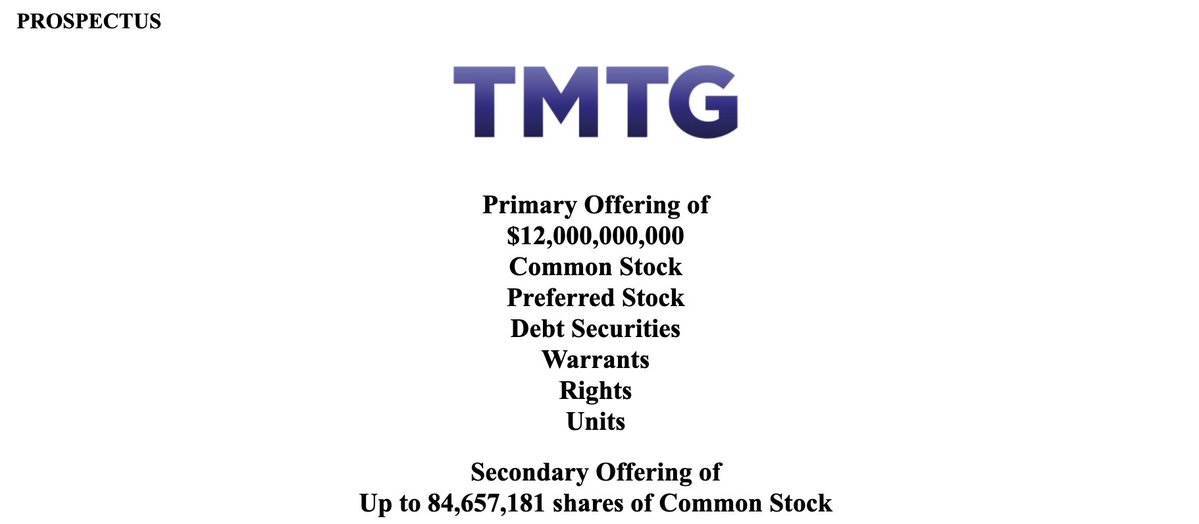

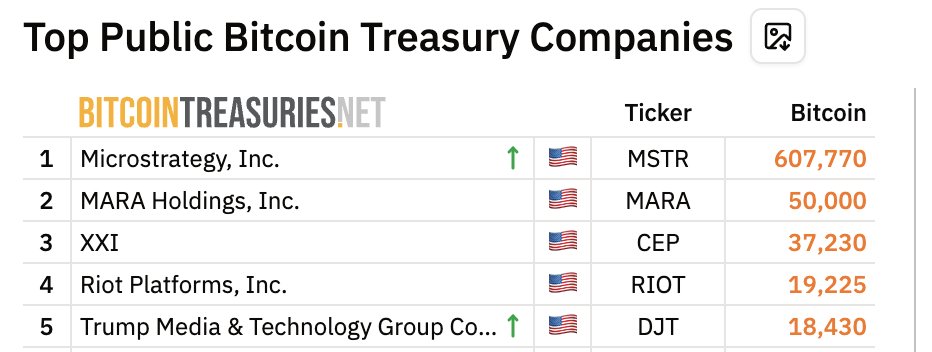

I have yet to see an official disclosure of the actual number of BTC purchased, but $DJT is now reportedly the 5th largest bitcoin holder after deploying $2B today. Unclear how much of DJT's $12B prospectus remains specifically for use on BTC purchases. But, likely more to come.

People have often described $STRF and $STRD as the new money market accounts, but really their volatility makes them poorly suited to short-term cash holdings. Provided Strategy can stabilize the price as well as advertised, $STRC is much better designed for this purpose.

What if you could buy shares of $ASST with bitcoin, but without paying capital gains tax on the bitcoin gains to do it? Strive has found a clever way to do this with a Section 351 exchange. (Not financial or tax advice)

Strive is now accepting interest in an exchange of Bitcoin for $ASST shares from accredited investors via a one-time Internal Revenue Code Section 351 exchange DEADLINE: 2PM ET on 8/1/25. 11 days to quantify FOMO What does this mean & how do I participate? See 🧵 below

People are saying $STRC is a $MSTY killer. But it isn't. I would like it to be. It would be awesome to see MSTY's AUM flow into STRC and fuel BTC buys. But that's not what will actually happen. The reality is that there is very little overlap between the types of buyers.

New Strategy preferred stock! Saylor is tackling the bond market segment by segment. $STRC will be a variable rate pref tied to SOFR.

Strategy is offering $STRC (“Stretch”), a new Perpetual Preferred Stock via IPO, to select investors. $MSTR

👀👀

'Buy Bitcoin' search interest going vertical.