wonkmonk

@wonkmonk_

"The ultimate, hidden truth of the world is that it is something that we make, and could just as easily make differently." - David Graeber

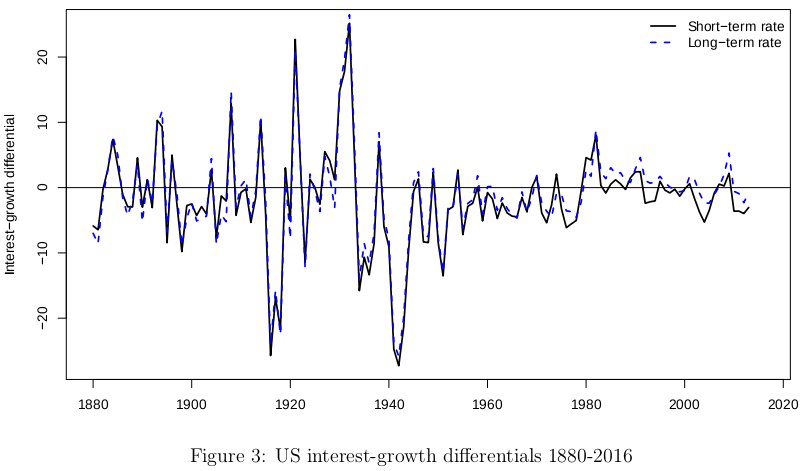

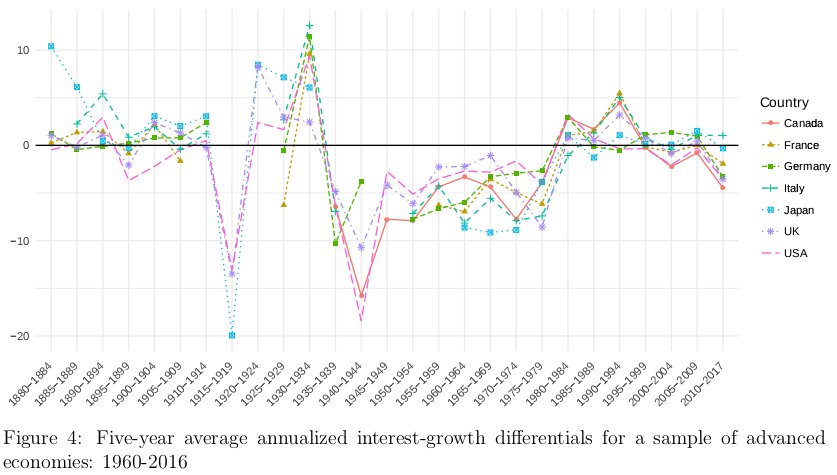

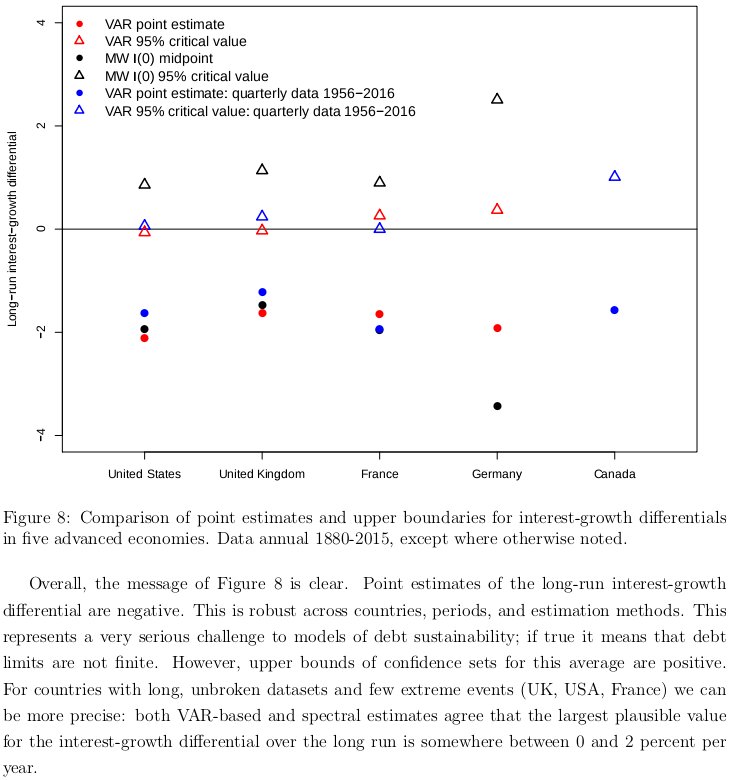

IMF: Interest-Growth Differentials and Debt Limits in Advanced Economies imf.org/en/Publication… neweconomicperspectives.org/2013/01/functi… cc: @stf18

The $12 Trillion US Repo Market: Evidence from a Novel Panel of Intermediaries federalreserve.gov/econres/notes/…

The International Role of the U.S. Dollar – 2025 Edition federalreserve.gov/econres/notes/…

Sun Machines: Solar, an energy source that gets cheaper and cheaper, is going to be huge economist.com/interactive/es…

Why does the average consumer feel worse off? Because 41% of consumer spending goes to: housing, utilities, healthcare, medications, and insurance. This was 16% in 1947, 30% in 1980, and 35% in 1990. Fewer consumer dollars are left for true discretionary spending.

David Autor: We Warned About the First China Shock. The Next One Will Be Worse. nytimes.com/2025/07/14/opi… archive.is/NIBMJ

The National Debt (That Isn’t): @StephanieKelton (2021) milkenreview.org/articles/the-d… "The truth is, the entire national debt could be paid off tomorrow, and none of us would have to chip in a dime."

NYT editorial: "The expected increase in the debt is particularly absurd because the government would borrow much of the money from the same people who got the biggest tax cuts from the bill. Instead of taxing the rich, the government pays them interest." nytimes.com/2025/06/27/opi…

Foreign Capital Inflows Don’t Lower U.S. Interest Rates: @michaelxpettis carnegieendowment.org/china-financia…

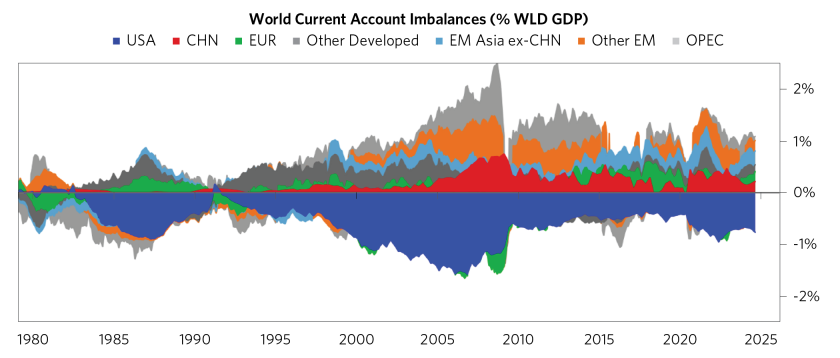

1/8 Robert Skidelsky, who has written great books on Keynes' life and work, wrote (with Vijay Joshi) a really good essay—way back in 2010—on the problems of unbalanced trade, and why Keynes' bancor proposal at Bretton Woods made so much sense. @RSkidelsky robertskidelsky.com/2010/06/23/key…

1/6 Martin Wolf's “pluto-populism”: the rich receive most of the goodies; the poor become poorer; and the fiscal deficit stays huge. The "supply-side" argument in favor of income inequality is that because the rich save more of their income than do... ft.com/content/31f40b…

Martin Wolf: Why global imbalances do matter ft.com/content/e2c8c6… Rebalancing the world economy: Right idea but wrong approach (2025) brookings.edu/articles/rebal… Trade Intervention for Freer Trade (2024) carnegieendowment.org/research/2024/…

How gold became the world’s refuge from uncertainty ft.com/content/97fd4d… archive.ph/xUEpH In an era where core assumptions about the global economy are being questioned, gold has once more become an anchor — especially for central banks

Bridgewater: We’re All Mercantilists Now bridgewater.com/research-and-i…

Many may wonder what _False Dawn_ could possibly reveal about the New Deal and the U.S. Great Depression that they don't already know. So here's a brief list of some things that may qualify. press.uchicago.edu/ucp/books/book…

Class Consciousness for Billionaires (2024) newyorker.com/magazine/2024/… We used to think the rich had a social function. What are they good for now? As Gods Among Men: A History of the Rich in the West (2024) press.princeton.edu/books/hardcove… #book

Quentin Skinner: Liberty as Independence: The Making and Unmaking of a Political Ideal (2025) doi.org/10.1017/978113… #book newbooksnetwork.com/liberty-as-ind… #podcast #interview

"in 1926 when Congress allowed oil companies to deduct their taxable income by 27.5% of their sales." Senator Tom Connally: "We grabbed 27.5% because we were not only hogs but the odd figure made it appear as though it was scientifically arrived at." nytimes.com/2025/05/26/bus…

Peter Orszag: "It is hard to find any modern economy with a freely floating exchange rate and debt denominated in its own currency, both of which the United States enjoys, that has defaulted on its debt." nytimes.com/2025/05/26/opi…

Jason Resnikoff: Labor's End: How the Promise of Automation Degraded Work (2022) press.uillinois.edu/books/?id=25bh… #book youtube.com/watch?v=Ep0L17… #interview The End of Work as We Know It? (2024) youtube.com/watch?v=0rOFbU… #lecture

Martin Wolf: Trump’s assault on the global dollar ft.com/content/d96568… archive.is/dcw8T The difficulty is that, however unsatisfactory the hegemon might be, the alternatives look worse

Martin Wolf: The challenge of using excess global savings ft.com/content/c71591… archive.is/iXbQI We now seem unable to turn the surplus in some countries into productive investment elsewhere