DeFi Mago

@defi_mago

DeFi Research | @Dune Data Wizard 🧙♂️. Turning On-Chain Chaos into Visual Alpha | Vibing with LST/LRT

🔴 @SeiNetwork has been on an absolute heater this past year. ─────── • Daily active users: from ~1.3K → 685K+ (that’s 500x, lmao) • Transactions: 57K/day → 1.65M/day (28x) • Protocols: more contracts, more activity – LSTs, RWAs, stablecoins, lending, you name it…

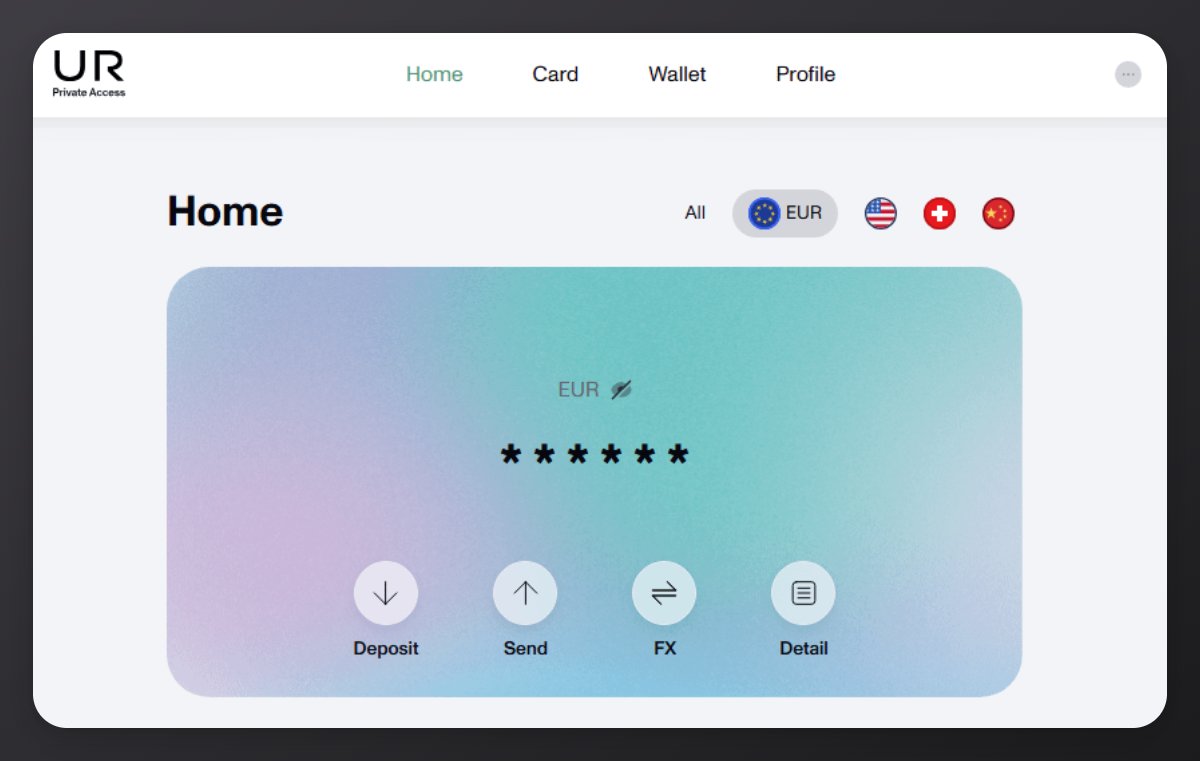

Been keeping tabs on @Mantle_Official lately! Love the “Blockchain for Banking” angle they’re pushing, all about security, scale, and privacy. Clean narrative! Got myself early access "The Mantle UR Beta Access Initiative" by @URNeobank. So what is UR? UR = “You Are”, the…

The Mantle ecosystem has been buzzing for months on end, and yields are juicier than ever. If you’ve been keeping up with my @Mantle_Official yield series, you’ve probably been expecting a third part of the guide. So here’s me bringing you more low risk yields to explore.

One month. That’s all July gave @SeiNetwork , and it ran with it. 🧵🪡

🎇 @OriginProtocol ARM S Vault just went live on @SonicLabs, it’s a sweet play if you’re holding $S and wanna farm yield from LST peg volatility. What’s the deal? ARM = Automated Redemption Manager → basically, it farms when OS depeg a bit. • When OS dips below peg, ARM…

Yo if you're just sitting on the sidelines while the market’s doing its thing - don’t let those stables collect dust. There’s some good yield floating around if you know where to look 👀 Check this: @pendle_fi x @aegis_im is lowkey printing right now with $sYUSD. ───────…

Pill covered a solid 34% ROE stables strategy using YUSD on @eulerfinance, but there's an even better opportunity available right now... 115% ROE with @Re7Labs' USD1/YUSD Vault👇 here's how to capture it: 1️⃣ Mint YUSD on @aegis_im • use Pill's 10% points booster:…

"single-sided lending is cool and all, but I want to do some leveraged stuff" one thing for sure, you won't be disappointed on @eulerfinance how to go about leveraging @aegis_im YUSD 👇 @Re7Labs' YUSD/USDT vault → mint YUSD → supply YUSD (get 7.92% APY) at 90% LTV, borrow…

Pendle's early integration with @Terminal_fi is more than just another 'yield opportunity'. This signals the dawn of a new financial era: The convergence of TradFi <> DeFi-native primitives at the most foundational level. This is herald by Converge (built on @arbitrum): a…

Circle's USDC and CCTP v2 have officially launched on @SeiNetwork • USDC = most trusted + regulated stablecoin. • @SeiNetwork = fastest + cheapest L1 out there. Why’s this a big deal? > @circle actually invested in Sei early (yep, they even mentioned Sei in their IPO…

Native @USDC and CCTP V2 by @circle are live on @SeiNetwork! The fastest L1 now offers native access to the world's largest regulated stablecoin. USDC Moves Faster on Sei. ($/acc)

We are excited to announce that @MEXC_Official will be the first to list $AMPED 🫡 The protocol comes to life tomorrow. $AMPED yield is backed by real usage. With $800k+ in fees, $AMPED stakers will take their share. Buy $AMPED now before the listing at get.amped.finance!

🔔 #MEXC New Listing 🔔 🔹 $AMPED @AmpedFinance 🔹 $AMPED/USDT Trading: Jul 25, 2025, 14:00 (UTC) 🔹 Deposit: Opened 🔥 The $AMPED airdrop+ campaign is heating up! Join to share 1,041,520 $AMPED & 15,000 $USDT! 👉 Join airdrop+: mexc.com/token-airdrop/… 👉Learn more:…

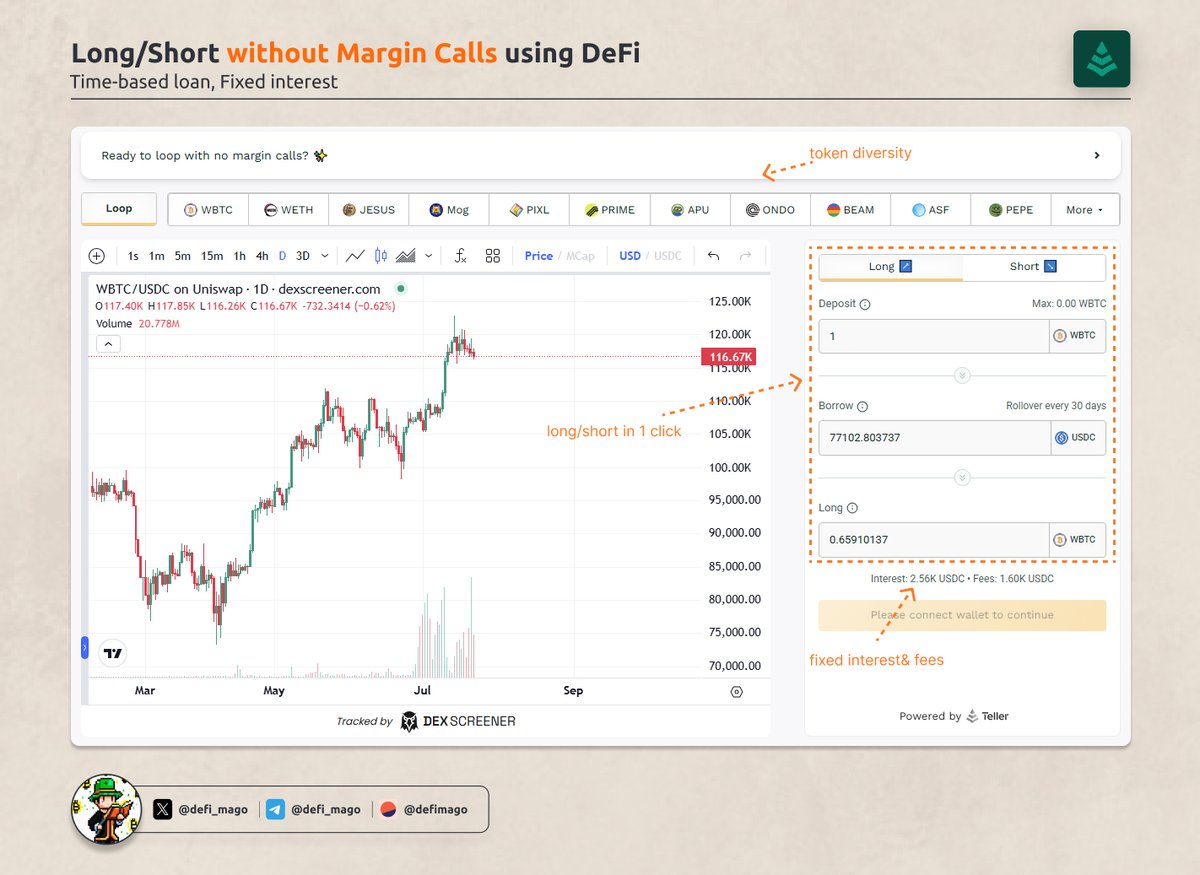

Wanna long or short without stressing over margin calls or liquidations? Normally, there is a way to long/short using DeFi: Lend → Borrow → Loop = Leverage But, this kinda setup has 2 headaches: • APR can jump around • Price swings can get you liquidated So how to avoid…

$1.4T stablecoins by 2030. That’s not a prediction, it’s a countdown. SEI = launchpad. Seatbelts recommended. @SeiNetwork

Stablecoins are reaching escape velocity. The total market is projected to 5x by 2030, reaching $1.4T. At that scale, it's clear why Sei is becoming the preferred base layer for stablecoin expansion. Markets Move Faster on Sei. ($/acc)