nanocap100index

@nanocap100

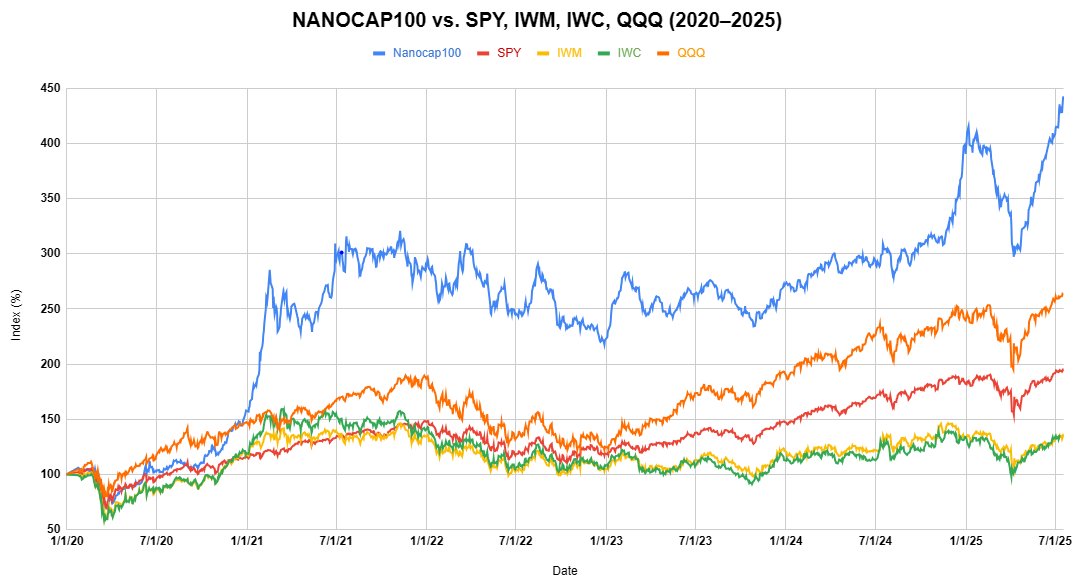

Benchmark index for select US listed nanocap stocks. CAGR since inception (1.1.2020): 31%

I’d like to introduce a benchmark index for the bottom range of US listed (NYSE,AMEX,NASDAQ) stocks. I’ve specialized in investing into small companies for 20 years. Using my selection methodology, I’ve created a nanocap (equally weighted) index with average market cap $30M

25-Jul, -0.75%, 447.48 (started 100, 1/1/2020, +14.6% YTD) The index's 15th consecutive positive week (+1%). Over the past 12 months, Russell2000 $IWM remained flat, while @nanocap100 gained 47%. --- $SOWG +91% this week. No offering. Yet.

Remember the Zweig Breadth Thrust 3 months ago, on April 24? 3 months later the S&P 500 is up 16%, the 2nd best return for a ZBT in history. The average return 1 year from the signal for ZBTs that were up 13%+ after 3 months is 32%. We're talking SPX 7240 on April 24 2026.

24-Jul, +0.60%, 450.85 (started 100, 1/1/2020, +15.5% YTD) The index has surpassed 350% gain milestone since inception. Remarkable, Russell2k $IWM has only 35% gain. $SOWG +50% (volume 10 times float), pre-offering? $AMPG: $5M new orders, $3M beyond $40M previously disclosed LOI.

23-Jul, +1.08%, 448.15 (started 100, 1/1/2020, +14.8% YTD) Another record ATH day. Controlled euphoria... $SYNX: $500K order from IDF. $SND: $0.10 special dividend. For $FONR holders' attention: $DALN got an offer to be acquired for $14 while stock was $4.39. Today another…

22-Jul, -0.28%, 443.45 (started 100, 1/1/2020, +13.5% YTD) Volatile day. Again, 'at the close' dump lowered the index by 0.7%. $BWEN: $6M follow-on order. $OPXS: $10.2M award, for 5 years, $4.3M first-year order. Backlog was $39.2M. It means $OPXS recognized ~$5M revenues in the…

21-Jul, +0.42%, 444.58 (started 100, 1/1/2020, +13.9% YTD) Another index record day. $FGF suddenly jumped 52%. $GIGM purchased an additional $1.5M of Aeolus Robotics convertible notes. Overall >$14M (2020-25).

$MOB secured $1.4M in orders from a Tier-1 US drone manufacturer. Who is the customer? Per Grok: "the customer is most likely one of Boeing, Northrop Grumman, Lockheed Martin, or Raytheon Technologies, as they are the only U.S. drone manufacturers with revenues exceeding $5…

@nanocap100 vs. S&P500 $SPY, Nasdaq100 $QQQ, Russell2000 $IWM, and Russell Microcap index $IWC since index inception 1.1.2020. @nanocap100 growth rate: 30.75% CAGR.

18-Jul, +0.33%, 442.74 (started 100, 1/1/2020, +13.4% YTD) +3.2% week. 14th index's consecutive positive week. +49% since April-8 bottom (even Bitcoin +42%). --- $FONR: Investor group led by CEO/Chairman provided/received supplementary 'take private' proposal. Now $17.25 cash.

$SONM: endless circus. $SONM to be acquired by Social Mobile for $20M, including $5M for potential earn-out. BoD approved, shareholders' approval required. However, they failed to disclose the acquisition price per share. Does BoD know how many shares are outstanding?

17-Jul, +1.39%, 441.30 (started 100, 1/1/2020, +13% YTD) Nanocaps went through the roof. Strong momentum, improving breadth. $AMPG: preliminary 2Q $11M sales, more than the previous 4 quarters combined. $SGRP 1Q: EPS $0.02, 2Q performance 'looks good'. 10K(amended), 10Q filed.…

16-Jul, +1.78%, 435.24 (started 100, 1/1/2020, +11.5% YTD) Nanocaps roared back, with the help of $DTST (+57%) acquisition. Some other index stocks broke resistance lines: $BWEN, $AMPG, $NTWK, $FGI, $PRZO, $PPSI. Seems there is more upside for nanocaps.

15-Jul, -1.08%, 427.63 (started 100, 1/1/2020, +9.5% YTD) Another acquisition! $DTST will sell Cloudfirst subsidiary for $40M cash (about $5.5 per $DTST share). After the closing (with shareholder approval), $DTST plans to tender 85% of its outstanding shares. The remaining…

Index companies morning news: $RFIL: $2.3M follow-on orders with aerospace company. $OSS: $3.9M awards to support Poseidon reconnaissance aircraft. $NTWK: strategic agreement in China. $VRAR 4Q: preliminary $3.5M organic revenue (+100% y/y) and positive EBITDA.

14-Jul, +0.78%, 432.31 (started 100, 1/1/2020, +10.7% YTD) Index companies that keep robust momentum (short squeeze in some cases): $OPXS, $RFIL, $OCC, $OSS, $SIF, $IZEA. $JCTC 3Q: First index company showing clear damage from tariffs. 20% reduction in workforce. Still 11.6-acre…

11-Jul, -1.50%, 428.95 (started 100, 1/1/2020, +9.9% YTD) Remarkable index week: +3.3%, 13th consecutive gain, up 44% since April 8 bottom. Now @nanocap100 is ahead of major indices YTD: $SPY +6.4%, $QQQ +8.4%, $IWM +0.3%. $IWC +1.1%. Index breakout (reclaiming 30% CAGR since…

10-Jul, +1.10%, 435.47 (started 100, 1/1/2020, +11.5% YTD) Perfect breakout for nanocaps (5% in 3 days). Considering recent correlation to Bitcoin, there is more upside for @nanocap100. Four reports today $TKLF, $NTIC, $SOTK, $ARTW. All the same pattern: resilience in the current…

Index companies morning news: $AIRI: $5.4M contract (landing gear components) for B-52. $OSS: $2M order from Medical Imaging EOM. --- And another acquisition (unfortunately, not index stock, but indicative), $DALN was acquired with 219% premium.

9-Jul, +2.60%, 430.72 (started 100, 1/1/2020, +10.3% YTD) First day after index break-out, another leap, $SUGP +172% (+22% more AH), 206M sh. volume. A classic asymmetric risk/reward stock. $FONR: acquisition proposal by a group led by the founder's elder son…