New Low Observer

@NewLowObserver

Dow Theory, Price, & Research Specialists. We're touching the financial & economic third rail, so you don't have to. 皆さんがそうしなくてもいいように、私たちは金融と経済の第三レールに触れています。

March 1981: Squeeze on Home Buyers Only 3.2% qualify for a mortgage. Why? The 60% increase in annual income needed. 2025: "In other words, one needs to earn 82% more to buy the median-priced home than to rent the typical apartment." Wash. Rinse. Repeat.

Housing affordability is getting worse: The annual income required to afford a typical home in the US rose to a whopping $116,600 in February. This metric has nearly DOUBLED over the last 5 years. By comparison, the annual income required to rent a typical apartment in the US…

Winter 2008: Boomer Housing Bubble Crash There is some hope for the housing bears, boomer home selling might be on the horizon. We just don't know when exactly. "...for 30 states, we do not expect the number of buyers to fall below the number of sellers until well after 2025."

We remember when boomers were gonna crash home prices (1988) and making the mistake of dipping (2005)..."to pay off debt, make home improvements, buy homes or take out second home loans." Maybe soon, but so far, the wait continues. x.com/NewLowObserver…

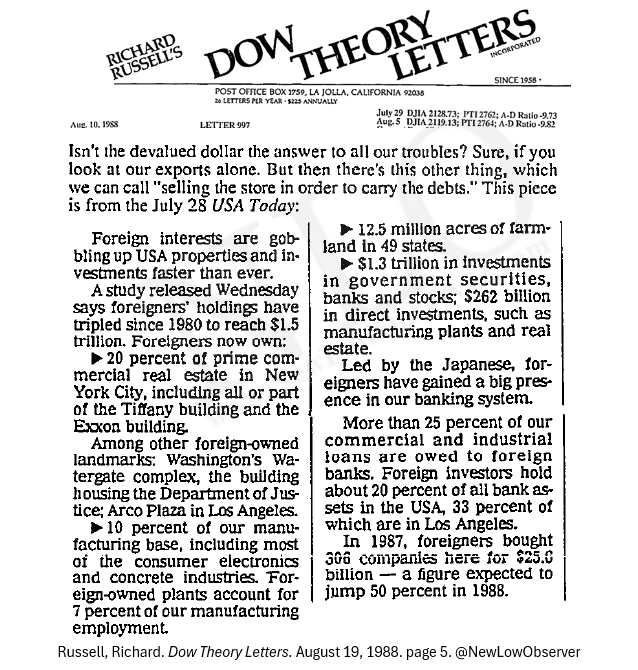

2025: "China is eating our lunch." 1988: "The Japanese were copycats...no longer. Today Japan is challenging us..."

In order for us to keep our lead in AI we must build up our electricity grid. It takes a lot of energy to run AI. China is eating our lunch.

August 1988: Foreigners Taking Over "Foreign interests are gobbling up USA properties and investments faster than ever." "In 1987, foreigners bought 306 companies here...a figure expected to jump 50 percent in 1988."

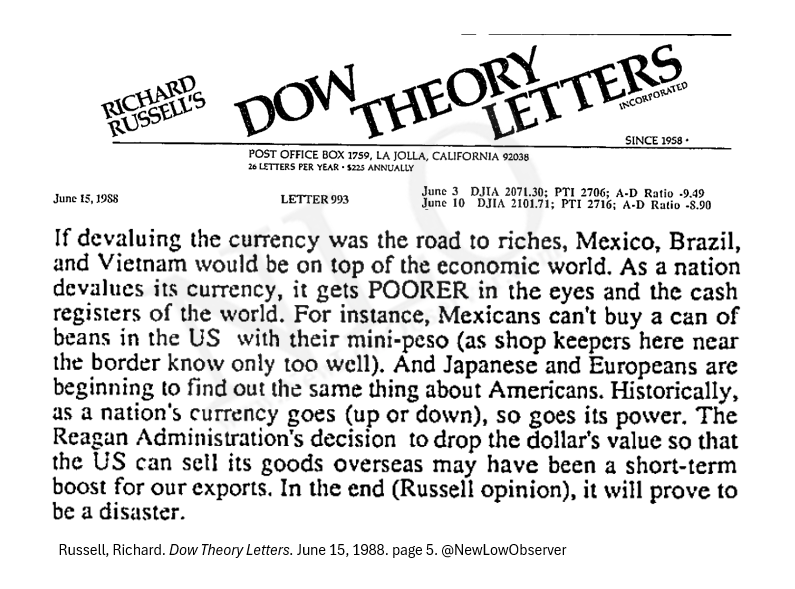

June 1988: Competitive Devaluation "If devaluing the currency was the road to riches, Mexico, Brazil, and Vietnam would be on top of the economic world."

Step 3: Become New Low Observers "The entry point is critical for future returns. Specifically, the stock should be close to its 12- month low at the time of purchase and, ideally, have fallen in price considerably in the preceding six months." #Yartseva

Here's what else mattered in the enhanced model: Size factor (small caps confirmed) Profitability factor (confirmed) Aggressive investment (but only when profitability supports it) Entry price timing (52-week lows outperform) But FCF yield ruled them all.

Step 2: Start Fishing in the bigger pool "He [Phelps] suggested searching for small and relatively unknown companies..." More companies are in the lower priced stocks of "relatively unknown companies." You'll find high priced multibaggers, but fewers. #Yartseva

Small caps outperformed as expected. But here's the twist: when she looked at median returns instead of averages, the size effect weakened. Translation: Small cap alone isn't enough. You need other factors in combination.

Step 1: "464 companies that returned 10x+ from 2009 to 2024. That's a 16.6% annual return minimum." Don't start at the beginning of a bull market but at the middle of a bull market. This means start the analysis from 2016/2017. #Yartseva

Her study was published at Birmingham City University in February. Completely unnoticed by most investors. 464 companies that returned 10x+ from 2009 to 2024. That's a 16.6% annual return minimum. The goal? Find factors that actually predict outperformance.

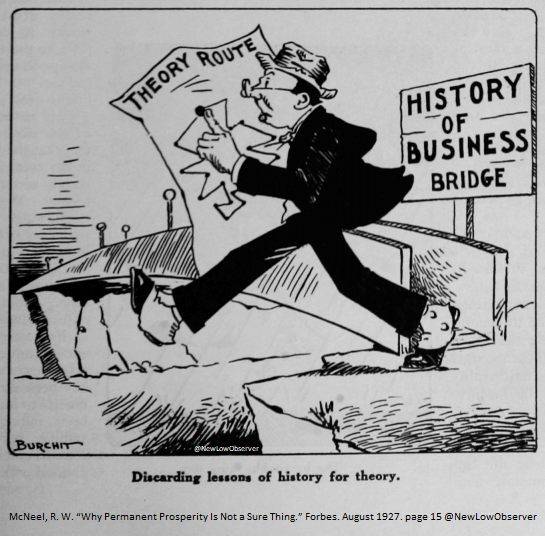

In accordance with #DowsTheory , we always like to look at where the cycle started before the Depression or Panic began. In this case, almost ironically, the decline of Hamilton and ascendency of Jackson helped to set the stage for the Panic that followed. A great start.

@NewLowObserver digging into The Panic of 1819 for my blog and was curious if you had any insights you’d like me to consider. New fan. Big fan of your work.

Panic of 1819: "Niles in particular made himself both the prophet and the historian of the depression." Get your hands on the Niles Register, if you can. We'll try on our end.

@NewLowObserver digging into The Panic of 1819 for my blog and was curious if you had any insights you’d like me to consider. New fan. Big fan of your work.

1965-1970: Output Per Manhour Japan, Netherlands, Sweden, Belgium, France, Switzerland, West Germany, Italy, United Kingdom, Canada, United States

March 1972: Strange-Request-of-the-Month Dept: "Under-Secretary Volcker ('Mr. I hate gold' himself)" "Standby devaluation power"

#DowsTheory "Repeat as many times as you need to in order to absorb the lesson: 'The stock market leads the economy, NOT the other way around.'"

The S&P 500 bottomed on 10/13/2022 and has rallied +30%. Today GDP is announced as +2.4%. Repeat as many times as you need to in order to absorb the lesson: “The stock market leads the economy, NOT the other way around” (typically by about–you guessed it-9 months) @sentimentrader

1920-1921: Rail Car Data From shortage to glut...classic pandemic action. @FreightAlley @RunningSignal

July 27, 2022: If China Stumbles, So Will the World? "...there is a chance that China's banking crisis isn't as much for a factor as it seems." Not really.

When confidence is down to such extremes, outside of China, then there is a chance that China's banking crisis isn't as much for a factor as it seems. Additionally, the 2008 banking crisis and bailouts didn't get confidence levels as low as today.

Gold and Commodities: "Since 1650, any time there has been a parting of the ways between gold and commodities they have ultimately come back together." Gold eventually got as low as $252 from a high of nearly $800.

1940-1951: Commodities and Stocks “For the past 25 years the commodity market and the stock market have moved almost exactly together ( source: Dow, Charles H. Review and Outlook. Wall Street Journal. February 21, 1901.)” #DowsTheory #DowsEconomicTheory

August 1972: 20 Largest Banks, ex-U.S. Only 6 Japanese banks made the list (30%). By 1988, 15 banks comprised the top 20 for the entire world (75%).

1988: World's largest banks Japan leading the pack

July 1970: America's Largest Landlords Remember when the largest life insurance companies got into the business of becoming landlords? The collapse and bailout was staggering.

1973-1979: REITs Share Price Index

1/2 1970: "Cabot, Cabot & Forbes, in fact, has quadrupled in size over the past four years. Says Mortimer B. Zuckerman, its chief financial officer: "For some real-estate developers the insurance companies' greed is a cultural shock; for others, like us, it is a boon.'" 1974:

July 1970: America's Largest Landlords Remember when the largest life insurance companies got into the business of becoming landlords? The collapse and bailout was staggering.