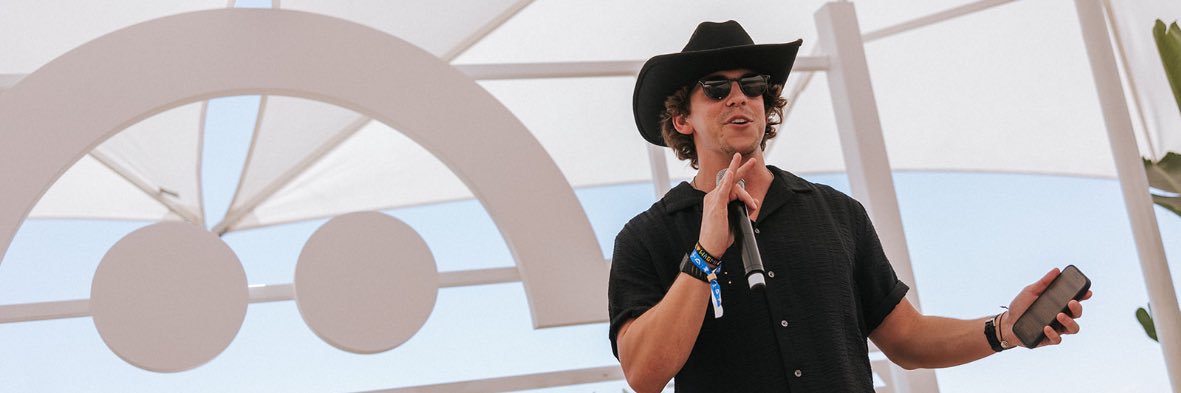

Kolten

@0xKolten

Propagandist @aave / @avara.

New incentives are live for EURC borrowers on @ethereum. Cheap euros while supplies last 👻

Whoa, @aave has bought more than $14M worth of AAVE tokens via buybacks, now worth almost $19M. Simultaneously, treasury value has also been going up during 2025. Flywheel in effect. Dashboard by @Token_Logic.

Risk Premiums in Aave V4 address a long-standing issue in DeFi lending: uniform borrowing rates that overlook collateral risk. Instead of applying the same rate to everyone, they adjust borrowing costs based on the quality of user's collateral; and suppliers earn more.

Aave V4 will introduce Risk Premiums, which allows the protocol to provide borrowing rates that better reflect risk. We've published a blog post detailing what Risk Premiums are and why V4 will use them. Read it below ↓

Aave V4 will introduce Risk Premiums, which allows the protocol to provide borrowing rates that better reflect risk. We've published a blog post detailing what Risk Premiums are and why V4 will use them. Read it below ↓

The Cap Stablecoin Network continues to grow in number. We are excited to announce the addition of Circle's @USDC to the CSN with @aave and @yearnfi powering base yield generation. Here's how it works:

Aave keeps melting faces. - TVL broke $50B and its OTW to $60B. - Daily fees on the rise, consistently surpassing $2.5M / scratching $3m. - Daily revenue consistently surpassing $300K for the last 10d. No incentives? No problem. @aave is, unarguably, crypto's liquidity hub.

See what @CPOfficialtx has to say about our ETH Flywheel and how it works with @aave 👇 cryptopolitan.com/btcs-uses-aave…

About $ETH rates and why there’s no much to worry about 1) Justin moving billions around happens every other week, he always deposit back. 2) instant APY is quite meaningless, the avg borrow rate of ETH stays sustainable, you should enjoy the nice supply yield boost while it…

New incentives are live on @base 🟦 Borrow @USDC or @GHO, or migrate your assets to Aave to start earning. More details below ↓

Just Use Aave. dlnews.com/articles/defi/…

If you have $ETH drop it into Aave. All institutions wanna borrow it, allow them to play top $ for your long.

There's $22.7B active loans on @aave, which is more than every competitor combined. Just use Aave.