astutex.ai

@AstutexAi

Data-driven insights and ideas. Tweets are for informational purposes only and do not constitute investment recommendations. Email: [email protected]

$SFM AppStore download rankings YoY improving again

Sprouts Farmers Market $SFM is one of the companies that should continue to benefit from change in eating habits in favor of fresh and healthy food: - comparable store sales accelerated for 4 quarters in a row with a whopping 11.5% increase in 4Q24, EPS up 60% - company figured…

Puma problems getting worse, but concentrated in Apparel/Accessories, Footwear growth actually accelerated from +2.4% in Q1 to 5.1% in Q2 2025 $PMMAF $PUM.GY

Puma Surprises Market With Early Q2 Results, Slashes Guidance for 2025 trib.al/Feq2Lxy

My wife checking my credit card statement with all the LLM provider API bills and vibe coding subscriptions 😁

Wow, $DECK domestic sales down 2.8%, not sure it will hold the gains tomorrow

In its July 17th article @Placer_ai explicitly flagged this weakness in comps at $CMG A must follow if you are into consumer stocks

As far as I'm concerned, the 5% drop in transactions in $CMG isn't being talked about enough. That's a medium-level canary-in-the-coal-mine for the US consumer. What do others think?

$FOXF officially in up-trend and ready to run, Shimano $SMNNY next

We see more and more evidence bicycle market bottomed and channel inventories are normalizing after Covid-19 boom and bust. And we think the best way to play this up-cycle are premium component manufacturers Shimano $7309 (check out @sweetstocksblog write-up) and Fox Factory…

Ok, $MODG also looks interesting here as company is experimenting with pricing to increase utilization and attract younger cohorts

Premium sports (golf, yachting, tennis) should outperform the rest also due to instagrammability $GOLF

Market is missing the story on Basic-Fit $BFIT. Trading at just 5.3x our 2026 EBITDA, we see >2.5x upside with a path to €65/share. A classic compounder hiding in plain sight. Full write-up: seekingalpha.com/article/480360…

Mizuno $8022 is our second favorite stock in the space - re-positioned the brand, probably gaining share in specialty running (Wave Rider/Neo Vista/Wave Rebellion), tailwinds from golf, sportstyle and look how diversified they are

Why we still like $WWW after its huge run, Mizuno is also looking optically cheap $8022 $7936 $PMMAF $VFC

"Demon Slayer" film sets Japan opening 3-day box-office record #Japan #DemonSlayer #鬼滅の刃 english.kyodonews.net/articles/-/577…

A lot of golf related topics are trending and the best part - very little growth is expected for $GOLF

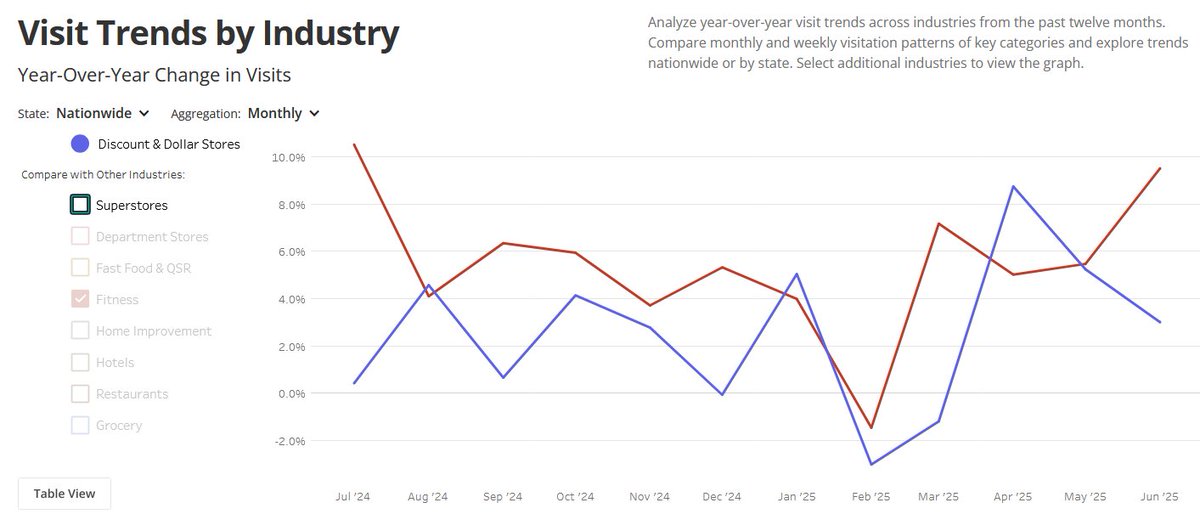

The only industry that can compete with Fitness $PLNT $LTH on comps is Discount & Dollar Stores. $OLLI earnings should be 🔥 Data by fabulous @Placer_ai

Japanese soft power in action $SONY $NTDOY $SNROF $TOEAF

By 2033, the country wants to quadruple the amount of content it sells in overseas markets each year — primarily anime (animation), manga (comic books) and video games. That would put sales at around ¥20 trillion ($130 billion), almost twice the value of the cars Japan currently…

Why did you buy Basic-Fit into your portfolio? Yeah, you know - they had Saucony in their investor presentation 🫡 $BFIT x $WWW

Worth checking comments $GOLF

Teenage boys in the UK have spontaneously taken up golf. Not because of a marketing campaign or a charismatic young golfer. They just like it.

Comrades ultramarathon finisher shoe distribution 24/25 - Asics $ASCCF stable #1 (deserves a premium valuation), Adidas $ADDYY biggest gainer, $NKE biggest loser, $DECK Hoka 3% share shows its more of an amateur/fashion brand (also applies for $ONON)

$BFIT is a unique asset and reaching an inflection point: - growth normalizing as openings slow to around 100 p . a. - positive free cash flow & start of €40 m buy‑back in 2H 2025 - exploring franchising possibilities in 2026 - a lot of potential for cross-selling to engaged…

$BFIT

IG Port $3791 - ouch -21% after another set of messy numbers, dip presents an excellent opportunity for a long-term investor. Cost overruns in Video Production and investment amortization schedule mask outstanding growth in Product sales which is basically also licensing revenue

IG Port $3791 erased the whole Sanrio news gap and reports full-year results on Friday. Valuation is quite reasonable given momentum company has. Idea is clear - establish recurring revenue base from stable projects (80% of profits come from recurring franchises) with partners…

This will be a long thread on manga, anime and why we think IG Port $3791 - an anime production company (and co-owner of IP for Attack on Titan, Spy x Family, Haikyuu! and upcoming Kaiju No.8) - is a multi-bagger from here and has a fair chance of becoming a smaller version of…