Simon French

@Frencheconomics

Chief Economist & Head of Research @panmureliberum Former @cabinetofficeuk @dwp. 🏏 @hmtreasury. @thetimes columnist. 🚴♀️ tours & 🐝-keeping. Views are my own

Trump trade deals so far: #1 The UK, 10% reciprocal with sectoral reprieve, esp auto at 10% with quotas #2 Vietnam, 20% (vs 46% threat) tariff w/ 40% punishment for transhipment #3 Indonesia, 19% vs 32% threatened #4 The Philippines, 19% vs 20% threatened but was actually 17%…

The UK’s laggard approach to stablecoins reveals so much on.ft.com/4nUzozL | opinion

Some top talent leaving the building - @johnvanreenen was one of the best I met with since last year’s general election: theguardian.com/politics/2025/…. The need for more market-facing capability is now the most pressing need for HMG (IMHO) given broadening evidence of market…

This podcast from @WilfredFrost is getting some terrific guests. Very telling warning from GS on options for locating top finance talent anywhere in Europe.

.@GoldmanSachs CEO @DavidSolomon with stark warning on London's "fragile" leadership position in global finance. Specifically on Non Dom: "If you create tax policy or incentives that push people away you harm your economy & don't drive revenue increases." podfollow.com/1817704682

A UK wealth tax sounds simple: "tax the super‑rich, fund public services" But it's not. Our 16,000 word deep‑dive shows revenues are fragile, it puts growth, investment and jobs at risk, and there's no revenue before 2029. Here’s the evidence:

Good from the OBR to look at the quarterly picture given known volatility in monthly numbers (analogous to interpretation challenges facing monthly GDP). But the govt won’t want this to deteriorate further in Q3 else would signal a new gap to 🔌 in the Autumn.

Borrowing in line with forecast in first quarter of 2025-26 – our monthly commentary on the public finances will be published later this morning 📊

Borrowing in line with forecast in first quarter of 2025-26 – our monthly commentary on the public finances will be published later this morning 📊

However politically difficult the UK government think this is, they need to weigh it up against increasing signs from Gilt market pricing that creditors are suspicious about long term liabilities are being left unaddressed (particularly the state pension, public sector pensions,…

The government has launched a review of the state pension age, which is currently 66 But the review is simply a legal obligation - from what I'm hearing the government won't go anywhere near increasing it this side of the next election The view is that doing so would be…

Pretty sensible of the Chancellor to rule this out for three reasons. The most important (agnostic of what you think of the wisdom of extending wealth taxation in the UK) is there is zero chance of the UK data being available anytime soon to do a comprehensive levy on net assets.…

The Times: Reeves set to defy left over call for wealth tax #TomorrowsPapersToday

The one universally positive thing that investors had been saying about the UK govt was its vocal commitment to planning reform as a vehicle/accelerant for raising growth, wages & wellbeing. We get the sclerosis on these metrics that we deserve.

EXTREMELY disappointing that the Government is giving in on the Planning and Infrastructure Bill. These amendments will ❌ Slow down development ❌ Make infrastructure more expensive ❌ Do nothing to solve the housing crisis!

Notwithstanding the challenges being experienced by the Labour Force Survey it is picking up a striking trend in working age inactivity rates. Those born outside the UK have a considerably lower working age inactivity rate than the UK-born population - with very considerable…

More encouragingly working age inactivity now seeing a sharp reversals on the post-pandemic increases. Numbers down to 9.1m and the rate down to 21% - this aspect of the UK labour market is making progress despite clear demand weakness.

More encouragingly working age inactivity now seeing a sharp reversals on the post-pandemic increases. Numbers down to 9.1m and the rate down to 21% - this aspect of the UK labour market is making progress despite clear demand weakness.

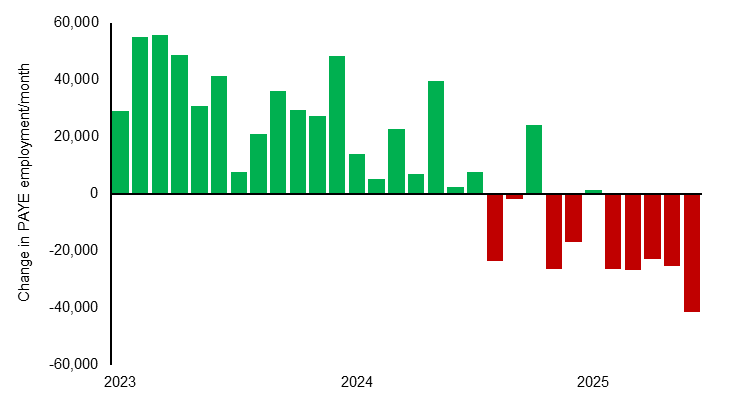

A decidedly mixed UK jobs report with payroll employment falls accelerating in June, and now averaging 17k/month since last year's General Election. Policy indigestion from combination of NLW, employee rights package, & employer NICs burden the most likely drivers of this…

A decidedly mixed UK jobs report with payroll employment falls accelerating in June, and now averaging 17k/month since last year's General Election. Policy indigestion from combination of NLW, employee rights package, & employer NICs burden the most likely drivers of this…

Breaking: Trump is likely to fire Federal Reserve Chair Jerome Powell soon, a White House official said, and discussed the possible move in a meeting with congressional Republicans on Tuesday night bloomberg.com/news/articles/…

Think it's hard to build infrastructure now? Former Environment Secretary Baroness Coffey's amendment to the Planning Bill would give MPs the right to argue in person against any infrastructure proposed for their constituency

A further tricky aspect is the judgement on what the hell is going on in the UK labour market. PAYE employment has fallen 282,000 from its July 2024 peak. LFS suggesting total employment is up 320,000 over the same period. Possible payroll-to-self employment pivot, but not…

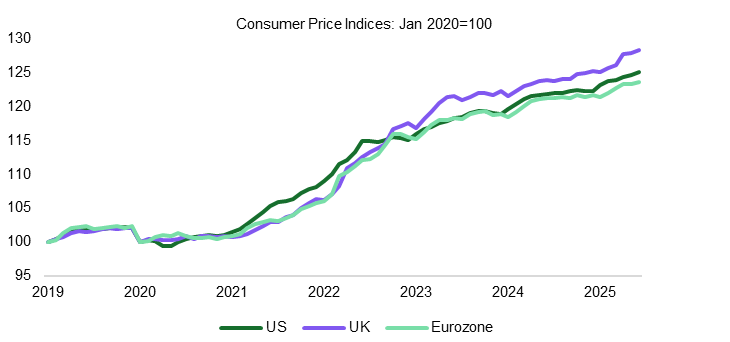

One of the tricky aspects to the MPC's upcoming deliberations is the run rate for UK consumer price growth. 3.6% YoY is just one measure, and looks all a bit Bazball. Another way to look at it is that the 2025 trend has been close to 2014-2021 average (ex April, and the EPC/NICs…

One of the tricky aspects to the MPC's upcoming deliberations is the run rate for UK consumer price growth. 3.6% YoY is just one measure, and looks all a bit Bazball. Another way to look at it is that the 2025 trend has been close to 2014-2021 average (ex April, and the EPC/NICs…

Compound price wedge to UK consumer prices continue from the energy spike of mid-2022. Economists focus on YoY changes - most consumers and business expectations are (for quite a lag) influenced by changes to the price level

Compound price wedge to UK consumer prices continue from the energy spike of mid-2022. Economists focus on YoY changes - most consumers and business expectations are (for quite a lag) influenced by changes to the price level

Credit where due. Chancellor gets a lot of flak, but to acknowledge that the post GFC regulatory & risk balance has been overcooked (vs US, frontier financial centres) and has had a blowback on the domestic economy is not politically easy. Scars of ‘08 run deep.

Rachel Reeves: the pendulum has swung too far on risk on.ft.com/44Jg3ss

Rachel Reeves: the pendulum has swung too far on risk on.ft.com/44Jg3ss