Mr. VIX

@yieldsearcher

fmr distressed credit analyst who loves macro and global affairs. NOT a flow guy, so NO trading/investment advice here. Korean American.

I am happy to follow folks who have interesting and unique things to say, and I am happy to engage w/ folks who appreciate mine regardless of size Goal is to have fun and engage in interesting convo. # of follower to me is a sign of natural progression, never the goal itself.

It is true that Japanese OEs are getting a better deal than US OEs here, in large part due to Japanese govt subsidies. Would be hard to imagine Mexican govt stepping up to help out GM and F. That said, two things to consider 1. I have to imagine there will be some carrots given…

“GM is financially better off just buying Toyota’s directly from Tokyo, changing the logo, and reselling them for 5% higher. Rather than paying 50% steel tariffs, 50% aluminum tariffs, 50% copper tariffs, 25% Canada tariffs, and 25% Mexico tariffs.” 😭🤣

US BESSENT: 15% FOR JAPAN AUTOS IS A DIFFERENT KIND OF DEAL; JAPAN GOT 15% DUE TO INNOVATIVE FINANCING MECHANISM

June’s 9% yoy decline in Chinese steel output points to ongoing deflationary pressures in the Chinese economy. Interestingly, though, Chinese and Singaporean iron ore traders are calling a trough here. Past data vs forward expectation Iron ore 1yr px chart below

CHINA CRUDE #STEEL OUTPUT FALLS 9.2% TO 83.2 MLN T IN JUNE 2025 VS JUNE 2024 GLOBAL CRUDE STEEL OUTPUT FALLS 5.8% TO 151.4 MLN T IN JUNE 2025 VS JUNE 2024 - WORLDSTEEL mktnews.com/flashDetail.ht…

No comment

Let me just add this to the water table… Bill Pulte would be an exceptional pick to run the Federal Reserve. He is crushing it at Fannie/Freddie and deeply understands rates. I think the next Fed Chair needs to be: someone who understands rates because they actively…

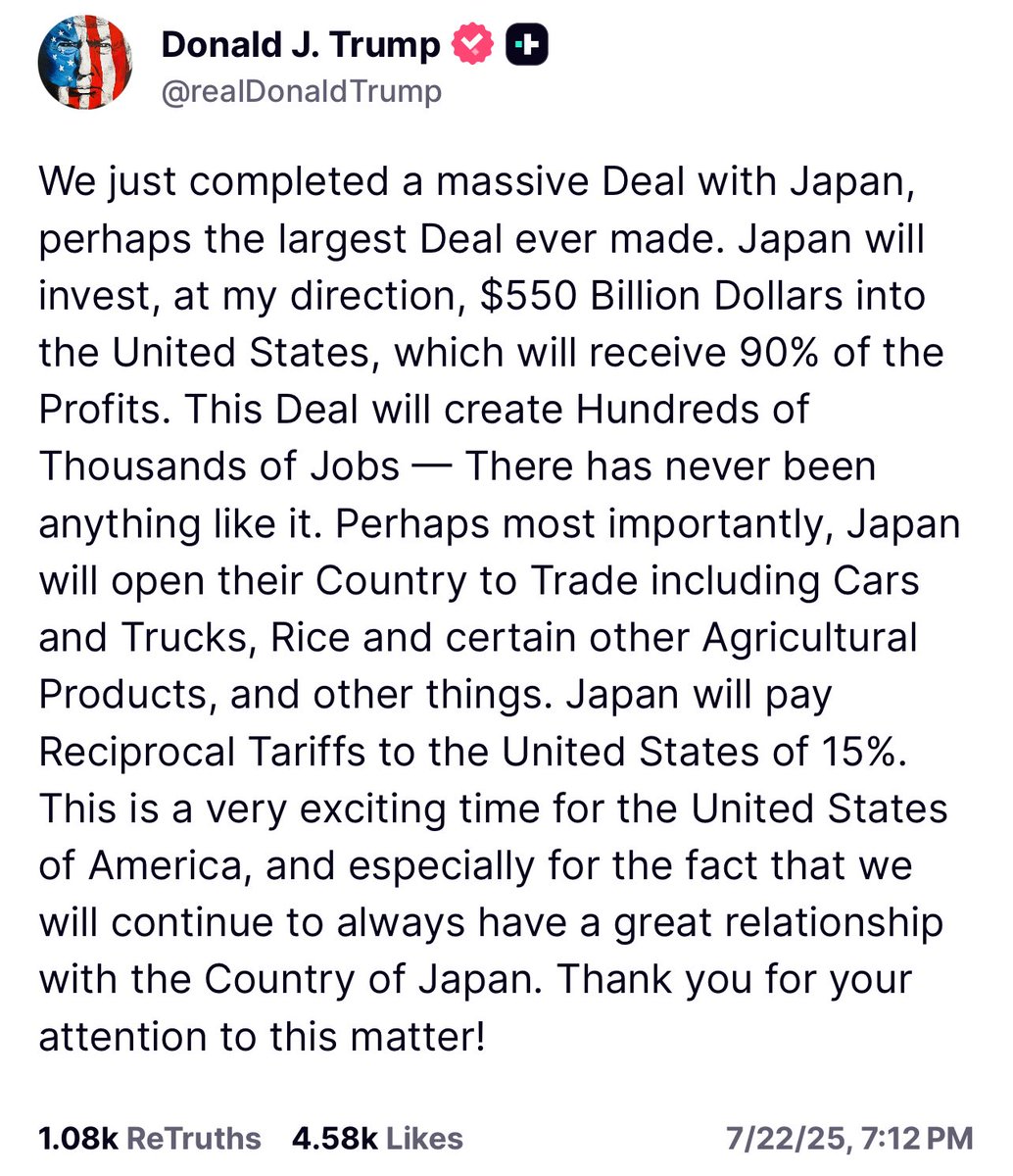

Fundamentally speaking, a $500b transfer from the Japanese govt to the US is negative for JGBs and positive for USTs. (And to those who think this $500b is a meaningless antic, let’s just say the Japanese bond market strongly disagrees with you.) But the global financial…

Mind you, this is being released exactly as a critical 40Y JGB auction is underway Very very signature 🤡Ishiba thing to do

🇯🇵🤡Ishiba to resign by end of August

This may not come intuitively to many, but in Japan, taking the fall - or becoming the scapegoat - for the good of the group is considered a very noble act. Seppuku and kamikaze are some extreme examples from its history, and that collectivist mentality continues to permeate in…

*ISHIBA AVOIDS ANSWERING QUESTION ON WHETHER HE WILL STAY AS PM

US autos love tariffs now? Where have they been?

Detroit's Big Three Automakers Oppose U.S.-Japan Trade Deal, Says Trade Group

Meaningful bear flattening in Japanese yield curve. (5/10/30Y) TBD whether this carries over to Europe and US overnight. So far, US rates are pretty tame, up ~1bp across the tenor

Another way to frame this: Japanese govt will be subsidizing a big portion of the tariffs that corps will otherwise pay This is why Nikkei is rallying big time up nearly 2%. This is a partial bailout by the Japanese govt that adds 12% GDP worth of obligation to its balance…

Another way to frame this: Japanese govt will be subsidizing a big portion of the tariffs that corps will otherwise pay This is why Nikkei is rallying big time up nearly 2%. This is a partial bailout by the Japanese govt that adds 12% GDP worth of obligation to its balance…

Japanese auto companies shares are up on the news guarantee you see huge carb outs or auto technology, etc.

My analytics are separate from trading recommendations. But I do suspect market will be unpleasantly surprised by the impact these tariffs will have on corporate margins either this quarter (with q3 guidance) or next quarter (when they actually see the numbers). GM -8% today.…

It always best to a first mover. They get the best deals! The smaller Asian countries are terrified of China and of losing US markets share.

American market doesn't care, but Japanese one definitely does!

Bad certainty is better than lack of certainty, so I expect a positive mkt reaction. But the marginal move suggests that either mkt is kinda waiting for full details and/or is appreciating the scale of value extraction at hand here. Japan’s export is $150b/yr. Now replicate this…

Have to say. I did not expect Japan to be the first to cut a deal. I thought they’d be the last. But in any case… - 15% is 5% higher than what is currently being collected, but lower than the 25% the US had threatened. - Japan exports $150b to the U.S. annually. At 15%, that…

Have to say. I did not expect Japan to be the first to cut a deal. I thought they’d be the last. But in any case… - 15% is 5% higher than what is currently being collected, but lower than the 25% the US had threatened. - Japan exports $150b to the U.S. annually. At 15%, that…