The Kobeissi Letter

@KobeissiLetter

Official X account for The Kobeissi Letter, an industry leading commentary on the global capital markets. Email us: [email protected]

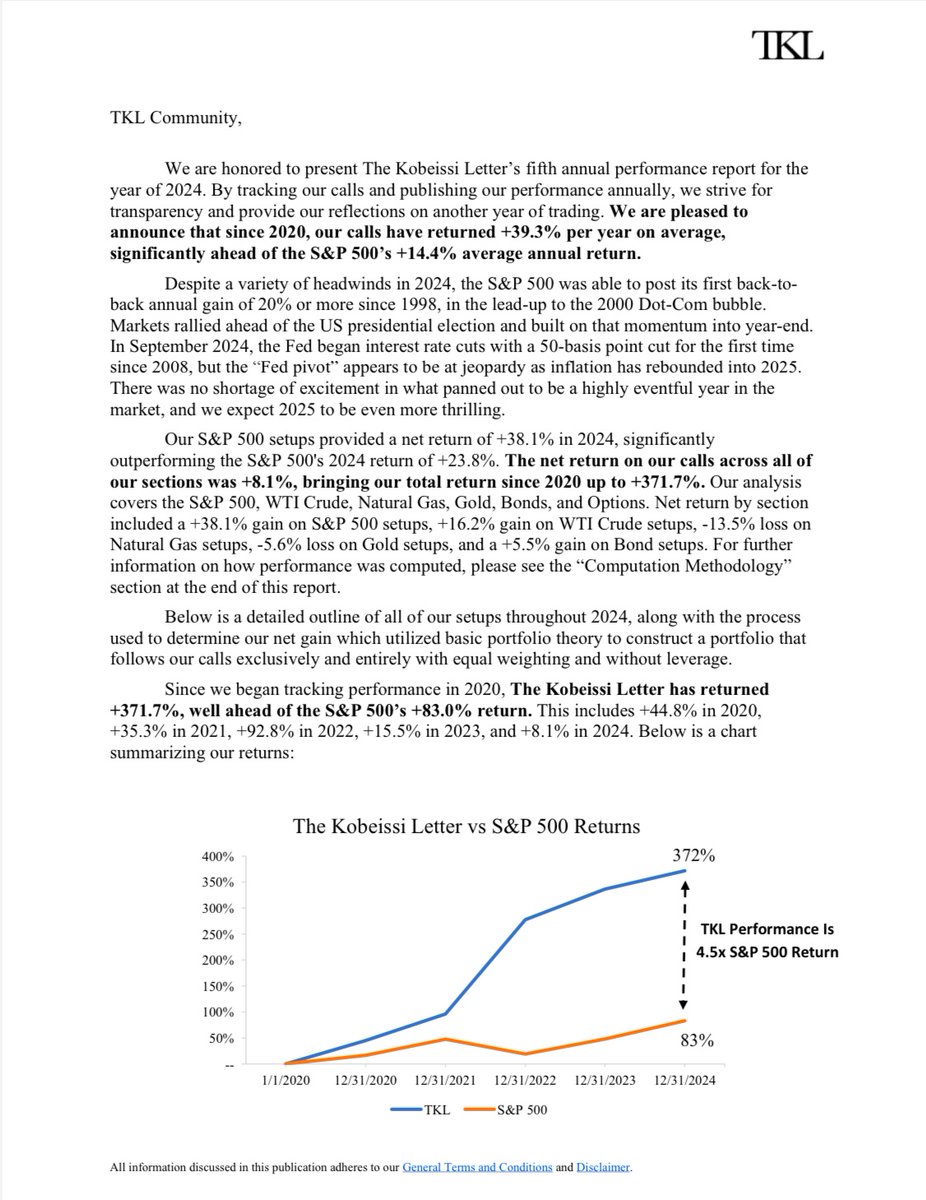

ANNOUNCEMENT: We are excited to present The Kobeissi Letter’s 2024 performance report. Our setups have returned +371.7% since 2020, significantly outperforming the S&P 500’s +83.0% return over the same period. Our S&P 500 setups provided a net return of +38.1% in 2024, also…

BREAKING: The Conference Board Leading Economic Index (LEI) declined -4.0% YoY in June, posting its 38th decline out of the last 40 months. As a result, the LEI dropped by -2.8% in the first half of 2025, a much faster pace than the –1.3% decline in the second half of 2024.…

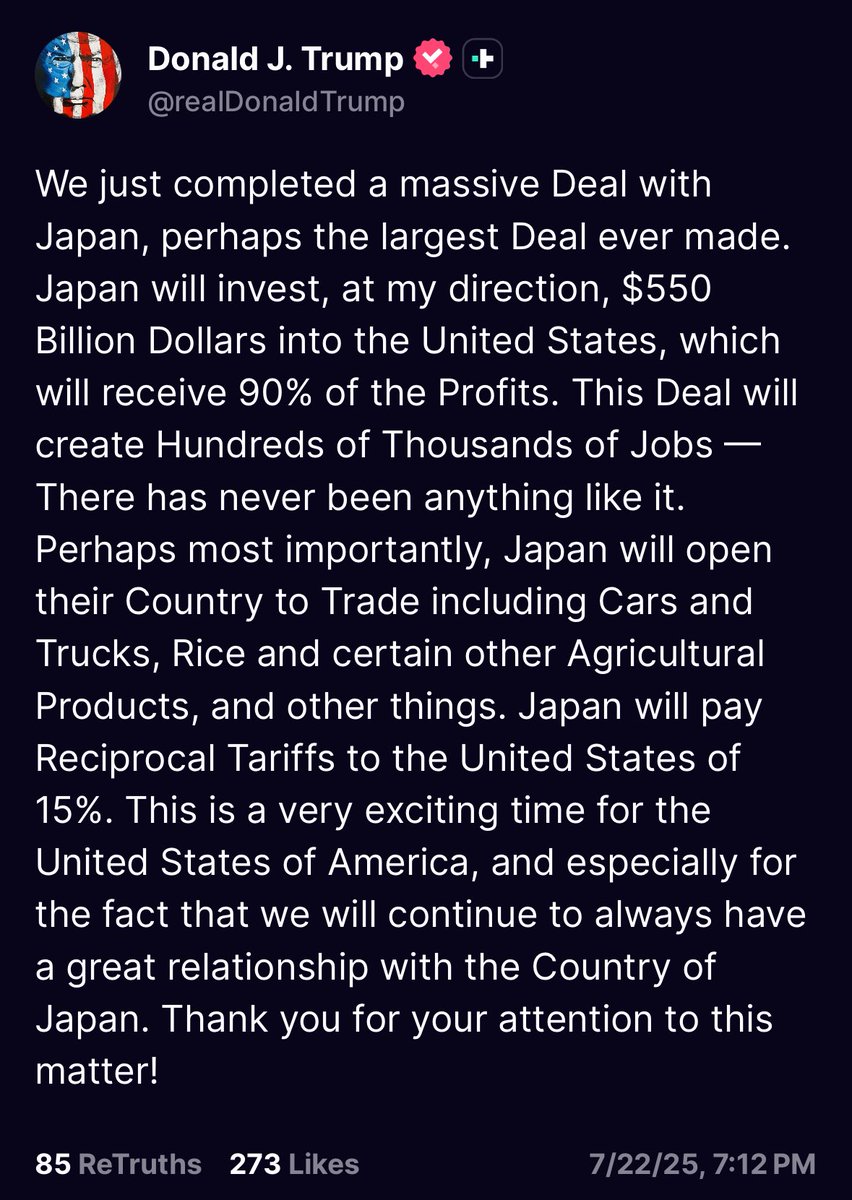

BREAKING: President Trump announces a trade deal with Japan which includes a $550 billion investment in the US and a 15% “reciprocal tariff” on Japanese goods imported to the US.

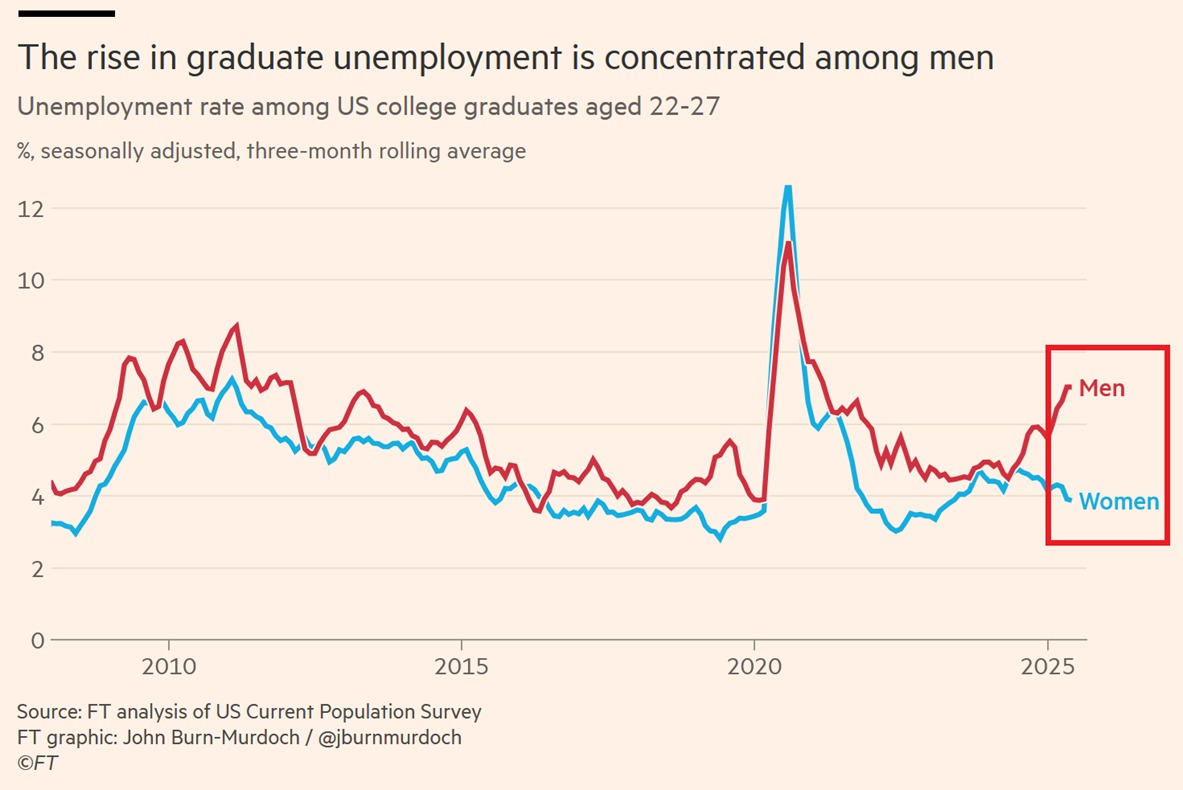

Unemployment is surging for recent grads: The unemployment rate for recent male graduates has jumped more than 2 percentage points over the last 12 months, to 7%, the highest since 2020. Outside the pandemic, this is the highest level in 13 years. By comparison, the…

Tech stocks ARE the stock market: Technology stocks no reflect a record 46% of the S&P 500. This percentage has DOUBLED over the last 8 years. To put this into perspective, this percentage was ~33% at the 2000 Dot-Com Bubble peak. The top 5 stocks alone now reflect a record…

There are currently fake reports circulating that Fed Chair Powell has "officially resigned" from dozen of "sources" Meanwhile, the market didn't move a single percent. Markets cut through the noise.

This is historic: The Nasdaq 100 has gone 60 consecutive trading days closing above its 20-day moving average, the longest streak since the 2000 Dot-Com Bubble. The previous record lasted for 77 straight sessions and ended in February 1999. During the current streak, the…

There are currently reports circulating that Fed Chair Powell has "officially resigned." These reports are FAKE. Fed Chair Powell has yet to even discuss a possible resignation. And, in his comments this morning, Powell did NOT discuss any topics pertaining to a resignation.

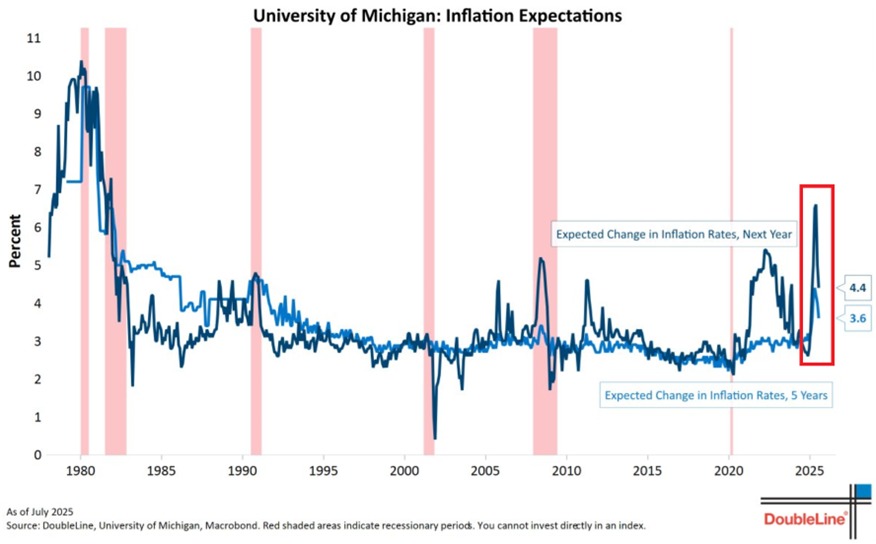

Americans’ inflation expectations are changing: US consumers’ 1-year inflation expectations fell to 4.4% in July, the lowest since February 2025. Over the last 2 months, expectations have declined 2.2 percentage points, marking one of the largest 2-month drops in history. This…

Rate cuts are coming: Prediction markets now see a 40% chance of 2 interest rate cuts in 2025, for a total of 50 bps. Furthermore, there is even a 13% chance of 3 interest rate cuts this year, per Kalshi. The base case currently shows rate cuts beginning in September. Next…

JUST IN: Goldman Sachs expects Fed to begin rate cuts in September Our traders forecast: • 20% chance of 0 cuts • 23% chance of 1 cut • 40% chance of 2 cuts • 13% chance of 3 cuts • 6% chance of 4 cuts • 2% chance of 5 cuts

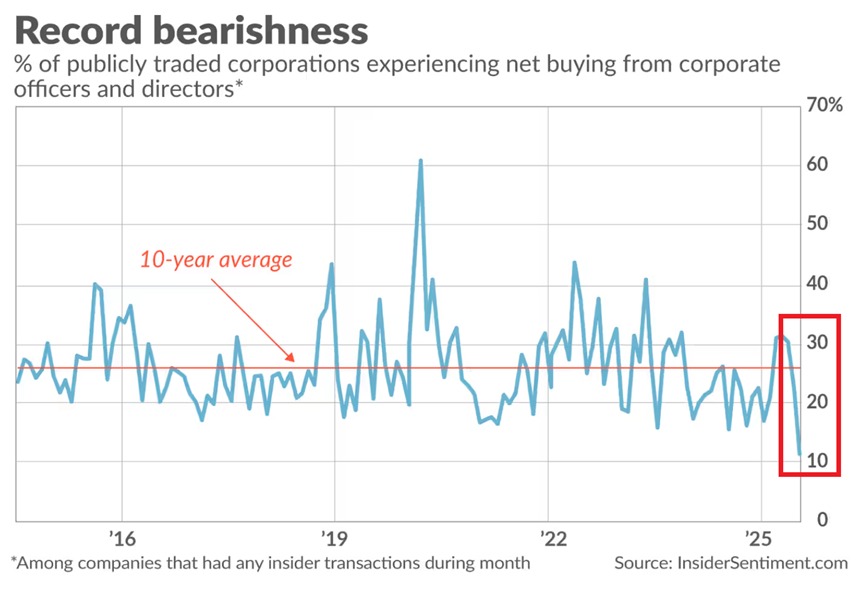

Insiders have rarely been this bearish before: Only 11.1% of companies with insider activity are seeing more buying than selling by corporate officers and directors, the lowest share on record. Over the last decade, this figure has never fallen below 15%. This means insiders…

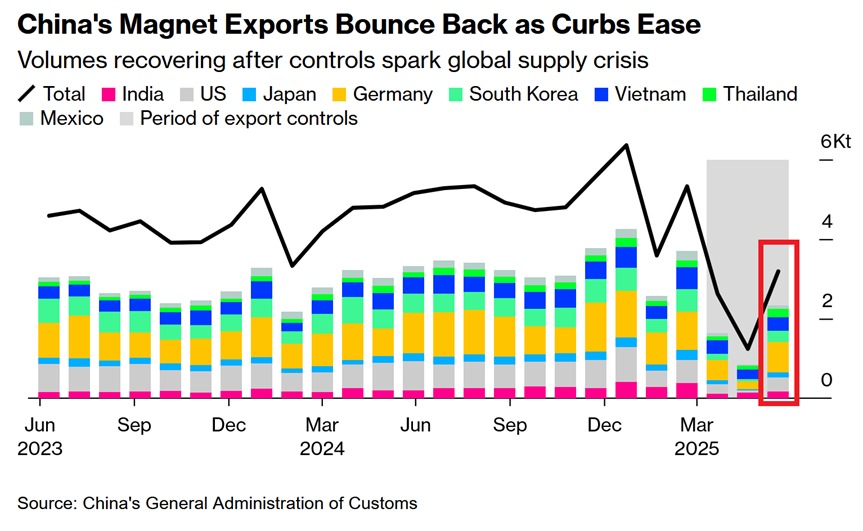

BREAKING: China’s total export volumes of rare-earth magnets jumped +158% MoM in June, to 3,188 tons, the most since March. Exports to the US surged +667%, to 353 tons, from just 46 tons a month earlier. Despite the rebound, overall shipments remained well below the levels seen…

The labor market continues to weaken: Job postings on Indeed fell -8% YoY in the week ending July 11th, reaching the lowest level since February 2021. Postings are now down -65% from their March 2022 peak. As a result, available vacancies in the US are just 4% above…

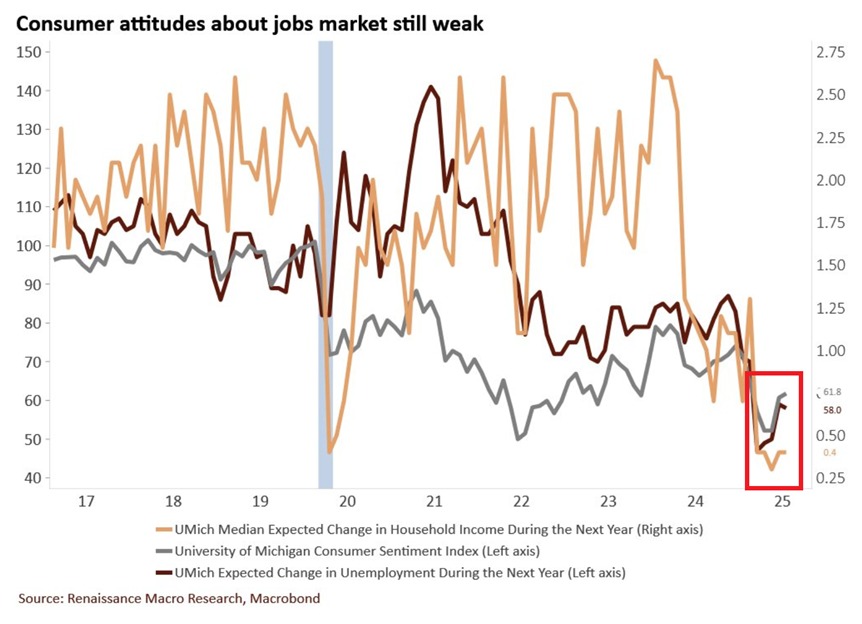

Labor market sentiment is still declining: The index tracking Americans' expectations for unemployment over the next 12 months fell to 58 points in July, the third-lowest since 2008. This level of pessimism also aligns with readings seen during the 2001 and 1990 recessions.…

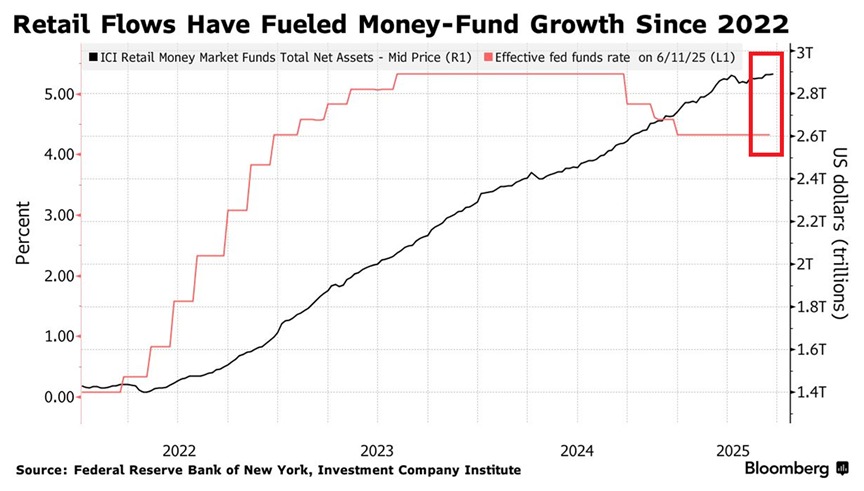

Retail is piling into money market funds: Total retail assets in money market funds are up to a record $2.9 trillion. Since 2022, household inflows into these funds have DOUBLED. During this time, retail investors accounted for 60% of the total increase in money market fund…

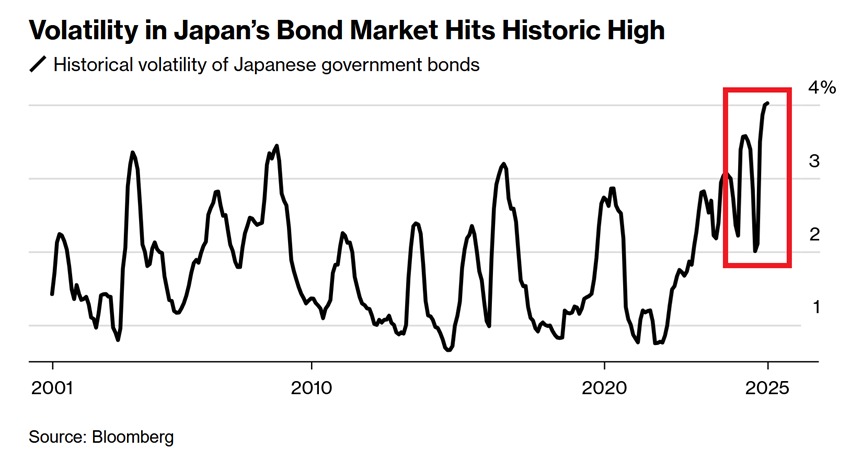

Keep watching Japan's bond market: The volatility gauge for Japanese government bonds spiked to a record 4.02%. Volatility in the world’s 3rd-largest bond market has DOUBLED over the last 5 months. This comes as the 30Y yield has risen ~75 basis points to 3.08% during this…

Implied volatility has fallen off a cliff: The average S&P 500 tech stock's implied earnings-day move is just 4.7% for Q2 2025, the lowest in 19 years. In other words, options investors are pricing very little volatility for tech earnings. By comparison, in Q1 2025, the…