Jay Kaeppel

@jaykaeppel

Jay is Senior Market Analyst at http://www.Sentimentrader.com and author of Seasonal Stock Market Trends (Wiley). Trader, writer, instructor and former CTA.

Still holding gold and hoping for a breakout and continuation. That said, a failure to breakout would also be instructive (hence the trailing stop).

$GLD over 318 would mean a confirmed ascending triangle pattern, and thus much further upside potential for #gold. "The most bullish thing the market can do is go up."

Am still holding gold stocks and hoping for a continued rally. That said, I have also located the exit nearest me - you know, just in case...

A terrific long-term reminder of how the market really works (and of why my uneasy gut might need to just pipe down).

it's not easy to accept that our opinions get in the way of the reality that faces us, as investors... S&P 500 $SPX long-term ATR model... when volatility turns downwards, it's bullish for stocks, whether you're bearish or not...

I am not a fan of small-caps at the moment. BUT the status NEVER remains quo forever in the markets. So keeping an open mind.

Small caps are 20.5% cheaper than large caps on price-earnings ratio. The years that witnessed this discount are 1973, 1976, 1998, 2001 and 2020. Even investors who were early in 1973 and 1998 would have then witnessed two legendary small cap cycles: 1974-1981 and 1999-2018.

Not all tech stocks are created equal. XLK vs. RSPT: Large-cap vs. Equal-Weight XLK vs. PSCT: Large-cap vs. Small-cap For now, large-cap still rules the roost. @sentimentrader

Should we be surprised if the torrid advance in copper cools off? Probably not. @sentimentrader

My daily routine for monitoring market trends, sentiment, seasonal opportunities, strong stocks in strong sectors, and some favorite mechanical strategies. @sentimentrader tinyurl.com/yt6dzyy3

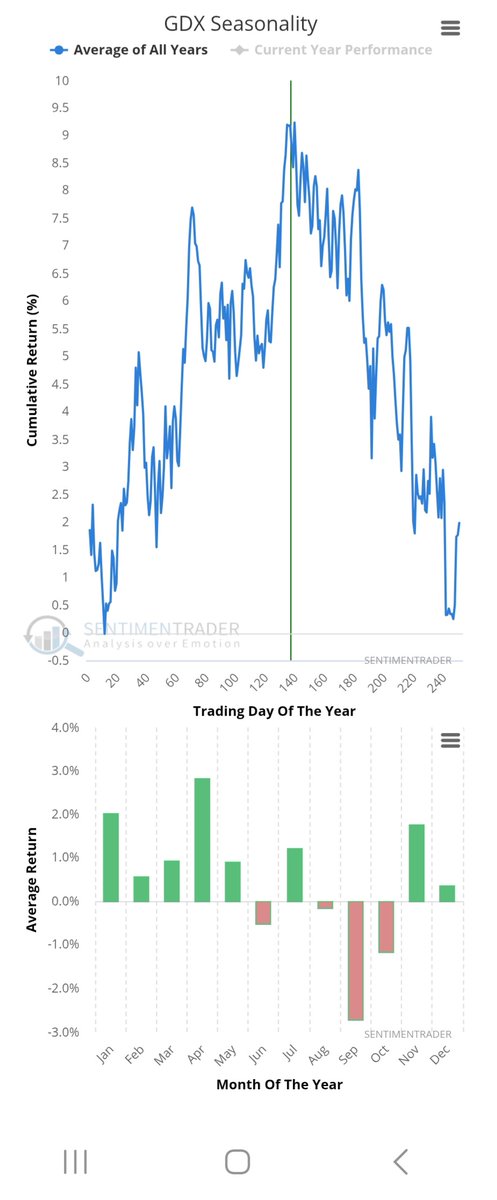

I posted a bearish seasonality chart for gold stocks yesterday. However, price AND seasonality MUST agree before I would turn bearish gold stocks. Price action is still strong, so still on board... for now.

$NEM +7% after a stellar Q2 report 📈

Anytime 90% of economists agree on anything, my Contrarian Meter gets so overcharged it just about bursts into flames.

NEARLY 90% ECONOMISTS, 89 OF 100, SAY THEY ARE CONCERNED ABOUT THE QUALITY OF OFFICIAL U.S. ECONOMIC DATA, INCLUDING 41 SAYING VERY CONCERNED

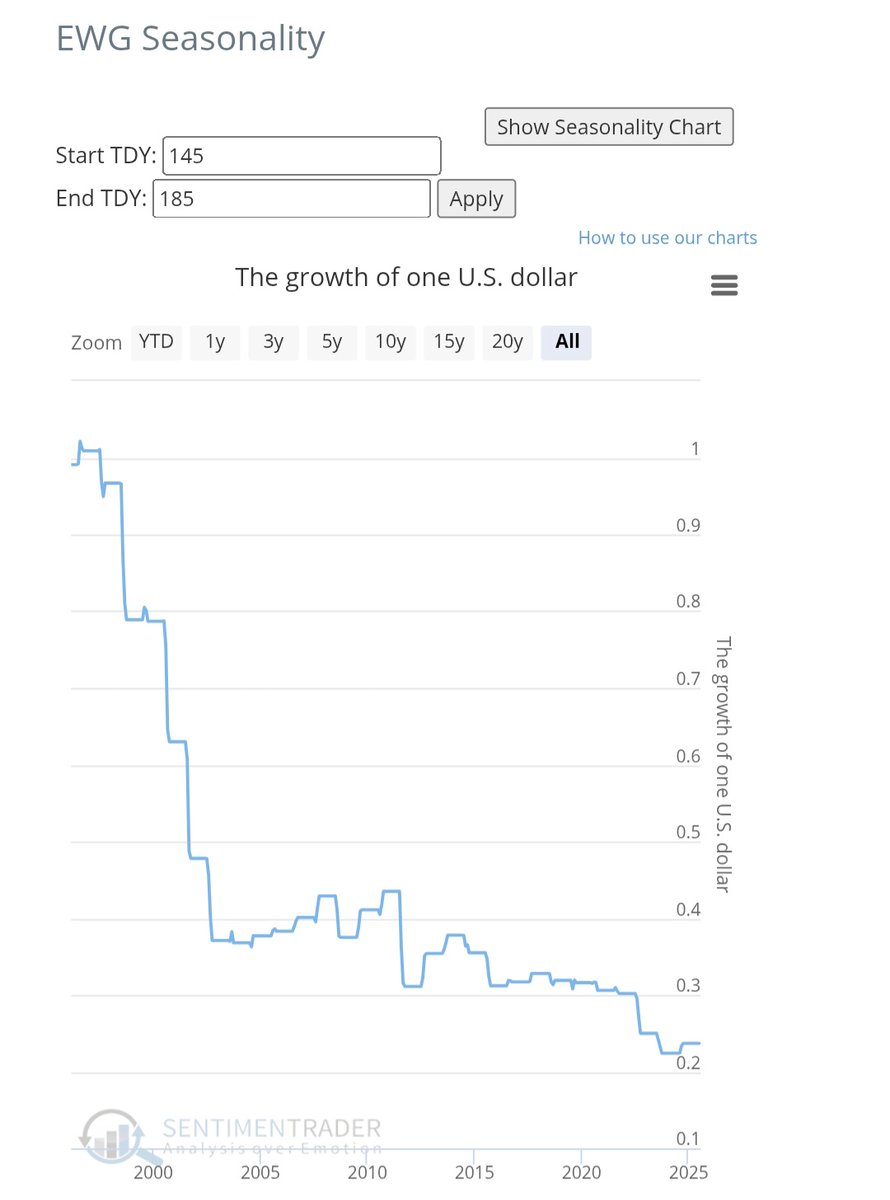

Thinking about buying German stocks? History suggests checking back later this fall. @sentimentrader

Well done. A whole lot to chew on in one post.

Paging John Murphy

It would also be instructive of they don't...

It would be great if these three could make new highs soon. $DIA $MAGS $XSD

No guarantees. But I am positioned for a breakout higher, with a stop-loss below the horizontal red line. The market will decide from here. Same as it ever was...

$IBIT - Nice Little Consolidation The Bitcoin Trust

On my watch list. Planning to buy an actual breakout. Until then, just an interested observer.

$KWEB Weekly. Tight!

In the immortal words of Ted Nugent "Dog, dog, dog eat dog." Granted "every dog has its day", but these have been horrible laggards. I do monitor these, but haven't owned them for along time.

$IWC vs. $IWM

How I use Sentimentrader.com (and you can too). tinyurl.com/yt6dzyy3

Another lesson in "The Benefits of Trend-Following."

17-year lows for equal weighted S&P 500 $RSP vs. cap-weighted $SPY...

My gut tells me that the stock market will consolidate in the months ahead. But a good, objective remimder here: Sometimes I wish my gut would keep it's big mouth shut!!

The S&P 500 just closed above the 20-day MA for 60 days in a row, the longest streak since '98. Going back 50 yrs, this has happened 4 other times. Up a yr later between 20% and 26%. Never lower 3 months later. It is what it is, yet another clue this bull market has legs.

Remember folks, it doesn't have to be rocket science!

ETF's are the easiest way to invest. 1. open a brokerage account 2. contribute consistently 3. buy your favorite ETF's no matter what the market is doing Here are my 5 favorite ETF's:

The good news: REITs ARE undervalued (IMO). The bad news: REITs are (primarily) sensitive to the economy and interest rates, neither of which is terrific at the moment. Bottom line: Value? Yes. Trend? No.

Investors Hate REITs 😳 Implied portfolio allocations to REIT ETFs are at all-time record lows. And there are headwinds + challenges facing the sector, but the time to take a closer look at any market/asset is when no one else is interested. Their time will come...