Juan Leon

@singularity7x

Senior Investment Strategist @BitwiseInvest | Not Financial Advice

How can $COIN get to $1,000 in this #crypto cycle? • 2023 Net Revenue Estimate: $2.6B • 2025 Net Revenue Estimate: $14.5B • 2023 Monthly Transacting Users Estimate: 8.5M • 2025 Monthly Transacting Users Estimate: 32M • 2023 Assets on Platform Estimate: $130B • 2025…

As the dollar loses its grip on purchasing power, bitcoin is stepping in as the new “hard” money—a scarce asset that can’t be debased at will.

The world is becoming financialized because the dollar can’t provide a reliable store of value function anymore.

These articles make sad. People are trapped in the current financial system, and can't imagine a better future. Our financial system is actually not that great. Banks pay an average of 0.01% interest on checking accounts. Checks clear in five days. Stocks settle T+1 and not on…

Longtime crypto skeptic @allisonschrager has changed her mind: She no longer thinks it will crash and burn. But that doesn't mean Bitcoin is good for your 401(k) bloomberg.com/opinion/articl…

Stablecoin summer is blazing everywhere: in Hong Kong as many as 50 companies are looking to apply for licenses to issue stablecoins, more than 5x the amount authorities plan to hand out.

ETH ETF Flows July 2024 - June 2025: $4.2 billion July 2025: $4.4 billion 👀

YOU: I wish there were like 10 charts that told me the biggest stories in crypto today. BITWISE: Good news. (a 🧵) No. 1: Spot Bitcoin ETPs are gobbling up way more bitcoin than the kitchen is making.

Tether will be joining Circle, JPMorgan, Bank of America, Citigroup, Wells Fargo, PayPal and others looking to get involved in stablecoins. The ultimate winner will be the US consumer.

Tether CEO: US market entry 'well underway' amid plans for institutional stablecoin theblock.co/post/364032/te…

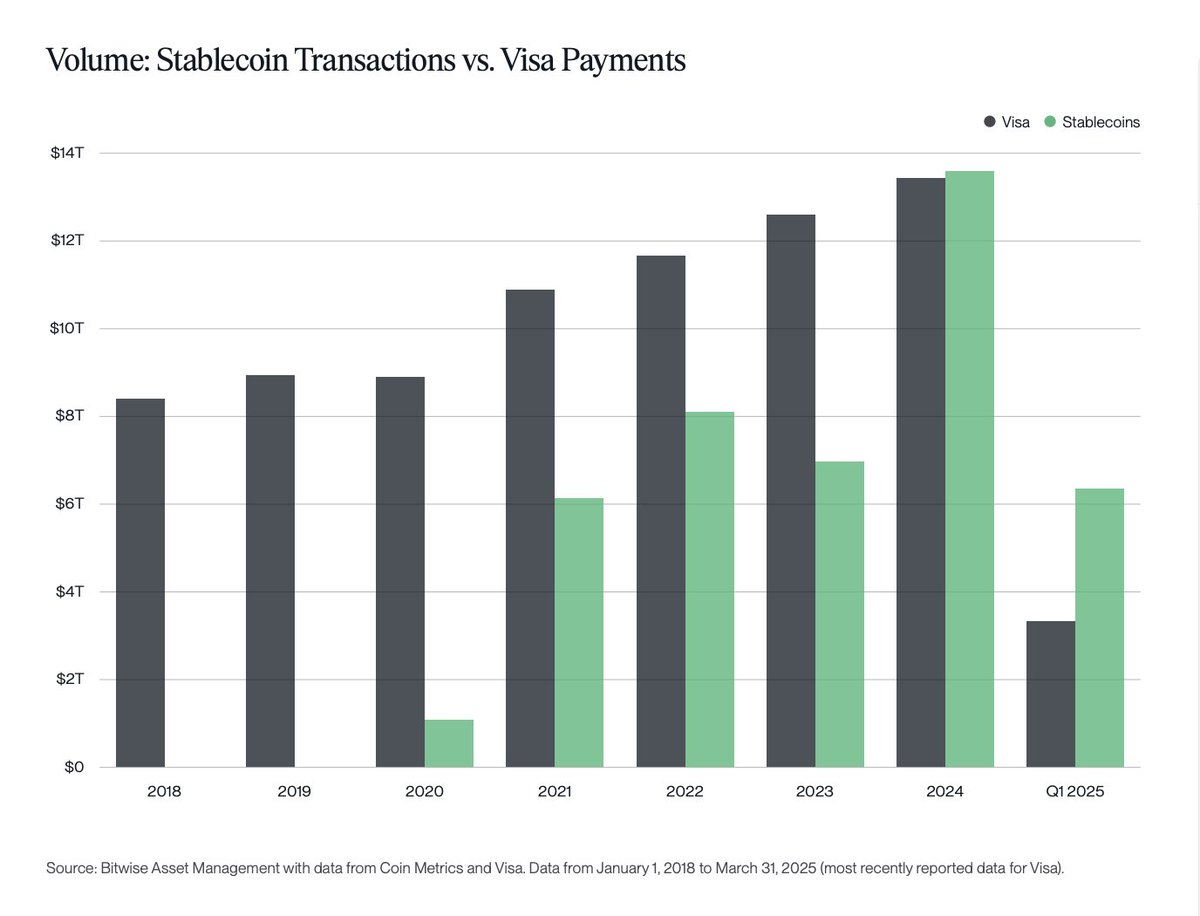

Stablecoins have hit escape velocity, and are accelerating into mainstream commercialization.

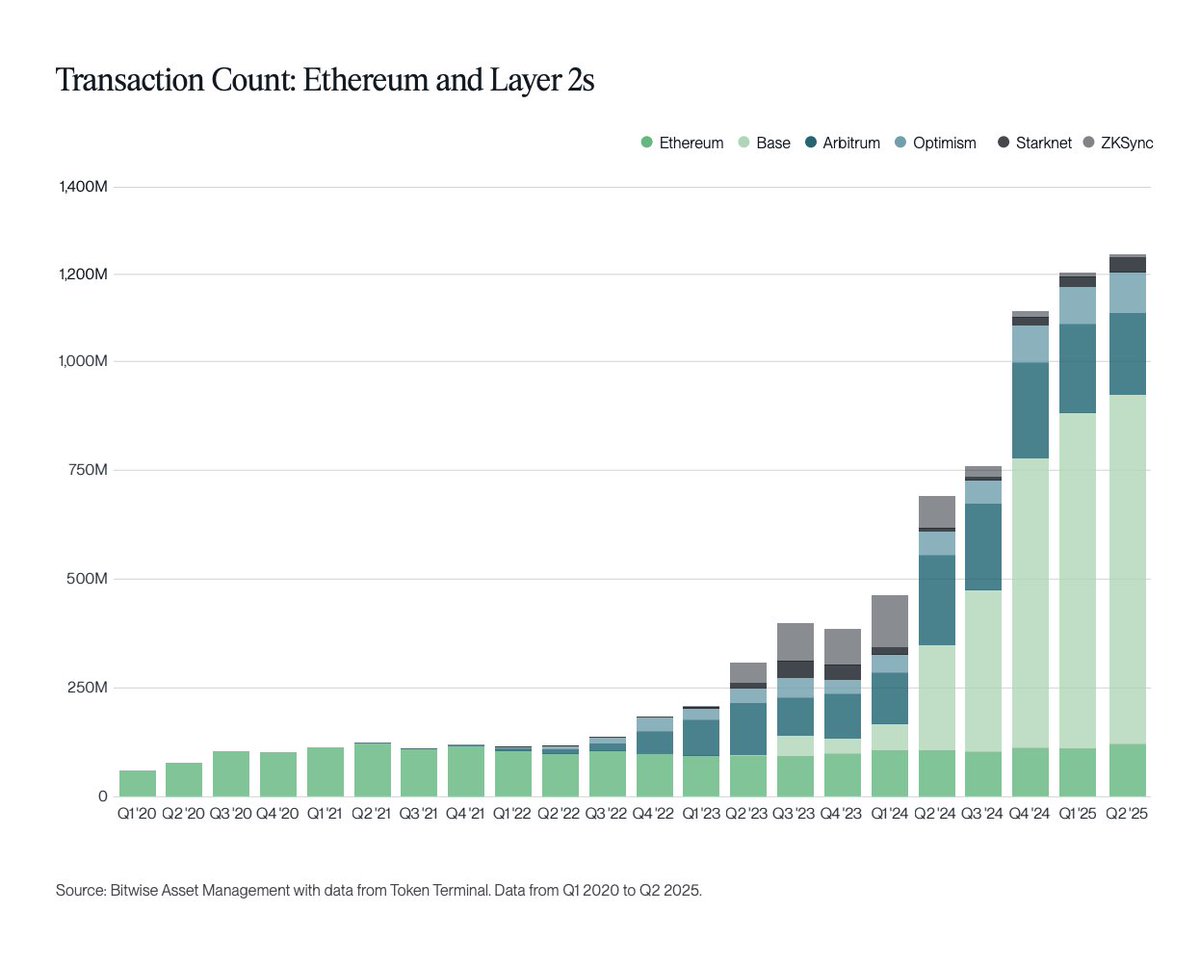

Ethereum is benefiting from multiple growth drivers including stablecoins, RWA tokenization, DeFi and ETH treasury companies. Accelerate.

A short story of supply and demand: - Bitcoin produced in Q2: 41,000 - Bitcoin bought by companies in Q2: 159,000 - Bitcoin price change in Q2: +31% The End

The Ethereum Demand Shock A thread on why ETH's price is rising and why it will continue to rise in the months ahead. 🧵

I'm going to be talking about stablecoins this a.m. Traditional payment rails are: 1. Slow 2. Expensive 3. Not programmable Stablecoins are: 1. Fast 2. Cheap 3. Programmable Keep it simple. Stablecoin summer.

Looking forward to speaking here tomorrow. Looks like a great scene.

ETH Treasury Cos snowballing

🔥 BREAKING: Pantera-backed Ether Machine goes public with $1.5B raised, launching with 400,000 $ETH to offer the largest institutional Ethereum exposure and yield.

Here’s what Wall Street doesn’t understand: Coinbase isn’t the Charles Schwab of crypto, it’s the Amazon of crypto. - Trading - Staking - Custody - Stablecoins - Base - Venture - Payments - Tokenization - Asset Management - Apps - And more…

JUST IN: $10 trillion Charles Schwab CEO says they will launch Bitcoin trading "sometime soon" and will be competing with Coinbase 👀

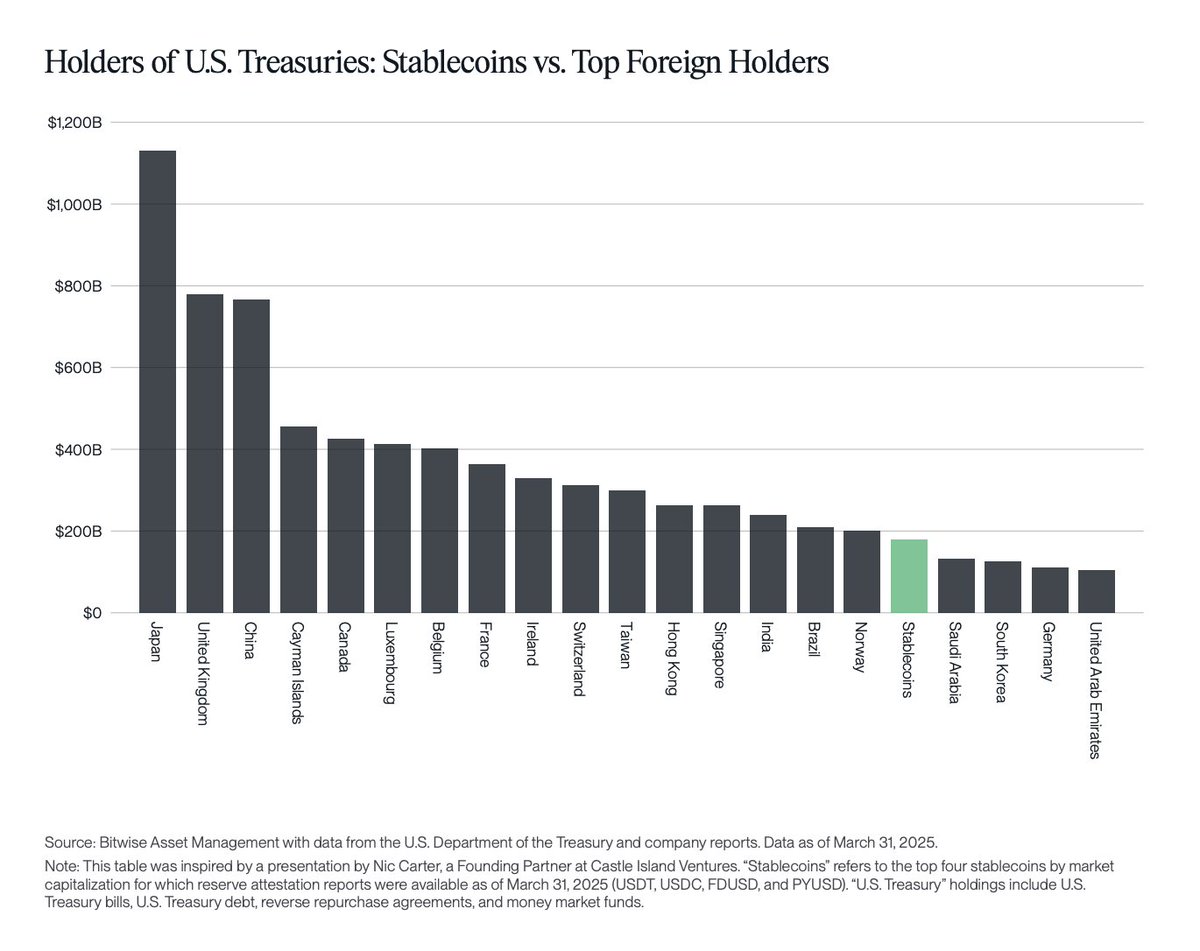

Stablecoins are the future of the USD. The U.S. Secretary of the Treasury forecasts stablecoins scaling from $250B today to $4T by 2030. At that size stablecoins will become the top holder of U.S. Treasuries.