junkbondinvestor

@junkbondinvest

Credit analyst. Focus on high yield bonds, leveraged loans, distressed debt, special situations. Lots of satire.

High yield rally continues: - 3rd straight session of gains (biggest in 3 weeks) - Yields drop to 7.05% (2-week low) - Spreads at 280bps (still well below 300) - CCCs yielding 10.79%, spreads at 660bp Strong earnings trumping tariff concerns 🔥

Glendon seeing distressed opportunities because PE can't exit during bull market Sometimes the best of times highlight the worst problems

Anthelion using large language models to identify "attractive middle market loans" 100% believable. CLO credit analysis nearly 100% automatable.

Want to know how hot the HY market is? $24B+ in junk bond supply this month Busiest July since 2021 The issuance machine is back $HYG $JNK

Kohl's is a real estate company pretending to be a retailer but bondholders trading at 56¢ already know this Billions in unencumbered assets mean someone will get paid when the story breaks. The only question: who collects, and how much? $KSS

Middle-tier PE firms struggling to “differentiate themselves”… Being in the middle means being invisible

Investor who went long $KSS bonds and short $KSS stock…. because fundamentals still matter, right?

Direct lender hearing the sponsor he "supported through the tough times" is refi'ing him out with a cheaper BSL

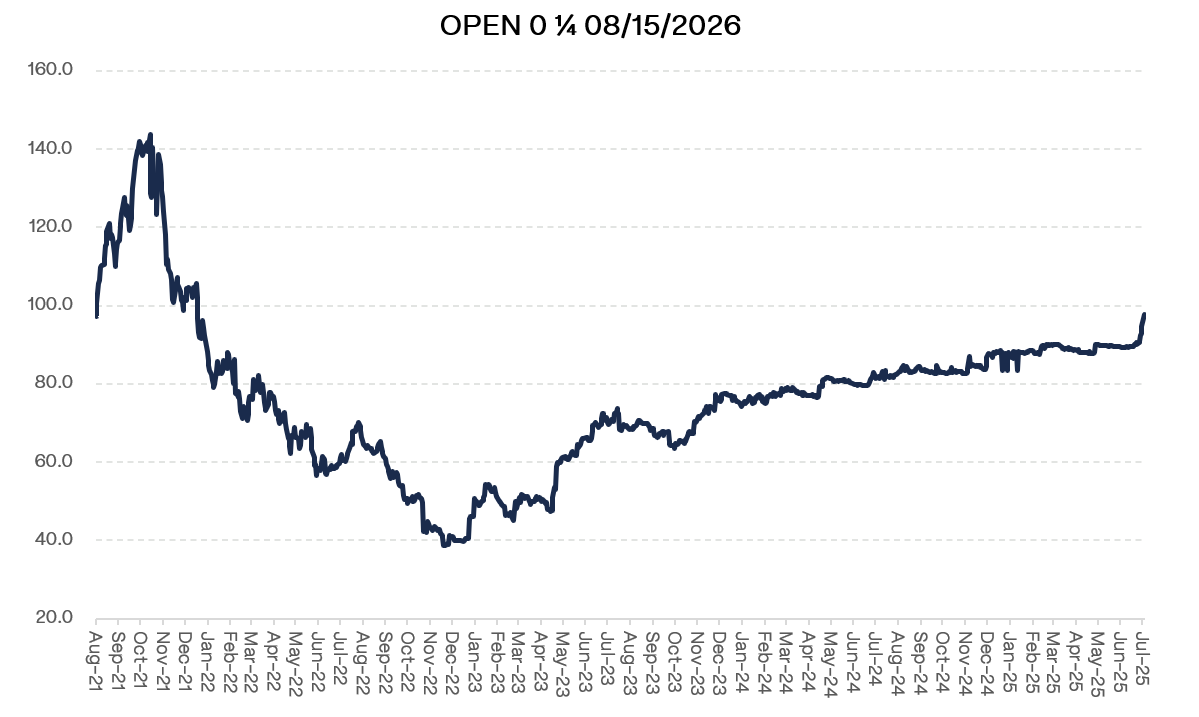

$OPEN converts bottomed at 40 cents in 2022 Today: probably worth remembering when you're buying converts at par

Apollo promising “increased secondary market liquidity” for illiquid private credit The most optimistic interpretation of blockchain ever

EM borrowers: “Dollar down 8%, time to issue euros” Currency markets: “What happens when the dollar bounces?” EM borrowers: “We’ll diversify back to dollars”