Eric Basmajian

@EPBResearch

Business Cycle Analysis For Asset Managers & Cyclical Business Owners

I write short blog posts almost every week on key Business Cycle trends. Clear, data-driven updates that help make sense of where the economy is heading. Read by more than 9,000 investors and business owners. You can sign up for free here: epbresearch.substack.com

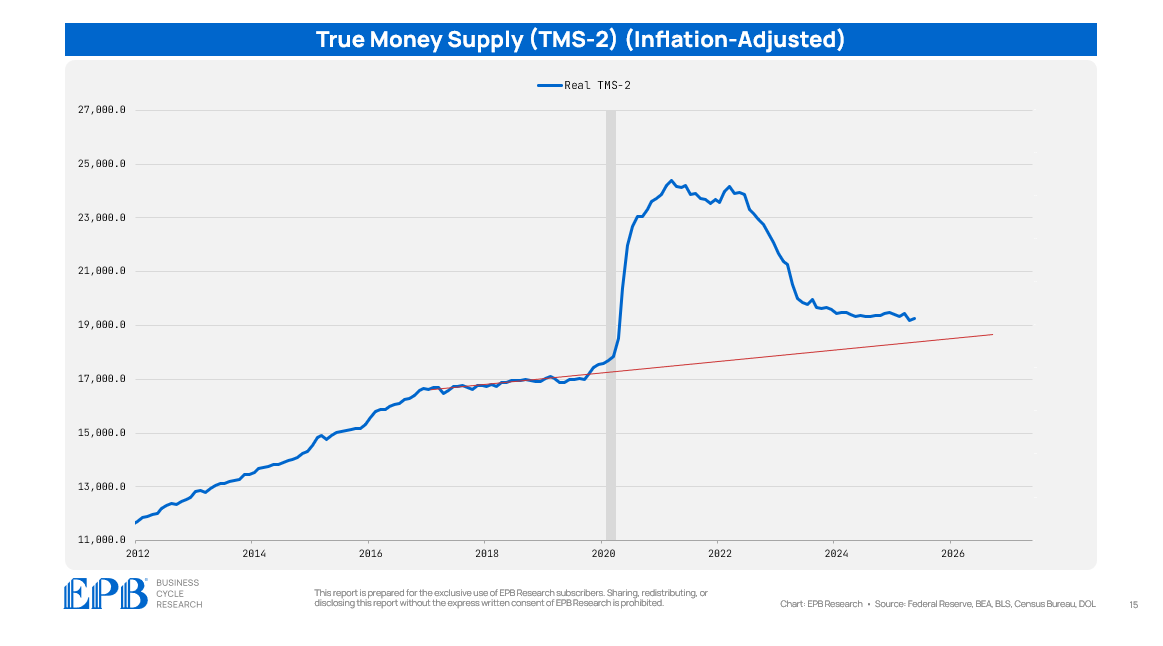

Real Money Supply Is Still Contracting - And Housing Is the Next Domino Despite a continued decline in real true money supply, excess from past stimulus remains. A further contraction will push tightening effects deeper into the business cycle. epbresearch.substack.com/p/real-money-s…

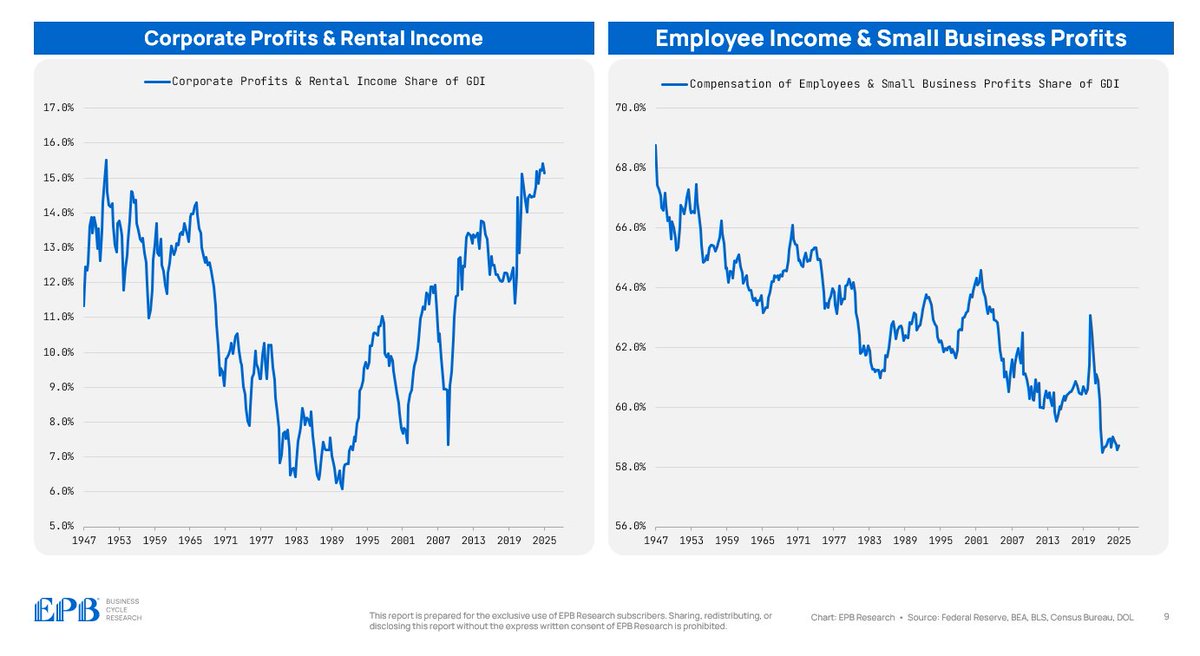

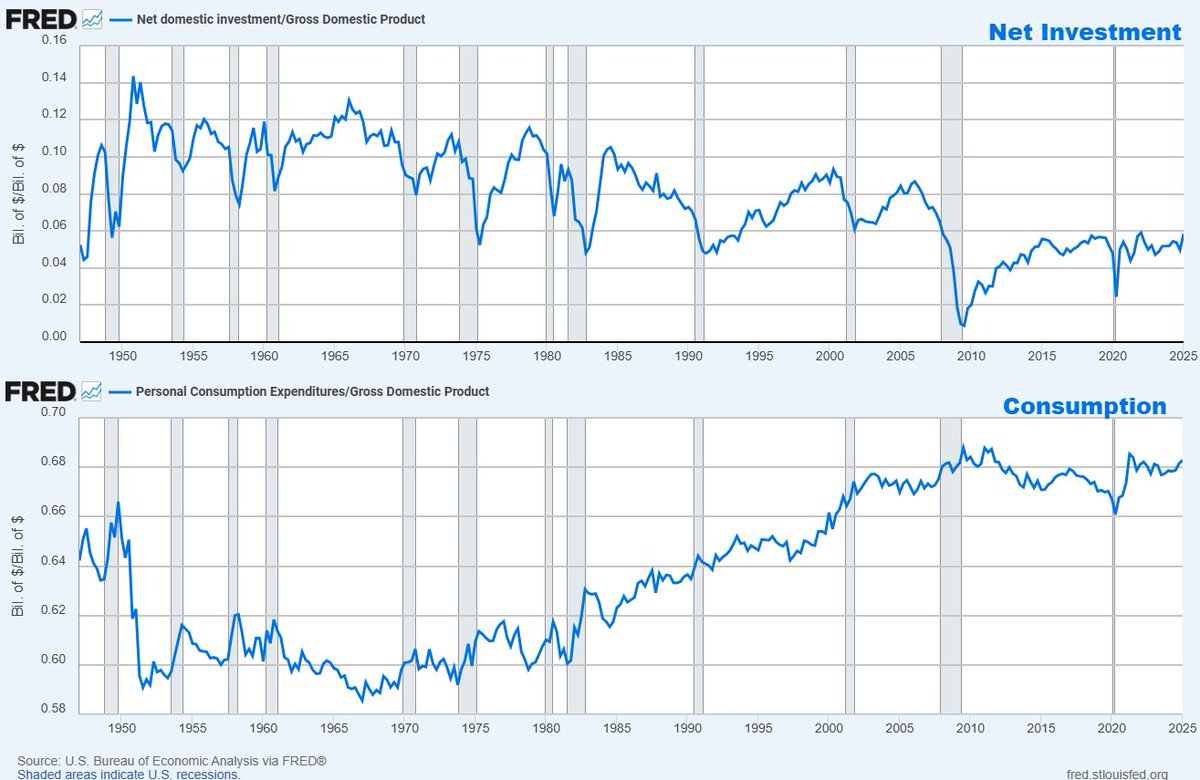

The US Economy has about $30 trillion of gross domestic income. That $30 trillion flows to various places, such as: * Employee compensation * Small Business Profits * Corporate Profits * Rental Income (Landlords) * Taxes Over time, a larger share of total income is flowing to…

Without increased government intervention or increased government size, how would you shift the economy towards more investment and less consumption?

When using money supply as a leading indicator, should you include money market funds? We say no in this post 👇 Although a healthy debate emerged.

I write blog posts almost every week on key Business Cycle trends. This week we dove into real money supply and the impact of an ongoing contraction on the housing market. You can read that post here: open.substack.com/pub/epbresearc…

I write blog posts almost every week on key Business Cycle trends. This week we dove into real money supply and the impact of an ongoing contraction on the housing market. You can read that post here: open.substack.com/pub/epbresearc…

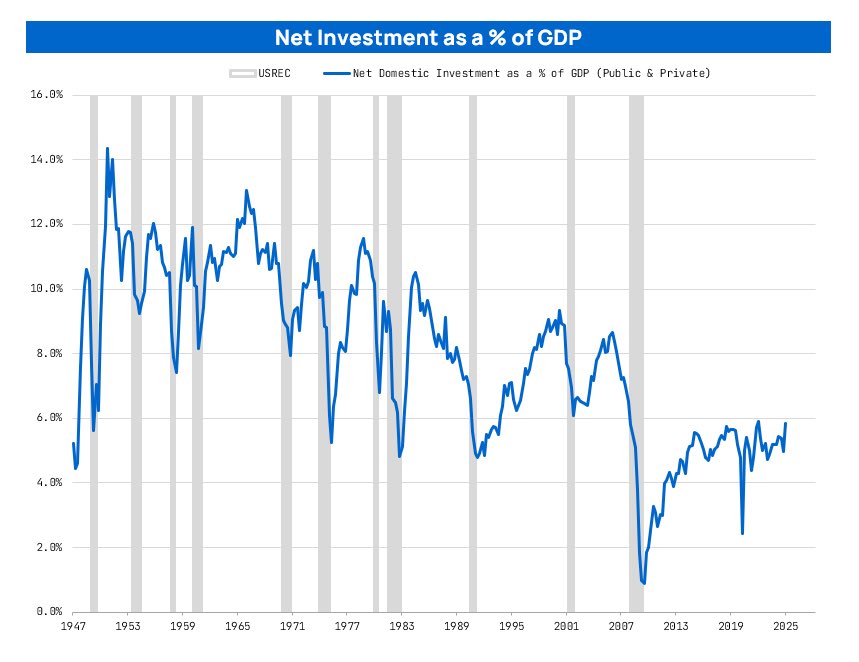

Net investment as a % of GDP has collapsed from over 12% in the 1960s to just 4–5% today. We’re eating the seed corn and calling it growth.

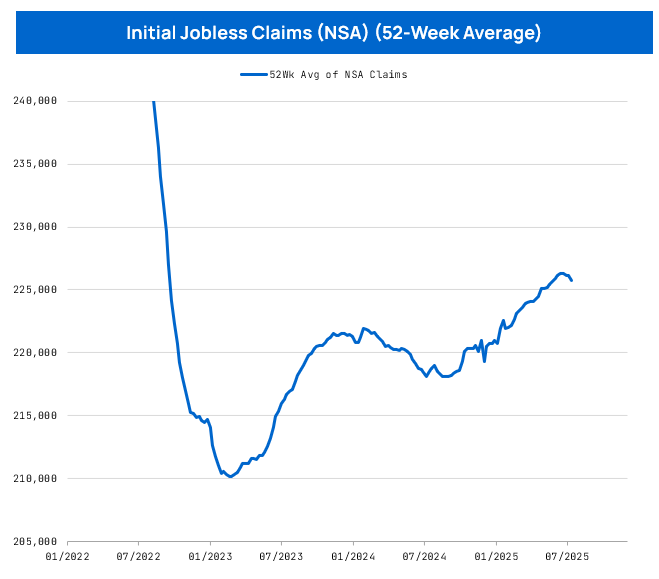

The 52-week rolling average of NSA jobless claims ticked down in recent weeks.

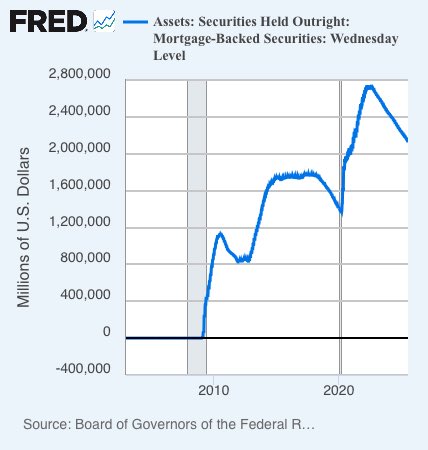

With housing affordability a primary issue, should the Fed be holding mortgage-backed securities?

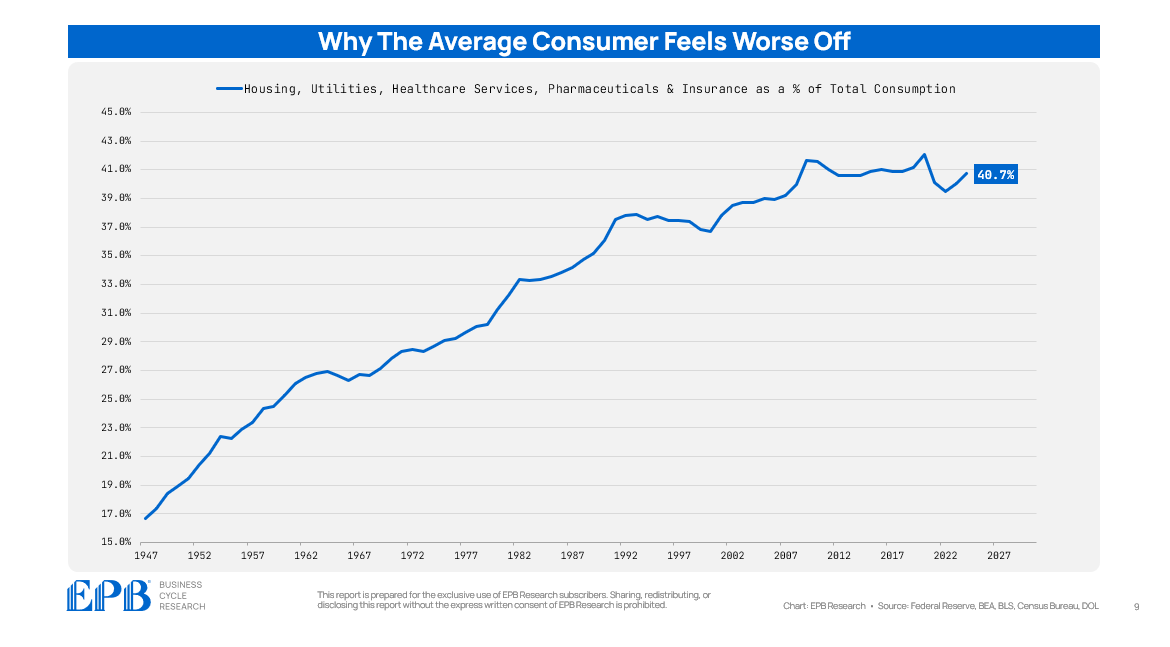

Why does the average consumer feel worse off? Because 41% of consumer spending goes to: housing, utilities, healthcare, medications, and insurance. This was 16% in 1947, 30% in 1980, and 35% in 1990. Fewer consumer dollars are left for true discretionary spending.

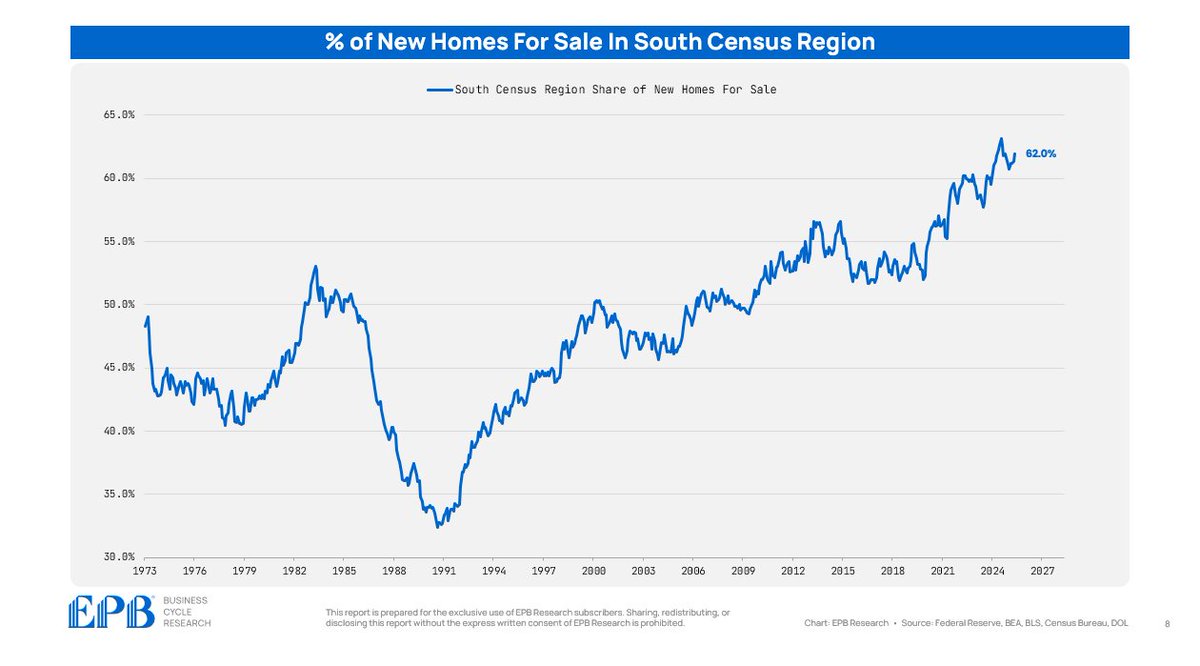

Of the new homes listed for sale, 62% are in the South Census region.

Residential employment is becoming more remodeling and less new builds.

Residential building is one of the most important categories of employment for the business cycle. Residential building includes single & multi-family building as well as remodelers. Remodeling has increased from 30% to nearly 50% of total residential building employment.

Is it sustainable for an economy to invest in intellectual property but not physical assets like structures and equipment? Can you invest in AI (IP) without more grid capacity (structures)? What are the implications of robust IP investment but depreciating physical assets?

How much money does the government spend per person, adjusted for inflation (2025 dollars)? 1965: $10,400 1975: $15,500 1985: $18,400 1995: $20,100 2005: $23,700 2015: $25,800 2025: $31,000 *this federal, state and local government spending per capita, adjusted for inflation.

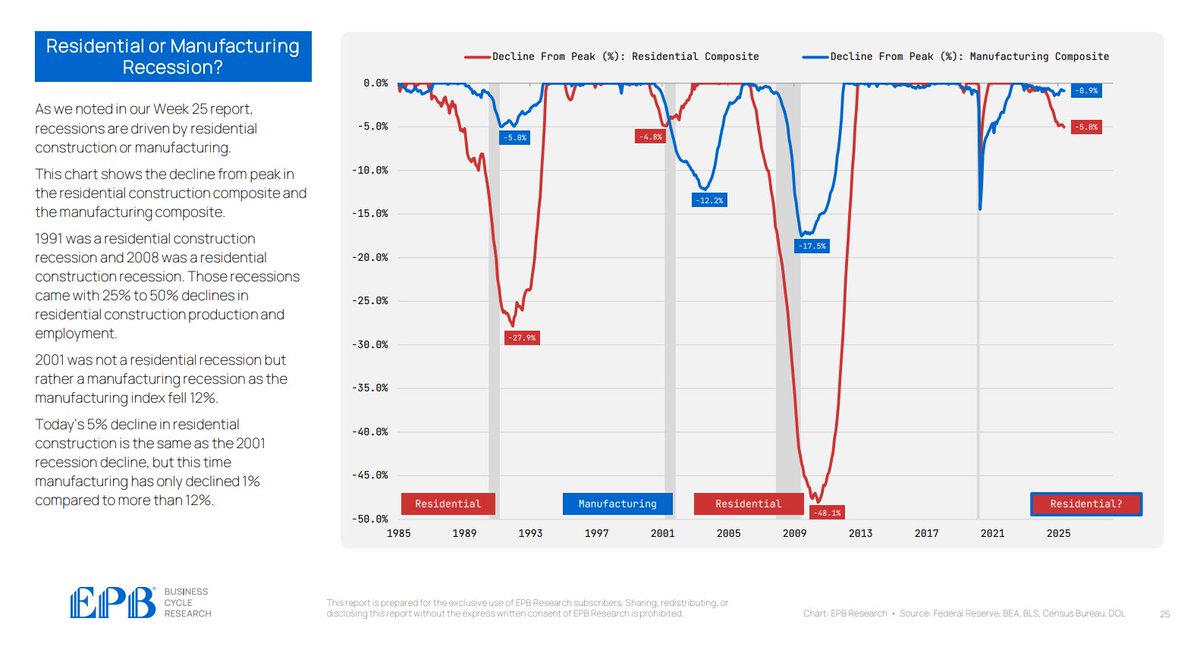

Recessions are always driven by residential construction or manufacturing. Residential leads in almost all cases, which is what we see today, although the magnitude of the decline remains small...for now. This was a key topic in our June Business Cycle Trends Update.