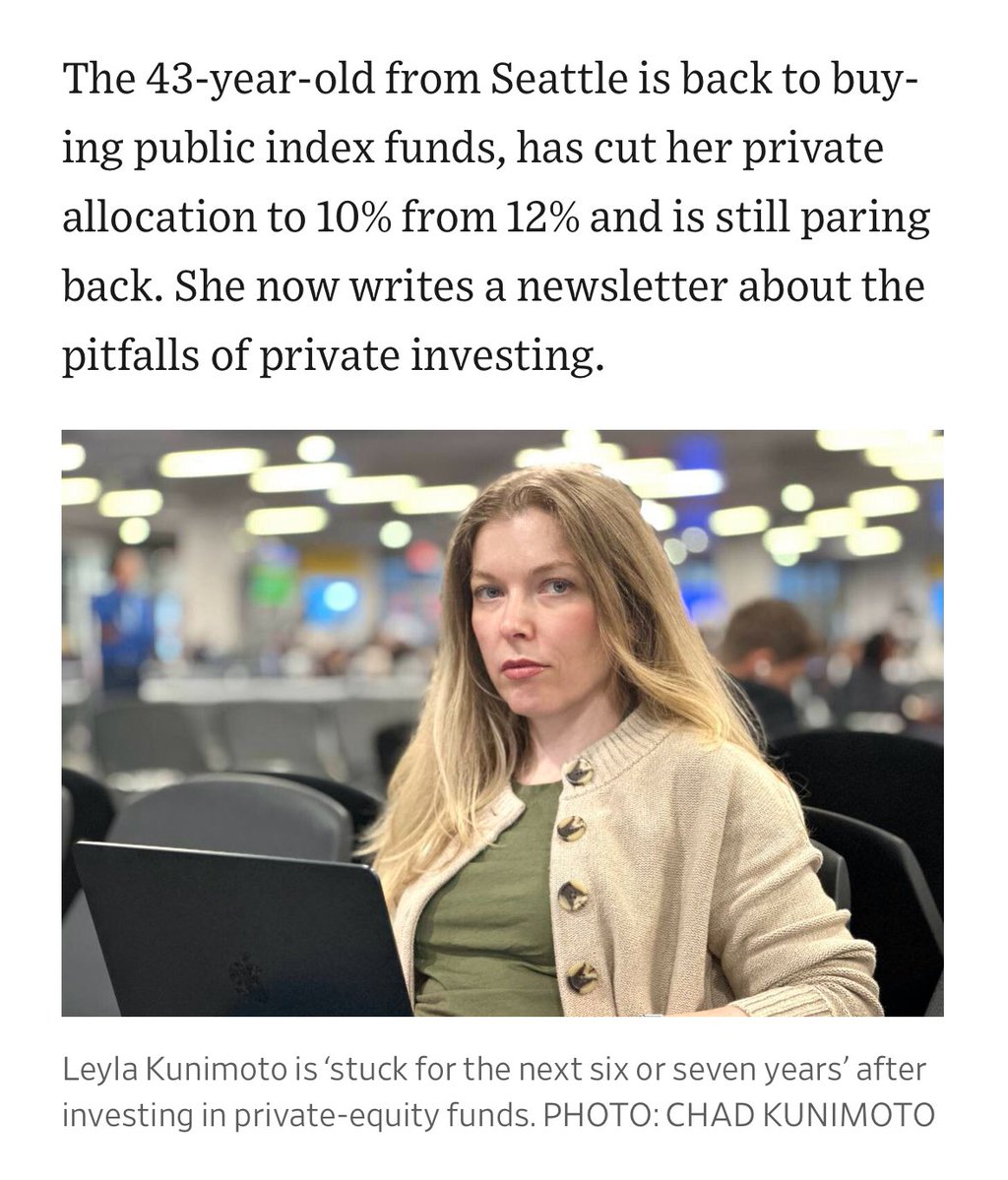

Leyla

@LeylaKuni

LP investor | Co-founder: @accreditedLP | Empowering fellow investors and providing unbiased insights. Join my mailing list ⬇️

Well, one thing that wasn’t on my BINGO card this year was appearing in the Wall Street Journal. The piece explores how Vanguard and other retail giants are embracing high-fee private market funds, just as some of us are learning the hard way what that really means.

There are 18,000 companies held by private equity. The highest on record. Large PE funds is the new small cap index. With one MAJOR difference. There is no required disclosure. Privately held companies don't have to file quarterly financials with the SEC. Yet you will soon…

I understand the intent of this language, of the whole newsletter, because I wrote it. bloomberg.com/opinion/newsle…

Relative performance of Nevada PERS compared to peers: The remarkable thing is this: the $60B+ fund is managed by a team of three. Steve Edmundson joined Nevada PERS in 2005. At the time, the portfolio was split evenly between actively managed and index funds. From 2006 to…

Listen to Robert, everyone -- -- in VC you have SPVs, in real estate and PE you have funds of funds. This is what happens to your returns when there are multiple layers of fees. Don't invest in multi-layered structures, kids (not investment advice, obv)

Don’t ever let me catch you investing in a 3rd-layer SPV. I don’t care how hot the startup is, or how great the returns in the underlying company might be. It’s a con, you’re the mark, and you’re going to bleed out on fees. If you’re not familiar with a 3rd-layer SPV, it’s an…

Buying a stabilized core+ multifamily asset with a 3-year loan at a 4.8% cap rate and underwriting a 17% IRR is delusional. Invest at your own risk. I’ll have no sympathy for you.

Billy, this is a fund of funds with 4.19% expense ratio, and investors can't get enough of it. The defect is we used 3% cap rate to get NAV and need to sell the assets.

It’s not the avocado toast that’s killing Millennials, it’s the tip on it. At a local coffee shop: the default tip amount on the machine is $3 That’s 75% on my $4 medium black coffee 😳

A vertically integrated GP (who didn’t do any 3rd party management) once told me the biggest benefit of owning the property management arm is that your clients never fire you.

If you’re in your 20s right now, finding a great spouse and having a couple of kids with them will get you a better life in the long run than any MBA or graduate degree.

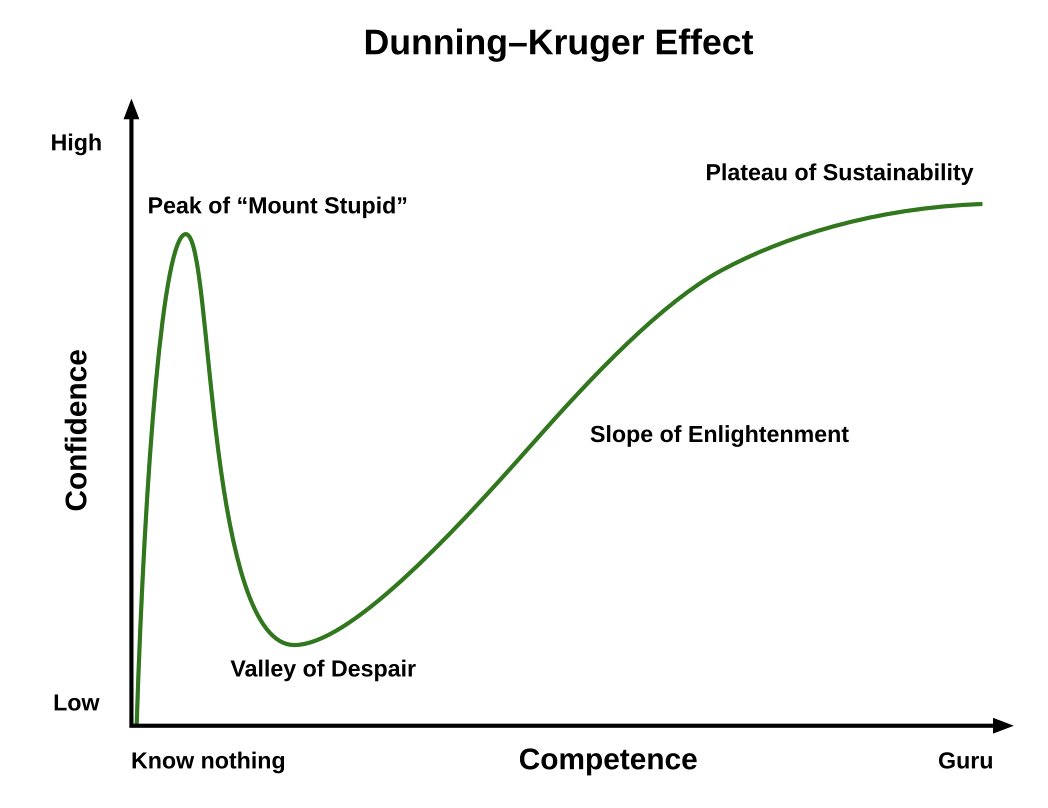

If the crowd of newly minted IT-bros-turned-CRE-syndicators reached the Peak of Mount Stupid in 2021, where are they now on this chart?

I firmly believe the most money will be made by the public shareholders of whatever asset manager figures out the illiquidity conundrum the soonest. The fees they’ll collect will be a thing to behold.

Apollo promising “increased secondary market liquidity” for illiquid private credit The most optimistic interpretation of blockchain ever

How to cold DM on LinkedIn, from someone who receives tons of DMs: - state your ask - don't ramble - if it's a favor you're asking, be polite - if you are pitching, don't be coy. State so. We all pitch. SIDE NOTE: if you like something someone wrote, reach out and say so,…

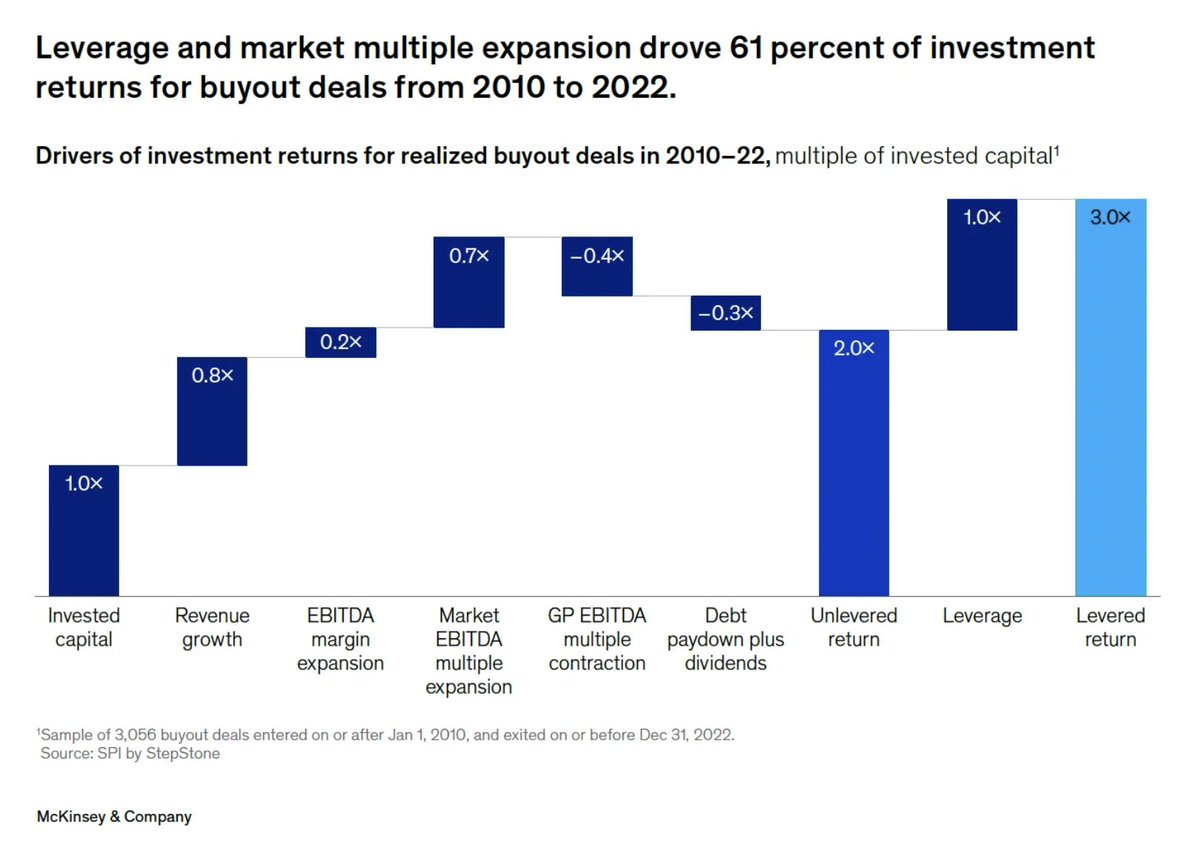

One of the most eye-opening charts you will see on private equity performance - for each invested dollar in PE buyouts, leverage and market multiple expansion drove 61% of returns. Translation: financial engineering and factors outside the GP’s control drove most of the value

Help a sister out please I know a few GPs who are doing it right on the lower end of the market (AUM< $1B). What large AUM fund manager does this right (AUM >$1B)? And generates outsized returns? Consistently? Any asset class: PE, CRE, private credit..