Ken Tumin

@KenTumin

Founder of http://DepositAccounts.com & former Senior Industry Analyst at @lendingtree. My 2 cents on banking, saving & investing. If not online, I'm walking my pup.

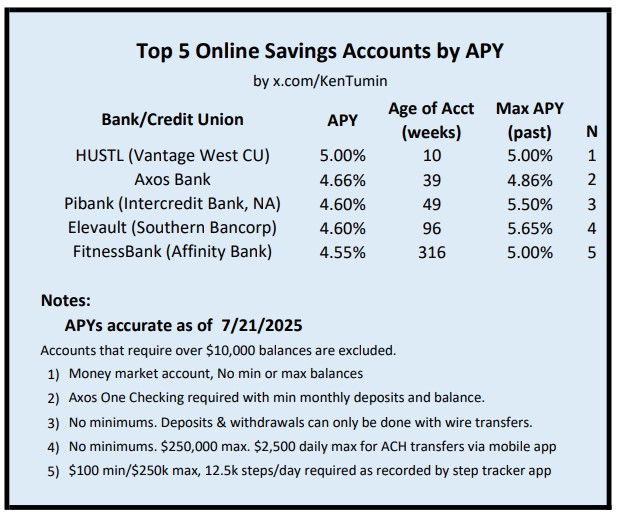

Top 5 online savings accounts by APY as of 7/21/2025 & thread on online savings account (OSA) yields and how OSA & money market fund (MMF) yields have changed since the first Fed rate cut (9/18/2024):

Are Index Funds Ruining Small-Cap Investing? | @barronsonline “In a paper titled “Passive Investing and the Rise of Mega-Firms,” 3 finance professors [...] reveal how asset flows from active funds into passive index funds have created so-called megafirms” barrons.com/articles/index…

At the Fed’s Banking Conference [...] via @WSJ "The Federal Reserve convened top bankers to discuss a new approach to banking regulation [...] Bankers are advocating for simpler, less burdensome rules, while proponents of stringent regulations fear a repeat of past crises."

At the Fed’s banking conference, Sam Altman, capital rules and avoiding the Powell drama wsj.com/economy/centra… via @WSJ

Due to Capital One's acquisition of Discover, Capital One is now the 8th largest US bank based on assets. It moved ahead of PNC, Truist and TD Bank. Assets are from Q2 earnings reports. Capital One was the last of the largest 10 banks to report.

Capital One Swings to Loss After Discover Financial Acquisition | @WSJ "Adjusted per-share earnings were $5.48, surpassing the $4.03 forecast, while revenue increased 31% to $12.49 billion." wsj.com/business/earni…

S&P 500 Total Returns by Decade Broken out by sources of return

Powell’s speech. No monetary policy. Just bank regulations. “We need our large banks to be well capitalized and to manage their key risks well. And we need large banks to be free to compete with one another, with nonbank financial firms, and with banks in other jurisdictions”

On July 22, 2025, Chair Powell delivered opening remarks at the Integrated Review of the Capital Framework for Large Banks Conference: federalreserve.gov/newsevents/spe…

Boom! “PNC $PNC and Coinbase $COIN will work together to develop an initial offering that will allow clients to buy, hold and sell cryptocurrencies”

More from @BlackRock “And investors are demanding more compensation for the risk of holding long-term bonds, leading to a steepening of global yield curves.”

"Some 80% of global fixed income assets now offer yields above 4% as interest rates have settled above pre-pandemic levels." @BlackRock

POWELL OPENS FED CONFERENCE, AVOIDS POLICY COMMENTS Powell opened a banking regulation conference Tuesday without mentioning monetary policy or Trump’s pressure on the Fed. Due to the pre-meeting blackout, Powell stuck to brief remarks, saying he welcomes feedback on improving…

Your Bank Might Punish You for Those ‘Buy Now, Pay Later’ Purchases Lenders are wary of the fast-growing installment plans, but FICO says they could lift credit scores buff.ly/6jFlatQ | @MoiseNoise for @WSJ

One of the largest money market funds, Vanguard Federal Money Market Fund (VMFXX), has a yield of 4.22%. MMFs are a reasonable alternative to high-yield savings accounts.

Retail is piling into money market funds: Total retail assets in money market funds are up to a record $2.9 trillion. Since 2022, household inflows into these funds have DOUBLED. During this time, retail investors accounted for 60% of the total increase in money market fund…