Sam Berridge

@strikeextent

Commodities | Fund Manager | Mining & Energy Investment | Geologist | Navigating the future of natural resources

FT - Gold has overtaken the euro as the world’s second most important reserve asset for central banks, driven by record purchases and soaring prices, according to the European Central Bank. Bullion accounted for 20 per cent of global official reserves last year, outstripping the…

"When Origin Energy pulled out of the Hunter Valley Hydrogen Hub in NSW, Bowen stepped in to prop it up with another $432m in taxpayer cash. The idea of this project is to supply green hydrogen to Orica’s ammonia plant in Newcastle. But look closely and you learn all this cash…

This is going to matter in Australia - lead times for gas turbines blowing out, and as usual we're late in joining the queue: “if we want to build a new gas-fired generation facility…we can’t get it online until 2032.” publicpower.org/periodical/art…

Thanks to @FootnotesGuy and @EnergyWrapAU for throwing some sunlight on this. Turns out the CIS is a mechanism by which Australian tax payers are funding European multi-nationals, using Chinese-made goods to make Australian energy more expensive.

As promised, there's a plot twist on this question about CIS funding curtailment. The first 6GW of generation contracts of CIS did get funded for curtailment. So @simonahac is dead wrong about this blanket claim. But CIS is changing... maybe? 1/

This thread is…

"No, you're wrong, because my friend in high public office assured me in private that I'm right." This is the "SHaC excuse" for ignoring uncomfortable facts. Last week @simonahac tried it on @EnergyWrapAU, who patiently and exquisitely dismantled Simon from public sources. 1/

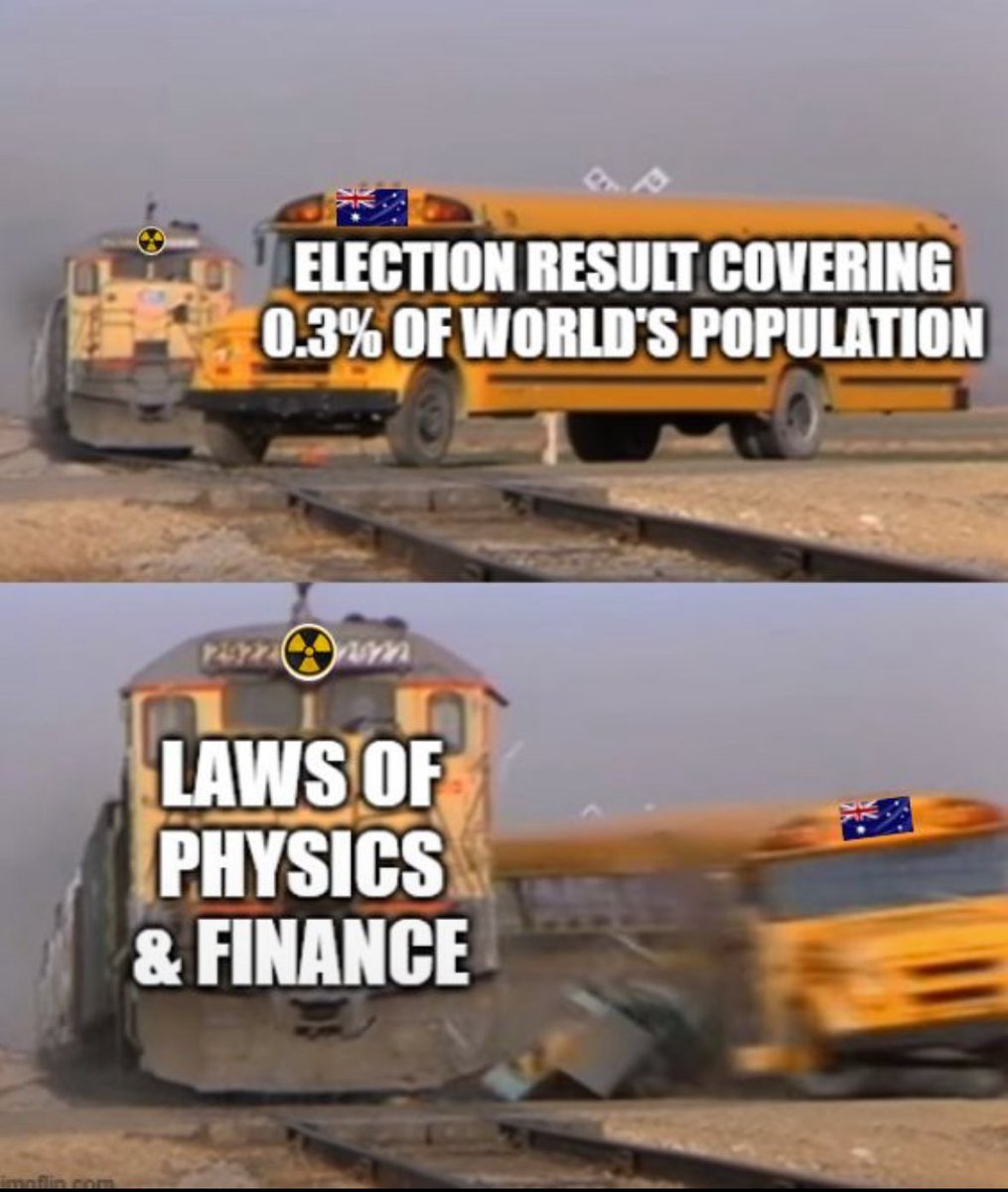

Quick snapshot of the accelerating return to nuclear which is occurring within the cradle of intermittent energy - Europe. Countries which have taken tangible steps towards either re-introducing or increasing the proportion of nuclear in its future energy mix include: ◾…

MUST READ 🧐 German heavy industry emphasises the need for more competitive energy prices in strongly worded letter to Chancellor Merz: "If the energy transition is an open-heart operation on our economy, as is sometimes said, then this operation has so far been a complete…

Great thread, and as usual @FootnotesGuy is 🎯🎯🎯

Every week @DavidOsmond8 does this copperplate simulation, demonstrating a net-zero grid is quite achievable and affordable. Slowly, as energy literacy improves, I think he'll succeed in proving the opposite. Let's chat through some charts. 1/

Every week @DavidOsmond8 does this copperplate simulation, demonstrating a net-zero grid is quite achievable and affordable. Slowly, as energy literacy improves, I think he'll succeed in proving the opposite. Let's chat through some charts. 1/

Thread: Each week I run a simulation of Australia’s main electricity grid using rescaled generation data to show that it can get very close to 100% renewable electricity with 24GW/120GWh of storage (5 hrs at av demand) Results: Last week: 85.0% RE Last 201 weeks: 98.5% RE (1/5)

Was wondering why it took so long for obviously sub-economic projects to be canceled…

Crucial. 👇 The ‘private investors’ in offshore wind weren’t idiots who failed to notice that it doesn’t stack up. The proposals were paid for by public money from the get-go. “Pre-feasibility” Smart guys who will happily get paid to polish a turd they can walk away from.

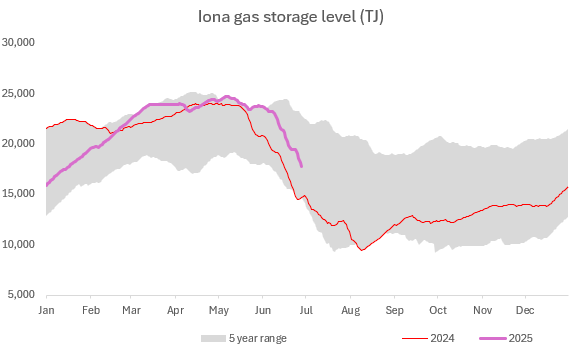

All of a sudden, gas balances in Victoria are looking very tight. The Iona gas storage facility in Victoria is ground zero for any gas shortage which occurs. This facility can inject about 500TJ/d a day of gas into the network. For context Longford, the gas plant which all of…

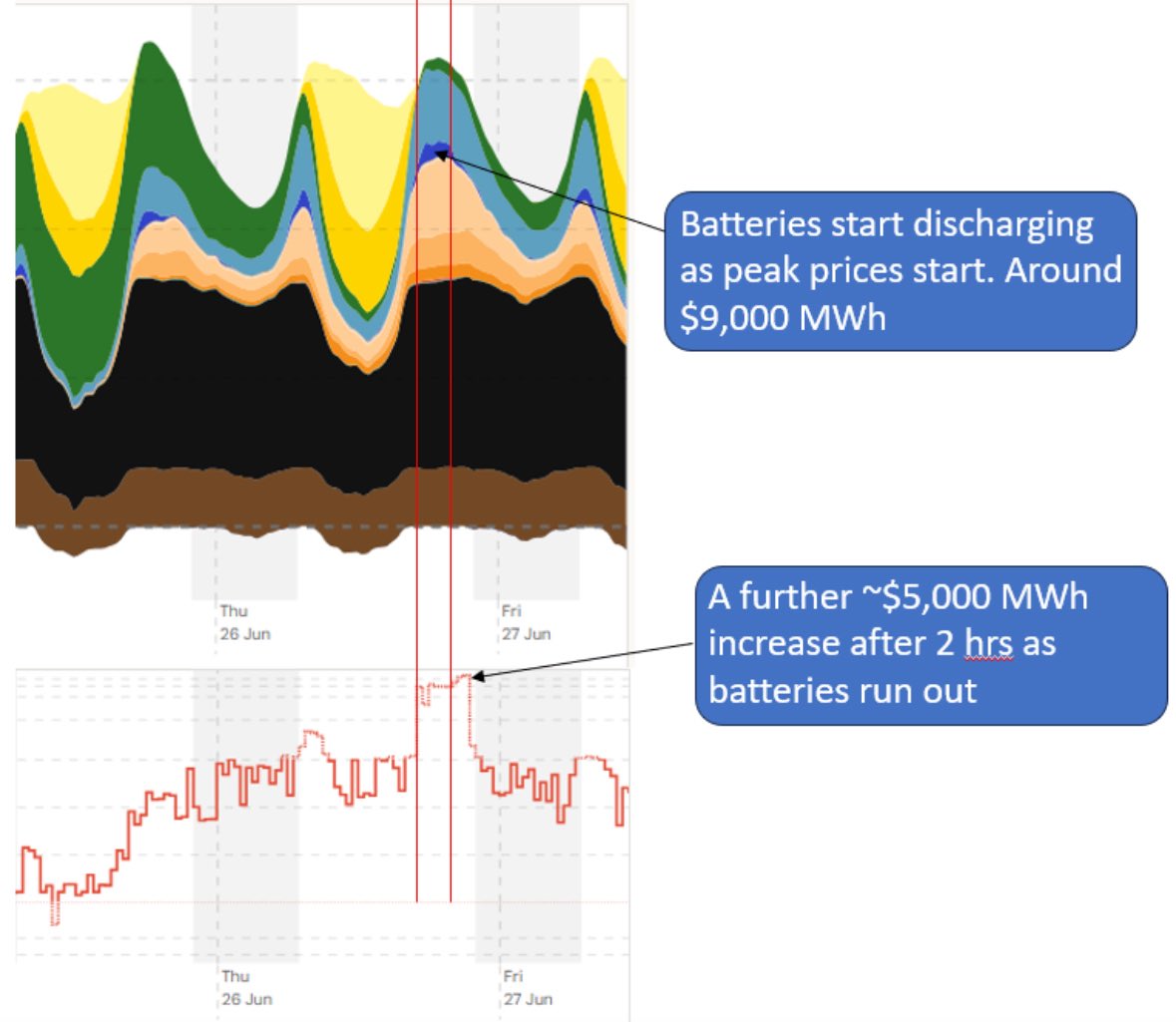

We flagged dispatchable generation as an industry with structural tailwinds a while ago. Last night gave a snapshot as to why. Overnight prices (Thurs) reached eye-watering levels across the NEM, as calm conditions resulted in shortages of dispatchable power generation. While…

#Australia has a financing problem for the 23 GW of wind and solar it needs to build by 2030. It would be nice if #superfunds came to the party, because the big #gentailers won’t.. reneweconomy.com.au/australia-want…

#Australia has a financing problem for the 23 GW of wind and solar it needs to build by 2030. It would be nice if #superfunds came to the party, because the big #gentailers won’t.. reneweconomy.com.au/australia-want…

7-8 year lead time for new gas turbines… The race for dispatchable generation is on and Australia is trying to figure out how to tie its laces.

GB is facing the imminent retirement of 10 GW of CCGTs built in the 1990s @neso_energy thinks it will keep all of the existing 35 GW fleet of CCGTs and OCGTs in reserve for use 5% of the time by 2030 But a third of the fleet is very old and effectively at the end of life And…

Citi released it's contribution to the forecast rise of robots this week. Lots of great charts, but this matrix on payback periods jumped out. Assuming comparable competence between humanoid robots and domestic staff, the payback period in already below 12 months at the lowest…

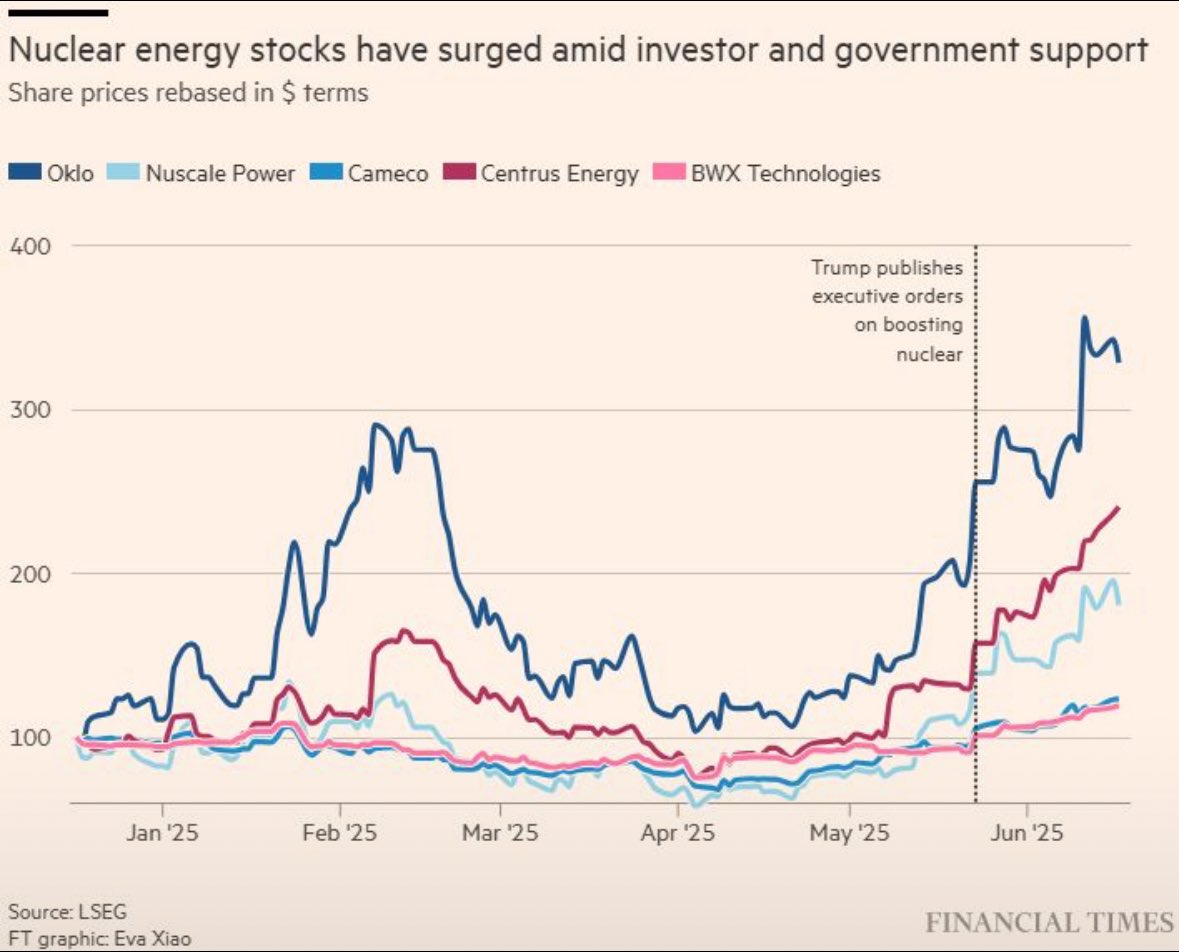

FT - "Two companies backed by Bill Gates and Sam Altman have raised more than $1bn amid a surge in investor optimism that nuclear energy will help power the artificial intelligence revolution." While solar & wind are quick to build, they can't deliver a grid which works.…