Office for Budget Responsibility

@OBR_UK

Official Twitter channel of the Office for Budget Responsibility (OBR). The OBR provides independent and authoritative analysis of the UK’s public finances.

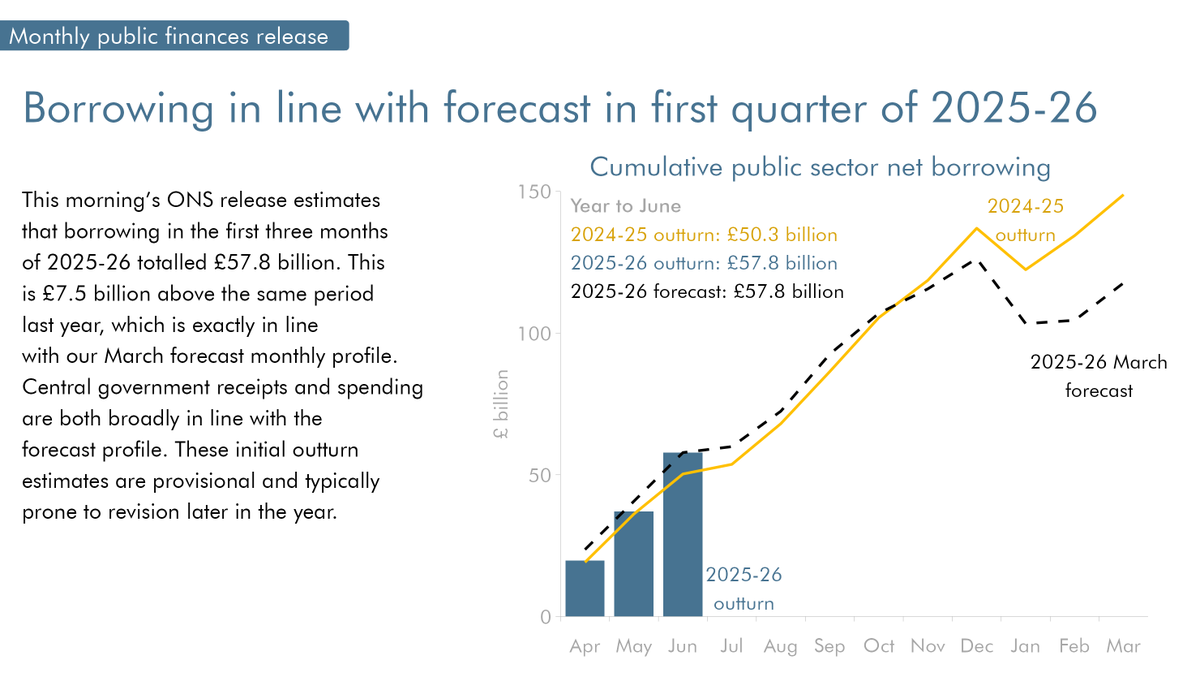

Borrowing in line with forecast in first quarter of 2025-26 – our monthly commentary on the public finances will be published later this morning 📊

The @CommonsTreasury has confirmed the reappointment of Richard Hughes as the Chair of the OBR for a second and final term.

Tomorrow morning from 10.15am we'll be discussing the Fiscal Risks and Sustainability Report with members of the Budget Responsibility Committee. This will be followed by a re-appointment hearing with Richard Hughes as Chair of the @OBR_UK. Find out more 👇

All #OBRfiscalrisks and sustainability reports contain topical ‘box’ analysis 📊 On Tuesday we covered pensions, debt, the public balance sheet, climate change, and lots more #ICYMI Read all FRS boxes on our website: obr.uk/report/fiscal-…

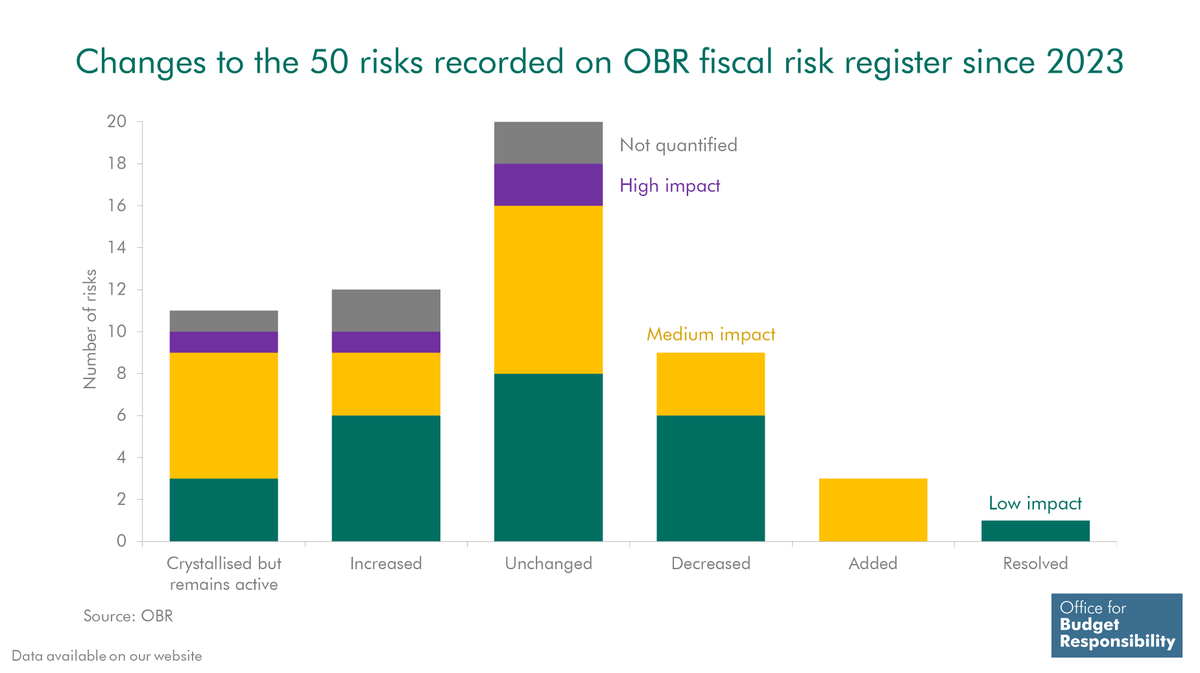

Our #OBRfiscalrisks register highlights the most substantial risks to the public finances, including pensions, the public balance sheet and climate change. There are 47 other risks on our fiscal risk register, including those related to trade, defence and tax, which you can read…

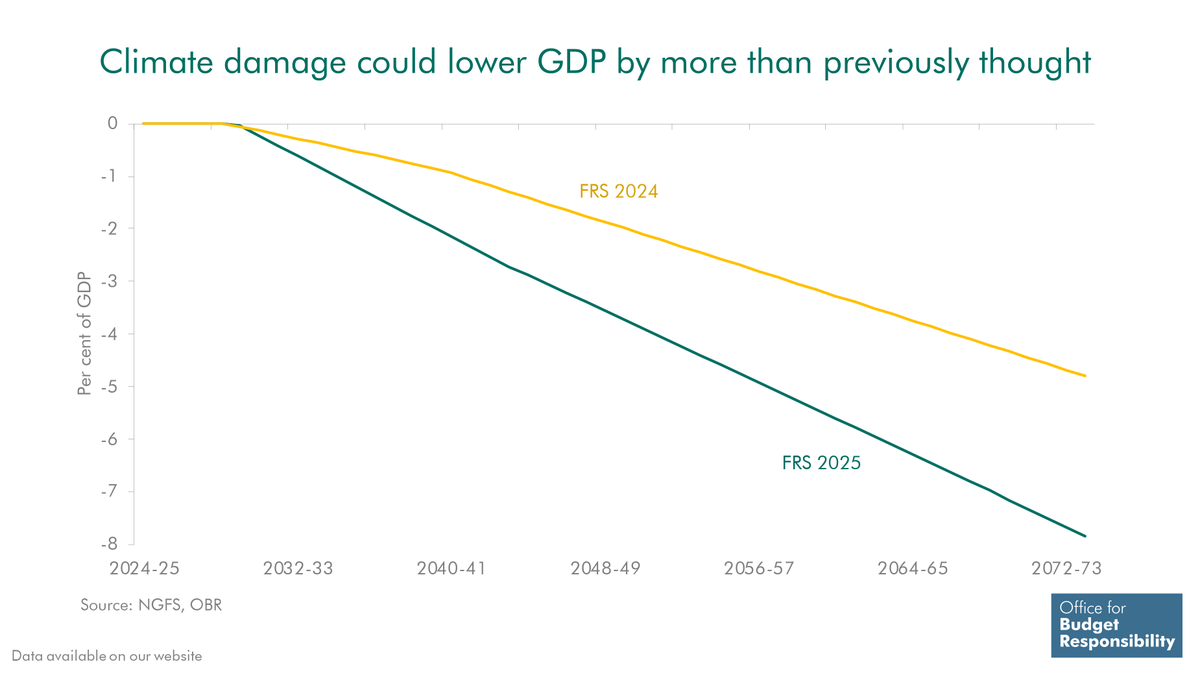

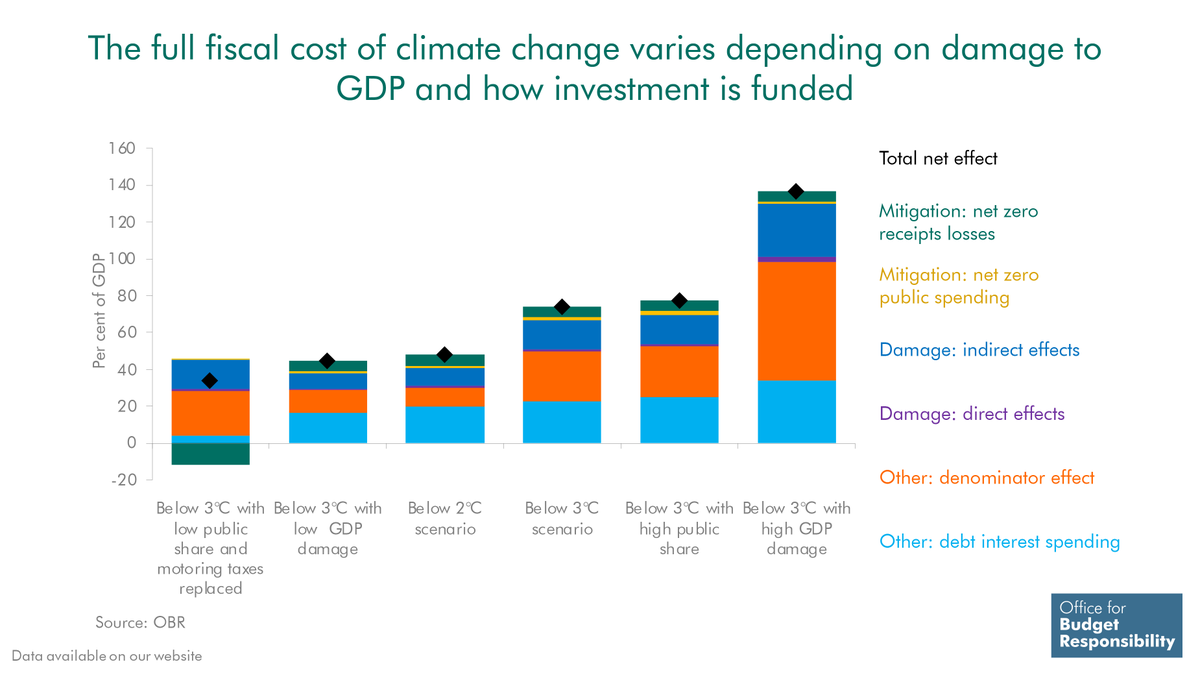

By the early 2070s, climate-related damage could increase primary borrowing by 2% of GDP annually, 0.7 percentage points more than our previous estimate. The accumulated impact, including debt interest, could raise public debt by 56% of GDP 📈 #OBRfiscalrisks

By the early 2070s, climate-related damage could reduce UK GDP by 8% in a scenario where global temperatures rise to just below 3°C 🌍 The impact on GDP is 3 percentage points more than estimated in the 2024 FRS #OBRfiscalrisks #ICYMI

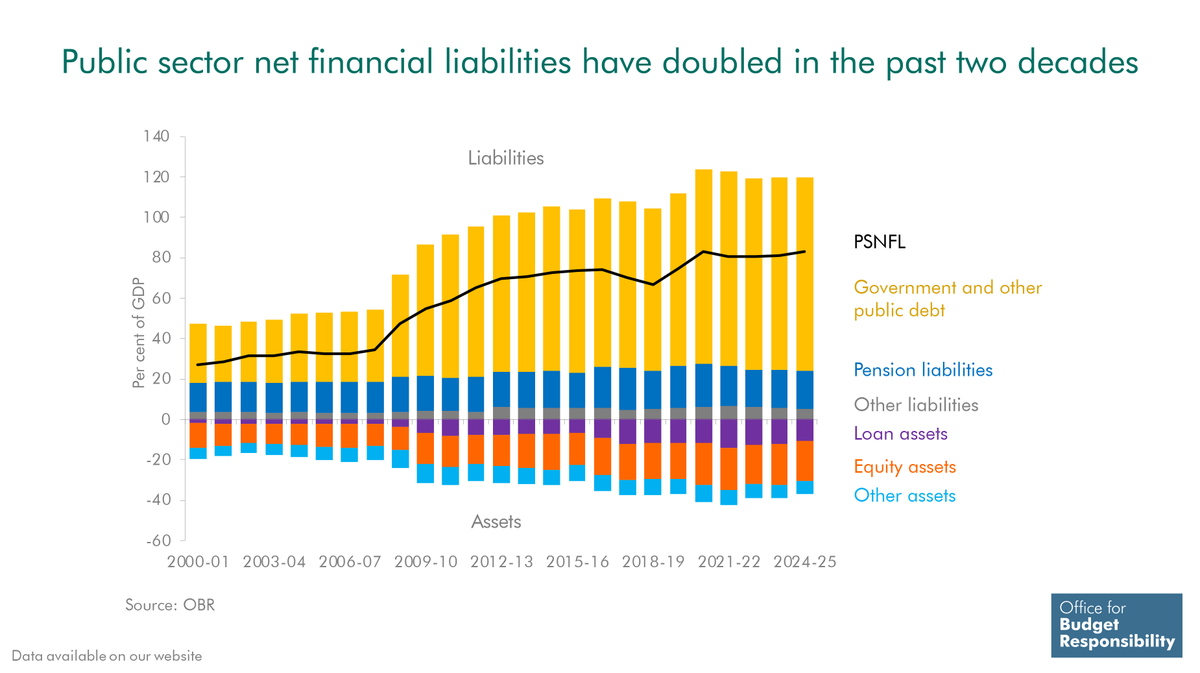

Year-to-year changes in PSNFL have mostly been driven by public sector net borrowing, financed by the issuance of debt securities. Since 2008, the Bank of England’s QE programme has led to increases in currency and deposit liabilities #OBRfiscalrisks

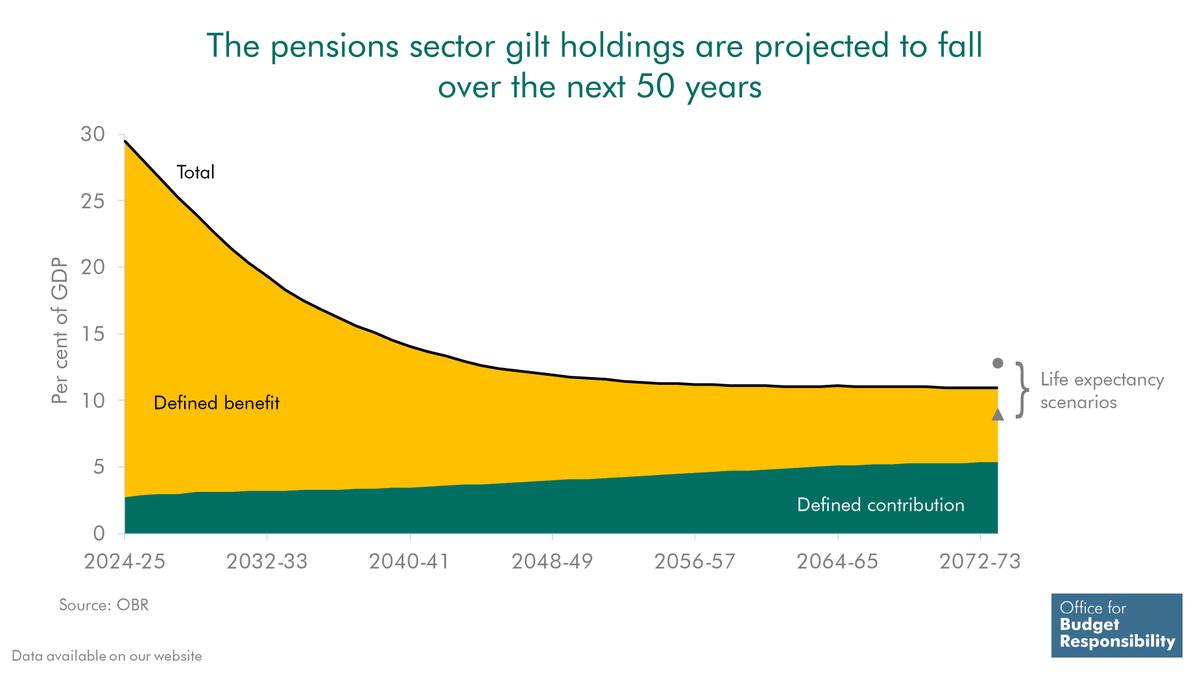

In our central projection, pensions sector gilt holdings fall from 30% of GDP to just over 10% in 50 years, driven by the shift from DB to DC schemes. This could raise gilt yields by 0.8 percentage points over the long run #OBRfiscalrisks

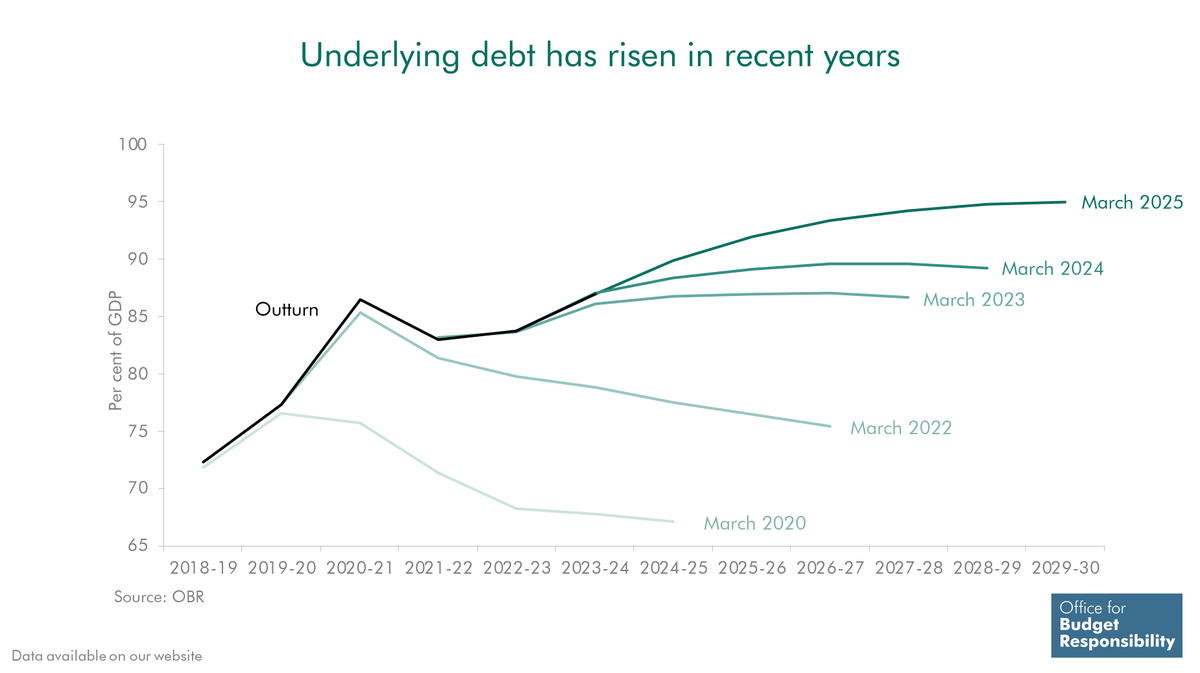

Efforts to put the UK public finances on a more sustainable footing have seen only limited success. Despite fiscal rules targeting debt falling, underlying debt has risen by 24% of GDP since 2010, driven by shocks, reversed consolidation plans and loosening of rules…

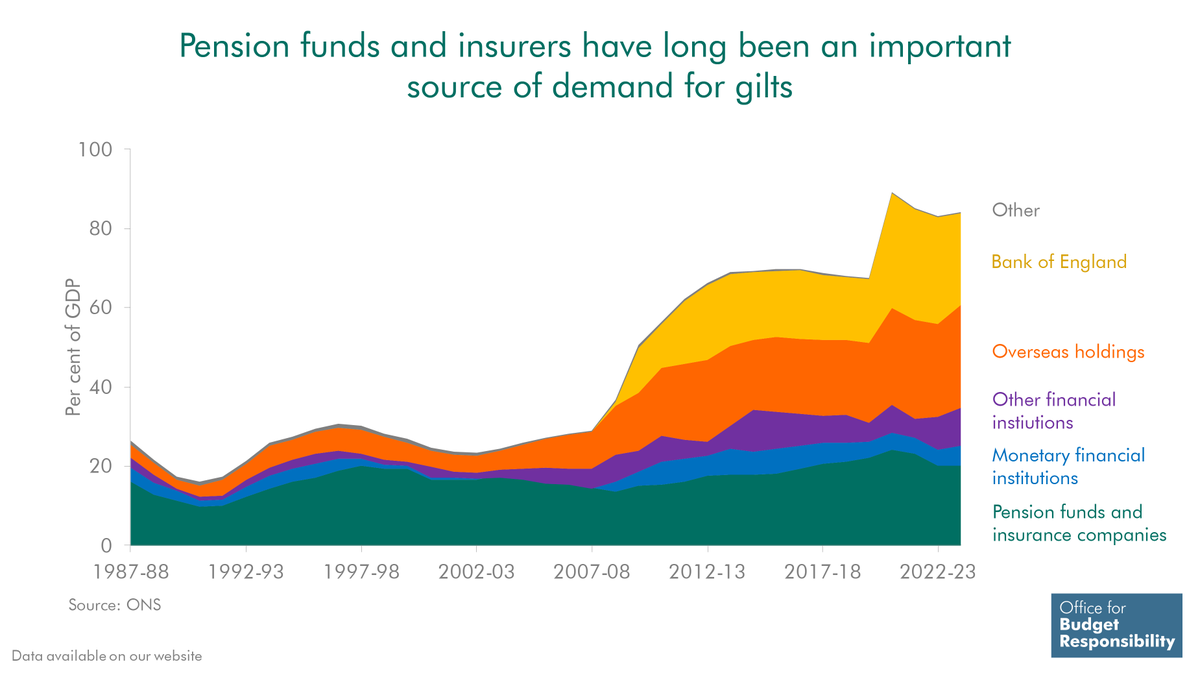

Pension funds and insurers have been major holders of gilts for decades, with relatively stable holdings as a % of GDP #OBRfiscalrisks However, the rising stock of gilts means they have gone from holding around two-thirds of all gilts in 1999 to around one-third in 2023-24.

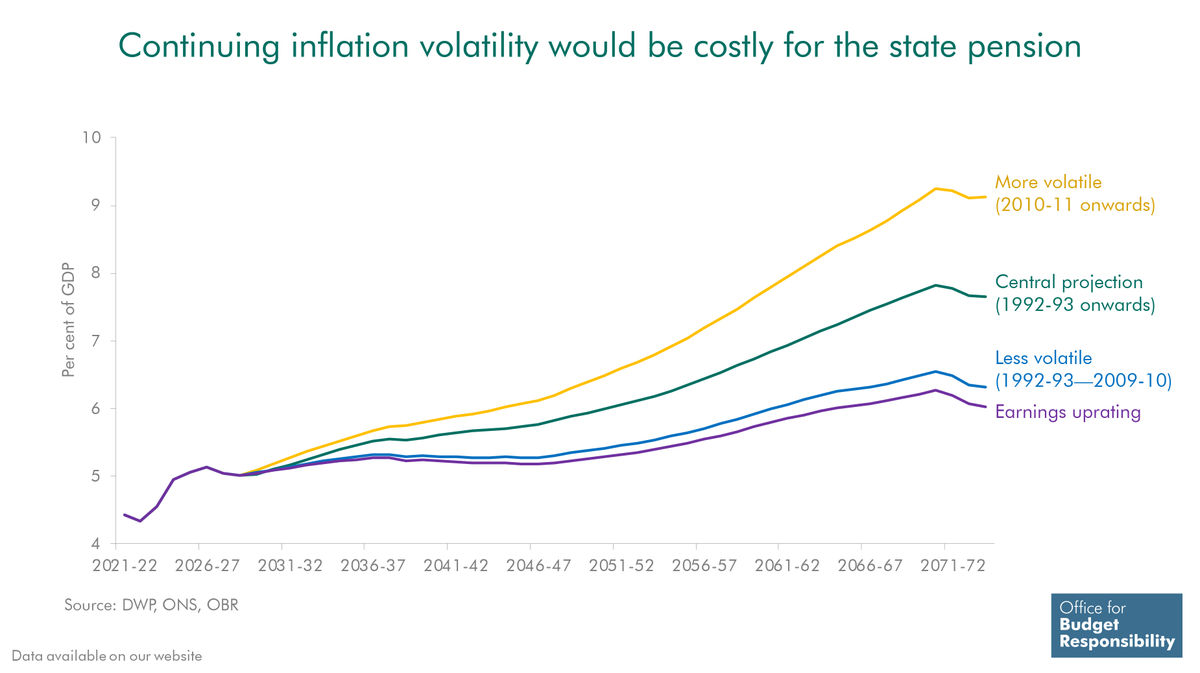

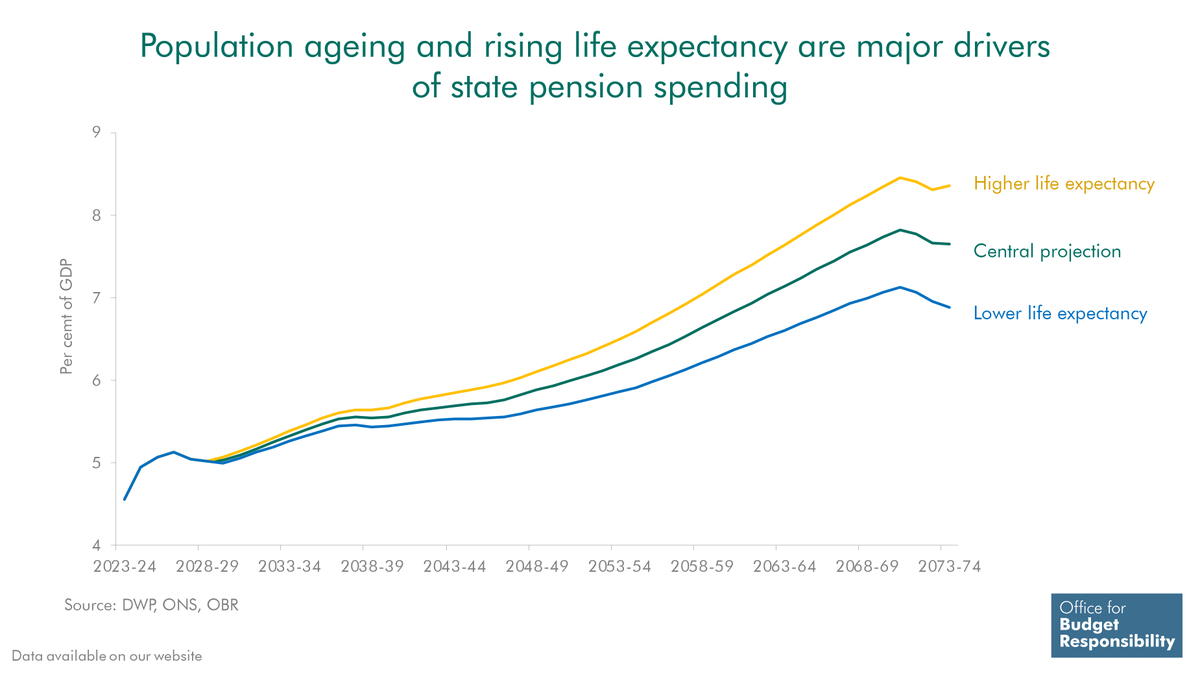

Over the next 50 years, we project state pension spending to rise by 2.7% of GDP, with 1.6pts driven by demographics #OBRfiscalrisks If life expectancy at 65 reaches 29 years, spending could be an additional 0.7% of GDP higher; if it falls to 20 years, it could be 0.8% lower.

Our scenarios show that if negative shocks to discount rates, equity prices and loan valuations occurred in 2025-26, they could raise PSNFL by between 1% and 2.6% of GDP #OBRfiscalrisks But the fiscal target, to see PSNFL falling in the final year, is met in all cases 📉

The overall fiscal impact of climate change is uncertain and depends on temperature paths, economic damage and who bears transition costs. Our scenarios estimate that the impact of climate change on debt in 50 years’ time could range from 40% to 140% of GDP 📈 #OBRfiscalrisks

Our 2025 FRS presents three major fiscal risks: 1. The sustainability of the UK’s public and private pensions system 💰 2. Risks to assets and liabilities on the balance sheet ⚖️ 3. The growing pressures from climate change 🌍 It also updates the #OBRfiscalrisks register 📋

We published our latest Fiscal risks and sustainability report yesterday 📗 Our 2025 FRS contains chapters on: Pensions 💰 Public balance sheet ⚖️ Climate change 🌍 Along with an update to the #OBRfiscalrisks register

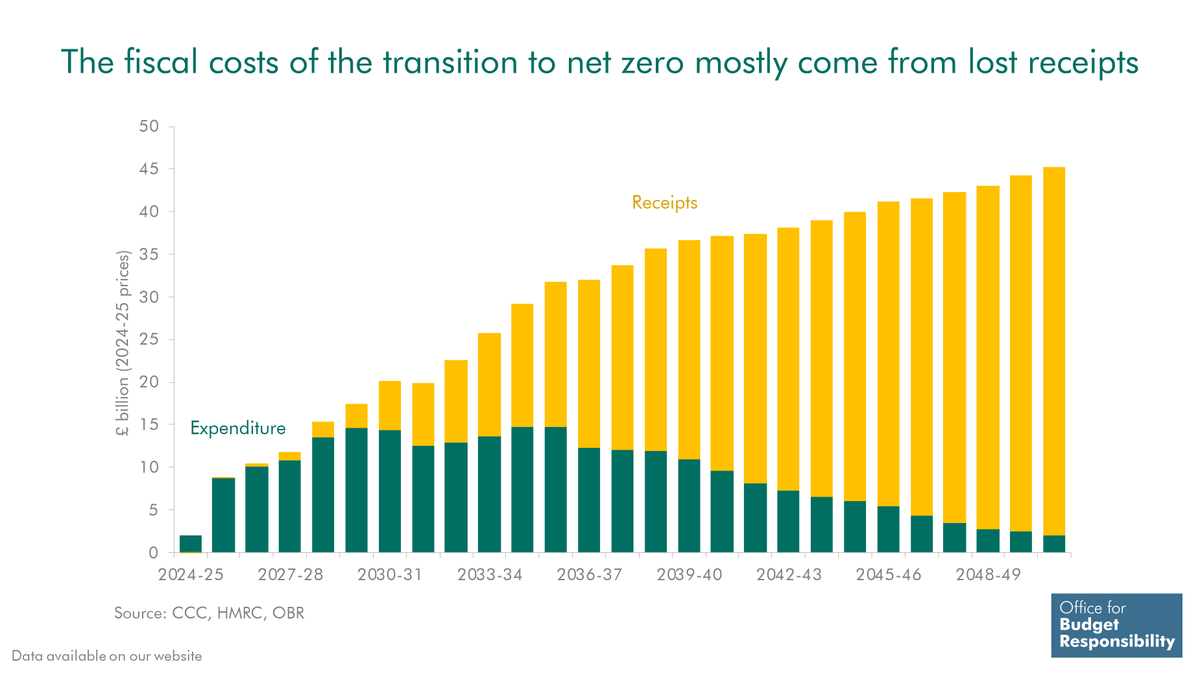

Our central estimate puts the fiscal cost of the transition to net zero by 2050 at 21% of GDP. Two-thirds stems from lost fuel duty and other receipts as electric vehicles replace petrol cars. We also assume government funds 36% of total net zero transition investment…

Public sector net financial liabilities, one of the Government’s new fiscal targets, stand at 83% of GDP. This is more than double the level recorded in 2004-05. Liabilities have risen to 132% of GDP, while financial assets are now 50% of GDP #OBRfiscalrisks

The triple lock has cost around 3x more than expected. In our central projection, the triple lock explains 1.6pts of the 2.7% of GDP rise in state pension spending. If recent volatility persists, it could add a further 1.5pts; a steadier path could reduce it by 1.3pts.…