Michael Fritzell (Asian Century Stocks)

@MikeFritzell

15 years in Asian equities. I'm the author of the "Asian Century Stocks" Substack newsletter (http://www.asiancenturystocks.com). Personal account.

A list of my most recent write-ups on the Substack newsletter Asian Century Stocks: asiancenturystocks.com/p/table-of-con…

Trump trade deals so far: #1 The UK, 10% reciprocal with sectoral reprieve, esp auto at 10% with quotas #2 Vietnam, 20% (vs 46% threat) tariff w/ 40% punishment for transhipment #3 Indonesia, 19% vs 32% threatened #4 The Philippines, 19% vs 20% threatened but was actually 17%…

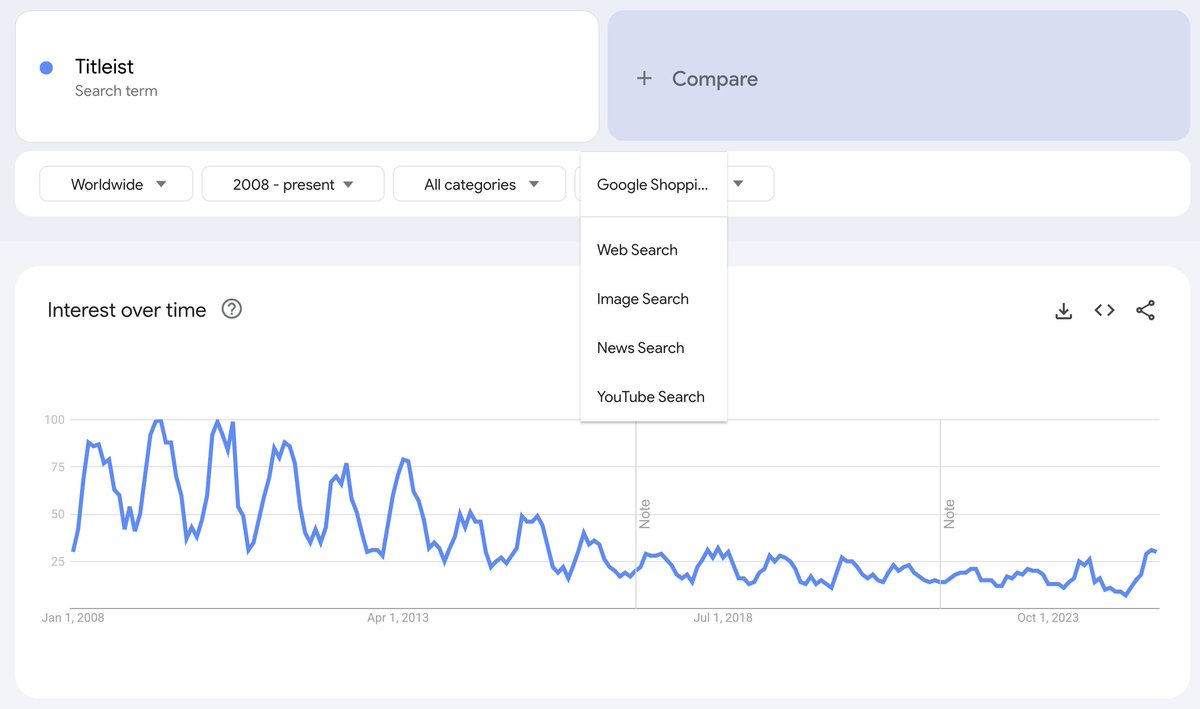

Just realized that Google Trends now has "Google Shopping" as one of its categories... should capture intent better than normal web search

Highly recommend giving this podcast a listen Seth Klarman, one of the most legendary value investors, dives into his investment philosophy Great discussion around fundamental analysis, bargain hunting in public markets, distressed investing and portfolio management

Agree large caps doesn't feel cheap anymore, China has and will be a momentum market though, that's how the Chinese culture works, everyone wants to do what everyone else is doing, if it's buying Labubu toys, queuing up for the latest waffle shop or piling into the same equities.

I was wrong. Trump’s $550bn deal with Japan is crazy. Per Bloomberg: 1) Trump decides where funds are invested 2) Japan only gets 10% of the profits on their investments What the ?!?

Fresh today - $CYND (4256) Business Plan and Growth Potential deck - in English 🤩 Growthy SaaS VMS at a big discount, yes pls ssl4.eir-parts.net/doc/4256/ir_ma…

Mizuno $8022 is our second favorite stock in the space - re-positioned the brand, probably gaining share in specialty running (Wave Rider/Neo Vista/Wave Rebellion), tailwinds from golf, sportstyle and look how diversified they are

Why we still like $WWW after its huge run, Mizuno is also looking optically cheap $8022 $7936 $PMMAF $VFC

🎥 Asian Terminals Unpacked: Growth Drivers and Market Outlook Strong pricing power, 7% yield, 30% earnings growth — but still just 9x PE? @RaoPranav speaks with @SameerTaneja41 on why $ATI might be under the radar. 📖 Insight: skr.ma/oH8fD Disclaimer:…

Asia: amazing assets all over the region, but companies are rarely run in the best interests of minority shareholders... governance matters more than anything asiancenturystocks.com/p/guide-to-cor…

Why is every other small cap in Asia rallying?

Smartest man in Thailand gave me a great random thought: Which major group stands to lose the most with a full open trade deal with the US? And are they preventing Thailand from signing the tariff deal?

As you may know, I’m a diehard train fanatic, especially on bullet train. So when I warn that the West is wasting billions on vanity high‑speed rail schemes, you know I’m deadly serious! lovetransit.substack.com/cp/169017041

Indonesia lowest tariff rate amongst peers countries. With commodities, crude palm oil, machinery, and textiles as key exports to US.

this sounds dumb but it is a lot easier for a company to go from under-levered to over-levered than other way around

The modern version would be to ask ChatGPT for the bull case, then the bear case and finally compare the two answers