Cheeezzyyyy

@0xCheeezzyyyy

part-time yapper; janitor @mementoresearch; prev @pendle_fi SWE

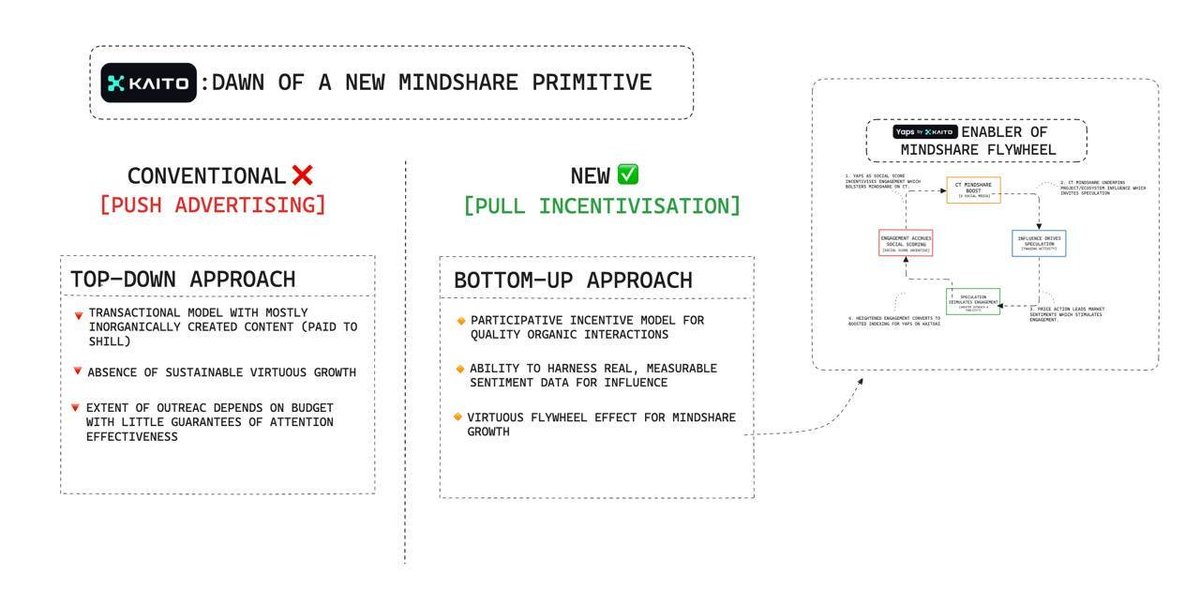

1/ In today’s attention economy, mindshare → influence → value-accrual. Crypto with its peak speculation, offers a massive yet underexplored arena for monetising attention. Few realise, but @_kaitoai is transforming the CT mindshare primitive with yaps. 🧵Personal Insights

$ETH has been pumping and yields in AMMs are peaking this summer! Here is how to earn 18% APY on replicated spot $ETH exposure using @GammaSwapLabs and @AerodromeFi 👇

The Mantle ecosystem has been buzzing for months on end, and yields are juicier than ever. If you’ve been keeping up with my @Mantle_Official yield series, you’ve probably been expecting a third part of the guide. So here’s me bringing you more low risk yields to explore.

Clip below is from a presentation called 'The Road To 80k $ETH: Tradfi, Treasuries, And Trump'... from Mantle's Tim Chen- @tx0zz - that I highly recommend watching if $ETH price appreciation is a subject that interests you :) Is also very interesting re: Mantle... which…

10 Catalysts for Ethena brought to you by @EntropyAdvisors's Data (✍️/10)

Converge quietly went live on @pendle_fi around June 11, but things got real fast. Since then, Pendle's TVL surged, hitting $5.29B (up 23%) and grabbing 58% market share in yield protocols as of mid‑2025 . That’s more than double the activity rolling in —> $7.8B in matured…

Agent Memory ≠ Agent History Here’s how @Infinit_Labs is redefining DeFi automation through coordinated AI agents...and why coordination could be the next competitive edge. [🧵] i/ 𝗪𝗵𝘆 𝗗𝗲𝗙𝗶 𝗔𝘂𝘁𝗼𝗺𝗮𝘁𝗶𝗼𝗻 𝗜𝘀𝗻’𝘁 𝗘𝗻𝗼𝘂𝗴𝗵 DeFi has plenty of automation but…

➥ CT Smart Accounts You Should Follow Pt. 2 Smart Accounts to Follow is back with its second parts. These accounts consistently share insights to help you navigate the chaotic world of Web3. Here's the list (NFA + DYOR): ➠ @YashasEdu - I've known Yashas since the bear market…

Pendle's early integration with @Terminal_fi is more than just another 'yield opportunity'. This signals the dawn of a new financial era: The convergence of TradFi <> DeFi-native primitives at the most foundational level. This is herald by Converge (built on @arbitrum): a…

Pill covered a solid 34% ROE stables strategy using YUSD on @eulerfinance, but there's an even better opportunity available right now... 115% ROE with @Re7Labs' USD1/YUSD Vault👇 here's how to capture it: 1️⃣ Mint YUSD on @aegis_im • use Pill's 10% points booster:…

"single-sided lending is cool and all, but I want to do some leveraged stuff" one thing for sure, you won't be disappointed on @eulerfinance how to go about leveraging @aegis_im YUSD 👇 @Re7Labs' YUSD/USDT vault → mint YUSD → supply YUSD (get 7.92% APY) at 90% LTV, borrow…

InfiniFi Labs is changing the game in decentralized finance by offering innovative ways to boost yields without using leverage segmenting stable assets for better returns while ensuring safety and efficiency in capital use. This protocol is seeing a rapid rise in its metrics…

This whole follower count obsession is backwards thinking. I've watched KOLs with 50-80K followers get ignored by their own community while accounts with 3K followers move markets with a single tweet. The difference isn't numbers - it's trust. You can spot the bought followers…

If I had to pick just one narrative to focus on, it’d be institutional-grade DeFi. That’s why I’m sharing @Terminal_fi, the BlackRock-backed marketplace for institutional asset trading. Terminal has grown to $137M in TVL over days, with ~67% of inflows from @pendle_fi. 🧵

➥ The New Kids On The Block - Digital Asset Treasury Companies In recent months, several Digital Asset Treasury (DAT) companies have burst onto the scene, with some pivoting from their original ventures. What are these companies, and how they works? Let's dive in and find out…

$USDe just pulled in $2B in a week. What was the reason? The simple explanation is yield. @ethena_labs’ offering 10% on sUSDe. Money flows to the highest risk-adjusted return, & right now that's clearly Ethena > USDC, USDT make money when Treasury rates are high > Ethena makes…

Yo if you're just sitting on the sidelines while the market’s doing its thing - don’t let those stables collect dust. There’s some good yield floating around if you know where to look 👀 Check this: @pendle_fi x @aegis_im is lowkey printing right now with $sYUSD. ───────…

When I say ‘gSilo’ my brain pulls up these stats like muscle memory now @SiloFinance is sitting at $520M TVL with a $33.4B addressable market in front of them. 🔷 $53B tvl DeFi lending & Addressable Market: 🔹Total DeFi Lending: $53B TVL 🔹Shared-Pool Protocols: $28.2B (Silo's…

The number one L2 by TVL is @arbitrum at $17B. It has deep app breadth, live fraud proofs, and a maturing governance and treasury. @Mantle_Official is the fourth L2 by TVL, but also one of the fastest-rising Layer 2s. It is built on OP Stack and runs with EigenDA as an…

Constant market adaptation is the cornerstone of a project's PMF strategy in every phase. With the rising RWA wave and robust TradFi capital flowing into DeFi, Pendle is strategically transforming into a pivotal bridge through @ethena_labs and @convergeonchain. So how can…

@Terminal_fi × @pendle_fi × @ethena_labs 👉Why $10B worth of funds are set to flow into Converge? 👉How can you invest in their future early? Duh, thorugh terminal and Pendle 🔹 Converge = An EVM-compatible L1 founded by Ethena and Securitize 🔹 Terminal = The liquidity hub of…

x.com/i/article/1943…

Alpha

Pendle's early integration with @Terminal_fi is more than just another 'yield opportunity'. This signals the dawn of a new financial era: The convergence of TradFi <> DeFi-native primitives at the most foundational level. This is herald by Converge (built on @arbitrum): a…