Jesse Myers (Croesus 🔴)

@Croesus_BTC

Implementing Bitcoin treasury strategy for @UTXOmgmt portfolio companies @MoonIncHK and @smarterwebuk past: Stanford MBA, Bain & Co

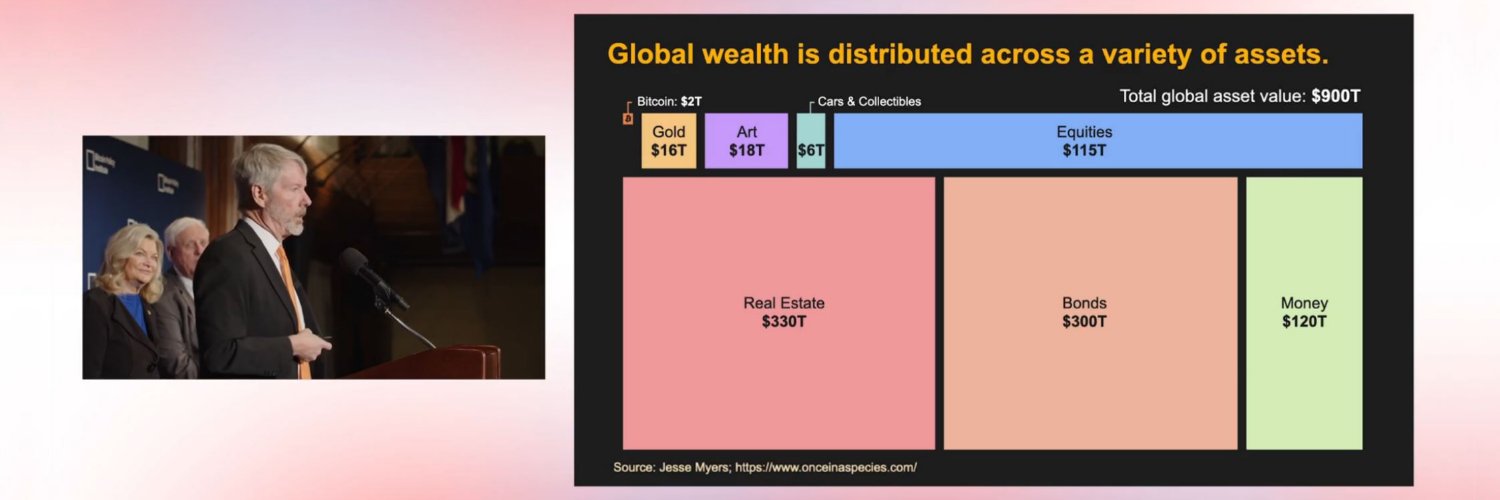

Global asset landscape - 2025 update! In 2023, there was $900T of global wealth. Today, that number has grown to $1000T. THREAD on the key insights of this analysis...

Looking back at each week for The Smarter Web Company (#SWC $TSWCF $3M8.F) is something that is always fun. It is also quite interesting to compare it to the share price. In my opinion that is the only negative metric this week, as the [fiat] share price is down 29.3%. In…

The Acropolis team had some very sharp questions about BTC treasury companies and how I see this all playing out Check out this in-depth discussion about @smarterwebuk and BTCTCs in general!

The Next 21 Years of Bitcoin Treasuries with Jesse Myers of UTXO Management — New Foundations E45

We will add P/BYD to the @smarterwebuk analytics dash at our next update. But in the meantime, SWC holders are already running the numbers. Look at these values! (P/BYD is analogous to a P/E ratio, but for a BTC treasury company)

Updated (and corrected) 30d chart:

.@smarterwebuk started July with 543 BTC. Meaning, we've added +235% more BTC in July alone What will we do the rest of the year?? @asjwebley #SWC $TSWCF $3M8.F

The Smarter Web Company (#SWC $TSWCF $3M8.F) RNS Announcement: Bitcoin Purchase. Purchase of additional Bitcoin as part of "The 10 Year Plan" which includes an ongoing treasury policy of acquiring Bitcoin. Please read the RNS on our website: investors.smarterwebcompany.co.uk/news/

To honour Jesse's @Croesus_BTC work, I've decided to calculate SWC's P/BYD ratio after today's Bitcoin buy. So, using the formula with mNAV at 3.67 and the 30 day BTC yield at 189%... y = ln(3.67) / [12 × ln(2.89)] ≈ 1.299 / 12.732 ≈ 0.102. P/BYD = 0.102 This is roughly 36…

Here are the two most compelling charts that I'm aware of in global finance. First, the rate of #Bitcoin accumulation by notable BTC Treasury Companies. One sticks out. Second, the mNAV chart for that standout. mNAV has now compressed to ~3.4x My thinking here... With…

The comparative ease of orange pilling my buddy who is a sailboat captain directly led to me writing "Why The Yuppie Elite Dismiss Bitcoin" Pretty cool to look back on 5 years later!

Five years ago today @Croesus_BTC nudged me into taking a closer look at #Bitcoin. It is indeed “stupid big.” 🤙

Bitcoin is just 0.2% of global asset value. Do you think it will stop here?

.@saylor is going to offer cash holders better interest rates than money market funds... all powered by #Bitcoin

Strategy is offering $STRC (“Stretch”), a new Perpetual Preferred Stock via IPO, to select investors. $MSTR

There's only 5.3% of #Bitcoin left to be mined. Meanwhile, ~0.1% of the world has adopted BTC as a primary treasury asset / savings technology. 0.1% of the world fighting over 94.7% of supply got us to $120k/BTC. How high will 99.9% fighting over the remaining 5.3% take us?

Are you viewing Twitter right now in light mode or dark mode?

BTC Treasuries Community Ranking – July 19, 2025 Link to spreadsheet: docs.google.com/spreadsheets/d…

"Chancellor on the brink of raiding #Bitcoin piggy bank to relieve budget failures." This is why G7 governments will be among the last entities to meaningfully adopt Bitcoin as a treasury asset. Even if they hold some, they can't resist "taking profit" Well-run BTCTCs are the…

My Big 3 Treasuries Right now, these are my highest conviction bets, with the best risk vs. reward. I call them my Big 3: 🇺🇸 Strategy 🇯🇵 Metaplanet 🇬🇧 Smarter Web These are the bets I am most comfortable in for the long term. I also see them as „bear proof“. All my other…

The Smarter Web Company (#SWC $TSWCF $3M8.F) RNS Announcement: Result Of Accelerated Bookbuild Raising in Total Approx. £17.5 Million. With a high level of demand the Bookbuild has raised £17,543,942, through the issue of a total of 5,947,099 new ordinary shares at £2.95 per…

Here’s the episode with @Croesus_BTC, hot off the press. We cover… - the long decline of FIAT - how the elite are warming to BTC - why volatility doesn’t scare BTCTC’s - the cultural shift BTC is triggering. Also available on major podcast channels. youtu.be/jzfpQKPWCos

To get my news on Bitcoin treasury companies, I've started scrolling through @BitcoinPierre profile. The latest and most interesting stuff is all there, would recommend.

"we've been calling it 'p-bid' in math lab" ... it's kinda like a code that says "I'm a quant" and you know how girls love quants!

The P/E ratio for Bitcoin treasury companies: P/BYD Price / Bitcoin Yield Delivered (we've been calling it "p-bid") represents a valuable new metric for #Bitcoin treasury company analysis. THREAD on how it works & what it reveals about traditional equities...

🔥THE ULTIMATE WAY TO VALUE BITCOIN TREASURY COMPANIES🔥 This is the P/BYD RATIO developed by Bitcoin Wizard Jesse Myers (@Croesus_BTC). Goodbye P/E ratios and other archaic valuation methods! If you've still value Bitcoin treasury companies by price-to-earnings,…