ℝ𝕦𝕓𝕚𝕜𝕤

@RubiksWeb3hub

I decode protocol economies for the curious, write deep technical threads, and build sustainable models for founders. Business: http://t.me/RuHub121

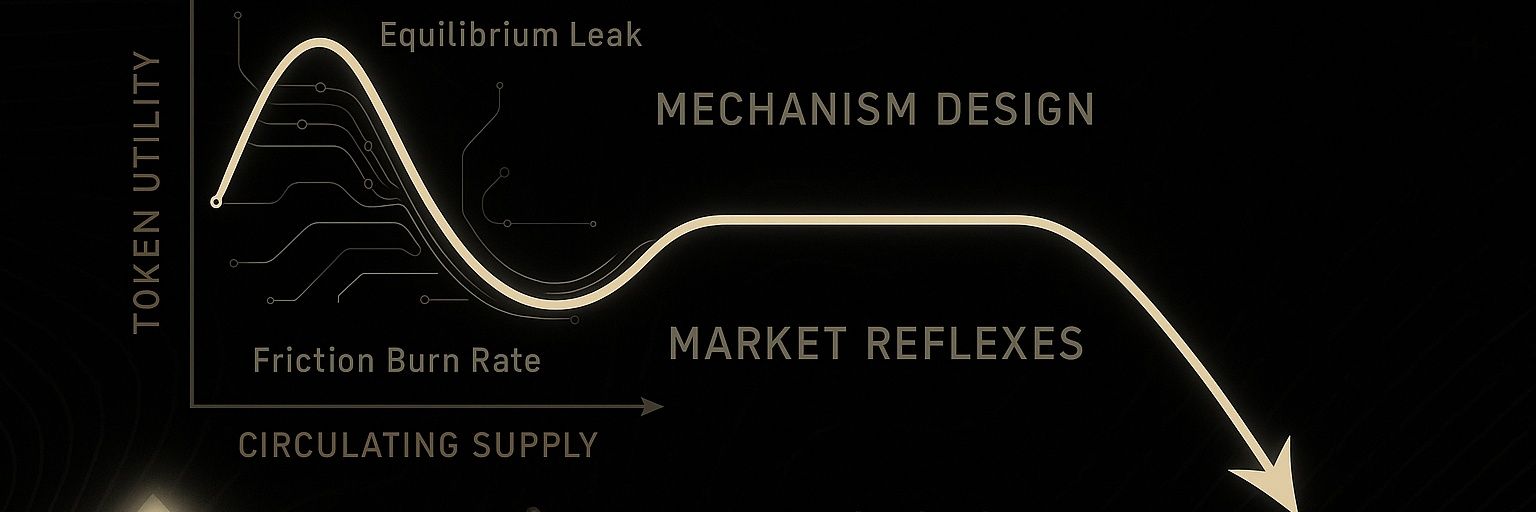

I reviewed a project's Tokenomics few weeks back and it turned out to be shitty! What was missing? The financial cash flow structure. To solve this problem, I came up with "The Tokenomics Circuit" analogy. Curious to know more? Let's dive in! A🧵

One of the things I loved @Mantle_Official about other than those fundamental backings and Institutional flow is Yield. There's so much to capitalize with even on Bybit. You want to earn yield? You're looking for strategies? Mine is a month old, so I recommend @Mars_DeFi post.

The Mantle ecosystem has been buzzing for months on end, and yields are juicier than ever. If you’ve been keeping up with my @Mantle_Official yield series, you’ve probably been expecting a third part of the guide. So here’s me bringing you more low risk yields to explore.

Stablecoin rewards bring composability to loyalty. Earn in one app, spend in another. It is great for users, but tough for businesses. Why? They issue yields or points that end up leaving their ecosystem. Their value exits before it drives retention. But this changes when you…

The searches for stablecoins are surging. People are waking up to their potential. Stablecoins are the product that can onboard the first billion people on-chain.

I had the hell of a day yesterday. So many activities, like every other day. But I thought it was over, until I was about to sleep. I opened my wallet to run a portfolio check and found an asset I had forgotten to withdraw from a HyperEVM pool. It took me a while to remember…

100x returns can only happen in trenches. Gone are those times when it was way easier for everyone. Now those who grind harder get their shot at these 100x returns. Let’s talk about the rise of trenches 🧵

SmolLM3 is here. A powerful open-source AI model you can run locally. It's trained on 11T tokens, supports 128k context, handles multiple languages, and comes with hybrid reasoning. Let’s break down what it is and how it works 👇

A warning for creators: your IP is being stolen. My latest content on @campnetworkxyz has been copied entirely and posted on another platform without permission. They have a 1:1 replica of my profile, including my avatar, bio, content, and even the icons. I don't know how or…

AI’s most powerful creative tools, like Stable Diffusion and Midjourney, are built on scraped datasets containing uncounted works of art, music, video, and photography. No permission. No licensing. No compensation. Just extraction at scale.

The number one L2 by TVL is @arbitrum at $17B. It has deep app breadth, live fraud proofs, and a maturing governance and treasury. @Mantle_Official is the fourth L2 by TVL, but also one of the fastest-rising Layer 2s. It is built on OP Stack and runs with EigenDA as an…

For the past 2 years, Permissionless has been a bullish factor for the Solana ecosystem. I wonder what'll happen this year.

I know we all want the best for @TheoriqAI and many won't talk about this. The change in the Tokenomics is the scariest thing for me right now. If it does well short term, what are the risk off mid term and long term? Generally, it is obvious that most teams don't build nor…

As of now, @SeiNetwork has adopted native USDC and CCTP v2. The integration of @Backpack with Sei is significantly enhancing Backpack's metrics more than anticipated. For instance, the lending market on Backpack Exchange is thriving, with over $413m lent, despite the absence of…

My thoughts: There are a few potential scenarios for the integration between @Backpack and @SeiNetwork: 1. Direct Support of Sei Network on the Backpack Wallet ➜ If this happens, it will be the first time Backpack supports a network other than Solana. Sei could then be…

0/ 11 years ago, the vision for Ethereum was published in the Ethereum Whitepaper. The initial paper included ideas like savings wallets, financial contracts, and financial derivatives. These concepts anticipated what would become known as DeFi.

Perhaps ETH is going back to ATH. And when that happens, you know what/who will follow. Therefore, if you haven't read this, you should. It is a clean-cut comparison of two great L2s, @arbitrum and @Mantle_Official, without bias. Would worth your time to learn something new.

The number one L2 by TVL is @arbitrum at $17B. It has deep app breadth, live fraud proofs, and a maturing governance and treasury. @Mantle_Official is the fourth L2 by TVL, but also one of the fastest-rising Layer 2s. It is built on OP Stack and runs with EigenDA as an…

Airdrops I'm Currently Farming Alright my bros... here's everything I'm currently focused on airdrop-wise :) Lighter_xyz - perps dex generating much excitement lately OstiumLabs - perps dex that also lets you trade tradfi assets TradeNeutral - yield/structured products…